Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowWe added a new employee today but his Child Support Payments do not show in the "Pay Taxes & Liability" section of payroll. But the Wage Garnishment does show for another employee previously setup.

The new payroll items were added to the Payroll Item List the same way as wage garnisment. We have double checked it?

What are we missing?

Solved! Go to Solution.

Hi accounting,

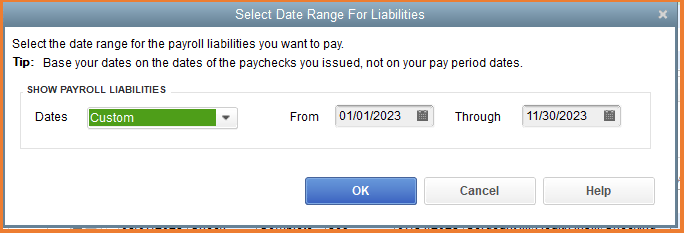

I'd be pleased to help you out with this. There's a possibility that the new payroll item was not assigned to a deposit schedule yet in QuickBooks. Here's how to check:

Hope this helps. Let me know if you need anything else.

Hi accounting,

I'd be pleased to help you out with this. There's a possibility that the new payroll item was not assigned to a deposit schedule yet in QuickBooks. Here's how to check:

Hope this helps. Let me know if you need anything else.

I've been wondering this forever. All previous attempts were unsuccessful. Thanks!

But... now that I have it set up correctly, there are A TON of overdue Child Support liabilities showing. How do I remedy this? Previously, we just knew to send the check and we added it as a bill then paid it. Please help?

I'd be happy to assist you today, PhillipsBros.

Welcome to the Community. I'm here to help you with an overdue child support liabilities in QuickBooks Desktop.

QuickBooks has the flexibility to enter prior payments for overdue liabilities if you've already paid for them.

Here's how:

Enter the payment using the Enter Prior Payments option in the YTD Adjustment window:

Here's an article with detailed information about entering prior payments: https://community.intuit.com/articles/1763241-scheduled-liabilities-show-as-overdue-or-in-red.

If you'd like to go through this over the phone, you can call our dedicated team who will be happy to assist you. Our contact details can be found here along with our opening hours:

Feel free to get back to us if there's anything else you need. Happy Holidays!

Here is the Error to correct: "Previously, we just knew to send the check and we added it as a bill then paid it"

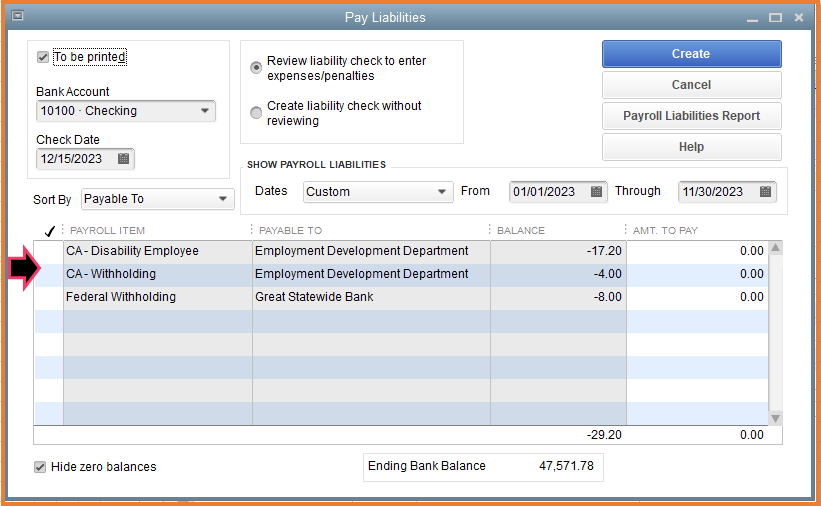

It was never a Bill. You would have used Create Custom Liability Payments.

Now you need to look at what you put on the Bill; did you post it as Expense or as Liability? As Expense = never employer expense. As Liability = you broke the relationship between Payroll item and Payroll Liability account tracking.

Here's how to fix it. For each Bill you made, you will use Pay Liabilities now, selecting the overdue payment and this Pay Liability Check will be for the same date and check and amount as you paid using the AP method. Click on the Expenses tab of this Pay Liability check and put here the same account you used on the Bill that was the error, but using negative Amount. Now hit the Recalculate Icon. This is a $0 Payment, it paid the liability the Right way, and it offsets the bills that were done in error.

