Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I had to restore QuickBooks and needed to go back several weeks. I now see a message that I am missing payroll data. Quickbooks is telling me to click Send Payroll Data from the Employees menu and hit the Send Button. Is it that simple or is there something else that I need to do?

Solved! Go to Solution.

Hello there, @JBRR.

I recommend recreating the missing Direct Deposit and Paychecks in your QuickBooks Desktop Payroll. The Payroll information may be missing due to a restored up file created before sending the paychecks. No worries, I have the perfect Community Article that goes more in detail and explains how to enter the information with ease: Recreate Paycheck in QuickBooks Desktop Payroll.

For paychecks that were issued the year before using the Payroll service, then you'd want to make sure the Historical Data is correct because this ensures the correct year-to-date totals.

This should do the trick! Let me know how this goes for you. I'll be here if you need further assistance.

Hey there, @JBRR.

Glad to have you here. If you're seeing the message, "This QuickBooks file may be missing some of the payroll data that you have already sent to the Payroll Service. Before creating any new transactions, you need to restore the missing data by clicking Send Payroll Data from the Employees menu and then clicking the Send button", sending payroll data is the right move. I see you've mentioned that you've already done this, so you're good to go!

If you'd like to learn more, check out: Fix backup company file issues in QuickBooks Desktop

Shoot me a reply if you have any other questions. I'm determined to be your one-stop shop for QuickBooks Desktop. Have a safe weekend.

Hello Michael,

Thanks for your guidance. I did that & I still have a problem which I probably did not accurately describe initially. There were 3 payrolls that I ran from the point to which I backed up & my QB payroll is showing that they are past due. I am guessing that I need to reenter data for those pay periods? How do I best do that and avoid the problem of paying out payroll & payroll taxes twice? I issue payroll with both checks and direct deposit.

Thanks for your attention to this and your continued assistance.

Jim

Hello there, @JBRR.

I recommend recreating the missing Direct Deposit and Paychecks in your QuickBooks Desktop Payroll. The Payroll information may be missing due to a restored up file created before sending the paychecks. No worries, I have the perfect Community Article that goes more in detail and explains how to enter the information with ease: Recreate Paycheck in QuickBooks Desktop Payroll.

For paychecks that were issued the year before using the Payroll service, then you'd want to make sure the Historical Data is correct because this ensures the correct year-to-date totals.

This should do the trick! Let me know how this goes for you. I'll be here if you need further assistance.

I have the same issue! I had to go back to the last time I backed up my data and I lost one payroll doing this. Thankfully, I have only one person on it! Is it as easy as following those few steps or am I in for the long haul of undoing and redoing this payroll? I'm in need of getting this fixed before this Friday 3/27. Thank you for any info!!

Hi ofcgdss,

There's no need to resend your direct deposit payroll. You can follow the recommended resolution provided by my colleague, Ashley H, to recreate the missing direct deposit paycheck in QuickBooks. This makes your books and year-to-date taxes accurate.

To check the status of an employee's direct deposit, follow these steps:

I've added some articles in case you want to know when to submit direct deposit payroll on time. These links will serve as a guide on how federal holidays and non-banking days affect your payroll.

Leave a comment below if you have further questions. We're always around to fill you in. Have a wonderful day.

Would it not duplicate the payroll already sent?

Also, under recent payrolls there's the same amount and date of payroll that says "to sent"

How could we remove it? If we void them, they would still show as DD and it confuses my reconciliation.

Thanks for joining this thread, @mrule.

I can share some details about the direct deposit in QuickBooks Desktop.

If the paycheck was deleted and recreated then it will be duplicated. However, if it's hasn't been deleted and recreated then it will not be duplicated even if you click the send payroll data.

Also, to remove the same amount and date that say to send. You'll have to change the direct deposit paycheck to a paper check. This will only affect the current paycheck you are creating and will not remove the future paychecks of this employee from direct Deposit. I'll guide you how:

For more detailed steps, click this article: Change a direct deposit paycheck to a regular paycheck in QuickBooks Desktop Payroll

These articles will give you more details about Direct Deposit:

I'm always here if you have follow-up questions about Direct Deposit or if you need anything else. Have a good day.

