From running reports to offering insights to stay on track to meet your business goals, Intuit's Finance Agent delivers efficiency 24/7 to help you stay ahead of surprises.

FINANCE AGENT

Smarter insights.

Stronger moves.

Drive profitability, get performance insights, and plan for your future with an Finance Agent that’s 100% committed to your business.

Find the right path to success

Use tools inside QuickBooks Online to make plans that keep you moving forward.

Level-up your inventory tracking

Stay on top of stock management with real-time tracking, inventory calculator, and alerts that let you know when it’s time to reorder.

Estimates that push projects forward

Featuring customizable templates, clear project details, and the ability to convert to invoices in a snap, QuickBooks estimates can take you from proposal to payment.

Never miss a bill

Keep your bills organized in QuickBooks with the rest of your business finances, rather than in a spreadsheet, so you always know what you owe and can avoid missing due dates and cash flow disruptions.

Make a plan for taxes

When you work with contractors, keeping payments accurate and organized is critical. QuickBooks takes care of it all and makes it seamless to prepare 1099 forms and file with the IRS at tax time.**

Work with our tax experts to get help filing your tax return, unlimited, on-demand advice throughout the year, and a seamless books-to-tax experience.

Keep everything organized and in one place so you’re ready to go when it’s time to file. You can also give your accountant access for easier collaboration.

Plans for every kind of business

Subscribe to QuickBooks Online and try Live Expert Assisted FREE for 30 days.

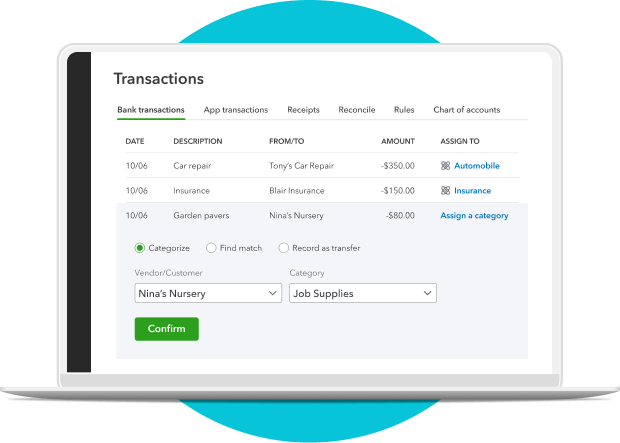

- QuickBooks learns how you categorize income and expenses and then automatically matches and records transactions from then on.

- $0.50/standard ACH transaction over monthly allotments. Allotments may vary.**

- Automatically invoice clients who have regularly-scheduled orders.

- AI-powered insights proactively surface trends, anomalies, and what’s causing them, personalized to your business.

- Close your books in a fraction of the time with advanced AI that includes anomaly detection that automatically finds and resolves discrepancies with you in control.

- Create and manage users and pre-defined roles, assigning them specific access levels to various areas of QuickBooks.

- Build and save reports that are tailored to your business needs.

- Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.See more

- Stay consistent, compliant, and credible with automated revenue recognition.See more

- Use your historical financial data to analyze trends and create projections of future outcomes, so you can make better-informed business decisions.

QUICKBOOKS LIVE EXPERT ASSISTED

Live experts. Total confidence.

Feel confident in your business—and your books. Get setup help and guidance with Live Expert Assisted FREE for 30 days.*

Plan your path forward

With QuickBooks Online, you’ll get the info and tools you need to stay on track.

Guarantees

Payroll Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Offer terms

QuickBooks Online Payroll terms: Each employee (active or on paid leave) is an additional $6.50/month for Core, $10/month for Premium, and $12/month for Elite. Contractor payments via direct deposit are $6.50/month for Core, $10/month for Premium, and $12/month for Elite. The service includes 1 state filing. If your business requires tax calculation and/or filing in more than one state, each additional state is $12/month for Core and Premium. There is no charge for state tax calculation or filing for Elite. The discounts do not apply to additional employees and state tax filing fees.

**Product information

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Online System Requirements: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). Network fees may apply.

QuickBooks Online Mobile: QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Third party apps: Apps may require a third-party subscription. Third party applications available on apps.com. Subject to additional terms, conditions, and fees. QuickBooks Online Payroll legal marketing guidelines available here.

QuickBooks Time: legal marketing guidelines for U.S. available here.

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription services that offers limited guidance by QuickBooks Live Bookkeepers to help you manage your books while you maintain full ownership and control of your books. Intuit will provide you with virtual access to a team of Live Bookkeepers, including but not limited to: the ability to schedule appointments during normal business hours subject to the Live Bookkeeper's availability, and the ability to collaborate and share required documents with the Live Bookkeepers. The Live Bookkeepers can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Tax Powered by TurboTax.

**Features

**QuickBooks features

Beta features have very limited availability and are subject to change. Features may be more broadly available soon.

Spreadsheet sync: Automatic refresh requires setup and will update workbooks or individual sheets every time you open the workbook or login to Spreadsheet Sync. See more details here.

Automatic Matching: QuickBooks Online will only match bank deposits with transactions processed through QuickBooks Payments. Not all transactions are eligible and accuracy of matches is not guaranteed.

Receipt Capture: Requires QuickBooks Online mobile app. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Pay-enabled invoices: Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval. E-invoicing QuickBooks Payments is an optional fee-based service. Additional fees may apply. Additional terms and conditions apply.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile app. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile app is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Bill Pay: Subject to eligibility criteria, credit, and application approval prior to first payment. Subscription to QuickBooks Online required. Bill Pay Basic is included with QuickBooks Online when purchased directly from QuickBooks.com or QuickBooks Sales. Not available in U.S. territories or outside the U.S.

QuickBooks Term Loan (“Term Loan”) is issued by WebBank.

Auto-match transactions: Automatic Matching: QuickBooks Online will only match bank withdrawals with transactions processed through QuickBooks Bill Pay. Not all transactions are eligible.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**QuickBooks Payroll Features

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Garnishments and deductions: Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

File 1099s right from QuickBooks: Additional form fees may apply.

Call Sales: 1-877-866-5232

© 2025 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.