Step 1: Calculate the asset's purchase price

The purchase price refers to the total cost of an asset. You can calculate an asset's purchase price by adding the following figures together:

- Price: The original price you purchased the asset for

- Shipping: Any fees that relate to the delivery of your asset

- Taxes: An additional fee that reflects a percentage of the asset’s price

- Maintenance: Costs associated with maintaining the asset

- Any applicable fees: Anything that adds to the cost of the asset

After you gather these figures, add them up to determine the total purchase price. Then, it’s time to calculate the asset’s life span and salvage value.

Step 2: Determine the asset’s life span and salvage value

You can calculate the asset’s life span by determining the number of years it will remain useful. This information is typically available on the product’s packaging, website, or by speaking to a brand representative.

Next, you’ll estimate the cost of the salvage value by considering how much the product will be worth at the end of its useful life span.

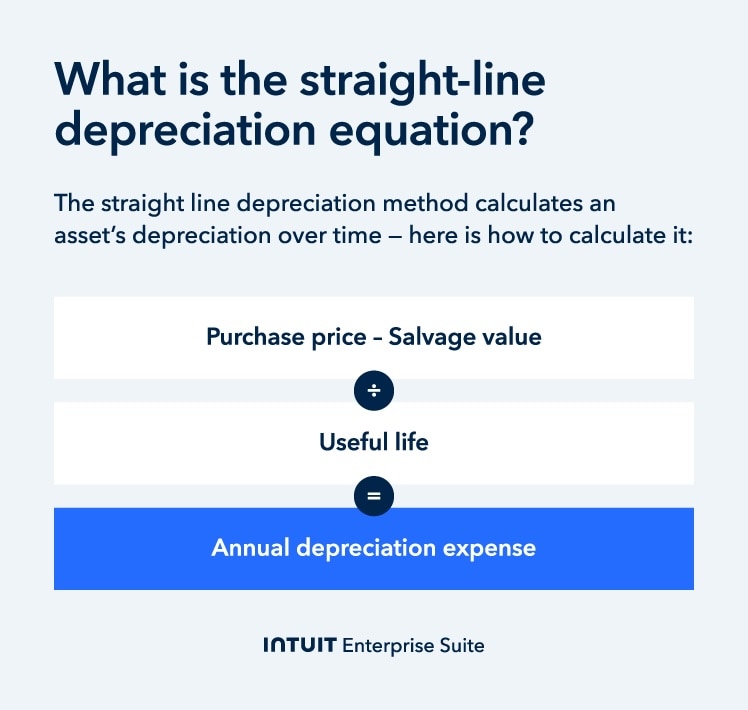

Step 3: Subtract the salvage value from the purchase price

Now that you have calculated the purchase price, life span, and salvage value, it's time to subtract these figures.

Subtract the asset’s salvage value from the purchase price. This number will show you how much money the asset is ultimately worthwhile calculating its depreciation.

Step 4: Calculate depreciation expenses

Once you understand the asset’s worth, it’s time to calculate depreciation expense using the straight-line depreciation equation.

This means taking the asset’s worth (the salvage value subtracted from the purchase price) and dividing it by its useful life. This number will give you an asset’s annual depreciation expense.

Step 5: Divide by 12 for monthly depreciation (optional)

If you want to take the equation a step further, you can divide the annual depreciation expense by twelve to determine monthly depreciation. This step is optional, but it can shed light on monthly depreciation expenses.

With these numbers on hand, you’ll be able to use the straight-line depreciation formula to determine the amount of depreciation for an asset on an annual or monthly basis.

At the end of each year, review your depreciation calculations and asset values. Adjust for any unexpected changes, like reduced useful life due to heavy usage or market shifts affecting salvage value.

At the end of each year, review your depreciation calculations and asset values. Adjust for any unexpected changes, like reduced useful life due to heavy usage or market shifts affecting salvage value.