Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Sales Tax collected and tax payable are 2 different amounts. They should be the same, I had a previous problem with this and it seems I was to do an audit but can not remember how to go about it.

Solved! Go to Solution.

Sales Tax Payable is affected by your prior payments, if the amount was higher or lower than the amount owed at that point in time. That is just a Running Balance, in other words.

Example:

You owe $1,000 for Jan and pay it. Then, you issue a Credit Memo or otherwise Change something in Jan. Now Feb is going to reflect that difference that happened because of changes in Jan.

Perhaps the "audit" you are asking about is the Audit Trail report. Run it on Sales transactions, dated in the prior month, for changes Entered/Modified after the end of that month. This reveals where someone made changes to your historic data = making a mess of the prior sales data, affecting Sales and Sales Taxes.

Sales Tax Payable is affected by your prior payments, if the amount was higher or lower than the amount owed at that point in time. That is just a Running Balance, in other words.

Example:

You owe $1,000 for Jan and pay it. Then, you issue a Credit Memo or otherwise Change something in Jan. Now Feb is going to reflect that difference that happened because of changes in Jan.

Perhaps the "audit" you are asking about is the Audit Trail report. Run it on Sales transactions, dated in the prior month, for changes Entered/Modified after the end of that month. This reveals where someone made changes to your historic data = making a mess of the prior sales data, affecting Sales and Sales Taxes.

Current balance in "collected" would be all taken in. Liability payable is for filing period. Should be only one account. It might not hit zero. Do not use Write Check to pay this but use Vendors>SalesTax>Pay Sales Tax.

Also, there may be a difference in tax reported between Accrual and Cash basis if you have open Invoices.

John,

I have a big issue. I never had a problem until I updated to QB2020. I use a Cash based system in where I do not pay sales tax until a job is completed. I don't want to pay tax on an invoice where I've collected a deposit. Especially if a client doesn't pay and I get stuck with full sales tax. This also could span between quarters causing an issue with Accrual.

However, in QB2020, now there is a Cash and Accrual reporting method which is confusing. If I set it to Cash is shows that the amount I've collected versus what I owe being different and usually lower. If I do Accrual is shows all the open invoices I have and nothing seems to match.

The issue is that if I go to Vendors>Pay Sales Tax for the period, this number doesn't add up to the number I put in my States Tax table to pay. Those numbers I put in equal the Collected tax. So what am I supposed to do? I cannot just add extra money to my states tax form as it will not accept it. If I put it as excess collections (which is typically a few pennies) and happens often, $52.00 is not typical and likely to throw a red flag causing an audit or additional fee for withholding or overcharging clients.

The way QB2020 is recording/report sales tax payable is not good and I need to know how to navigate it so that I don't have standing balances. My sales tax payable has always been $0.00 after I paid. Now if I go back to my past Sales Tax Liabilities it either shows a +/- and this isn't good. I need to get this balance ASAP. Thanks.

Glad to have you here, Matt K.

Allow me to share some insights on how the accounting method affects your sales tax in QuickBooks.

Your accounting method affects the sales tax amount you owe. If you're using the accrual basis method, you report your income when you bill it. However, when you use the cash basis method, you report your income when you receive it.

Moreover, you'll have to ensure that you enter the correct payment date on when the sales tax payment happened.

Since modifying your accounting basis will affect your reports, I recommend consulting with an accountant. They can offer you some accounting advice to ensure the changes don't mess up your financial records.

You may want to check these articles to learn more about how sales tax works:

Additionally, I've added an article about running sales tax reports in QuickBooks Desktop. This helps you make sure everything is accurate before paying taxes: Sales Tax Report.

If you need additional help with the Sales Tax feature in QuickBooks, please let me know by clicking the Reply button below. Have a great day!

I'm not sure I follow. I've always been using Cash basis. When payments are made, sales tax payable goes in to that quarter. At the end of the quarter QB shows me the sales tax owed. I run the Sales Tax Lability report and enter my numbers on my Tax Agency's website form and everything is fine.

Now, none of this works or balances correctly. No matter what, the number changes on my collecting/reporting. So even if I use a Cash bases system as before and run a Cash based report, it's not accurate. What I've collected and what I owe is different. However, trying to figure out Adjustment is a nightmare. I've read all the articles and its very confusing and makes you have to create a bunch of separate accounts. I've been running my business for over 10 years with no accountant an now all the sudden because QB had been changed on it's reporting and collecting of Sale Tax I can't even run my own business. I can't afford thousands a year to have an accountant on retainer and even if so many don't explain or like to let you know what they do.

The articles you provided do not help. Like I said I've been doing it for years with no issues and now everything has changed for the bad. My tax agency does not use your reporting methodology and therefore trying to balance between their system and the way QB tracks payment will not work. It's always going to show me having to pay more than my agency is trying to collect or me having an under/over payment.

