See what people are talking about.

Buy and Save today.

Select the plan that’s right for your business.

See QuickBooks in action

Stress less about due dates.

- Track bill status, record payments, and create recurring payments

- Pay multiple vendors and bills at the same time

- Create checks from anywhere and print when ready

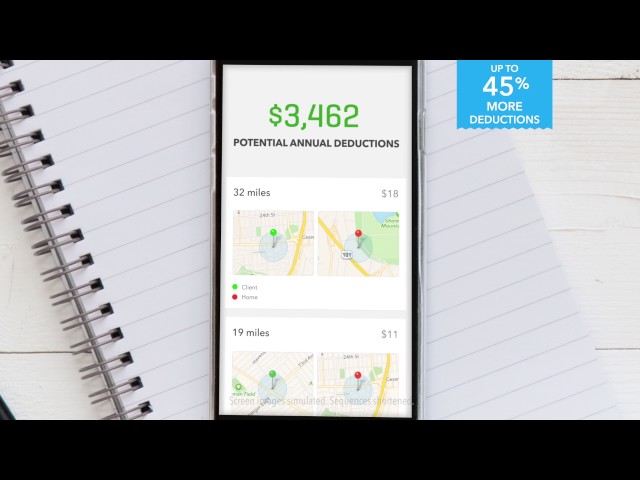

Make every mile count.

- Reliably and automatically track miles with your phone’s GPS.

- Categorize business and personal trips and add trips manually

- Find on average 45% more deductions by logging your miles

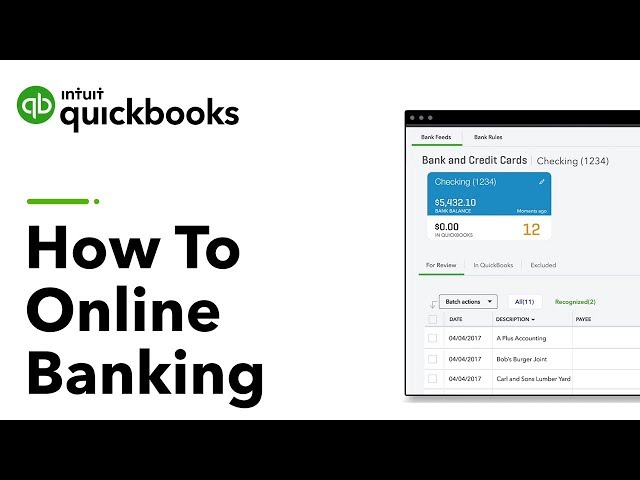

Know where your money is going.

- Import transactions from your bank, credit cards, PayPal, Square, and more*

- Automatically sort transactions into tax categories

- Snap photos of your receipts and link them to expenses right from your phone

Look professional and get paid fast.

- Accept all credit cards and free bank transfers, right in the invoice

- Track invoice status, send payment reminders, and match payments to invoices, automatically

- Create professional custom invoices with your logo that you can send from any device

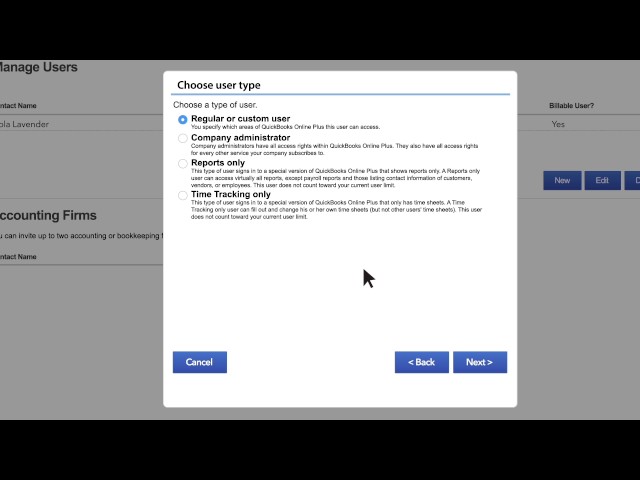

Save time when you work together.

