Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've got your back, @rhondaabc.

You can Print 1099's from QuickBooks Online by following the instructions below:

Printing 1099-MISC Forms

Check out our guide on printing 1099s in QuickBooks Online for more information. I'm also attaching a brief video demonstration of this below:

Doing this will allow you to print your 1099 forms right away. Please know that you can always reach me here for all of your QuickBooks needs, I want to ensure your success. Thanks for dropping in, wishing you and your business a great 2019 ahead.

I've done all this for 2018 and it won't let me start looking at 2019. It keeps throwing me back into printing 2018 forms

Hi @kfine,

The 2019 forms for 1099-MISC won't be available until the end of December up to January.

Once they become available, you follow the same steps provided by @MichaelDL above.

You can take a look at this article as well: Prepare and file 1099s. Here you can find the steps on how to prepare and file your 1099s.

Do you have additional questions? Leave them below, and I'll get back to you.

Thank you so much.

Too bad though. I'd prefer to get a jump on reconciliation/tracking down IC info I might not have, etc.

Help! When I get to the file step, I am not able to select anything. Have tried explorer and chrome, same results.

Hello there, @Be1986.

To resolve your concern, you can review the details of the previous steps. You've might missed other information that needs to be selected.

If the issue persists, you can contact our Technical Support team to check this further. They can thoroughly investigate the cause of why you’re unable to file the form.

Here's how:

You can visit this article for further guidance in filing 1099: E-file through the 1099 E-File Service (QuickBooks Online).

I also added an article to check out our support hours in QuickBooks: Support hours and types.

Feel free to reply to this thread in case you have additional queries. I'll get back to you.

All I need is to create one corrected 1099 form. I don't have a printing kit since I had QB online do all my other forms. Can't I just create a 1099 pdf in QB Online and print and mail that? - please tell me how to do this. The deadline is in 3-1/2 hours...

You can correct the information within QuickBooks and reprint the form, kdate.

Let me show you how:

On the printed form, click the CORRECTED box at the top. Mail the corrected form to the IRS and your contractor.

If you're subscribed to our Full Service plan, you can contact directly contact us.

Feel free to get back to me if you need anything else!

Thank you Catherine, unfortunately this doesn't answer my question. I have done all the steps you suggest, but Quickbooks assumes I already have pre-printed forms to put in my printer. I only need one corrected form, and do not have a printing pack. Is there any way to just create a pdf of the form, make multiple copies, and mail this to the IRS and contractor? It seems crazy to pay you $58.99 for a printing pack, wait for it to arrive, then go through the steps for one contractor!

I know it's convenient on your part to create and print the 1099 form through PDF, Kdate. This option is unavailable, though.

The only report you can save through PDF is the 1099 Information.

You'll want to download the 1099-MISC form instead, then manually enter the information. Make sure to tick the CORRECTED box.

If you have additional questions, please leave a comment below.

Thank you Kristine. For anyone who reads this thread, here is the full story, which I only found out after multiple calls/chats/searches with various parties:

The IRS REQUIRES that you use their red-ink, scannable paper forms for 1099s and the 1096 that comes with them. You MUST use these forms. They are carried at Office Depot and other supply stores. If you are in a hurry and don't have time to order them through Quickbooks, drive to the store, buy the forms, take them back to your office and use them in your printer via Quickbooks to fill them out. You will save yourself time if you buy the type of forms that come with envelopes.

On Quickbooks online, you will need to use the "finish 1099s" window several times to print 1) the red 1099 form for the IRS; 2) the red 1096 form which must be submitted to the IRS with the 1099s; 3) a black and white 1099 Form B to submit to your contractor; and 4) a black and white 1099 Form C to keep for your records.

I wish this post had been here when I needed it! Good luck!

You can order all your end-of-year payroll forms "FREE" through irs.gov "forms/instructions". Left side of site, click "Order Forms and Pubs" Select Online Ordering. Select # of forms need, scroll to bottom and "Add to Cart" Review, enter your address, and you will receive your "FREE" form: W-2s, W-3s, 1099, 1096 etc.... They are very quick and takes about 4-5 days. Envelopes not included.

Can you help me I’m just starting to use QB online this year but need to print 10 - 1099’s can I do that if I have no entries from last year? I have their totals from my boss and their I formation. Do I need a special version of QB online we do t have any employees just 1099 recipients.

Feel free to call me [Removed by moderator]. I’ve printed out many 1099’s in the past on desktop but not using online

QB but it looks easy.

Thank you.

Belle

Hey there, @Belle.

Thanks for following the thread. Excited to see you join the QuickBooks team!

You can easily print your 1099s right from QuickBooks. Let me walk you through the steps.

Please know these steps walk you into organizing your contractors and payments, so your filings are correct.

For more details about filing and printing 1099s, check out Create and file 1099s using QuickBooks Online.

Please let me know if you have further questions or concerns. I'll be here every step of the way. You can always reach out to the Community or me any time you need a helping hand. Take care!

When I click on, continue your 1099s, it ask for the EIN # I put it in and save and it says, something is not right :-90 what do I do? That is the correct EIN #.

I'm not sure the last treasurer did them in here or not.

Hi there, @Judy2100.

I can help you generate the form without entering the EIN on the 1099 page in QuickBooks Online.

Let's ensure that the EIN is already entered in the company information so it will automatically flow. With that, you don't need to re-enter it.

