Key benefits of dynamic pricing

Dynamic pricing helps drive profitability, improve operational efficiency, and enhance customer experience. Here are some of the key benefits that can help you decide whether dynamic pricing is a good idea for your organization.

Revenue maximization

Dynamic pricing helps maximize revenue by optimizing market demand. Adjusting prices based on real-time conditions prevents overstock or understock situations, ensuring your business captures the highest possible revenue.

It also focuses on profit optimization by aligning pricing strategies with demand patterns, reducing the risk of lost sales opportunities.

Operational advantages

Dynamic pricing offers key benefits, including automation and data-driven processes. It allows you to quickly adjust prices in response to changing market conditions, reducing the need for manual intervention.

This, in turn, enhances operational efficiency by providing deeper market intelligence, improving inventory management, and ensuring that supply levels remain aligned with demand.

Customer insights

Dynamic pricing provides valuable insights into customer behavior, demand patterns, and purchasing trends.

By understanding how customers respond to different pricing strategies, you can refine your approaches and offer more personalized and relevant pricing that enhances the overall customer experience.

When implemented correctly, dynamic pricing can complement pricing strategies like

When implemented correctly, dynamic pricing can complement pricing strategies like

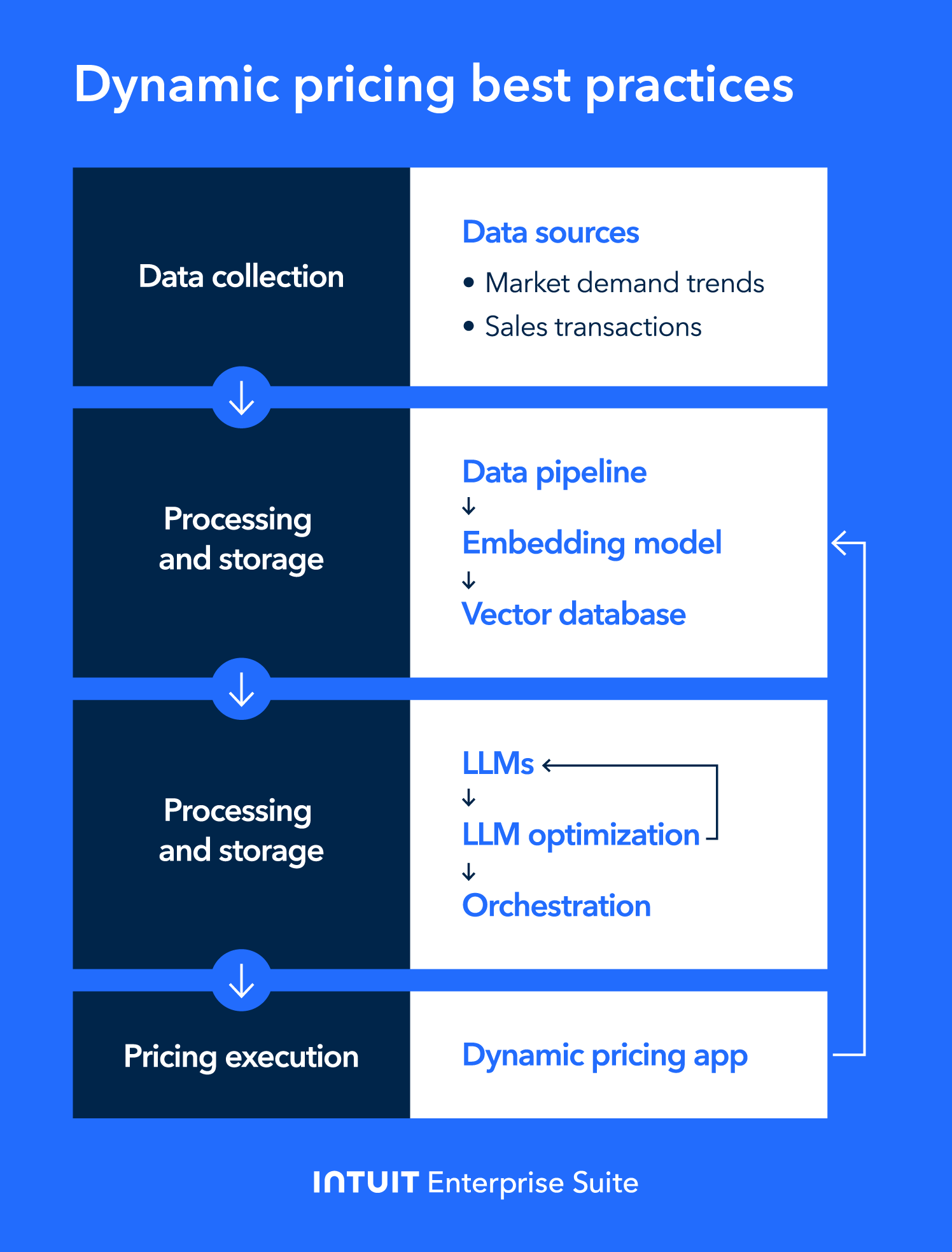

To maximize dynamic pricing, ensure you have the right tools and data sources—such as advanced analytics and AI-driven systems—to track demand fluctuations and customer behavior effectively.

To maximize dynamic pricing, ensure you have the right tools and data sources—such as advanced analytics and AI-driven systems—to track demand fluctuations and customer behavior effectively.