- Invite your accountant to access your books for seamless collaboration

- Give employees specific access to features and reduce errors with auto-syncing

- Protect sensitive data with user-access levels and share reports without sharing a log-in

Stay compliant on all your 1099s.

- Assign vendor payments to 1099 categories

- See who you’ve paid, what you’ve paid, and when

- Prepare and file 1099s right from QuickBooks*

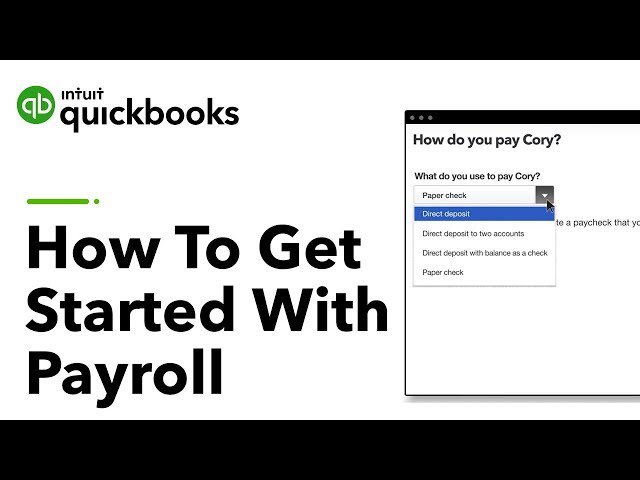

Make every payday count.

- Pay employees with free, 24-hour Direct Deposit.

- Get automatic tax calculations, flexible pay types, and unlimited payrolls.

- Pay and file payroll taxes right from QuickBooks. Or let us do it for you with our Full Service option.

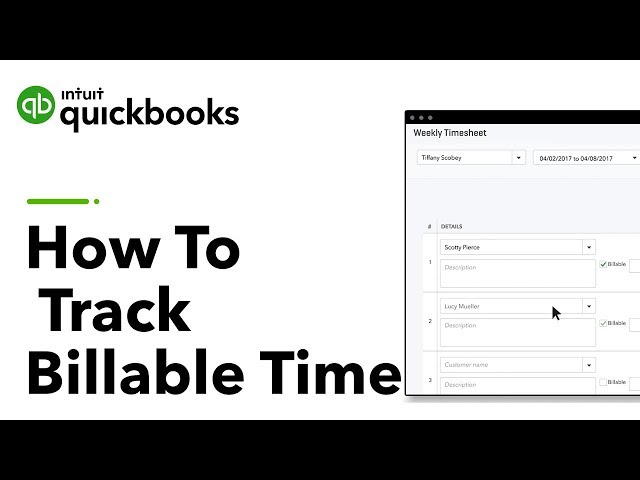

Clock employee time and billable hours.

- Track billable hours by client or employee and automatically add them to invoices

- Enter hours yourself or give employees protected access to enter their own time

- Seamlessly integrate with TSheets by QuickBooks for simpler time tracking*

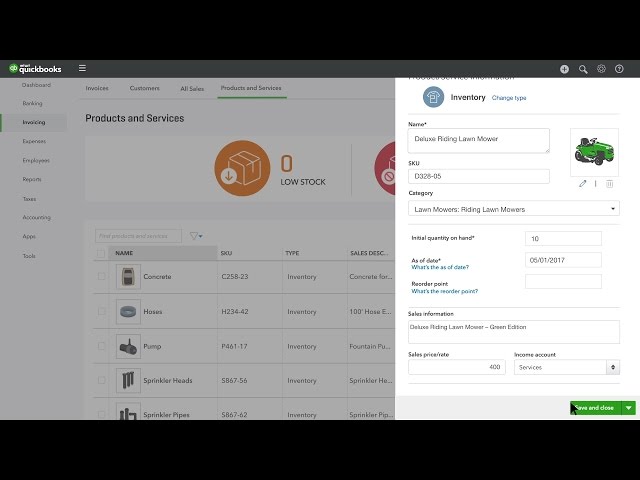

Stay stocked for success.

