Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Hi there cdawkins, Thanks for providing those details. Si...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

I received an expense from a vendor that is ACH directly from my bank account twice a month. I entered the expense and matched it when it hit the bank. The same vendor issued credit for the bill, depositing the funds back. I entered a vendor credit because I want record of the credit memo and expense (in and out), but how do I match the bank entry with the vendor credit which still shows a balance amount?

Labels:

37 Comments 37

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hi there cdawkins,

Thanks for providing those details.

Since you already entered a vendor credit, we must create a Bank deposit first to match your bank transaction.

Here's how:

- Select Plus Icon (+) at the top, and click Bank Deposit.

- In the Add other funds to this deposit section, fill in the following fields:

Received from: Select or enter the vendor name.

Account: Select the Account payable account.

Amount: Enter the check amount. - Select Save and Close.

To link the deposit to vendor credit:

- Select Plus Icon (+) at the top, and click Check.

- Select Choose a payee drop-down arrow, and click the vendor name.

- Provide the Check #, Date, Amount and Memo fields blank.

- From the Add to Check sections, select Add for the outstanding vendor credit and deposit.

- Select Save and Close.

You can also check the article: How do I handle vendor credits and refunds?

Should you have other questions, please let me know. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

This method seems to cancel off the outstanding amount on the expense account, but it leaves the original cost and refund transactions in the Banking "for review" list. Please explain... are we then meant to exclude those, and not match them to anything?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

"This method seems to cancel off the outstanding amount on the expense account,"

If you never entered a Vendor Credit, then your deposit is against that original expense account.

If you entered a vendor credit/return, you have an open negative AP; that's why the deposit of the refund is as AP. It isn't against the original expense account. You already took care of that in the vendor return entry.

If you never entered a Vendor Credit, then your deposit is against that original expense account.

If you entered a vendor credit/return, you have an open negative AP; that's why the deposit of the refund is as AP. It isn't against the original expense account. You already took care of that in the vendor return entry.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

The linking of the deposit to the vendor credit, shouldn't that be a NON-posting transaction or if it does create a journal entry, the amount should be 0 . Otherwise it would be creating a negative balance for AP again and it offsets the deposit of the funds back. To summarize: VC: dr A/P, cr Exp. Bank Deposit: dr Cash cr A/P (AT THIS POINT IT SHOULD BE FINE), but when the link is done via check/bill pay instructed above, this creates the following journal entry: Billpay: dr AP cr Cash

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

I'm recording the refund, so the cash should end up with just a debit since it's supposed to reduce the already issued cash previously. with the last JE made by linking , disburses the cash again and creates an unnecessary AP negative balance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

The same vendor issued credit for the bill, depositing the funds back. I

entered a vendor credit because I want record of the credit memo and

expense (in and out),

this is fine

but how do I match the bank entry with the vendor

credit which still shows a balance amount?

As suggested, on the deposit change the from account to accounts payable and use the vendor name - THEN use pay bills, select the bill the deposit made, and apply the vendor credit to pay it.

match the deposit in QB to the banking download

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

"The linking of the deposit to the vendor credit, shouldn't that be a NON-posting transaction"

You got Real Money. That needs to Post as part of banking.

"or if it does create a journal entry"

Never use JE for AP or Banking. You don't use JE when Names are involved, and you don't use JE for anything where the program already has tools. You have Banking tools and Vendor Tools. And using a JE for AP means you just broke "cash vs accrual basis" reporting.

"To summarize: VC: dr A/P, cr Exp."

No.

"Bank Deposit: dr Cash cr A/P"

No.

Learn to use the Tools that are provided.

If you got a refund and enter that as a Deposit, such as returning a bad toner cartridge = Office supplies, you realize, Hey, I cannot use my product/services here, or track that it relates to a specific customer name. So, when you need to enter More Info, such as returned Inventory products or got a refund for Services rendered, and might also want to track Customer name, that is why you start with the Vendor Credit.

And if you used Vendor Credit, you already created negative AP. That means the Refund is Debit Bank and Credit AP; which means using the Deposit screen, to show the deposit of the refund check is AP for that vendor name. That is why you then can link the refund to the available credit, in the Bill Payment function.

"Otherwise it would be creating a negative balance for AP again"

The Deposit, posting as AP, shows as if this is Bill to be paid; that's why you can link the earlier Vendor Credit to that deposit. That closes out the AP for that name.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Can you please tell me if the same steps can be followed for an expense?

I bought some items and paid on my Visa which is one of my downloaded accounts. I returned a few of the items and entered as a vendor credit to the same expense account. Would your solution above work for my scenario?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

It’s nice to see you in the Community space, pgazso.

I want to ensure the returned items are properly tracked in your account.

I'm glad to let you know that you can enter a bank deposit and input the transaction to the same expense account. Let me provide you the step by step process.

Here’s how:

- Go to the Plus icon (+) at the top, and select Bank Deposit.

- Click on the drop-down for Account, and select the appropriate bank.