This is not the impression we want you to experience while using QuickBooks Desktop, Matt K.

Let’s try some new steps to fix this. Aside from the solutions provided by my colleagues, let's try opening the Sales Tax Liability Report and enter the correct period. This helps us determine if the payment was applied to a different period. Also, this report summarizes your sales tax liability (the sales tax you've collected and currently owe to your tax agencies). The report shows your total taxable sales, total non-taxable sales, and the amount of sales tax you owe each tax agency. Here's how:

If the payment is recorded to the correct date and the balances are correct, it would be best to contact our Customer Support Team. They'll pull up your account in a secure environment and investigate what's causing this issue. Here's how to reach them:

Feel free to visit our Taxes page for more insights about managing your taxes in QuickBooks.

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks. Assistance is just a post away. You have a good one.

That’s what I did. Did you not see the screenshot with the report window. Like mentioned I’ve been running these reports for 10 yrs. However, they no longer report accurately and I cannot pay Sales Tax Payable when my Tax Agency doesn’t show that number. It has to balance with the numbers from Total Sales/Taxable Sales/Tax Exempt Sales. There’s no information to provide on my tax agency web form that will allow me to populate the numbers QB2020 is showing. It seems this number changes depending on invoices been closed or open. But if this is Cash system, why is my Sale Tax Liability changing and being reported inaccurately? I’m not supposed to be seeing open invoices or invoices that were paid. They should go on the current period, not the past (paid) period).

Even if I pay the Sales Tax Collected it’s going to put me in a deficit with QB. This is not how this is supposed to work and I have no clue on why it was ever changed. I never would have upgrade had my 2016 version had I been force to b/c it was no longer supported.

Hi there, Matt K.

As mentioned above accounting method or report basis you use affects the sales tax amount you owe. If this is a Cash basis, QuickBooks calculates sales tax payable only when you receive the payment. When you receive full payment for the invoice. The full sales tax amount will show in the month when the payment was received. However, when there are non-taxable line items on the invoice or if you receive partial payments, or if there are credits/discounts applied to the invoice. Then, for accrual, QuickBooks calculates sales tax payable as soon as you invoice your customer. Regardless of the payment amount or date, the full sales tax amount will show in the month when the invoice was created. To see more details on how QuickBooks helps you keep an accurate record of taxes so you can easily monitor and remit them to the appropriate tax collecting agency, you can refer to this article: Handle cash basis sales tax.

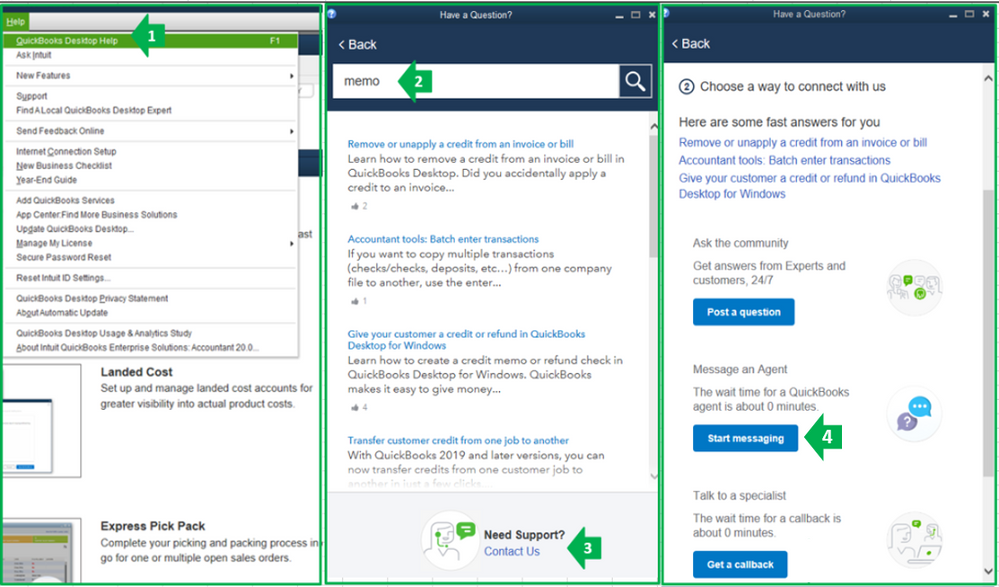

Then, you'll need to make sure that you enter the correct payment date on when the sales tax payment occurred. Since you already performed the shared above and the issue persists, I'd recommend contacting our QuickBooks Desktop Support team. They have the tools to further investigate why Sale Tax Liability changing and being reported inaccurately. Please note that QuickBooks Desktop support recently changed the way of how to contact them. This is to ensure you are routed to the right QuickBooks team. This is also the quickest and most secure way for you to find answers and get next-level assistance. That said, you'll need to go to the Help icon. From there, you'll have the option to contact us through messaging.

