Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickbooks Desktop is prompting me to "Update Your Payroll Account Info By July 31, 2021". Each time I attempt to do this (multiple times over the past few weeks) I get an error code 40001. I've had two support conversations - neither able to resolve the issue. Anyone else seeing this?

This isn't the kind of experience we want you to have, @DFUSPWR. That's why I'm here to help you fix the error so you can successfully update your payroll account info in QuickBooks Desktop (QBDT).

When you're paying your employees and contractors by direct deposit (DD), the federal and state regulations require us to verify your business and Principal Officer info by July 31, 2021. You’ll need to make sure to update your account info to avoid any possible DD issues (i.e., paying employees and contractors and electronically paying payroll taxes and filing tax forms).

Here's the following info you'll need:

To fix the error and update your business and principal officer info, you’ll need to do these two things:

In case you want to learn more about why you are required to provide your business and Principal Officer info in QBDT Payroll, I'd recommend checking out this article: Understand why you need to update your account info for payroll.

Also, I'm adding this article to further guide you in managing your payroll account and employees using QBDT: QuickBooks Help Articles. It includes topics about processing payroll and paying your liabilities, to name a few.

Let me know how it goes in the comments below. Don’t hesitate to visit us again here in the Community if you have other QuickBooks concerns. I’m only a few clicks away for help. Take care always.

Thank you for your response. I have automatic updates turned on, and in the second chat with an Intuit associate we went through these steps just in case but without success.

Any other suggestions?

Thanks for coming back to us, @DFUSPWR.

The error code 40001 occurs when the Realm ID that is present within your QuickBooks no longer matches the number we have in our payroll system. I would recommend contacting our payroll specialist. They'll help us check for a Realm ID within your company file and proceed with troubleshooting.

Here's how to contact them:

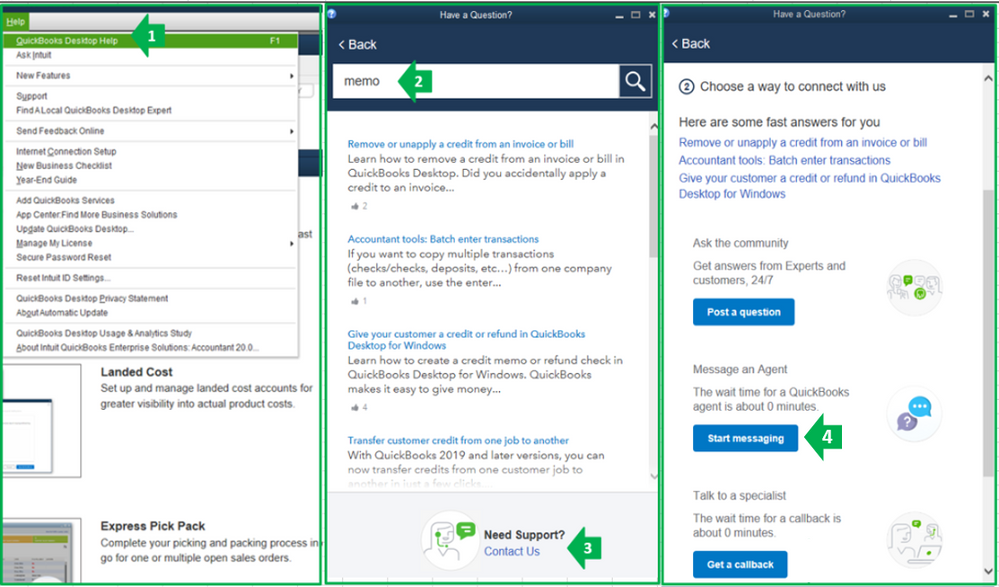

1. Go to the Help menu once you open QuickBooks.

2. Click QuickBooks Desktop Help or press F1 on your keyboard.

3. Select the Contact us button.

4. Enter a short description of your concern in the Tell us more about your question box.

5. Hit Search. Select Start a message.

You may want to check the article below to get additional information about entering payroll information: Add historical payroll information to your QuickBooks Desktop Payroll.

Lastly, in case you’re planning on running a larger than normal payroll for things like bonuses or pay raises in the future, you can request a direct deposit increase. For more info, please check out this article: Get help if you're over a direct deposit limit.

I've got your back if you have more questions about managing your direct deposits in QBDT. Just comment back so I can assist you further. Have a good one.

