Send, track, and file 1099 forms for your independent contractors. Be prepared when it’s time to file with the IRS and stay compliant.

Track payments to 1099 contractors throughout the year

1099 vs W-2

Sometimes the line between an independent contractor and an employee is fuzzy. It’s important to know the difference in order to comply with IRS tax rules. Take an easy quiz to determine whether your worker needs a 1099 or W2.

Log completed work

When you pay a contractor for labor, you’ll need to track it on a 1099 to stay compliant. QuickBooks Online Plus and QuickBooks Online Advanced tracks every payment you make to contractors and then creates ready-to-send 1099 forms at tax time.

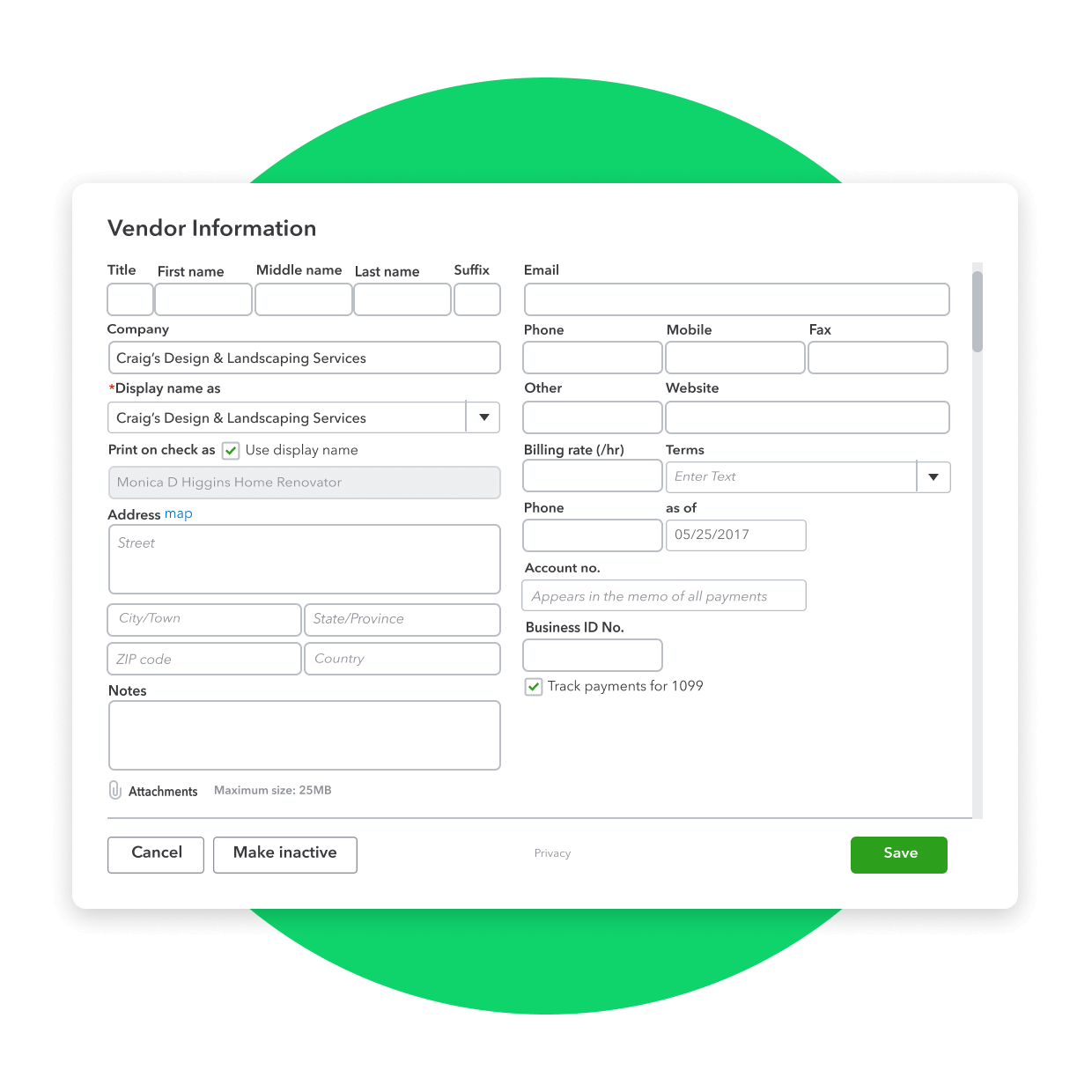

Separate vendor expenses

If you pay a contractor or vendor for equipment rentals or supplies, QuickBooks can track those as a separate expense. Keeping payments to contractors separate from expenses makes it easy to issue and file accurate 1099 forms for the tax year.