Here's how:

Please check the articles below to see different information on how usual sales tax workflow in QuickBooks Desktop. Then, the difference between Cash and Accrual basis and how to set them as preferences in QuickBooks Desktop for Windows.

Let me know if you have any other questions. I'm always happy to help. Have a good one.

I don't understand the discount part. So if I have a item discount on an invoice dated 6/25/20 and a payment applied 7/12/20 and I owe sales from 4/1/20-6/30/20, then the tax will be applied to the 6/30/20 quarter instead of the 7/1/20 quarter even on a Cash basis system? If so, this is really going to be hard for me to track how to apply partial payments and discounts. Essentially, this will cause me to have to change the dates of invoices so that the payments and dates fall within the sales tax quarters. Otherwise, I'm goin to have reverse calculating taxes and have to pay sales tax from one invoice in two different quarters. This will never balance out and always cause me to care a sales tax liability as well has not be compatible reporting for my tax agency.

I will check out what you provided.

Thank you for the detailed information, @Anonymous.

Let me add additional information to make things clear for you. Depending on how you set up sales tax if it is calculated as cash or accrual.

Since you've mentioned that you're using a cash basis. The sales tax will be allocated in the month of payment.

To learn more and have a deeper understanding of cash and accruals in Quickbooks, feel free to read this article: Cash vs. accrual.

You may be required to collect taxes for certain goods and services you offer. QuickBooks helps you keep an accurate record of these taxes so you can easily monitor and remit them to the appropriate tax collecting agency: Set up sales tax in QuickBooks Desktop.

I hope this gives you a better understanding of the issue. Let me know if you still have confusion, I'll be very much willing to help you.

Thanks. Its helps me understand the methods better, but I've been using Cash basis for years and as a sole proprietor I don't foresee ever needing an accrual based system. This is why I chose cash because its much simpler. However, QB2020 is treating my Sales Tax liability for a Cashed based system like an accrual system. Somehow it's using a hybrid method that uses reverse calculating. Even on some invoices where I collect in one month, and the sales tax is payable in that month, for whatever reason QB will show that tax for that invoice due in the month before. There is no rhyme or reason as to why this is happening that I could find. It's very frustrating to say the least and unless something is done by Intuit to fix this, I will have to keep dealing with it. It worked fine until upgrading to QB 2020.

Hello there, Matt K.

If we're experiencing unexpected behaviors in the program, we can do a few troubleshooting steps to ensure that your company file is in good condition. Here are the things that we can do:

Make sure your preference is set to Cash basis.

If the same thing happens, you can contact our Technical Support Team. They can give you further steps to get it working.

We'll be right here if you need anything else. Have a great day!

Thank you! All of this has been done. Still the issue persists. I was able to go in and change the dates on invoices and get it to with $7.00 of the Collected Balance and Owed balance. However, I could not trace down the $7.00.

Thanks for keeping us updated with the results, Matt K.

The steps shared above were the basic solutions to fix the issue about how recording and reporting sales tax payable works in QuickBooks Desktop.

Since you've tried the possible solutions above to no avail, it would be best to reach out to our QuickBooks Care Support. This needs to be investigated thoroughly to come up with a concrete resolution.

Here are the steps to contact support:

Please take note our operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

If you need helpful articles for your future task, you can always visit this link: Help articles for QuickBooks Desktop.

Keep me posted for additional questions or other concerns. I'd be more than happy to help. Wishing you the best of luck.

Some how or another I lost the option to pay sales tax under vendors any suggestions

We can perform some troubleshooting steps to get around this issue, @mizelec1.

Let’s update your QuickBooks Desktop (QBDT) software to ensure your company file is equipped with the latest security features and fixes. Here’s how:

You can also see this link for more details: Update QuickBooks Desktop to the latest release.

If the issue persists, I recommend running the Verify Rebuild utility tool. This easily identifies issues within your company file and fixes them right away.

Once everything looks good, you can now pay your sales tax from the Vendors menu. In case you need to make some adjustment to your taxes, see this article that can walk you through the process: Process sales tax adjustment.

If you have further questions about paying your taxes in QuickBooks, you can share it with me. I’m more than happy to assist you. Have a great day and keep safe!

It is the latest update. I think I have it resolved. But I had to manually change some historical information which is not what I wanted to do. Right now I am showing the correct taxes due in the cash method report.

Matt what do you mean change some historical information.

