Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Direct deposit has repeatedly failed. Funds are taken from our churches account, but never reach our pastors account.

Over the course of 6 weeks, I have spoken with several customer service reps. I am told each time that Direct Deposit is set up correctly, yet it is still not working.

We are a small church with 1 paid employee.

Confirmation from QB payroll that they have our churches correct banking account number and our pastor’s correct banking account number.

Confirmation received after sending DD that transaction was successful.

Confirmation from our bank (Regions) that funds are taken from account.

Any help you can offer will be very much appreciated.

Solved! Go to Solution.

Thanks for posting here with this Direct Deposit concern, @CdSecretary.

I know how it can be frustrating to be held up like this when you just want to get this payroll concern resolved. We want to make sure this is taken care of by the correct department. Please note that this is a public forum and we do not handle account-related concerns to protect our customer's data.

The best team to help you out with this is our Payroll Support people. I know you already called several times for this, but only them can open your payroll history and help with money movement.

When you call, ask the representative to do a Direct Deposit trace. They will give you a transaction number that you can give to the employee's bank so they can locate the funds.

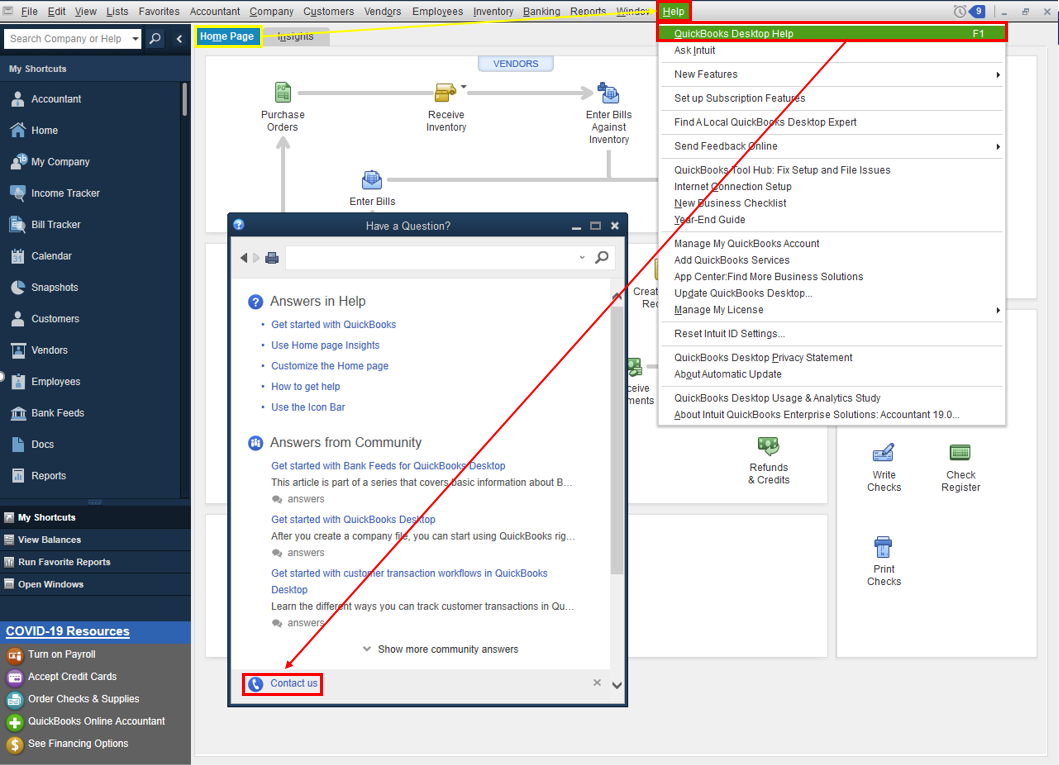

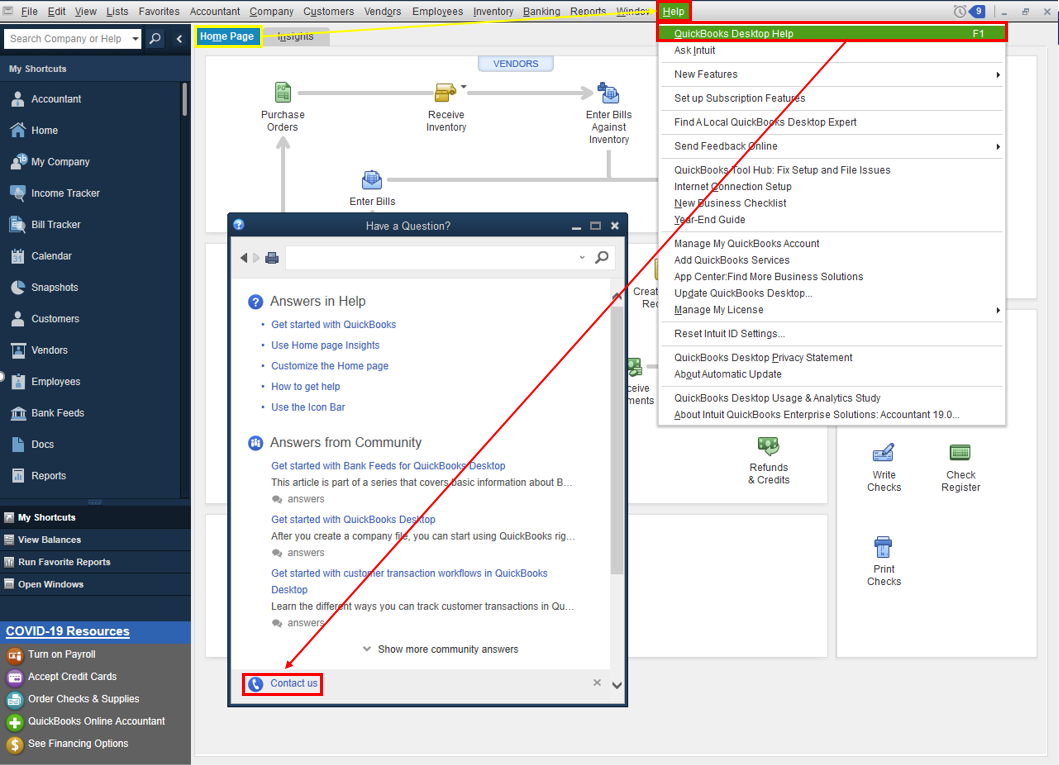

Use these steps to contact us:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Here are a few reasons why an employee's check is not deposited to the employee's account:

You can also request for a reversal to return the funds to your account. For the complete instructions and how it is done, see this link here: Reverse a direct deposit

Please update this thread on how the call goes. I want to make sure you're taken care of, and I'll be right here if you need other help with QuickBooks. Have a good one.

Thanks for posting here with this Direct Deposit concern, @CdSecretary.

I know how it can be frustrating to be held up like this when you just want to get this payroll concern resolved. We want to make sure this is taken care of by the correct department. Please note that this is a public forum and we do not handle account-related concerns to protect our customer's data.

The best team to help you out with this is our Payroll Support people. I know you already called several times for this, but only them can open your payroll history and help with money movement.

When you call, ask the representative to do a Direct Deposit trace. They will give you a transaction number that you can give to the employee's bank so they can locate the funds.

Use these steps to contact us:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Here are a few reasons why an employee's check is not deposited to the employee's account:

You can also request for a reversal to return the funds to your account. For the complete instructions and how it is done, see this link here: Reverse a direct deposit