If you paid it out on Bills as expense, this will change your Financial reporting, because they were Wrong all along.

if you paid it out on Bills as PR Liability, this doesn't change the Financial report.

Both conditions, you Fixed Payroll by using Pay Liabilities, now, and making them so that they offset the earlier mistakes.

Hello there, @Chadster,

I appreciate you for following the steps provided by my colleague in this thread.

Right now, QuickBooks can only set up the payment frequency for previous schedule liabilities. What you need to do is set up a scheduled liability as mentioned by qbteachmt so it will show up on the Payroll Liability tab.

Let me show you how:

For your guidance with the steps above, you can read through this article: Set up and pay scheduled or custom (unscheduled) liabilities.

Once done, you can then proceed with paying your liabilities. In case you've already paid them outside QuickBooks,make sure to record them in the system. To do so, check this out for the detailed steps: Enter historical tax payments in Desktop payroll.

The information I shared above will help you create a payroll liability schedule for last month and pay it.

Should you need anything else with your taxes, don't hesitate to comment below. I'd be glad to help you out.

Hello there, @Chadster.

To give you a confirmation, you can use the Create Custom Payments feature with a future date. Just ensure you're selecting the correct liability period. I also recommend checking with your accountant for guidance on how to avoid getting discrepancies on the payroll reports.

Check out this link to learn more: Set up and pay scheduled or custom (unscheduled) liabilities. It gives you the overview and steps on how to set up and pay liabilities.

I'm still here if you have other payroll questions. Just drop a comment or mention my name. Have a good one!

When I go to payroll center and click on Pay Liabilities, where do I find Change Payment Method?

I cannot find it.

I click on Employees, then Payroll Center, then Pay Liabilities.

WHERE IS "OTHER ACTIVITIES"?

I can'f find Other Activities.

I’m glad to help and walk you through how to locate Other Activities in QuickBooks Desktop (QBDT), @Starlite21.

The Other Activities section is located at the bottom part of the Pay Liabilities page. You can follow these instructions below:

I've attached a screenshot for your visual reference:

You might want to visit these resources to learn more about managing payroll liabilities in QBDT:

Don’t hesitate to leave a message if you have other payroll concerns. I’m always here to help. Have a great day and always take care!

Thanks, JenoP. Now if only one of the payment schedule options was bi-weekly, to match our payroll schedule. Oh well, there's always a manual work-around...

If your payroll is every other week, then choose Weekly. Since there won't be any payroll on the odd weeks, there won't be anything due on the off weeks.

Bi-weekly would only be useful if you had a weekly payroll and somehow only needed to pay every other week.

Wow! I had been struggling with this issue and it was keeping me up at nights! I googled it, watched youtube videos and here you were all this time. I followed your directions and had it done in two seconds. Thank you so much!!!!

I had been struggling and even losing sleep over this issue. I had googled it, watched youtube videos, etc. and then I found this!!!!! Got it done in two seconds! Thank you so very much!!!!!

Good morning, Wendy1961.

It's so great to hear that you found exactly what you needed here in the Community to get the issue resolved. You know where to come if you ever need assistance again in the future. Take care!

How to set up benefits for employee Like a after tax deduction?>

Hello there, pbj.

We appreciate your time for posting here in Community. We want to ensure we provide the resolution you need regarding setting up benefits for your employees. With that said, we'd like to ask what specific benefit and after-tax deduction you would like to create in QuickBooks Desktop.

It would greatly help us give an accurate solution for this concern.

You can always get back to this thread anytime if you have follow-up concerns. We'll be happy to assist you.

Perfect instruction. I found and corrected my issue in one minute. Thank you very much. This is why I love QB's. Fast easy solutions to most items.

You're always welcome, @Bo Starnes.

We're glad that the information shared in the thread helped you resolve your QuickBooks Desktop (QBDT) payroll concern. Please know that responding to your questions promptly to ensure a smooth return to business operations is always our highest priority.

Moreover, you can monitor and manage your payroll tax and sales tax payments by pulling up reports in QBDT. To guide you on how to do so, check out any of the articles below:

If you have follow-up QBDT payroll concerns, you can always get back to this forum. We'd be glad to provide further help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here