We keep track of thousands of tax laws so you don’t have to.

Sales tax calculations made easy

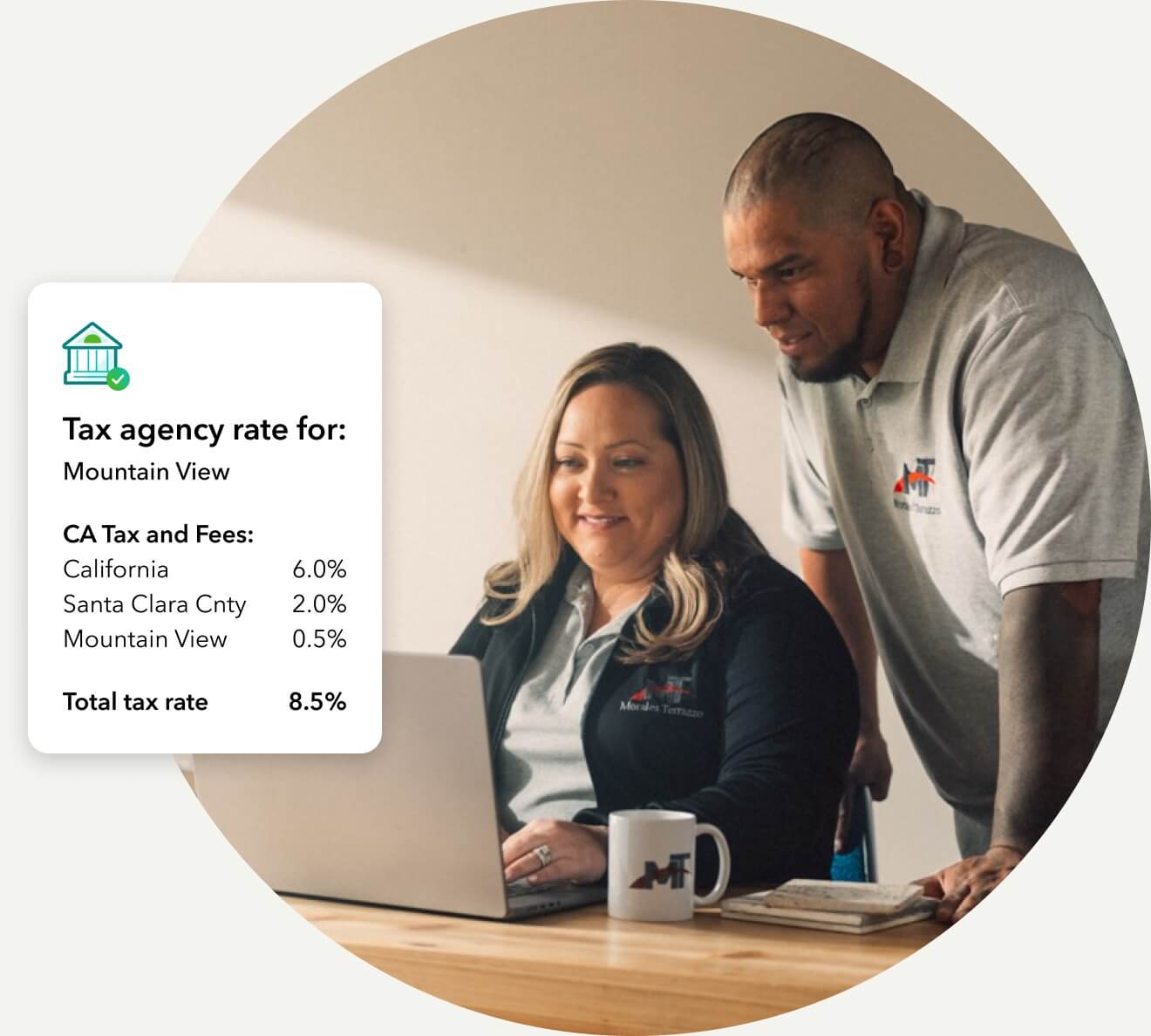

Automatic sales tax calculation

When you add sales tax to an invoice in QuickBooks, the calculations are automatically taken care of. We calculate the sales tax rate based on date, location, type of product or service, and customer you indicate.

Product categorization

Rules for how to tax a product can change from state to state. Once your products are categorized, QuickBooks will make sure the correct rate is applied to your transactions based on the product category and the location of sale you indicate.

