Expense tracking is a way to keep tabs on the purchases you make to run your business. By using the expense tracker in QuickBooks Online, you’re able to see exactly how much you’re spending on your business and proactively assign tax categories so you can claim deductions come tax time.

Always know exactly where you stand

QuickBooks tracks expenses all in one place so you always have a clear picture of your financials.

Connect your bank account

Organize receipts with a snap

Stay ahead of tax time

Insights at-a-glance

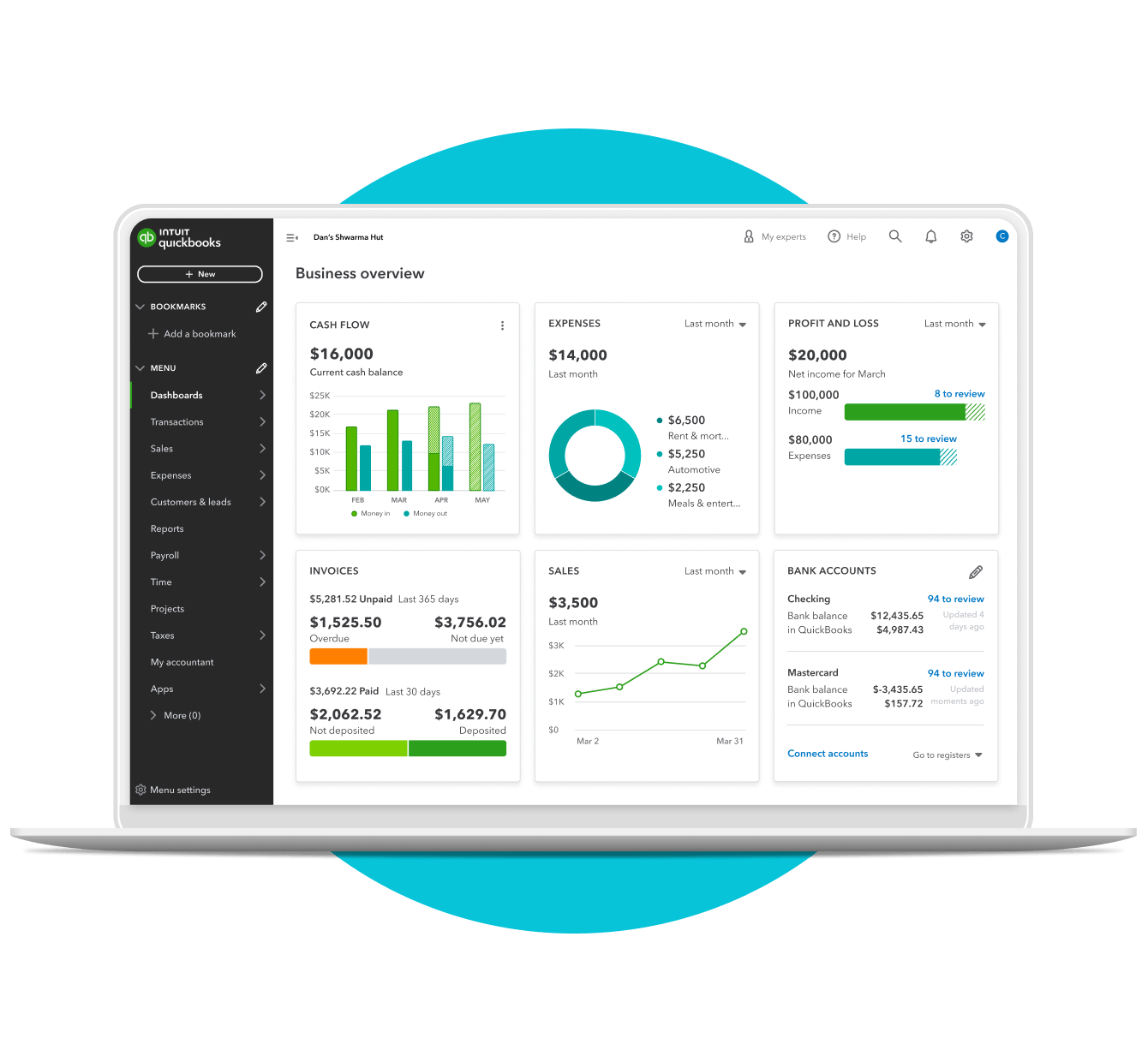

The dashboard makes it easy to view all the financial info you need to make the best choices for your business—income, expenses, outstanding invoices, and more.