Here's how:

See the sample screenshots below for your reference:

Then after that, perform the steps above to print the form. If the issue persists, I'd suggest doing primary troubleshooting steps to get rid. A browser abundant of cache and temp files can produce extraordinary performances.

To begin, please log in to your QBO account via incognito to isolate the problem. You can use these shortcut keys below:

From there, re-perform the process to check if it's already performing adequately. If that works, I'd recommend you to go back to your normal browser and induct clear the cache. Doing in other supported browsers is a surpassing choice too.

If there's no progress after following the troubleshooting above, I'd advise you to visit this link for other actions to take: Update your business info in online payroll.

I've also added some articles about handling 1099 issues, reports, transactions, and other matters.

If there's anything else I can do for you, please let me know. I'll be around to help you.

Thank you but I figured out how to create dummy checks from last year to do 2020 1099’s even though we didn’t start using QB online till end of last year. Now I’ll just go back and get rid of dummy checks. Since I

e-filed no need to buy and print out forms, unless I want to right?

If you e-file through QB online no need to send a 1096.

i'm in step 5 and don't see "I'll file myself" button

Hi Robert.

Thank you for joining the thread. I can guide you on how you can file the forms manually.

On the Your 1099s are ready to file window (step 5), you need to click on the No, I'll print and mail link at the lower-right corner. This way, you can file your forms manually.

From there, you're now ready to print a sample of your forms or prepare the final ones.

I've added these screenshots for your visual reference.

For additional tips when preparing your Federal 1099s, I recommend checking out these links:

Also, here's an article you can read more about the year-end checklist for your forms and taxes: Year-end checklist for QuickBooks Online Payroll.

Please let me know how else I can help you manually filing your forms. I'm always here to help. Keep safe!

I'll ensure you can file your 1099's seamlessly, @CoriWGG.

First, you can perform a couple of troubleshooting steps to fix the missing "manual file" button issue. To achieve this, you can follow the suggestions given by my peer @MichelleBh to use a private browser and clearing its cache. Using another supported browser is an alternative option as well.

Then, check if you have the No, I'll print and mail or the Print and mail option(see screenshot).

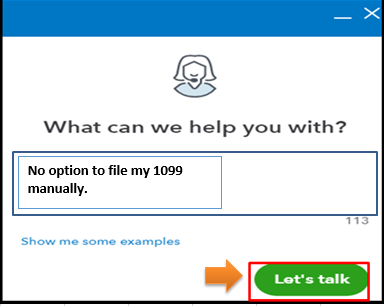

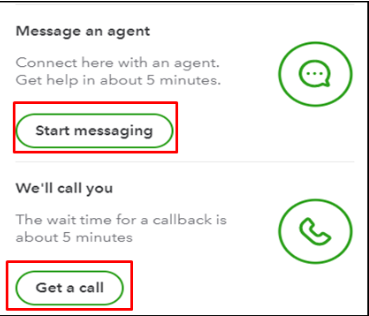

If you get the same result, I recommend getting in touch with our Payroll support team. One of our agents can perform a screen-sharing session and help resolve this for you.

Please review our support hours to ensure they can assist you promptly.

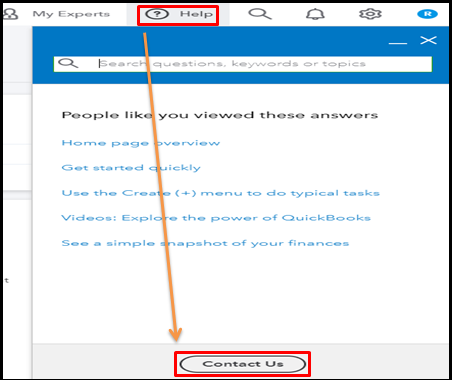

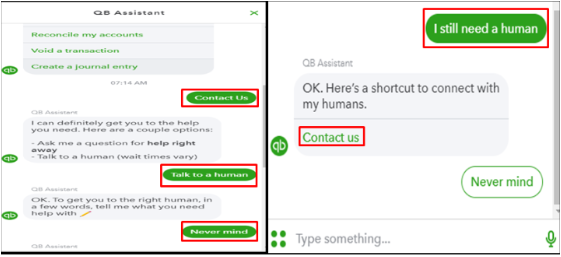

Here's how to contact our support:

After resolving the said issue, you're now ready to file your 1099 forms.

To access copies of these forms easily, you can print them. Please head to this link to get started: How do I print my 1099 forms?

Fill me in if you have more payroll questions. I'm always ready to back you up.

Hello, mktt1212.

The option to file my self in step 5 is the Print and mail. It's a manually filling of 1099, Though you need to order your 1099 Kit by mid-January and mail the forms by the January 31 IRS deadline.

For more information about printing 1099 forms, you can also check out this article: How do I print my 1099 forms?

Feel free to visit this website: Common Questions about 1099s. This link provides you answers to the frequently asked questions about form 1099-MISC, such as running reports to view your 1099 vendors and their payments.

Additionally, I'd recommend reviewing the IRS PDF Guide to learn more about its filing instructions.

However, if you don't see that option. Let's logging in your account using Incognito/private browser. These are built-in features in the browser that allows you to access websites without storing any data.

If you're able to see the option, you'll need to clear your browser's cache to optimize its performance. The next time you log in to QuickBooks Online, your browser will download fresh copies of everything you see on each page. Any cache-related issues should be cleared up.

Let me know if you have additional questions. We're always around here to help. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here