- In the Date field, enter the correct period.

- Go to the Add other funds to this deposit section.

- In the Received from column, select a vendor.

- In the Account column, enter the expense account you want to post the transaction.

- Enter the amount of the deposit.

- Click on Save and Close.

That'll do it. By following these steps, the returned items are already posted to the correct account.

I added a link where you'll find the latest news and updates about the product. You may want to visit this site: The QuickBooks Blog.

Keep me posted if you have questions about QBO. I'll be around to answer them. Wishing you the best.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Tried this with a supplier credit and when I try to match the deposit to the credit it won't let me add the credit without also adding a BILL. How do I show that a supplier credit was deposited directly into my back account through interac debit?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hello there, @andie787.

I appreciate you joining this thread. Allow me to step in and share some insights about managing vendor transactions in QuickBooks Online.

In order to record the supplier credit in your bank account, you will have to enter it as a deposit transaction and post to the A/P account.

- Click the Plus icon.

- Choose Bank Deposit.

- Go to the Add funds to this deposit section.

- Enter the necessary information.

- Click Save and new.

After entering it, you can match the deposit right away with your bank transaction, andie787.

I'm still here to help you more if you have additional questions. Just add a comment or mention my name. Have a good one!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Your post just saved my life!! I changed the from account to Accounts Payable and VIOLA!!!! Thank you. I have spent hours and days trying to figure this out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

I'm having trouble with the second part of your post, specifically step 4. I'm using QB Desktop Pro 2018 and can't seem to find "Add to Check" anywhere.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

I appreciate you following the steps shared by my colleague to record the transaction, @Schmitzlisan.

The instructions provided above is for QuickBooks Online. Since you're using Desktop Pro, I'm walking you through the second part, which is linking the deposit to the vendor credit.

Here's how:

- Go to Vendors and choose Vendor Center.

- Click the New Transaction drop-down and pick Pay BIlls.

- In the Pay Bills window, select Show all bills.

- Choose the AP account used on the deposit.

- Tap Set Credits.

- Pick the Credit tab in the Discounts and Credits window.

- Place a checkmark on the credit that you've created, then click Done.

- Hit Pay Selected Bills.

For more information about the process, please check out this article: Record a vendor refund in QuickBooks Desktop.

Know that you're always welcome to drop by the Community if you need further assistance. I"m here for you. Have an awesome day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hi HoneyLynn_G,

This makes total sense to me. I am having the same issue, but with an added layer of complexity with Project Tracking. I have the same situation, but I need to also track this back to a project. When I select New Deposit, the line items of the Deposit do not have the "Customer" field in it where I would track the transaction back to the customer project. My refund is coming from a vendor on the project. How would you match a bank feed deposit that needs to be split between more than 1 deposit source and project/customer?

Thanking you in advance for any assistance!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

I'll help you track and match that deposit, lainscough.

When we add a line item in the deposit, we can select the name of the project associated with your vendor from the RECEIVED FROM column. This way, we'll be able to link the deposit to your project. I'll guide you how:

- Click the + New icon.

- Select Bank Deposit.

- Choose the appropriate bank from the Account drop-down menu.

- Enter the correct period in the Date field.

- Go to the Add other funds to this deposit section.

- Select the project associated with your vendor in the Received from column.

- In the Account column, enter the expense account you want to post the transaction.

- Enter the amount of the deposit.

- Hit Save and Close to complete the process.

Since we're splitting the transaction and the amount is already divided, we'll no longer have to match it. We can just simply add it instead of matching the deposits. You can follow the steps that I've listed below:

- Select Banking from the sidebar menu.

- Click the Banking tab.

- On the For Review tab, select the deposit to open it.

- Tick the Add radio button.

- Click the Split button to open the Split Transaction window.

- Choose the name of the appropriate customer or project from the RECEIVED FROM column.

- Select a Category and enter an Amount for each category to assign to the transaction until the total amount matches the downloaded amount. You can select Add Lines to add more categories.

- Hit Save and Add.

- Then, click the Add button (beside Edit Split).

There you have it. In case you need to assign and categorize your downloaded banking transactions, you can visit our article to be guided in doing it: Assign, categorize, edit, and add your downloaded banking transactions.

Please know that the Community always has your back, so don't hesitate to let me know If I can be of any assistance. Feel comfortable to tag me in your comments.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Thank you! I was getting hung up on the refund coming from the vendor and was selecting that vendor in the Received From column.

I could also use a vendor credit, which I tried. Using this way, I was getting hung up on the visual in the Vendor >> Transaction List. When you use a vendor credit, then match the deposit to the credit by classifying it to Accounts Payable, then using a bill/expense/check to zero out the outstanding amount, total on the transaction list page shows that the amount is subtracted twice. However, when I check the affect of the transaction on the Income Statement, the expense account is correct and Net Income is correct. It's just a visual oddity on the Vendor Transaction List page.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Thanks for keeping us updated, @lainscough.

