Set up and track Alabama overtime exemption

by Intuit•12• Updated 6 days ago

| IMPORTANT: Starting July 1, 2025, all overtime pay in Alabama will be taxed. The state's exemption for overtime expires on June 30, 2025. Any overtime wages paid on or after July 1, 2025 won't be included in monthly or quarterly withholding returns. Overtime wages paid between January 1 and June 30,2025 will be reported on Box 14 of Form W-2. For additional information, please see the official Alabama Department of of Revenue announcement. |

Learn how to set up QuickBooks Payroll to track overtime pay exempt from Alabama (AL) withholding tax.

Effective January 1, 2024, if an hourly employee works more than 40 hours in a week, the pay from those extra hours is exempt from AL income tax.

Note: Starting October 1, 2024, the exemption includes nonexempt salary employees.

Here’s more about the state law, how to track it and report it in QuickBooks Online Payroll and QuickBooks Desktop Payroll.

Understand AL overtime exemption

- Alabama has amended the Overtime Exemption Act. The change extends the exemption to include salaried nonexempt employees.

- Starting October 1st, 2024, nonexempt employees (both hourly and salary) will be exempt from Alabama income tax withholding for any overtime pay earned for additional hours worked beyond the standard 40-hour workweek.

- The exemption, covers hourly employees starting January 1, 2024, and includes all nonexempt salaried workers starting October 1, 2024.

- Work performed over 40 hours in a week is exempt, whether it’s paid as overtime or regular pay.

- The exemption applies to all paycheck dates on or after January 1, 2024 through June 30, 2025.

- Overtime pay earned in excess of 8 hours a day under collective bargaining agreements aren’t exempt if your employees don’t work more than 40 hours in the week.

- This info needs to be reported on either a monthly or quarterly basis, and on Form W-2.

Find out more on the Alabama Department of Revenue website.

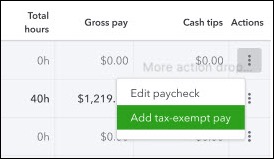

Track the AL overtime exemption

| Note: The AL-OT Withholding exempt item will show 0.00 on the employee's paychecks / pay stubs. This item is for tracking/filing purposes only. To see the wage totals, run a Payroll Item Detail report. |

Select your product below for instructions.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

Report the tax-exempt amounts to AL

This info needs to be reported on either a monthly (AL A-6) or quarterly (AL A-1) basis, and on Form W-2.

For 2023, there’s a one-time reporting requirement. The report needs the total number of full-time hourly employees who were paid overtime, and the total amount of overtime paid in calendar year 2023.

More like this

- Set up overtime trackingby QuickBooks

- Add overtime pay to an employeeby QuickBooks

- Fix Alabama Overtime Exempt calculations in QuickBooks Desktop Payrollby QuickBooks

- Set up manual Workers' Compensation in QuickBooks Desktopby QuickBooks