Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI received an expense from a vendor that is ACH directly from my bank account twice a month. I entered the expense and matched it when it hit the bank. The same vendor issued credit for the bill, depositing the funds back. I entered a vendor credit because I want record of the credit memo and expense (in and out), but how do I match the bank entry with the vendor credit which still shows a balance amount?

Hi there cdawkins,

Thanks for providing those details.

Since you already entered a vendor credit, we must create a Bank deposit first to match your bank transaction.

Here's how:

To link the deposit to vendor credit:

You can also check the article: How do I handle vendor credits and refunds?

Should you have other questions, please let me know. Have a great day!

The same vendor issued credit for the bill, depositing the funds back. I

entered a vendor credit because I want record of the credit memo and

expense (in and out),

this is fine

but how do I match the bank entry with the vendor

credit which still shows a balance amount?

As suggested, on the deposit change the from account to accounts payable and use the vendor name - THEN use pay bills, select the bill the deposit made, and apply the vendor credit to pay it.

match the deposit in QB to the banking download

"The linking of the deposit to the vendor credit, shouldn't that be a NON-posting transaction"

You got Real Money. That needs to Post as part of banking.

"or if it does create a journal entry"

Never use JE for AP or Banking. You don't use JE when Names are involved, and you don't use JE for anything where the program already has tools. You have Banking tools and Vendor Tools. And using a JE for AP means you just broke "cash vs accrual basis" reporting.

"To summarize: VC: dr A/P, cr Exp."

No.

"Bank Deposit: dr Cash cr A/P"

No.

Can you please tell me if the same steps can be followed for an expense?

I bought some items and paid on my Visa which is one of my downloaded accounts. I returned a few of the items and entered as a vendor credit to the same expense account. Would your solution above work for my scenario?

It’s nice to see you in the Community space, pgazso.

I want to ensure the returned items are properly tracked in your account.

I'm glad to let you know that you can enter a bank deposit and input the transaction to the same expense account. Let me provide you the step by step process.

Here’s how:

That'll do it. By following these steps, the returned items are already posted to the correct account.

I added a link where you'll find the latest news and updates about the product. You may want to visit this site: The QuickBooks Blog.

Keep me posted if you have questions about QBO. I'll be around to answer them. Wishing you the best.

Tried this with a supplier credit and when I try to match the deposit to the credit it won't let me add the credit without also adding a BILL. How do I show that a supplier credit was deposited directly into my back account through interac debit?

Hello there, @andie787.

I appreciate you joining this thread. Allow me to step in and share some insights about managing vendor transactions in QuickBooks Online.

In order to record the supplier credit in your bank account, you will have to enter it as a deposit transaction and post to the A/P account.

After entering it, you can match the deposit right away with your bank transaction, andie787.

I'm still here to help you more if you have additional questions. Just add a comment or mention my name. Have a good one!

Your post just saved my life!! I changed the from account to Accounts Payable and VIOLA!!!! Thank you. I have spent hours and days trying to figure this out.

I'm having trouble with the second part of your post, specifically step 4. I'm using QB Desktop Pro 2018 and can't seem to find "Add to Check" anywhere.

I appreciate you following the steps shared by my colleague to record the transaction, @Schmitzlisan.

The instructions provided above is for QuickBooks Online. Since you're using Desktop Pro, I'm walking you through the second part, which is linking the deposit to the vendor credit.

Here's how:

For more information about the process, please check out this article: Record a vendor refund in QuickBooks Desktop.

Know that you're always welcome to drop by the Community if you need further assistance. I"m here for you. Have an awesome day!

Hi HoneyLynn_G,

This makes total sense to me. I am having the same issue, but with an added layer of complexity with Project Tracking. I have the same situation, but I need to also track this back to a project. When I select New Deposit, the line items of the Deposit do not have the "Customer" field in it where I would track the transaction back to the customer project. My refund is coming from a vendor on the project. How would you match a bank feed deposit that needs to be split between more than 1 deposit source and project/customer?

Thanking you in advance for any assistance!

I'll help you track and match that deposit, lainscough.

When we add a line item in the deposit, we can select the name of the project associated with your vendor from the RECEIVED FROM column. This way, we'll be able to link the deposit to your project. I'll guide you how:

Since we're splitting the transaction and the amount is already divided, we'll no longer have to match it. We can just simply add it instead of matching the deposits. You can follow the steps that I've listed below:

There you have it. In case you need to assign and categorize your downloaded banking transactions, you can visit our article to be guided in doing it: Assign, categorize, edit, and add your downloaded banking transactions.

Please know that the Community always has your back, so don't hesitate to let me know If I can be of any assistance. Feel comfortable to tag me in your comments.

