Run your business in the cloud

With cloud accounting software, your data is always at your fingertips.

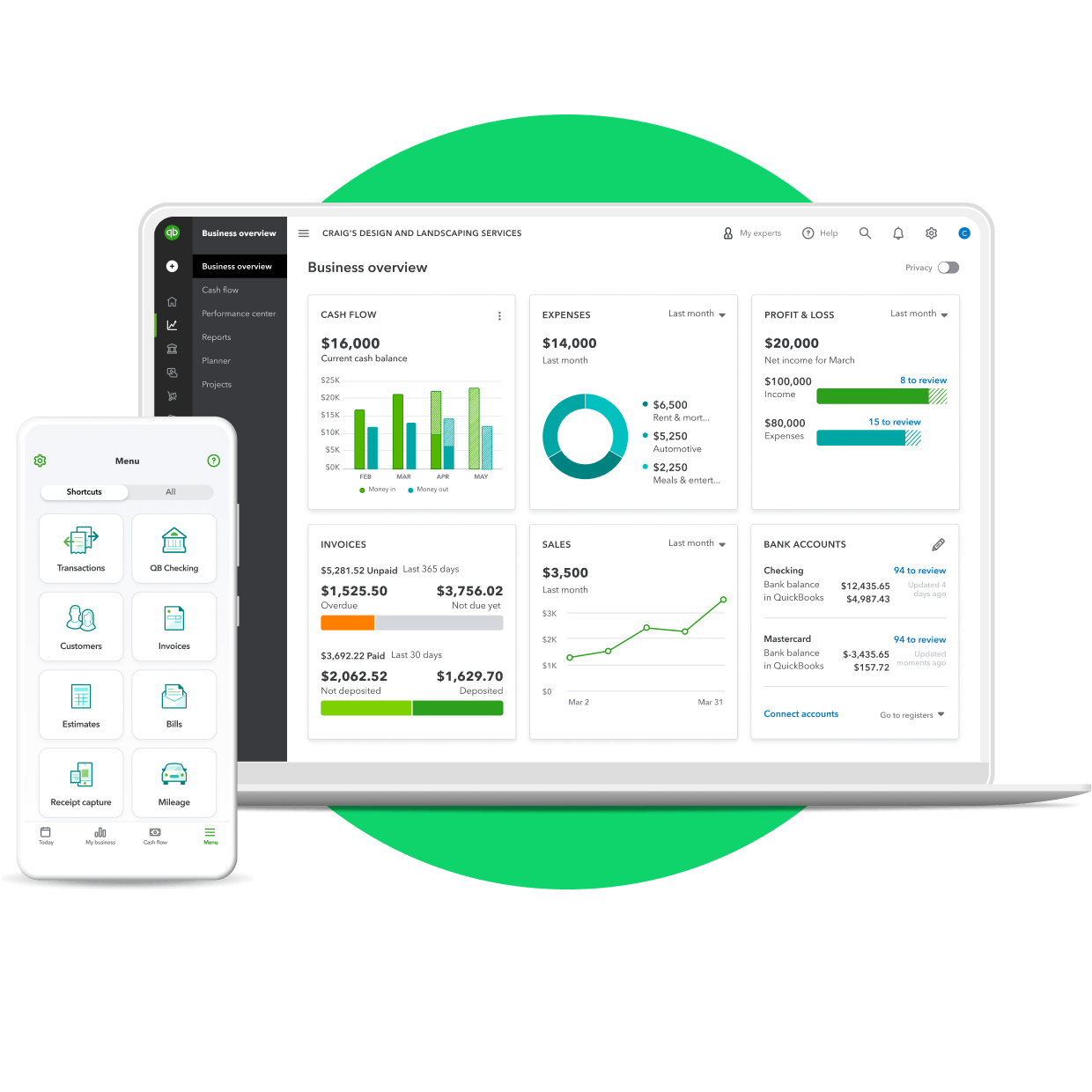

Get work done from anywhere

Access and manage your books from your computer, laptop, tablet, or smartphone–anytime you choose. All you need is an internet connection or data plan. Online accounting has never been easier.

A cloud accounting solution in your pocket

With the QuickBooks mobile app you can keep an eye on cash flow, use time tracking, and process payments, all from your phone. Upload receipts from anywhere for easy expense tracking.

Collaborate with colleagues

QuickBooks’ small business accounting software allows your bookkeeper, accountant, or colleagues to log in simultaneously and work directly with your data online. All changes are tracked through a detailed activity log.

Your security. Built into everything we do.

We take your security and privacy seriously. Our security specialists work to protect your financial data with our latest data encryption technology. Best of all, your information is automatically backed up, so you never need to save your work.

7 great benefits of switching to cloud accounting

By Kat Boogaard

You show up at your shop with your morning coffee in hand. You jiggle your key in the lock and realize that it’s already undone. Huh, maybe one of your employees is already here.

You swing the door open and realize the worst has happened: you’ve been robbed. Your shelves are wiped clean. Your cash drawer is empty. And the laptop you left on the counter is gone. The whole place has been ransacked.