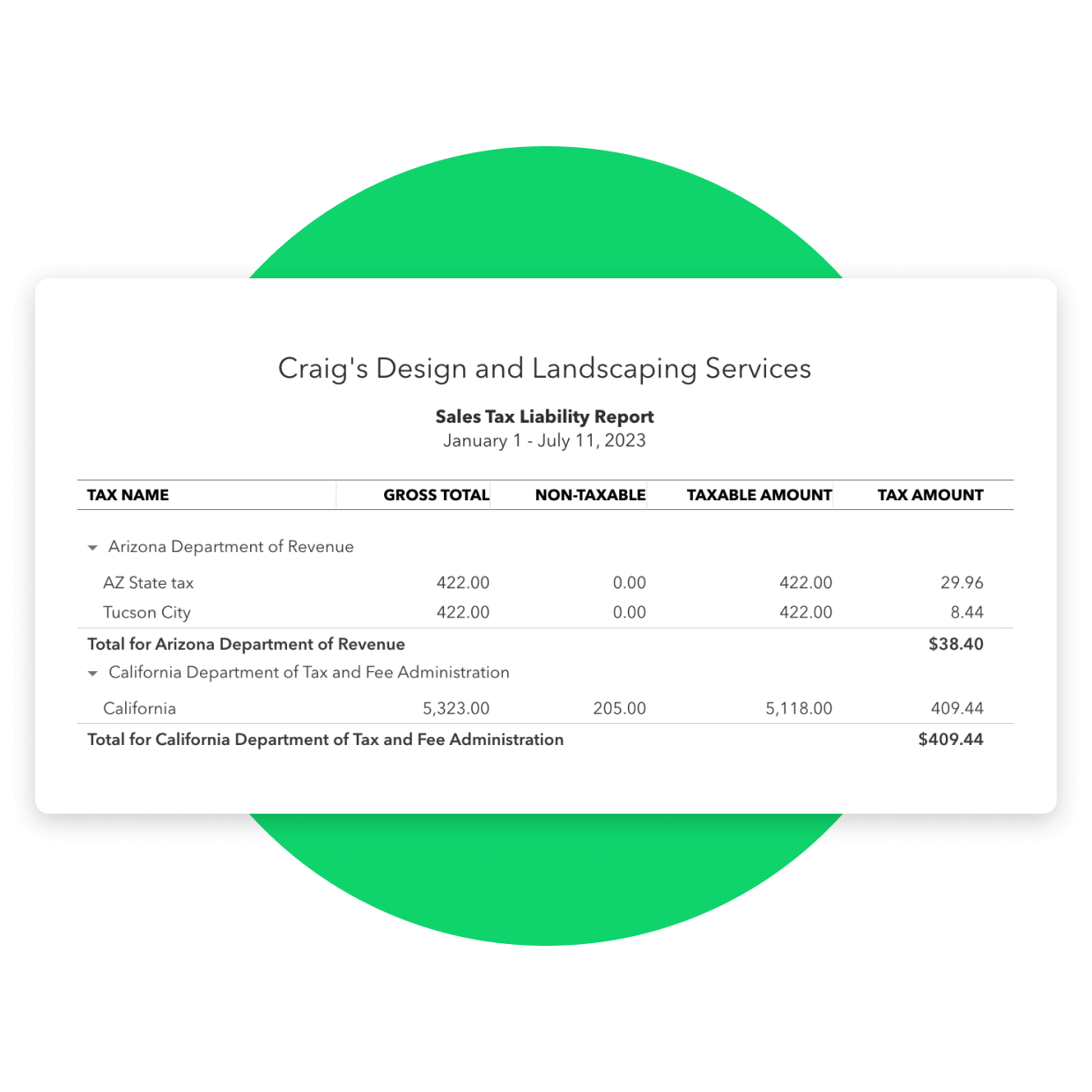

Know how much you owe

You can view your sales tax information any time with the Sales Tax Liability Report. This on-demand report will keep you up-to-date on your taxable and nontaxable sales, all broken down by tax agency.

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

Add sales tax to invoices

Easily add sales tax to invoices. You can include sales tax on your invoice templates, or you can add sales tax to individual invoices. When you add sales tax to an invoice, the calculations and tracking are done automatically for you.

Automatic sales tax tracking

Sales tax is a fee charged by government agencies, and in order to collect it, your customers pay the tax to you and then you are required to pass it on by making tax payments. Because QuickBooks automatically records your transactions, it keeps track of how much sales tax you need to send to the tax agencies.

Collect sales tax for multiple tax agencies

You may need to pay sales tax to multiple tax agencies, such as your city, your county, and your state. In QuickBooks, you can use a combined rate to charge your customer one sales tax amount, and then QuickBooks will split out the appropriate amounts for each tax agency.

Easily accessible reports

The Sales Tax Liability Report (STLR) shows a summary of sales tax you’ve collected and owe to the tax agencies. It gives you the total taxable sales, total nontaxable sales, tax rate, tax collected, and sales tax payable – all broken down by tax agency.