Please update this thread on how the call goes. I want to make sure you're taken care of, and I'll be right here if you need other help with QuickBooks. Have a good one.

Thank you for responding. After speaking with a rep in payroll again, it was finally discovered that the last digit of my employee’s banking account number was left off. Not sure how this error occurred. I reviewed the document I sent QB Intuit and it had the correct account number on it. It has been corrected now and that is my main concern.

Will you be kind enough to tell me what steps need to be taken when it’s time to pay my employee in a couple of weeks? I want to make sure DD goes through correctly this time. Also, I am a confused when to use scheduled or unscheduled. Will you clarify, please. I greatly appreciate your help. Sincerely, Carole

Appreciate you getting back to us, @CdSecretary.

I'll share some information about the Direct Deposit payroll. Since you've already discovered where the error is, you'll want to make sure your employee's direct deposit info is correct in QuickBooks.

Here's where you can check:

After checking, you are now ready to send a direct deposit payroll for your employee.

About scheduled payroll, this is the payroll type where you have a routine pay period and pay date based on the frequency you choose. The unscheduled payroll is when you need to issue a paycheck outside of your regular pay schedule. It includes bonuses, commission, or termination/final checks.

For details, please refer to these articles below:

Send payroll and direct deposit paychecks in QuickBooks Desktop Payroll.

Feel free to also browse this link in case you need help with payroll reports. It has payroll report topics that'll guide you: Payroll reports and forms.

Drop a reply anytime if you have follow-up questions or concerns. I'm more than happy to help. Take care and stay safe.

I’m having the same problem,I was supposed to get my deposit today and I got nothing I’m about to be kicked out because of this please fix it soon.

Thanks for posting here in the Community space, @ Sagemerr.

I'm stepping into the thread to share additional information about direct deposit payroll.

When processing employees' pay through direct deposit, the individual financial institution policies determine the exact time direct deposits are posted on the employees' bank. This means that the receiving bank is one of the factors why some of your employees receive their pay earlier than the pay date.

You can also check with your bank to find out when funds are posted. See When do direct deposits post? for more information.

Otherwise, you may connect with our Support Team and ask the representative to do a Direct Deposit trace. They will give you a transaction number to locate the funds.

Use these steps to contact us:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

If you need anything else about Direct Deposit, let me know in the comment. I'll be right here to help you with your payroll and all other things in QuickBooks. Have a great day.

Absolutly useless. Applied for an increase in direct deposit limits, was advised of the increase and still can't process a single direct deposit paycheck. There is no person to talk with and all you do is chase your tail until you just give up. Life is too short to deal with this.

