Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAfter spending a long time on the phone with support while writing up this post they now tell me this is a known issue since an update deployed around January 6 (which coincides perfectly with the timing of my issue). There is an open investigation (Investigation INV-40195) going on.

I'll still post this anyway since I'm wondering if anyone else is seeing this. Details below...

I'm using Quickbooks Desktop Pro 2020 MANUAL payroll to create and print paystubs. I do the math and make the entries. I also enter tax status, allowances and extra withholding for employees.

I've been doing this since mid 2015 - previously using Quickbooks Desktop Pro 2016 with the upgrade to 2020 at the beginning of December 2019. I process monthly payroll. Every paystub since the beginning up through January 2020 (processed 1/3/2020) displayed "Status (Fed/State)" and "Allowances/Extra" to the right of "Employee" and "SSN' in the header row. When I processed the February payroll on 2/3 the labels and employee details for Status and Allowances no longer appears in the header.

Hi @JRay111,

Thank you so much for posting this; since there is an investigation into this issue going on, it's important to let customers who are experiencing this issue know. I would encourage anyone who is running into this to contact support so they can be added to the investigation. Once a resolution is found, anyone added to the investigation will be notified via email.

Here are the contact options for payroll support, based on the product/service being used:

Thanks!

So frustrating!!!

several of us have been asking since January to have the missing information returned. Just waiting to hear, nothing so far.

Thank you for reaching out to me for updates, @Heidi1.

The product investigation (INV-40195) about marital status and allowances for both federal and state is not showing in the paystub is still in progress.

As of the moment, our product engineers are working hard to find out the root cause of this issue and to provide the best solution and will notify you of the updates regarding the status via email.

As mention by my colleague, anyone who has the same concern can contact support so they will be notified once it's fixed.

Here's how:

You can also visit our help website for articles that can help you moving forward: QuickBooks Support.

Please let me know if you have additional questions. I'm always here to help. Thank you and keep safe!

Processing payroll again today. It's been another month and still no progress on product investigation (INV-40195) about marital status and allowances for both federal and state is not showing on the paystub.

I do get a dialog telling me I can direct my employees to Quickbooks Workforce for this information. This is NOT a viable substitute: 1) It's an ADDITIONAL COST option to fix something that used to work just fine, 2) That information should be on the paystub regardless of it being available through another avenue. The full set of information should be available via both avenues.

Can we please get an update on when this will be resolved?

Thanks.

Hello, @JRay111.

Our Product Engineering team is still working on getting it resolved. To receive updates about this investigation, I suggest contacting our Customer Support. They can add you to the list of affected users to receive email notifications once we resolve the issue.

You can follow the steps provided by Rubielyn_J on how to contact the QuickBooks Desktop Customer Support Team.

The QuickBooks Workforce is free of charge. It’s an add-on to your payroll subscription. It’s where your employees access their paychecks using their credentials. To know more about this, check the following articles:

Let me know if you still have any questions. I'm always here to assist. Have a wonderful day!

Thanks for your reply. I'm already on the list to be notified, but there's been no news or progress in several months. Seems pretty unreasonable given that this was a deprecation of functionality that already existed.

Also, as I noted in the subject line of my original post - this is related to MANUAL payroll. I don't have or need a subscription to payroll for my needs. So, QuickBooks Workforce is an extra expense for me and many others with this same issue.

Is there a way to get a more specific status update or roadmap for the fix? "Still working on getting it resolved" is pretty vague several months out.

Thanks.

I have been watching these postings about the missing paystub Status/Allowances information and the postings about summarizing payroll in Excel for quarterly reporting. Why is it so hard to get issues resolved? I'm beginning to believe that no one is actually taking a look at these issues. It would be nice to have some resolutions, not just comments that the engineers are looking into the issue.

We value your time and your business, @Marlyce1.

I understand the need to get this issue fixed immediately. Rest assured that our product engineers are diligently working to find a permanent fix.

To ensure you'll get an update about the resolution status through email, I'd recommend contacting our Phone Support Team. This way, they can add your company to the list of affected users and provide this investigation number for easy tracking: INV-40195.

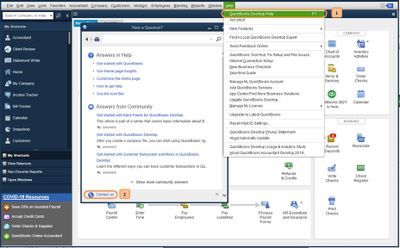

To reach them, click the ? Help button at the top-right corner and select Contact Us to talk with a live agent.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Thank you for your patience while we work for a fix. Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Mark,

Thanks for your post and informing the OP on how to be notified of updates.

However, it's been 3 months since my original post and 6 months since someone else originally identified the problem with no indication of progress.

Is it possible to get a more substantive update than another assurance that the problem is being diligently worked on? After six months it seems reasonable to at least have an expected date on a fix - especially since this was existing functionality broken by an update.

Thanks for any details you can provide.

Mark,

Thanks for your post and informing the OP on how to be notified of updates.

However, it's been 3 months since my original post and 6 months since someone else originally identified the problem with no indication of progress.

Is it possible to get a more substantive update than another assurance that the problem is being diligently worked on? After six months it seems reasonable to at least have an expected date on a fix - especially since this was existing functionality broken by an update.

