Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi, 8443.

Thank you for joining the thread. Let me guide you on how to get the new password and submit your taxes successfully.

IRS makes changes to pay taxes electronically. They implemented new password requirements from 12-30 characters. That said, if the password below 12 up to 30 figures, this will be the reason why you're getting rejected.

To update your password, please visit this page: EFTPS. Then, click on How do I get an Internet password under the Login Questions section.

Once the password is successfully updated, we need to reset the password in QuickBooks. You can follow my colleague's steps above on how to change it.

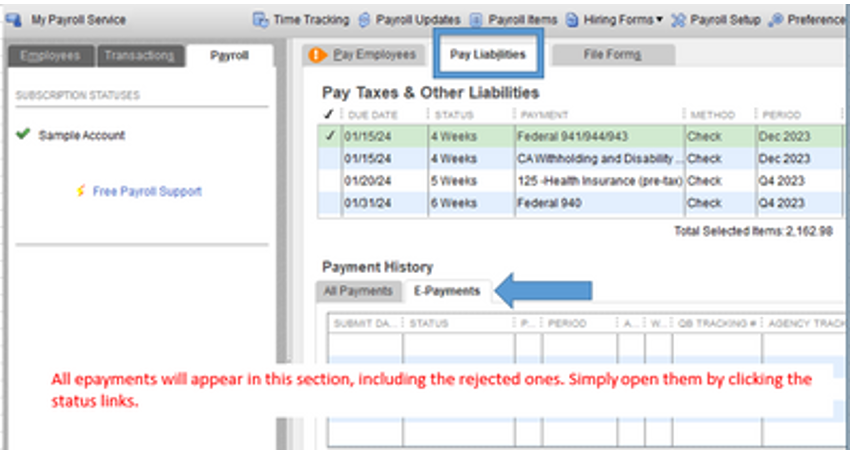

Once finished updating, let's go ahead and resubmit your electronic tax payment. You can refer to this article on what to do when your e-filing or e-payment is rejected: Troubleshoot efile or epay rejection issues.

For additional insight, I've attached a handy article it contains the status of your payment and form submitted in QuickBooks: Check E-file or E-pay Status.

Please let me know If you have additional questions or concern. I'm always here to lend a hand. Stay safe!

After voiding the check/payment that was rejected by EFTPS, I corrected the password issue and am ready to re-submit however it does not populate in the scheduled liabilities list for me to resend. How can I make that happen?

Hey there, Bren65.

To populate your scheduled liabilities again on the Pay Liabilities tab, you'll need to void the rejected payment check and reschedule them.

Here's the step-by-step process:

Once voided, you'll see the liability on the Pay Liabilities tab ready to resend. I'd suggest checking the messages and the corresponding solutions for the rejection before voiding to ensure your payments are submitted on time.

Our articles also offer a bunch of guides regarding payroll and tax details, compliance and employee management. Give them a shot if you need help: QuickBooks Desktop Payroll general help articles page.

Let me know the result of this troubleshooting in the comment below. I need to make sure this is resolved and you're back to running your normal business processing. Happy Holidays!

Thank emann for the solution to something I've been searching for EVERYWHERE.

Intuit/QB has not clearly communicated this issue in any way as far as I've seen. Way too many threads about the issues everyone has been having.

Someone responsible needs to make sure that every QB user gets an automatic email/notification notifying them that their password will not work after 13 months as indicated elsewhere. Again, this is not an EFTPS issue, it's a QB/Intuit issue as we've all had zero issues with EFTPS & making payments after the rejections.

Next, a properly worded document outlining the steps to help EVERY POSSIBLE OUTCOME needs to be pinned as the first answer we all see.

My payment was rejected & yet I neither received a notice online at that point that it was rejected (there was an email but since I wasn't working in email, why should that be my first point of confirmation?), next, there was a message about there being a problem but there was no way to go back in & try to resubmit the payment once I realized that it was a new PIN requirement. Then there's no information on how to void the payment in the records -- sorry, there is information but it's all incorrect. Now I need to go in & re-create the payment to show in QB and I have yet to find the proper way to do that because the only option I have is for filing quarterly.

THIS process is a QB ERROR... EFTPS does not ask employers to change their PIN or PASSWORD.