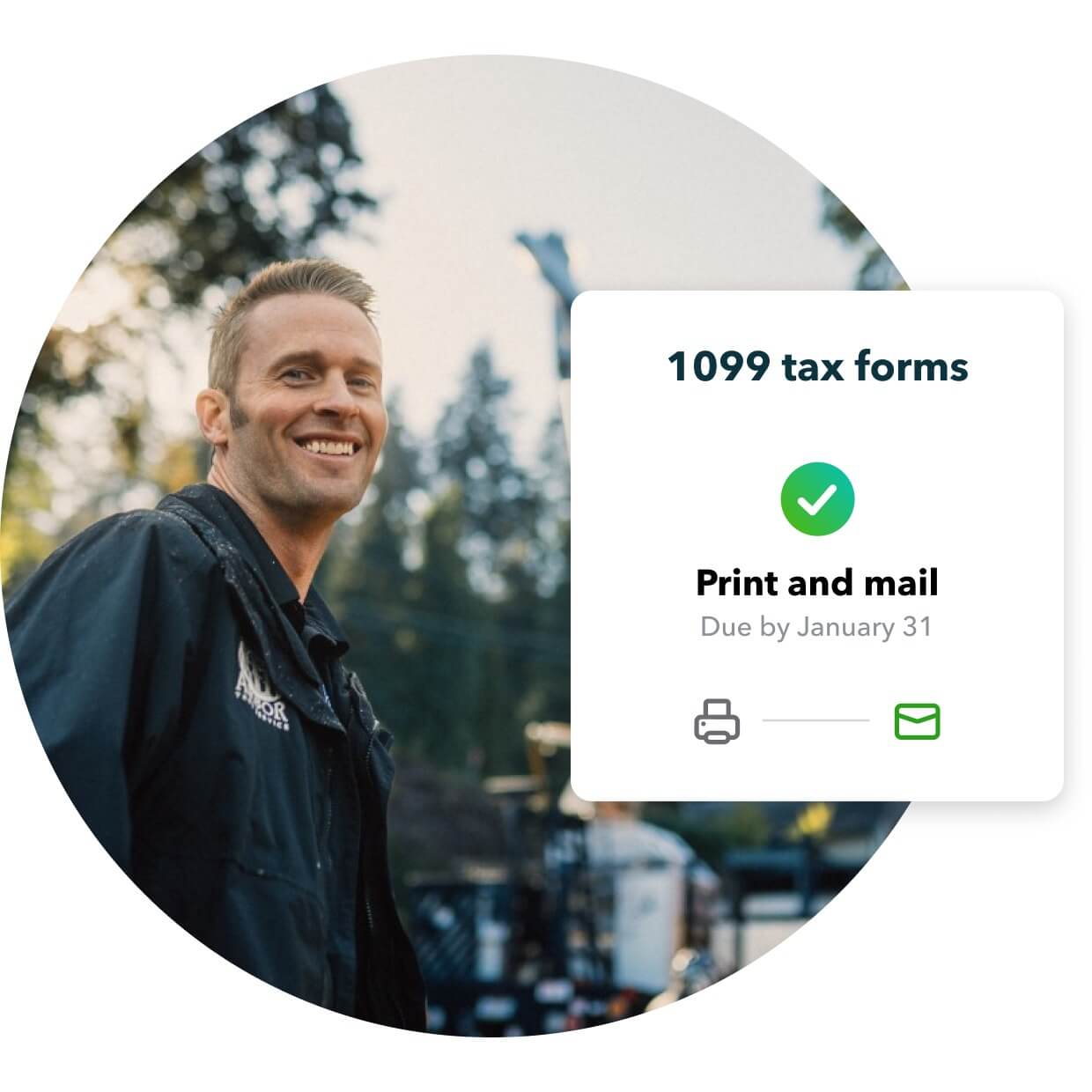

Prepare tax forms

We’ll walk you through how to map your contractor payments to the correct boxes on the 1099 tax form. Then, it’s easy to email or print-and-mail a copy to your contractors.

Conveniently e-file online

Automatically e-file through QuickBooks one-click file service starting at $14.99 for three forms. We are an approved IRS e-file provider, and we’ll transmit the form securely and electronically for you.

Print and mail 1099 forms

Purchase official 1099 forms within QuickBooks and print them directly from your printer. If you choose to print and file 1099 forms by mail, remember that they are due to the IRS by February 29.

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

1099 vs. W-2 employees: What you need to know before you hire

By January Colandrea

Taking the leap as a business owner can be both challenging and rewarding. Many people start businesses to be self-employed and take control of their own destiny. If you’re a new business owner, you may not have realized how much responsibility you have as an employer on the financial, legal, and tax fronts.