Thanks for any details you can provide.

We don't want you to feel that way, JRay111.

I have reviewed the update from the investigation. As of now, our product engineers said this is working as designed based on the changes of the W-4.

The changes to the paycheck stub are a result of changes made to the new 2020 W-4 (allowances are no longer part of the equation) and to accommodate additional Sick/Vacation/PTO details.

Please don't hesitate to reach back out if there's anything else I can assist with.

If this is the case as you say, "changes to the paycheck stub are a result of changes made to the new 2020 W-4". Then what about the employees who did NOT update their W-4's to 2020. It is not mandatory and many do not even change and still use the W-4 titled in QB as "2019 and Prior". This is the same window and drop down entries as they ALWAYS have been. Filing status...SAME! Allowances...SAME! If they are still the same then logically according to your statement the pay stubs should still be the same and showing the "filing status" and "allowances". Also, QB's claim that the work around was in Workforce and employees could see their "filing status" and "allowances/dependents" there, but this is not true either. The Federal is showing on screen and not state (our business is in CA). I was told by one customer support agent, "well that is because Federal and State are the same". This is not true...in CA, many people have to report different filing status and allowances in Fed & State to make sure they do not owe on their CA income tax returns. I will not hold my breath for a resolution to Investigation INV-40195, but will hope for the best. Any news regarding this issue "Moderators" or "QuickBooks Team" support????????

Hello, @hsimech.

Yes, you're right. Your employees aren't required to submit a new Form W-4. If they don't give you a new form, withholding will continue based on a valid form they submitted before.

Also, when you update an employee’s W-4 to the 2020 version, you can no longer go back to the 2019 version.

Upon checking on INV-40195, they’ve identified that this is working as designed based on changes to the W4. On the newest update, when printing their paystubs, they can no longer see the federal withholding (marital status with allowances) and the state withholding (marital status with allowances).

You can refer to this link for more details: FAQs on the 2020 Form W-4

For additional guidance, you can check out these articles about the form W-4:

Let us know if there's anything that you need. I'm always here to help. Have a wonderful day!

I do appreciate your response. However, there was no added knowledge to this issue. It sounds like the issue is closed and their will not be federal or state withholding status/allowances resuming on the paystubs. As far as it working as QUICKBOOKS has designed, it is a design flaw. Employees need to have the ability to keep track of this. I have been told it will be on Workforce, but it is not showing state (at least not CA) withholding status and allowances. Just wondering does your or other Intuit employee's paystubs show status and allowances?

Thanks hsimech for reviving my thread. I had missed the last reply in June where a Moderator said "our product engineers said this is working as designed based on the changes of the W-4."

This was after I reported this issue in March (and at that time QB had been aware of the issue since January from other reports).

In May the QB Team said it was being worked on.

Then again in June the QB Team reported "Rest assured that our product engineers are diligently working to find a permanent fix."

I replied asking for a more substantial update on the resolution after the issue had been open for 6 months.

The Moderator post I mentioned above was the same day. How can there be such a disconnect that on the same day "diligent work" is proceeding toward a "permanent fix" and then it is reported that this is not a flaw but rather "working as designed"?

I agree with hsimech that the flaw is with the design. Until the IRS forces everyone to move to the 2020 W-4 version this design does not serve all QB users. The paystub reports should work as before for 2019 and prior W-4 EEs and also as appropriate for 2020 W-4 EEs.

I'm in VA and we also have different allowances than the Federal (as I believe most states do). This is completely unrelated to the Federal W-4 change. The QB paystub should still reflect the state filing status and withholding allowances.

I'm very disappointed that it took this long for QB to acknowledge they are really not working on this. Even more disappointed to hear the "fix" is a flawed design that does not reflect proper current payroll practice.

And finally, please do not suggest (again) that QB Workforce is the solution. This is a fee based service. My original case was and still is regarding MANUAL payroll. I don't want or need to pay for QB payroll.

Please reconsider and properly fix this issue.

Hello, I have Enterprise Deskstop and I have the same issue. I just got off the phone with Support and they are telling me it a product limitation....... Seriously!!! With QB this should not be a product limitation this is important info to have on a paystub. Has anyone else heard anything different?

Thank you

Does anyone know of a payroll system that works with Quickbooks and can produce proper paystubs?

I am getting complaints from all the staff about the lack of marital status and deductions on their paystubs. Does Intuit even care about their user base?

Richard

Way isn't this issue resolved yet? If QB had this displayed years ago but what some are saying, why can't it be reinstated????

Has this issue, investigation number for easy tracking: INV-40195, been resolved?

Hi there, @ErikaGBI.

As of now, we haven't received any updates yet. Rest assured that our engineers are working diligently to get it resolved.

I recommend contacting our Payroll Support team so that you can be added to the list of affected users. This way, you'll receive email updates of the investigation's status and be notified once it's been resolved. I've included the steps to contact support below.

These instructions are also available from our guide: Contact QuickBooks Desktop support.

You can check out these articles to get updated with the latest payroll news and enhancements, as well as the new changes to the Federal W-4:

I appreciate your patience as we work through this. If you have any other concerns, please don't hesitate to drop a comment below. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here