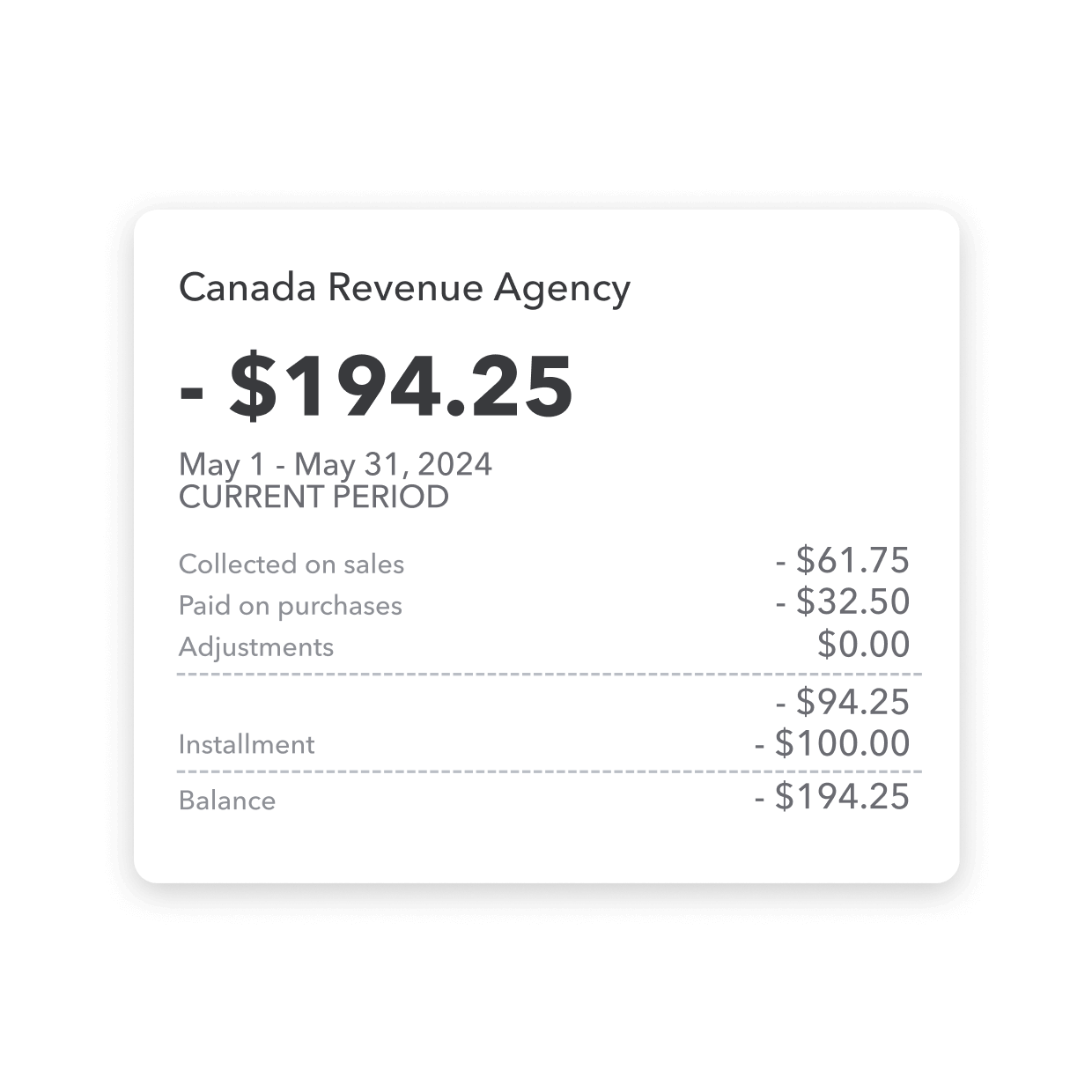

Automatically track sales tax

QuickBooks can automatically track sales tax for you. Plus, access all the Canadian sales tax codes you need.

Find a plan that’s right for you

Keep your eyes on the big picture

QuickBooks makes it easy to see where you stand and plan for what’s next.

Take charge of your cash flow

Track your money-in and money-out and get actionable insights right in QuickBooks.

Track profits and loss

With reports in your dashboard you always know how much money’s on-hand and where you stand.

Explore reports

Frequently asked questions

More ways to learn about tracking expenses

Find more of what you need with these tools, resources, and solutions.

10 common business expenses

Each month, you might pay for everything from office supplies to electricity. The government allows you to deduct these business expenses from your income at tax time—meaning you pay less in taxes.

How to track expenses for a small business

In this guide to expenses, you’ll find everything you need to know about recording, tracking, and managing expenses so you’re able to keep more of what you earn.

How to write off vehicle expenses

You need an accurate record of the kilometres you drive for work. Here are some tips for tracking vehicle expenses and mileage.

Unlock expert advice

for your business

Sign up to receive personalized content to help you choose the right tools, optimize business efficiency, and scale faster.