- Track products, cost of goods, and receive notifications when inventory is low

- See what’s popular, create purchase orders, and manage vendors

- Import from Excel or sync with Amazon, Shopify, Etsy, and more*

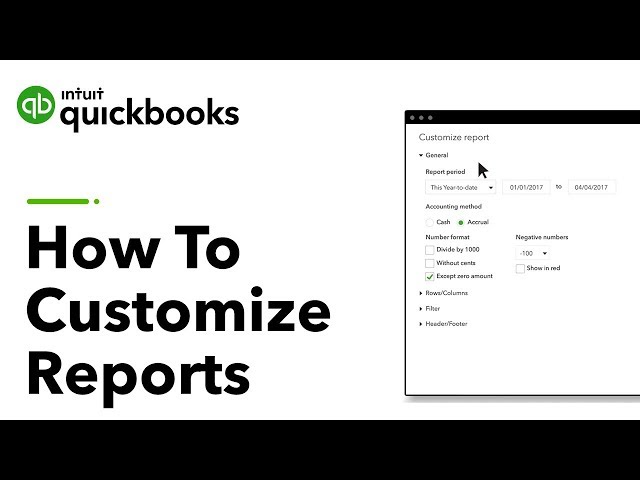

Better decisions with valuable insights.

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create customized reports to get important insights specific to your business

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Keep sales in sync no matter how you get paid.

- Accept credit cards anywhere with our mobile card reader or sync with popular apps

- Connect to the e-commerce tools you love including Shopify*

- Automatically calculate taxes on your invoices

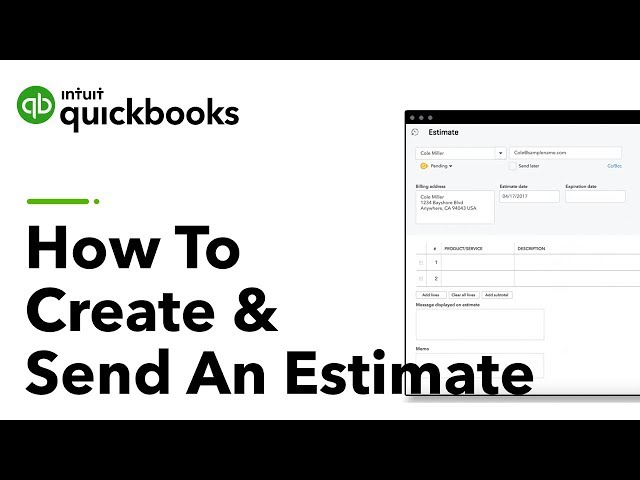

Get hired with professional estimates.

- Customize estimates to fit your brand and business needs

- Accept mobile signatures and instantly see estimate status

- Convert estimates into invoices in a single click

Help avoid tax-time surprises.

- Know what you owe before taxes are due

- Easily organize income and expenses into tax categories

- Share your books with your accountant or export important documents come tax time

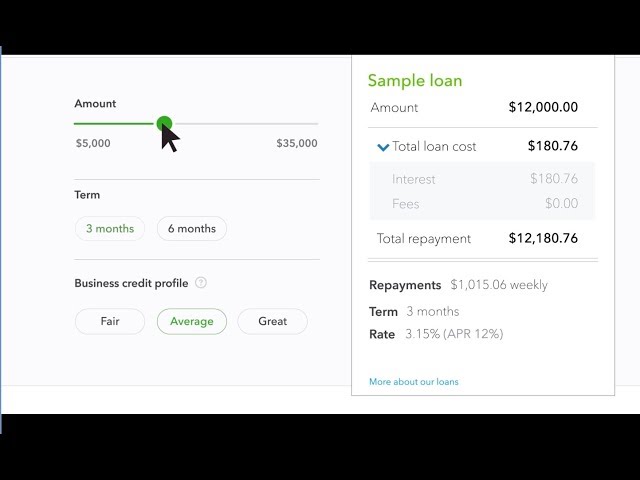

Smart funding to grow your business.

- Apply from Quickbooks and see loan costs upfront- no surprises

- Approved loans fund in 1-2 business days to your bank account

- Save on interest with an early payoff at any time without penalties

FAQs

Which devices are compatible with QuickBooks?

QuickBooks Online works on your PC, Mac, tablets, and phones.3

Is there an additional fee for the QuickBooks mobile app?

QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost.

What is included in the QuickBooks Online subscription?

QuickBooks Online includes: Full use of the features of the particular version of QuickBooks Online, automatic upgrades to your selected version at no extra cost, secure storage of your data, and product support4 at no extra cost. You can add optional features at any time for an additional monthly fee.

Offer terms

*Discount available for the monthly price of QuickBooks Online (“QBO”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Offer cannot be combined with any other Intuit offer.

Additional Payroll Offer Terms: Each employee you pay is an additional $5/month for Payroll. Service optimized for up to 50 employees. If you file taxes in more than one state, each additional state is $12/month. The discounts do not apply to additional employees and state tax filing fees.

After your 30 day free trial, you will automatically be charged monthly at the then current rate for the service you have selected, until you cancel. Each Full Time Employee or Contractor you pay is an additional $5/employee-per-month for employees 1-10, and then $2.50 for employees 11-150). If you file taxes in more than one state, each additional state is currently $12/month. Cancel at any time by calling 866-272-8734. Offer valid for new QuickBooks Online customers only, for a limited time. You can place orders weekdays by phone by calling 800-556-0507 between 6 AM – 6 PM PT. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks plan.

QuickBooks Online Simple Start includes 1 user license. QuickBooks Online Essentials includes 3 user licenses. QuickBooks Online Plus includes 5 user licenses.

Features

1.Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

2.Customers who use QuickBooks Online with Payments get paid on average twice as fast as those who don’t, based on data from 9/13-2/14. QuickBooks Payments is an optional fee-based service. Subscription to the latest version of QuickBooks Online is required, sold separately. Application approval, an Internet connection on a Windows PC and Chrome, Firefox, Internet Explorer 10, or Safari 6.1 browser required. Rates are determined by the financial institution and are subject to change without notice. Transactions are subject to Association guidelines. Starting at approval or first use (depending on service you select) your debit/credit card account will automatically be charged on a per transaction, monthly and/or annual basis at the then current transaction and/or monthly fees for the service you selected, until you cancel. To cancel call 800-558-9558. Swiped rate applies to qualified swiped Visa/MC/Discover network transactions. Most rewards, corporate and special card types are considered non-qualified transactions and merchant will be charged the keyed rate. American Express fees and transactions are based on industry type; additional fees may apply when accepting American Express. Additional fees may apply for specific occurrences, including chargebacks. Terms, conditions, features, pricing, service and support options are subject to change without notice.

3.First thirty (30) days of subscription to QuickBooks Online Simple Start with Payroll, QuickBooks Online Essentials with Payroll, or QuickBooks Online Plus with Payroll, starting from the date of enrollment, is free. After your 30 day free trial, you will automatically be charged $31.20/month to continue with QuickBooks Payroll Enhanced, or $79.00/month for QuickBooks Payroll Full Service for the first 12 months of service, or until you cancel. After 12 months, you will automatically be charged at the then-current monthly rate for the service(s) you have selected, until you cancel. Each employee is an additional $1.50/month for QuickBooks Payroll Enhanced or $2.00/month for QuickBooks Payroll Full Service. Pay up to 150 employees. If you file taxes in more than one state each additional state is $12 per month. Sales tax may be applied where applicable. You can place orders weekdays by phone by calling 800-286-6800 between 6:00 AM PST through 6:00 PM PST. Offer is valid for new QuickBooks Online with Payroll customers only and is available for a limited time. QuickBooks Payroll is not available with QuickBooks Self-Employed. Offer cannot be combined with any other QuickBooks Online or Payroll offers. To cancel your QuickBooks or Payroll subscription, call 866-272-8734 x111. Terms, conditions, pricing, features, service and support are subject to change without notice.

4.Get free expert help [Support available M-F 6am-6pm and Sat 6am-3pm PST]

5.QuickBooks Online Essentials and QuickBooks Online Plus include the manage and pay bills feature.

6.Phone support is free during the 30-day trial and included with your paid subscription to QuickBooks Online. Phone support is available Monday through Friday between 6 am – 6 pm PST. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Call Sales: 1-800-285-4854

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.