QB is causing problems where there is none.

PLEASE have your programmers in QB fix this. As an accountant, I run payroll for numerous companies and this is becoming a big problem. IF this continues, we may start looking at a different payroll processing option.

and NO I do not want to go to QBO payroll.

Dee

You are not the only one. I have had this issue for months, reset the password every time I make the payment, reset it on the Eftps website, and it still happens.

Been there done that!

Nice the cloud isn't allowing my message! Did they know I voted for TRUMP

Every single payroll client I have in QB 2021 crashes when I try to access the epayments tab.

I agree. I had success paying 941 for Jan 2021 but then today, paying Feb it was rejected.

When it was rejected the first time, I changed the password @ EFTPS level and went back to QB only to get rejected again. Went & successfully submitted my payment on the EFTPS site no problem.

QB -- THIS IS YOUR ISSUE.

Hello @dso0216, and @Soundscu.

I can see how beneficial for your business to be able to pay your taxes electronically. Let me help you use the E-file and pay feature seamlessly.

We have a built-in utility that can help resolve common errors or issues when using QuickBooks. Let’s download and run the QuickBooks Tool Hub, so you can e-pay your taxes.

Open your QuickBooks and the company file and try to pay the taxes. If you get eh the same result, perform Solutions 2-5 in this article: QuickBooks Desktop doesn't start or won't open.

In regard to the rejection issue, I’m adding an article that outlines the complete steps on how to resolve it: Troubleshoot efile or epay rejection issues.

For future reference, this guide covers all the details on how to manage rejected payments: Handle an e-payment that has been rejected by the agency.

Reach out to me anytime if you have other concerns or questions. I’ll be around to answer them for you. Have a good one.

Thanks.

The 'if-then-next' "solution" makes no sense when this feature worked fine at one point.

The fact that we - the user - have to jump through various hoops like you've outlined to make your program work is frustrating beyond measure.

For anyone following along, the " Troubleshoot efile or epay rejection issues " article has a suggestion to "forget" your log in credentials. This has nothing to do with EFTPS. When you go into e-pay your 941 (pay liabilities), the screen that comes up with your PIN/password/phone/email is where you'll find the check box at the bottom. I couldn't figure out a way to uncheck the box & have it save without processing the e-pay which was annoying so I just scheduled next months to process at the required date.

I have the same exact problem and it's so frustration! I too have tried all of the suggestions by QuickBooks to resolve this alleged expired password rejection issue. I too can go directly to the website and successfully file the EFPTS payments. I am constantly rejected on QuickBooks when I also try to efile the quarterly 941 Form. I have spent hours researching the issue and have tried everything QuickBooks has suggested. I've made sure my company name is exactly how the IRS has it and I know my Form 941 ten digit PIN number, updates are made to QuickBooks and the enhanced payroll subscription and I have a supported version of QuickBooks desktop, etc. The IRS states that all of my info is current & correct. However, nothing works. I haven't had any luck with the QuickBooks Tool Hub but I'll keeping trying for a little while longer. It would also be great if QuickBooks allowed a Form 943 in the drop down list for Agricultural Employers. I know we're not the only ones that also have Ag employees and need a Form 943. I so understand your frustration!! It's such a hassle that it makes me want to explore other accounting software. And I have had QuickBooks for an outrages amount of years. Ugh!

Utterly ridiculous, so now my payment is late because of Intuit's inept issue. I thought the e-pay feature was going to save an extra step of going onto the internet, logging in and making the payment. Now I'm getting another note that our password has expired and it has not been 11 months. WTF Intuit?!!!

I found out another really important fact when the EFTPS deposit have been rejected. If the rejection was due to an incorrect password, you must wait at least an hour before re-attempting a deposit with a corrected (new) password. I kept try to fix this immediately with no success and that was the reason!!!!

Same problem here. First time. Tried the change once, rejected again. Made the payment online manually. I will not waste my time trying to fix QB's problem, but rather spend my time researching alternatives to QB. No big deal, my two companies have only been using QB for 27 years.... but they apparently don't care......

I changed the password with EFTPS how do I change quickbooks

I've got you covered, rex45.

I know a way how to change passwords in QuickBooks Desktop.