I have QuickBooks Desktop Pro Plus 2021

We are supposed to update our payroll account before the end of June.......but when I click on "update"

I keep receiving the Error Code: 40001 it says "something's not right. We're unable to complete your request at the moment. Contact our support team for assistance."

WeIcome to this thread, patrex.

I appreciate you for letting us know you're experiencing the same error.

The steps outlined by my colleagues above are the common ways to fix the error code 40001. If you haven't tried them, I suggest doing so.

If the error persists, it would be best t reach out to our QuickBooks Team for further investigation. They can review the status of your payroll and look for ways to come up with a complete resolution.

Here are the steps to contact support:

Please take note our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

If you need other helpful articles in the future, you can always visit our site: Help articles for QuickBooks Desktop.

Feel free to drop a comment below if you have any other questions. I'm always happy to help. Have a good day.

Yes and of course you CANNOT get thru on the phone. I'm using the same pin as I can with the IRS and my payroll taxes go thru. I'm very frustrated. I paid over $1,100 last week to upgrade my QB and renew my payroll and now I can't get them to talk to me. The auto operator keeps hanging up on me.

I just don't understand why we can't talk to real people for help?

This isn't the kind of experience we'd like you to feel, @HD68.

I want you to know that your voice matters and I understand your desire to speak with our phone support right away. Since it's tax season, we typically have a high volume of calls. This is why it takes a longer time to get in touch with them.

I'd be glad to know more about the help that you need. Any details about your concern can help me narrow down the best resolution.

Also, I'd like to have another go at helping you over the phone or chat too. Feel free to follow the steps below to reach out to us:

Our representatives are available from Monday to Friday from 6:00 AM to 6:00 PM and Saturday from 6:00 AM to 3:00 PM Pacific Standard Time.

You can also visit our QuickBooks Help Articles page if you need some reference in completing your other tasks.

I look forward for any updates from you about this topic. Please feel free to post them here or mention my name so I can further help you. Have a nice day!

I have been having the same problem for weeks. This a.m. I requested someone to call me back regarding the 40001 Payroll Account Update Error. The automatic system called me back and then I was told that "looks like we missed you", please log back in and request another call. I am getting very frustrated with this issue. i am deeply disappointed.

Hello jn59, I wouldn't like you to be in that kind of situation.

I can see the effort and time you exhaust to contact our support team regarding the 40001 Payroll Account Update Error. Still, you can ask for another schedule for a call by following the steps shared above. Also, another way to contact us is through chat or using the link below:

However, before you contact them. You can update QuickBooks to make sure minimal issue is fixed. This helps the program to function efficiently when contacting our specialists within your company file. Here are the steps on how to do it:

You can enable automatic updates to ensure your QuickBooks program will have all the latest releases. For additional information and detailed steps, please see this article: Update to the latest release of QuickBooks Desktop.

One more thing that we can do is to make sure your information is up-to-date. You can refer to this article to learn more about updating business information: Update your business name and address for QuickBooks Desktop Payroll.

Please feel free to leave a reply if you have any additional questions or other concerns. Stay safe.

My automatic updates are on. I have followed all the written documentation that is available and it still doesn't work. What bothers me the most is that I have been working on this for over 3 weeks and today finally put a request in to be called back and when the call came in, I received a message "it looks like we missed you, please sign back in, put in another request to be called" and then it hung up. In reading all of the posts regarding this issue, it is clear to me that Intuit has an issue either in your software or in your instructions. As others have said, I don't have hours to spend on this, I have a business to run.

This is not the experience that I want you to have, @jn59.

I appreciate that you've followed the steps that my peers provided on this thread and the time you've exerted resolving the error.

I also want to get this taken care of right away. I understand that you already called our Payroll Support, I'd still recommend contacting them. They got the tools and pull up your account and able to screen share in a private and secure session to successfully update the payroll account info.

If you're using Assisted Payroll, please follow the detailed steps in this article: Update Payroll Admin information in QuickBooks.

I'm also adding this article to learn more about the earlier release update: Latest payroll news and updates.

Keep me posted on how the contact goes by commenting below. I'll be right here if you need additional assistance and information about the issue.

I am trying to update my payroll account info, but it tells me my pin is invalid.

Thanks for joining us here, grid.

I'll help you reset your pin so you can update your account info. Here's how:

Once done, update your account info again and enter your new pin. Just in case you're unable to reset the pin, you can fill out a form to send a request to change. Proceed to the Reset a lost or forgotten PIN section of this article for more details: Change PIN For Processing Direct Deposit Payroll.