Thank you! I was getting hung up on the refund coming from the vendor and was selecting that vendor in the Received From column.

I could also use a vendor credit, which I tried. Using this way, I was getting hung up on the visual in the Vendor >> Transaction List. When you use a vendor credit, then match the deposit to the credit by classifying it to Accounts Payable, then using a bill/expense/check to zero out the outstanding amount, total on the transaction list page shows that the amount is subtracted twice. However, when I check the affect of the transaction on the Income Statement, the expense account is correct and Net Income is correct. It's just a visual oddity on the Vendor Transaction List page.

Thanks for keeping us updated, @lainscough.

I'm so glad that we were able to provide you with some information on how to resolve your issue about matching a bank feed deposit. The Community is always here to have your back.

Let us know if you have any other questions. I'm always here to lend a helping hand. Have a wonderful day!

Thank you for the response and "translation" to Desktop. How exactly do you "Choose the AP account used on the deposit."? It only allows me to select a bill, of which there are none for this vendor. Without selecting a "bill" to pay the "Set Credits" button is grayed out and unavailable for use. I can select different banking accounts in the Payments section but that is already defaulted to our Operations Account. Do I need to create a zero bill to clear this out? Please advise.

For the first part here's the info on the Deposit:

Deposit to: Operations Account

Received From: Vendor Name

From Account: Proper Expense Account ie: Payroll

Memo, Check #, Pmt Method: Blank

Amount: $xxx.xx

Cash Back To fields are all blank.

Sorry for the confusion and thank you for the help.

Hi there, @LNS.

Thanks for reaching out to the Community.

Before going into detail, I want to ask if you could provide me with some additional information about what you're doing? Once I have a better understanding, I'll be able to provide you with a solution.

I look forward to chatting with you soon. Have an excellent rest of your day!

Thank you for the response but sadly it did not help. Here's the process I followed: A) Entered Bill B) Paid Bill then C) Steps 1 & 2 went swimmingly but when I get to Step 3 there are no bills or credits (the vendor doesn't show up at all on the Pay Bills window).

I do have "show all bills" selected. This was for a bill from an internet provider that I paid after we had vacated the building. They then sent us a check back. Could this possibly be a Company Setting issue?

Scenario 1: The vendor sends you a refund check for a bill that is already paid

1. Record a Deposit of the vendor check:

Go to the Banking menu, then select Make Deposits.

If the Payments to Deposit window appears, select OK.

In the Make Deposits window, select the Received from drop-down and choose the vendor who sent you the refund.

In the From Account drop-down, select the appropriate Accounts Payable account.

In the Amount column, enter the actual amount of the Vendor check.

(Optional) Enter a memo, check number, payment method, and class.

Select Save & Close.

2. Record a Bill Credit for the refunded amount:

From the Vendors menu, select Enter Bills.

Select the Credit radio button to account for the return of goods.

Enter the Vendor name.

Select the Expenses tab and enter the Accounts on the original bill.

In the Amount column, enter the appropriate amount for each Account (the amounts may have to be prorated).

Select Save and Close.

3. Link the deposit to the Bill Credit:

From the Vendors menu, select Pay Bills.

Check the Deposit that matches the Vendor check amount.

Select Set Credits and apply the Bill Credit you created earlier then select Done.

Select Pay Selected Bills, then select Done.

Hi, AngelLisa.

Thanks for joining the thread, I'm happy to provide some clarity on the issue going on. If you're getting hung up on the vendor credit follow along below.

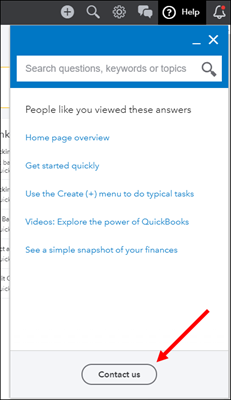

That should get your vendor credit to show up, however if you're still experiencing issues, I suggest reaching out to our Support team as they have the ability to dive into your specific account and even get into a screen share with you so you can go through the process together. Here's how you can reach them.

To ensure we address your concern on time, check out our support hours.

If you have any other questions or concerns, feel free to post below. Thanks again for dropping by the Community and have a nice afternoon.

Thank you for responding. I am using QuickBooks Desktop Pro 2018 and there is no option to "add to check".

Hello there, @AngelLisa.

You can go to Pay Selected Bills page and add to checks in QuickBooks Desktop (QBDT).

Here's how:

For more information about the process, please check out this article: Record a vendor refund in QuickBooks Desktop.

In case you need to assign and categorize your downloaded banking transactions, you can visit our article to be guided in doing it: Add and match Bank Feed transactions in QuickBooks Desktops.

Please know that the Community has your back should you have any questions. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here