Simple NOPAT Formula

You can use the simple NOPAT formula when you know your operating income and tax rate. Just subtract your gross profit from operating expenses to get your operating income:

NOPAT = Operating income x (1 - tax rate)

The tax rate is the percentage of income your business pays in taxes. For example, if your operating income is $100,000 and your tax rate is 21%, then:

NOPAT = $100,000 x (1 - 0.21)

NOPAT = $79,000

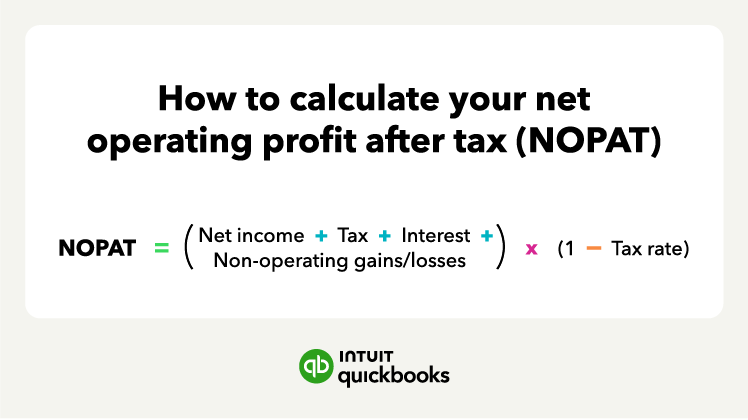

Long NOPAT Formula

This formula is more complex. You use this formula when you’re unsure how much income you’ve made solely from operations.

NOPAT = (Net income + non-operating income loss - non-operating income gain + interest expense + tax expense) x (1 - tax rate)

Don’t worry, solving this equation is easier than it looks. Here’s how to fill numbers in with each of these equations:

- Solve for net income. Net income = Total revenue - All expenses

- Non-operating income loss results from investment losses or other losses outside the core business activities

- Non-operating income gain includes anything your business earns from investing and other non-operating-related activities

- Interest expense can be found on the income statement

- Tax expense can also be found on the income statement, or you can calculate it if you know net income before taxes and the tax rate. Tax expense = Net income before tax x Tax rate

For example, let’s say you’re finishing up a project and have the following information:

- Total revenue: $1,000,000

- Cost of goods sold (COGS) = $400,000

- Operating expenses = $200,000

- Non-operating income loss = $30,000

- Non-operating income gain = $20,000

- Interest expense = $50,000

- Tax expense = $68,000

- Tax rate = 20%

First, we’ll solve for net income. In this case, your total revenue is $1,000,000, and your operating costs include COGS ($400,000), operating expenses ($200,000), interest expenses ($50,000), and tax expenses ($40,000):

Net income = $1,000,000 - $400,000 - $200,000 - $30,000 - $20,000 - $50,000 - $68,000 = $272,000

Now that you have net income as your starting point, let's look at what else you know. Non-operating income loss is $30,000 and non-operating income gain is $20,000. Interest expense is $50,000 and tax expense is $68,000.

Now, you have all of the information needed to determine your NOPAT. Once you plug all of the numbers into the long NOPAT formula above, you get:

NOPAT = ($272,000 + $30,000 - $20,000 + $50,000 + $68,000) x (1 - 0.20)

NOPAT = ($400,000) x (1 - 0.20)

NOPAT = $320,000