I'm so glad that we were able to provide you with some information on how to resolve your issue about matching a bank feed deposit. The Community is always here to have your back.

Let us know if you have any other questions. I'm always here to lend a helping hand. Have a wonderful day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Thank you for the response and "translation" to Desktop. How exactly do you "Choose the AP account used on the deposit."? It only allows me to select a bill, of which there are none for this vendor. Without selecting a "bill" to pay the "Set Credits" button is grayed out and unavailable for use. I can select different banking accounts in the Payments section but that is already defaulted to our Operations Account. Do I need to create a zero bill to clear this out? Please advise.

For the first part here's the info on the Deposit:

Deposit to: Operations Account

Received From: Vendor Name

From Account: Proper Expense Account ie: Payroll

Memo, Check #, Pmt Method: Blank

Amount: $xxx.xx

Cash Back To fields are all blank.

Sorry for the confusion and thank you for the help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hi there, @LNS.

Thanks for reaching out to the Community.

Before going into detail, I want to ask if you could provide me with some additional information about what you're doing? Once I have a better understanding, I'll be able to provide you with a solution.

I look forward to chatting with you soon. Have an excellent rest of your day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Thank you for the response but sadly it did not help. Here's the process I followed: A) Entered Bill B) Paid Bill then C) Steps 1 & 2 went swimmingly but when I get to Step 3 there are no bills or credits (the vendor doesn't show up at all on the Pay Bills window).

I do have "show all bills" selected. This was for a bill from an internet provider that I paid after we had vacated the building. They then sent us a check back. Could this possibly be a Company Setting issue?

Scenario 1: The vendor sends you a refund check for a bill that is already paid

1. Record a Deposit of the vendor check:

Go to the Banking menu, then select Make Deposits.

If the Payments to Deposit window appears, select OK.

In the Make Deposits window, select the Received from drop-down and choose the vendor who sent you the refund.

In the From Account drop-down, select the appropriate Accounts Payable account.

In the Amount column, enter the actual amount of the Vendor check.

(Optional) Enter a memo, check number, payment method, and class.

Select Save & Close.

2. Record a Bill Credit for the refunded amount:

From the Vendors menu, select Enter Bills.

Select the Credit radio button to account for the return of goods.

Enter the Vendor name.

Select the Expenses tab and enter the Accounts on the original bill.

In the Amount column, enter the appropriate amount for each Account (the amounts may have to be prorated).

Select Save and Close.

3. Link the deposit to the Bill Credit:

From the Vendors menu, select Pay Bills.

Check the Deposit that matches the Vendor check amount.

Select Set Credits and apply the Bill Credit you created earlier then select Done.

Select Pay Selected Bills, then select Done.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hi, AngelLisa.

Thanks for joining the thread, I'm happy to provide some clarity on the issue going on. If you're getting hung up on the vendor credit follow along below.

- Select Plus Icon (+) at the top, and click Check.

- Select Choose a payee drop-down arrow, and click the vendor name.

- Provide the Check #, Date, Amount and Memo fields blank.

- From the Add to Check sections, select Add for the outstanding vendor credit and deposit.

- Select Save and Close.

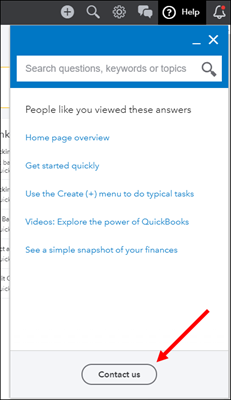

That should get your vendor credit to show up, however if you're still experiencing issues, I suggest reaching out to our Support team as they have the ability to dive into your specific account and even get into a screen share with you so you can go through the process together. Here's how you can reach them.

- Sign in to your QuickBooks Online company.

- Select Help (?) at the top right.

- Select Contact Us to connect with a live support agent.

To ensure we address your concern on time, check out our support hours.

If you have any other questions or concerns, feel free to post below. Thanks again for dropping by the Community and have a nice afternoon.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Thank you for responding. I am using QuickBooks Desktop Pro 2018 and there is no option to "add to check".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I match a vendor credit with the amount deposited back to the bank account?

Hello there, @AngelLisa.

You can go to Pay Selected Bills page and add to checks in QuickBooks Desktop (QBDT).

Here's how:

- Go to Vendors, then click the Vendor Center.

- Click the New Transaction drop-down and pick Pay BIlls.

- In the Pay Bills window, select Show all bills.

- Choose the AP account used on the deposit.

- Tap Set Credits.

- Pick the Credit tab in the Discounts and Credits window.

- Place a checkmark on the credit that you've created, then click Done.

- Hit Pay Selected Bills.

For more information about the process, please check out this article: Record a vendor refund in QuickBooks Desktop.

In case you need to assign and categorize your downloaded banking transactions, you can visit our article to be guided in doing it: Add and match Bank Feed transactions in QuickBooks Desktops.

Please know that the Community has your back should you have any questions. Have a great day.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...