Hi Balling123,

I understand how inconvenient it is when the direct deposit keeps failing.

Since you already applied for an increase, you should be notified through email regarding the status of your request.

If you didn't receive one, you can reach out to our Phone Support team so we can verify its status on our end.

I've also added this reference on what happens next once the request got rejected or not: Check employee's direct deposit status.

You can always mention my name as to how things work on your end. I'll be around to ensure that this gets resolved.

Our limit was increased. I tried to process a direct deposit for about 15% of our limit and received error message code 2103. How many time do I have to do this?

Hey there, @Balling123.

Thanks for coming back and providing us with an error code that you're receiving.

To clarify a few details, can you provide me with a screenshot of the error message when doing this action?

Once we gather this information, we'll review it and see what the best route would be for you and your business.

I'll be back around shortly to check in!

Thank you for turning to the Community about your direct deposit concern, brianyru.

I can see the urgency of adding your direct deposit bank account number into QuickBooks Desktop (QBDT) Payroll. However, I have to gather more information about the issue to ensure the best solution.

For your concern, may I know if you’re referring to Error code 2103 that the previous customer is experiencing? Can you provide the specific message or code you receive when entering your direct deposit bank account number?

Looking forward to your reply. I’ll be glad to work with you again, brianyru.

Good morning Rasa-LilaM,

I was actually referring to the church that couldn’t send direct deposits to their pastor due to his account having 17 digits.

There is no error code for this. Other than the direct deposit being returned.

In the USA all bank routing numbers have nine digits. Account numbers can be up to 17 digits.

When entering an employee’s direct deposit information, I can easily put in the bank name, if it is checking or savings, the bank routing number, but I can only enter up to 16 digits in the bank account number field. I can type 1000 digits, but only the first 16 are stored in the bank account field. I could spend all day typing non-stop in that field and no error would occur, but Quickbooks only allows the first 16 digits.

What this means is that an employee with a 17 digit bank account number can not receive direct deposits through Quickbooks. What is the solution to this problem?

Thank you,

Brian Russell

Thanks for keeping us updated, @Brianyru.

I'll provide some reasons on why a direct deposit will be declined and the things you can do to fix it.

Here are some of the payroll status errors:

Declined debit request: because of a lack of funds in your bank account. After 24 hours, we'll try to debit the money again. Wait for us to attempt again after adding funds to your account. While we work on this, your payroll service will be suspended. This hold may take up to 5 business days to complete.

Rejected debit request:

In the meantime, I suggest writing a check manually for your employees. Here's how you can do it:

For future reference, here's how you can keep track of how much you've paid out in QBDT Payroll: Create a payroll summary report.

Ping me for further questions or clarifications regarding payroll or QuickBooks. I'm always around and willing to assist. Keep safe!

Did you not read what I wrote?

I know why it was declined. It was declined because the account number was wrong. The account number was wrong because Quickbooks only allows up to 16 digit bank account numbers for direct deposit. The United States of America allows up to 17 digits for bank account numbers. Therefore, some bank accounts have 17 digits. That is one digit more than Quickbooks will accept to be entered in the bank account field. Which means that the bank account will be wrong. Meaning Quickbooks does not allow direct deposits for 17 digit bank accounts.

Quickbooks needs to allow 17 digit bank account numbers to be entered in the bank account field when setting up a direct deposit. And do not respond to this telling me how to set up direct deposits. I know how! The issue is in Quickbooks programming not allowing 17 digit bank account numbers in the direct deposit bank account field.

We are having a problem with direct deposit to an employee's Vanguard account via JP Morgan Chase. The funds have been taken from our bank account. Vanguard has not received the money. JP Morgan Chase is the custodian for Vanguard and they won't even talk to us because the employee is not in their system as being an account holder (their account is with Vanguard, not JP Morgan Chase). anyone else have this problem

I appreciate you providing the in-depth details of your concern, @MKB5.

I understand how it feels when you have no idea where the deposit is. I’ve come to route you to the best Support Team who can help you track it.

To safeguard the privacy of our customers, we do not address account-related issues here in the Community. Thus, I recommend contacting our Payroll Support as they’re the appropriate department in charge of this. They can access your payroll records and assist with money transfers.

From there, you can request a direct deposit trace. They will provide you with a transaction number that you can use to identify the funds and provide to the employee's bank. To proceed, follow these steps:

See this article for our support hours so we can address your concerns on time: Contact Payroll Support. You can also scroll down on the Chat with us online section to get our contact number.

I’ve added these resources to help you with handling direct deposit issues and learn when you can request a direct deposit reversal:

I'm only a post away if you have any other questions about direct deposit. I look forward to hearing from you again. Take care.

I have spoken to Quickbooks support many times and gotten the trace numbers. The problem is that JP Morgan Chase will not trace them (or even talk to us about the problem)because she does not have an account with them, her account is with Vanguard. Vanguard says they cannot do anything and they cannot give us a contact at JP Morgan Chase to talk to. Very frustrating.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here