Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.2

★★★★★

I work at a doctors office and use QuickBooks to manage all of the bills that are paid for the practice. It is easy to learn and user friendly.

It can easily keep an eye on all the payments and bills as it provides me all the information of [a] customer's transaction.

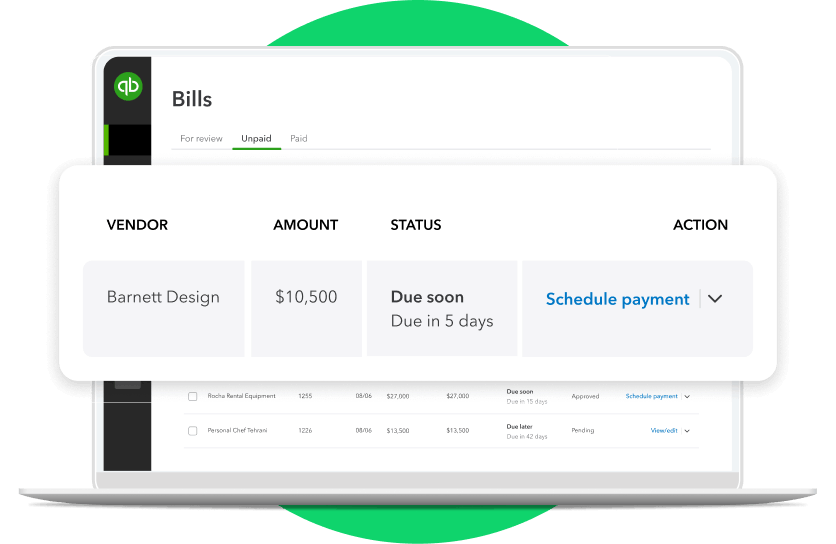

Bills don’t belong in a spreadsheet

Keep up with due dates for everyone you owe. The bills dashboard shows you what you owe, when, and to who, in a glance.

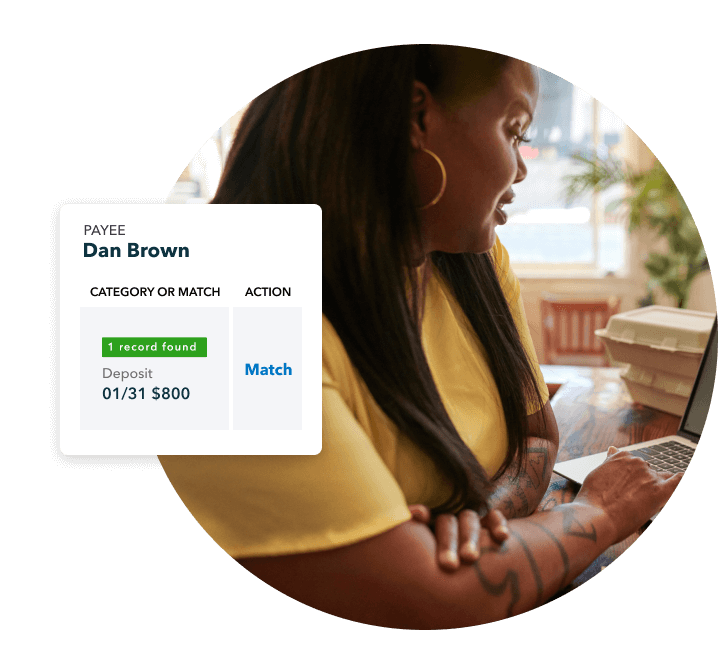

Once you connect your bank or business accounts (like Apple Pay® or PayPal), we’ll import your bill payments and match them to your vendors’ invoices.**

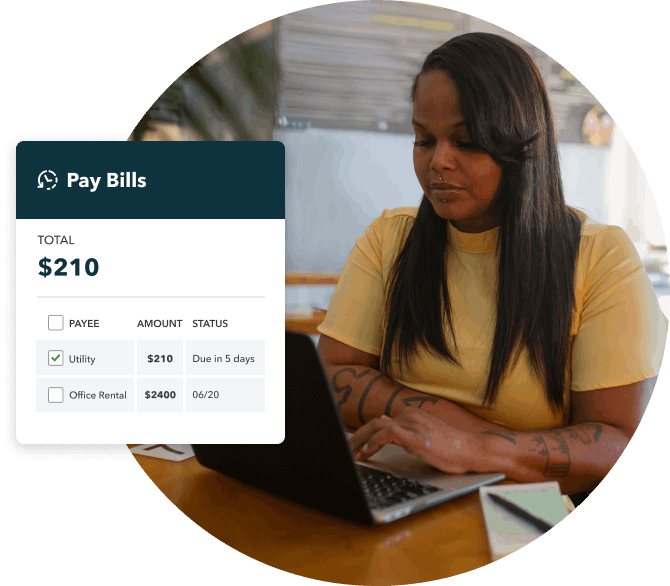

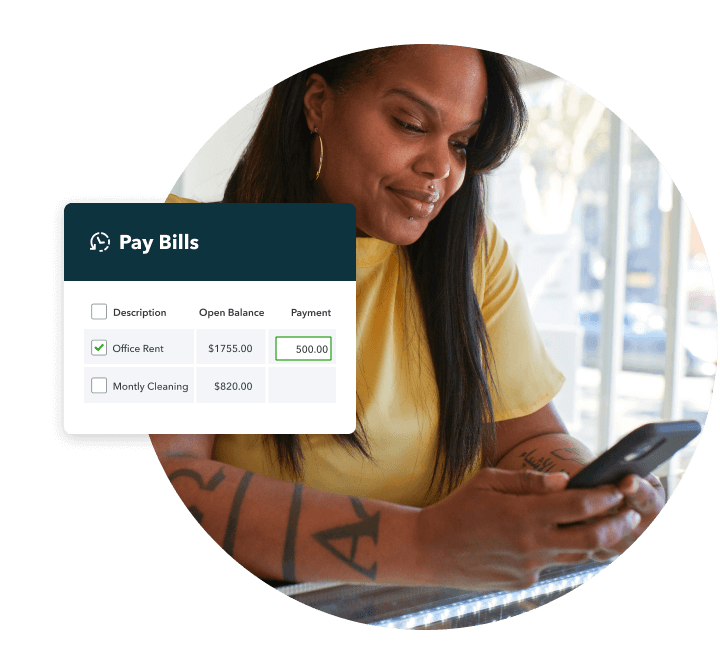

Enter the amount you want to pay and QuickBooks automatically tracks anything you still owe and when it’s due.

One place to streamline bill pay

From tracking and paying bills to gathering business insights, now do it all in QuickBooks to work smarter and free up more time.

Subscribe in your QuickBooks account

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

Frequently asked questions

More ways to learn about managing business bills

Find more of what you need with these tools, resources, and solutions.