Let me also give you these additional articles for future guidance and reference:

Don't hesitate to let us know if you need more help when working in QuickBooks. We'll make sure everything is sorted out.

I cannot update my payroll info either for the 7/31/21 mandatory update. It says I don't have permission even though I'm logged in as Admin.

I've been passed around to 9 different ppl and been on the phone with 2 pp only to be told they couldn't help me and they'll get me to the correct department. The last person just ended the chat and never said a word!

This is so ridiculous...WHY Quickbooks can you not help your users?!?

Hi there, bdorin,

I appreciate you for letting us know about your experience with the support. This is something Intuit doesn't want you to come across in your future interactions.

Since you're already logged in as an Admin and can't still update your payroll information, I suggest contacting our QuickBooks Care Support. This requires pulling of your account in a secure environment so we can review the status of your payroll and update it successfully

The availability of support depends on which type of subscription you're using. You can check out this article for our contact information. Click on the QuickBooks Desktop drop-down to see the most updated support schedule: Support hours and types.

I also encourage checking our Help articles page to learn some tips in managing your QuickBooks account. Please ensure that you selected the correct product. From there, you can read articles that can guide you in completing your future task.

Feel free to drop a message to this thread to share your concerns or questions. We're always here to assist.

I'm no longer receiving the 40001 Error, but now after I've entered my updated info., I'm getting an error message that my PIN isn't valid. I just used it this morning to transmit payroll. I have not changed it in months.

It’s great to hear that you’re no longer receiving the 40001 error. I’ll help you resolve this new error message, @CS Graphics.

In QuickBooks Desktop (QBDT), you have the option to reset your PIN. This way, you can successfully update your account information and continue to transmit payroll.

Here’s how:

Please ensure that your PIN consists of 8-12 characters. A combination of letters and numbers with no special characters like $ % #, etc. Check out this guide to learn more: Change PIN for processing direct deposit payroll.

You can use the Customer Account Management Portal (CAMPs) for QBDT if you need instructions about managing account information. It has several resources that contain things you can do in CAMPs.

Please don't hesitate to add a comment if you have other concerns with updating your payroll account info. We’ll be here.

Today I tried to do the required federal/state update of info in QB Desktop Payroll by following the QB instructions: Employees>Payroll Center>clicked on the info banner>clicked on Update Now. Nothing happened. No error message. No pop up window. I tried it repeatedly. With just a week left to be in compliance and be able to do direct deposit with next week's payroll what do I do now?

I can see the effort and time you exhaust to update your payroll account, RJW2792.

Upon further research, I've found that this is currently under investigation by our product engineer team (INV-59171). I'd recommend communicating with our Customer Care Team to add you to the affected users. This way, you'll receive an email notification whenever an update becomes available.

For more details and for you to be guided about our support hours, you can check out this link: Support hours and types.

Keep me posted if you need anything else concerning payroll. I’ll be right here to help you.

Mine has been saying by 7/31/21 for quite a while now, I've just been dragging my feet. But now I log in and it says by 8/31/21. Maybe people are having such a hard time with this that they are extending it. I wonder if it'll change to 9/30/21 the closer I get to the end of August.

I get all the way then asks for the pin for payroll deposit??? Put my ETF what ever it is called in and tells me that the pin is incorrect....please advise. Thanks

Hello there, @drsdvm1. Let's fix your PIN.

There are some possible reasons why the system is not accepting your PIN.

It could be that the PIN is entered incorrectly, or entered 3 times incorrectly. If this happens, you'll be locked out of the payroll service for 15 minutes. We recommend verifying that the Caps Lock key is not on or try typing your PIN in a program like Word or Notepad so you can view the characters you are typing.

Before we go through the steps for fixing and entering your PIN, I recommend updating your QuickBooks Desktop to the latest release to keep your software up-to-date, so you always have the latest features and fixes. Here's how:

Then, you can also get the newest payroll tax table in QuickBooks Desktop Payroll to avoid any issues when trying entering PIN for processing direct deposit payroll. You can open this article to see the process: Get the latest payroll tax table update.

Once done, enter your pin for processing direct deposit payroll:

If you're required to change PIN, you can try another method when changing or resetting your PIN. Please read through this article: Change PIN for processing direct deposit payroll.

Let me know how it works on your end. I'll be around to continue to help you if you need additional assistance. Take care and stay safe.

Where is the banner?? I have to run payroll on Monday for deposit on Friday. Is it going to work? Why is there not help available on the weekend?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here