Thank you @Anonymous for posting all of this. I have been having the same issues since that update as well. The only thing I have figured out as it has something to do with the previous months payment. Mine never balances out anymore either, especially after I make a payment it normally goes to zero and now it does not. It is a running total. I can't seem to fudge it to make it balance out. I have over paid it the last couple of months to see if that makes a difference but it just adds a negative amount to my screen for the next month. I don't know how to fix it either. If you figured something out please share it because I am also super frustrated with it.

Thanks,

Deanna

I meant I had to adjust the dates on invoices so that any that were showing discounts were reflected in the same quarter as the sales tax was due. Having one invoice with a discount and/or split between two collecting quarters creates a problem with cash based system. I file quarterly not monthly.

The issue that I found with QB2020 was identified by one of the comments made in one of the earlier answers. It has to do with discounts applied to invoices that have an origination date in one quarter of my collection period and the payment in another. Too add even more complication, I also receive a deposit in that first quarter, but it’s not applied until final invoice is paid in the second.

So the deposit is tracked/linked to a line item liability account received through a standard cash receipt. I hold it on the books until the final payment is satisfied. This allows me to track things more and gives more flexibility if I have to make changes.

But apparently, the date on which the deposit was received is retroactively applied to the original invoice date when I apply it to the final invoice. So to QB even with a Cash method, it records you as having received money in that first quarter (when deposit was made), therefore creating a tax liability for that qtr. If you are in the 2nd qtr you will then show past due tax. However if you only run quarter to quarter you won’t see it. But if you run the previous quarter you’ll see a balance for the applied deposit. So then the compounding issue begins.

So what happens is when I apply the deposit (that was dated back in the 1st qtr) its applied then it makes the sales taxes retroactive on the invoice showing partial sales tax for full invoice. Then the other half is due in the 2nd qtr when balance is applied. That’s why I said they are using a hybrid (cash/accural) method and it “reverse or retroactively” calculates the sales tax. This is a huge problem that QB has failed to recognize or fix. Prob b/c of some audit crap. So I did have to go back (at least for the current year) and change my invoice/deposit dates to reflect the same quarters so they are not split. This would show the balances as $0.00.

This is the only way I found to keep a zero balance and have my sales tax liability work out. Otherwise you’ll have a deficit in the 1st Qtr and overpayment in 2nd Qtr. The Dept of Rev doesn’t account for how you track sales tax. They just want their money and it better be right.

For you it may be best to make an Adjustment within the Sales Tax Liability window and show the overpayment. The issue with adjustments it that the issue is still there. It just correct the balance on what is owed for that cycle. If you go to a previous quarter (or however you remit) it will still be off. I was trying to go back to the source b/c it made me question all my payments and if they were right. That’s why I don’t like accounting. The numbers have to match, no exceptions. As of now my sales tax has worked out. I keep an eye on my running sales tax liability so I don’t get a year down the road and find out I have a bunch of invoice that are the culprit. Messing with historical transactions like this to “balance” everything out can affect a lot more than it fixes. Hope that helps.

@Anonymous We are on Accrual basis and I can't mess with invoices once the sales tax is paid since it is paid on a monthly basis because then I really mess everything up. I just pay the higher side (Tax Collected) of the sales tax liability report, then for the next month I start out with a negative amount because I over paid sales tax. I don't know on my end how to correctively fix that so that both columns match the next month. I don't want to do an adjustment because like you said it really isn't fixed it just shows correctly on the report. I can only hope that QB fixes this issue. I have been doing this for a long time and that update screwed the sales tax reports up.

Thank you for your quick response.

Deanna

Yeah, you are in a bit of a different situation. Being accrual you are technically paying in advance based on projected sales I assume. Sort of like income tax (if you have that). But unlike income tax, you don't get back overpaid sales tax. For me the Tax Collected always was lower than Tax Owed. Because I either collect deposits or bill after the fact. Rarely do I have a job where I collect at time of sale. Maybe at the end of this year you can start fresh and track where it starts to get off. If you start with $0.00 liability maybe you can follow where it starts to shift. I would have to understand more about your business and products to know what route to try. If you do a lot of daily sales, it'll be hard to track, but you should probably be using Cash method in that case. Technically, I should be using accrual, but cash is simpler.

I've never been fond of accrual methods, just because not having that money in hand puts more liability on the business than the consumers. I know most of the country and huge corps operate on this method for budgets, projections, etc. But you need a good financial foundation to determine it accurately. However, I believe once you start one method, you can't change it later unless you start fresh as to not mess with historical transactions.

Side Note: I've actually been in a situation where I didn't charge enough sales tax on my customers. Being in NC, we have 100 counties and sales tax ranging from 6.75% - 7.5% depending on the county. Because my client shipping addresses are where they are deemed to be purchasing from, I have to charge that sales tax, not where I am. So then, I had to pay the difference. On big ticket projects/items that can add up. Fortunately, it was less than $25. I learned quick to double check the sales tax I was charging. I now note their county on the invoice.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here