It’s every small business owner’s worst nightmare—and it’s made even more terrifying when you realize that this means all of your financial files are gone too. All of your accounting data was on that now missing laptop, and you can’t even remember the last time you backed that up.

If you’re breaking out into a cold sweat, we can’t blame you. But, this is just one of many hypothetical anecdotes that illustrates the importance of moving to a cloud accounting software solution—sooner rather than later.

Need more convincing? In addition to protecting your data, cloud computing offers numerous perks that will help you boost your productivity and your business’ bottom line. Here are seven different benefits that prove it’s well worth making the switch to a SaaS (Service as a Software) accounting solution.

1. Protect yourself from data loss

As the above scenario proves, having backups of your data on remote servers is important—so, it’s not surprising that the percentage of Americans who own a computer and have backed up their data has grown to 80% and that nearly 58% use the cloud as the primary method.

However, you’re a busy business owner, which means frequent backups aren’t always at the top of your to-do list. Fortunately, with online accounting software like QuickBooks Online, backups happen automatically. Your data is securely saved without you needing to lift a finger.

If you’re worried that this compromises your personal business information, don’t be. Even better than a trusty computer behind a locked door, top-tier cloud accounting software uses safeguards to protect your information while it’s stored in secured systems.

2. Access your data anytime, anywhere

Imagine that you’re waiting for a meeting with a potential client when you remember that you need to send an invoice to a different customer. With traditional desktop accounting, you would have to file away a mental note to do that when you’re back at your computer, but with cloud accounting solutions, you could send the invoice right then and there from your phone or tablet.

Cloud-based software is accessed via the internet so you won’t be tethered to your physical business location. Along with invoicing, you can check your company’s financial information anytime from the office, your home, or even in line at your favorite coffee shop.

When you’re a business owner, every minute matters. Working in the cloud allows you to complete your accounting tasks efficiently—exactly when it’s most convenient for you.

3. Get a clearer picture of your business’ financial health

You’re looking through your bookkeeping records, getting an idea of your business’ financial standing for this quarter. Then you realize that this report is outdated and missing several important pieces of data, meaning it isn’t at all accurate.

Now you need to invest hours tracking down different spreadsheets and manual data entry to get a grasp on how your business is performing.

Cloud-based accounting software uses your internet connection to connect directly to your business bank accounts and can help you easily track sales, expenses, and even inventory management. As long as you keep everything up-to-date on a regular basis, you know you’re always seeing real-time data in your accounting software.

4. Collaborate seamlessly with your partners and accountants

With single access, desktop-based accounting programs, you end up spending a lot of time compiling and creating financial reports for your accountant to review. It may even be a task you dread.

Using cloud-based accounting and bookkeeping software means you can set up access for your accountant so they can log into the software as needed.

You’ll have total control over how much financial information other people—from your employees to your accountant to an outsourced team—will be able to see by customizing their access. For instance, if you have an employee processing your payroll, you can give that employee access to the payroll portion of the software without letting them have access to your bank accounts.

You’ll be able to streamline collaboration (and save yourself a lot of headaches), while still keeping your data secure.

5. Improve your cash flow

Still printing and mailing your invoices? Are you frustrated by needing to wait weeks (or even months) for that money to land in your business bank account?

Cloud accounting software lets you easily create professional-looking invoices and send them to your clients by email soon after the purchase—even the same day if you choose.

You can also accept payment directly through this online invoice by credit card, debit card, and ACH bank transfers. The easier you make it for your clients to pay, the more likely they are to do so right away—putting less time between you and your money.

One of the best parts about cloud accounting is that you can get a grasp on your cash flow in real time. Whether you want to check a payment or look at a customer’s history, you can do that conveniently from whatever device you’re using and get an immediate grasp on your financial status.

6. Capture receipts on your phone

Expenses. Love ‘em or hate ‘em, you know that you can’t monitor your business growth or prepare financial reports without tracking them. Unfortunately, logging and categorizing those expenses can get away from you fast, especially if you’re just throwing all of your receipts in a shoebox to be entered during crunch time.

With cloud accounting and the QuickBooks mobile app, you can snap and save photos of your receipts wherever you are. Powered by AI, QuickBooks automatically uploads those receipts and scans them for key details like date, vendor, amount, and payment method so they’re matched with existing transactions from your bank feeds.

You’ll have a detailed log of all of your expenses, as well as all of the receipts you need to back them up. That’ll be especially helpful when tax time rolls around and you need to categorize your write-offs.

7. Ensure your software is always up to date

Your software has updates available. Install now?

If you’re like a lot of people, you immediately close out that distracting popup—and then you do that very same thing for the next several months. Before you know it, you’re operating with software that’s several versions behind (and, as a result, vulnerable to all sorts of threats and bugs).

QuickBooks Online rolls out updates every single month. They’ll happen automatically, so you’ll always be working with the most current version.

You might think that moving to cloud-based accounting software is a hassle. But in reality, it’s a bigger hassle not to. Making this simple switch offers plenty of benefits to help with your business needs.

The biggest perk of all? Less time obsessing over clunky and outdated traditional accounting systems means more time for doing what you do best: running your business.