Hello, RV5.

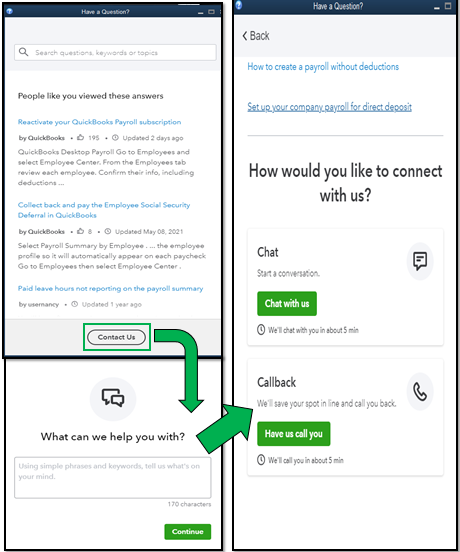

To restore your payroll data, you can follow the steps provided by my colleague, Ashley H. This ensures that your books are accurate. I'll make sure that you can get the help you need by contacting us through chat.

Here's how:

Please check this article for the support hour: QuickBooks Payroll Support.

For future reference, read through this article to learn more about how to cancel, delete a regular paycheck, and a direct deposit paycheck.

Feel free to leave a message below if you have additional questions about restoring payroll data. I'm a post away.

Hi,

Why not recreate the missing paychecks in the restored company file (as if you are generating that payroll now), but instead of doing a direct bank deposit, switch it to checks and don't print them. Next recreate the federal tax deposit and don't file it online. Would that work, or do you still need to follow the offset method as described in the referenced article?

Hey there, MikeMN. Thanks for chiming in.

We recommend using the steps in this article for the most accurate recreation: Recreate a missing or voided direct deposit paycheck in QuickBooks Desktop Payroll.

I hope this is helpful! I'm here if you have additional questions on this.

Thank you. We followed the instructions you referenced. When we did step 10:

The system asked whether to send the information to Intuit. We selected No since this was already sent out before we restored the backup. The software now shows a red bubble that warns that the payroll was created but not sent. Do we just ignore that, or is there another step we need to do? Thanks.

Hello there, MikeMN2.

Yes, you may not send the recreated paychecks. Then, try to review the checks if they were already recorded.

Feel free to check out these links that will you manage your paychecks:

Leave a comment below if you have further questions. We're always around to fill you in. Have a wonderful day.

I'm. Having the same issue except I get an error code when I send it stating it is rejecting my login, as if I don't have a payroll account. Error code 9000

Let's get rid of the error so you can continue processing payroll, @Brittany1987.

The error code 9000 happens if QuickBooks isn't able to communicate with its server. There are several reasons behind QuickBooks experiencing internet connectivity issues and fixing up these causes will automatically remove this error from the application. These are the following:

You need to check your system time and date settings and change them if they are not set correctly. You can also try clearing your browser's cache and sending the payroll again.

If the same thing happens, you can check this article for additional steps and resolution: Troubleshoot Payroll Service Server Error or Payroll Connection Error. The article is for QuickBooks Desktop Payroll, but it troubleshoots on the browser's connection.

Once everything is fixed, you can now proceed with processing payroll. Then, run and customize your payroll reports after running payroll. This way, you can review useful information about your employee's paychecks.

The Community forum is always open to help you again if you have additional questions about processing payroll. It's nice to work with you, @Brittany1987.

I have 1 payroll period that was processed after the date of my restored backup file. I followed your recommended steps in recreating them, which was straightforward. I did stop before pressing send to intuit. I just want to confirm if I should or should not send the recreated payroll period to Intuit (which was previously sent after the last backup date and thus not part of the restored file)

Hello, we purchased a company that used QB desktop for payroll. We merged their QB with ours but the payroll data did not transfer. We have attempted to find the data in their system but it appears to be gone. How can we find/restore the data?