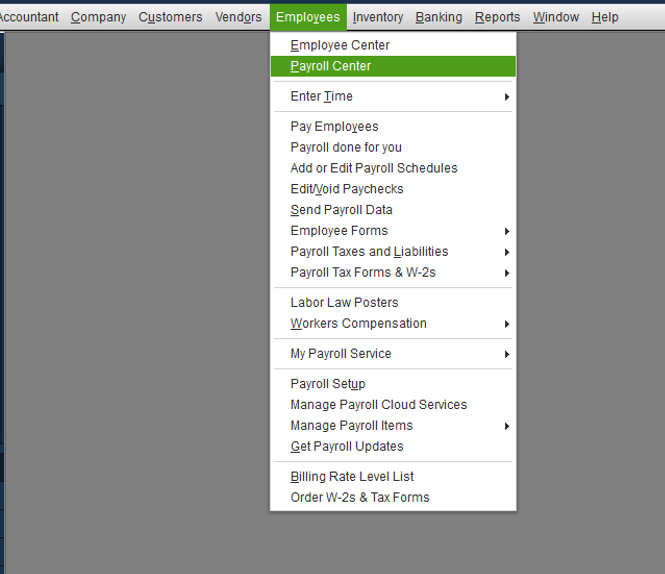

Here's how:

You can check this article for more details: Reset your password for QuickBooks Desktop.

I've also attached an article you can use to monitor the payment status in QuickBooks: Check e-file or e-pay status.

Let us know if you have any other concerns related to the tax payments. We're here to help.

this has to be a QB issue. Im having the same problem. I can log into EFTPS and i have now paid thru their website because no matter how many times i enter the new password into QB it STILL rejects it. crazy thing is i changed the password because of this issue but i could log into EFTPS to begin with, with my previous password. they are not having issues but my QB is

I'm using enhanced payroll for accountants as a PA. This is still an issue. I don't know how many times I've had to deal with this but it's costing me alot of money and time to correct. Often the FTD amounts are so similar the rejects aren't detected right away. Sometimes email notifications never arrive, and up until recently the program would crash when I tried to access e-payments tab. Several times I've changed the password online with EFTPS, entered the new password in QBDT, sent payments which rejected. I'd retry the process, even sending a small payment through EFTPS and then send a FTD through QBDT using the same password and the FTD sent through QBDT rejected. It's so frustrating because no matter how diligent I am checking for the payment acceptance it happens. I had one client screaming at me literally that he was getting the IRS notices. I'd gather my docs, screen shots, etc. and thankfully IRS did abate some of the penalties but not all. This is also very damaging to my credibility. Dealing with this issue since 2019 I'm convinced this is an Intuit problem. Not sure how we can resolve but if ever there would be a case for a class action suit this situation maybe headed in that direction, if not already.

Thanks for joining the thread and sharing your experience with us, @dso0216

I'd also feel the same frustrations if I were in your situation. I know how these tax payment rejections impact your business and reputation.

Let me share some troubleshooting steps you can use to immediately address this concern.

To start, let's download and install the QuickBooks Tool Hub. This contains a set of tools that would help us diagnose the cause of the issue and fix the problem. Here's how:

Once done, use the tools in the launchpad and select the appropriate type that fits your issue. For additional reference, you can check out this article: Set of tools to address different types of problems in QuickBooks Tool Hub.

If the issue persists, I'd recommend reaching out to our QuickBooks Payroll Customer Support. That way, they can further perform a further investigation and identify its cause, then fix it.

Additionally, you can check out this guide for more info on how to manage rejected payments: Handle an e-payment that has been rejected by the agency.

You can share the result of these troubleshooting steps with us. We'll be here to further assist you. Have a good one.

Tool Hub will not address this issue. This is an internal issue with QB. QB communicates with the IRS differently and created this issue. It is not an operator error issue.

It will help if you put your email on the submission page of the payroll deposits. Then you will get the notice right away.

to clarify... this issue is created by QB. QB requires everyone to change the password to EFTPS every year. EFTPS does not require this. This makes it a strictly QB programming issue.

IT would be extremely helpful if QB would actually send out an email telling everyone that they have 30 days to update the password before they start rejecting for incorrect passwords.

Email address is, and always has been included.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here