Tjank you!

I appreciate you for joining the thread, @Tammy2022. Now that I'm here, I'll help you locate the backup files so you can restore them in your QuickBooks Desktop (QBDT) company.

If you're unable to locate the data using the Find a company file button, you can consider manually locating them. I'll gladly input the steps below so you can proceed. To begin, here's how:

For more information, feel free to visit this article: Locating Backups and Company Data Files.

Once done, you can now proceed to restore it again so you can complete your tasks in QBDT. See this page for further details about restoring a backup file: Restore a backup of your company file.

If you got time, I'd also recommend checking this page to learn more about how to fix issues with company files in QBDT: Fix data damage on your QuickBooks Desktop company file.

I have same issue but I have Quickbooks enterprise not desktop- my liabilities show paid and the payroll taxes are paid but not payroll data at all

Thanks for chiming in on this thread, @danis1. Let me make it up to you by ensuring that you'll be routed to the best support available so that this gets sorted out immediately.

As much as I'd like to take care of this, the Community is a public platform, and we want to protect your security and privacy. That said, I recommend contacting our Technical Support Team. One of our experts has the necessary tools to check your account securely and perform a screen-sharing session to conduct further investigation into this behavior.

Here's how you can get in touch with an agent:

Please take note of our business hours to ensure we can attend to your needs.

Additionally, check out this article in case you'd want to have a quick view of your payroll totals, including employee taxes and contributions: Create a payroll summary report in QuickBooks.

I'm always around to lend a hand if you need more help with managing your payroll data or anything else related to QuickBooks. Take care and stay safe always!

Hi There,

This worked great and resolved my missing paychecks that I've already paid. Now the taxes and liabilities from those paychecks are showing overdue, when I have already paid those. It appears the tax payments are also missing. How do I restore those to QB without paying the IRS twice?

Thanks

-Mabel

Hi There,

This worked great and resolved my missing paychecks that I've already paid. Now the taxes and liabilities from those paychecks are showing overdue. However I have already paid those. It appears the tax payments are also missing. How do I restore those to QB without paying the IRS twice?

Thanks

-Mabel

Great day, @CheeryLily. We're glad to hear that your initial issue about the missing paychecks has been resolved. Yet, I understand that other concern arises, such as overdue paychecks and missing tax payments. It's our pleasure to provide you with help today and fix this together.

Before anything else, I'd like to share insights into why there are overdue paychecks behind being paid on time. After that, we'll proceed to the resolution steps.

Even after you have paid the scheduled payroll on time, there's still a possibility the status will appear as overdue. It might be of incorrect payroll schedule of an employee or outdated payroll. You can follow the process below to fix this.

Let's start by updating your payroll tax table to the latest release to provide up-to-date, accurate calculations for federal and supported state taxes and payroll tax forms. Next, edit the payroll schedule to zero out the overdue. Here's how:

Once done, review and change the schedules for those employees who need modification. After that, delete the payroll schedule for an employee that's not in use.

Moreover, you can check out this article for more information: Fix overdue or red scheduled liabilities in QuickBooks Desktop.

Regarding your missing tax payments, if this is the 942 tax payment. There are reasons why it won't show. You can check the list below:

However, if all of your tax payments aren't showing, this means you have one more tax item that doesn't have payment frequency selected. For example, monthly, quarterly, or annually. To get this fix, click the Go to Schedule Payments link in the message and then select payment frequencies for any tax where they're missing.

Note that this can happen if you add a new tax and don't schedule payments for the tax or if you've previously scheduled the payment. But, the governing agency changes the schedule options.

However, I recommend contacting Desktop Payroll support to ensure your payroll and tax liabilities are calculated and formatted correctly.

Feel free to utilize these articles to help you manage your QBDT Payroll account:

Thank you for posting here. Know that we're available 24/7, and if you have additional questions, please reply to this thread. We'll be happy to answer it. Take care, and have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here