As a new small business owner, you may find yourself hiring both full-time employees and independent contractors to help you achieve your business goals. If you already employ both types of workers, then you have a serious responsibility to understand the financial, legal, and tax consequences of each.

Full-time employees are issued a tax Form W-2 every tax season. The W-2 form from an employer shows how much federal and state taxes were withheld throughout the tax year. As a result, W-2 employees usually receive a tax refund every year.

W-2 Employees

W-2 employees are typically salaried employees and don’t own their own business. They have an obligation toward your company and acting in its best interest. W-2 employees work according to your company’s schedule and participate in employee benefit programs. Their employment contract lasts for an undefined period of time.

When W-2 employees start a new job, they file an IRS Form W-4. The W-4 form outlines how much you, as an employer, can withhold in taxes.

The more federal allowances (i.e. people to take care of in their household) an employee outlines in the form, the less the employer withholds. Consequently, the greater each paycheck is relative to taxes, potentially resulting in a lower federal tax refund at the end of the year. Fewer allowances result in more federal taxes withheld, resulting in lower paychecks but greater tax refunds.

An employer must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay payroll taxes and unemployment taxes on wages paid to an employee. As an employer, you must report these taxes to the Internal Revenue Service (IRS). The tax form you file is a Form W-2 and you file it on behalf of your employees.

Businesses pay a 15.3% FICA tax, which is used to fund Social Security and Medicare. An employee with a Form W-2 pays 7.65%, and you as an employer pay the other 7.65%.

By law, W-2 employees are guaranteed at least a minimum wage, set by both federal and state laws, for the time they’ve worked on an ongoing basis. Employers provide all the necessary tools and supplies forW-2 employees, and employees are typically reimbursed for business expenses they incur over the course of their employment.

Benefits such as pension plans, profit-sharing plans, health insurance, retirement contributions, and sick pay are available to all qualifying employees in a business.

1099 Independent Contractors

Independent contractors are non-employees and tend to have a greater degree of control over their work product. Independent contractors only work on one project at a time, but many serve multiple clients. Contractors are brought on to provide a service within their expertise for a defined period of time. Classic examples of independent contractors are consultants and freelancers. They are self-employed and take you on as a client. So they’re business owners themselves.

Unlike W-2 employees, businesses work with independent contractors for a defined period of time, outlined by a written independent contractor agreement. A sample independent contractor agreement would include an effective date, project expectations, and an expected timeline. When contractors begin work, they fill out a Form W-9, indicating their tax identification number (or social security number) and organizational status (i.e. sole proprietor, trust or estate, C corp, S corp) to the IRS.

This form indicates that you, the client, hired a contractor at one point throughout the calendar year. You need this to issue 1099-MISC forms to any contractors you hired. The independent contractor agreement can be renewed as many times as the contractor and the business owner see fit. The terms of this agreement can be amended upon renewal. Where W-2 employees work according to your company’s schedule, independent contractors define how and where they work, and can set their own hours.

Contractors have the flexibility to hire their own workers (i.e. subcontractors) to help them deliver the product or service that you hired them to provide. They provide their own tools and supplies to get the job done.

As a business owner, your level of financial and legal responsibility toward contractors is low. Workers who have independent contractor status pay both employee and employer self-employment taxes. A contractor with an IRS Form 1099-MISC is responsible for the full 15.3% of the “self-employment tax” and can deduct one half of the self-employment tax on their personal tax returns (Form 1040). Since a 1099 worker assumes the full self-employment tax, they will usually pay quarterly estimated tax payments.

Because a contractor’s work is set for a defined period of time, if the contract is not renewed for one reason or another, you’re not required to pay unemployment compensation or unemployment insurance. Independent contractors are also not eligible for the benefits you might offer your W-2 employees, such as 401(k) plans, pension plans, sick pay, health insurance, paid-time off, and overtime.

Hiring 1099 workers is much simpler than hiring full-time W-2 employees. It begins with an agreement written and signed between a business and a contractor. The terms of this agreement outline the salary, the dates of payment, and for how long the contractor is aligned with the business.

If there isn’t a fit between your business and the contractor, the termination of this agreement can happen at any time with no financial obligations (i.e. no need to issue unemployment payments and coverage).

Determining whether your workers are employees or contractors

You’re probably wondering why there are two types of workers anyway. Often times, it comes down to cost and convenience. It’s much easier to pay a contractor than it is to administer payroll and benefits or handle the other HR functions required of a business with employees.

Contractors can charge more money, especially if the contractor is brought in for their unique expertise to help on a project. In many cases, hiring contractors can cost more from a salary perspective since employee-type benefits, like insurance coverage, are not provided.

If the IRS or Department of Labor (DOL) audits you and finds out that you’ve misclassified workers, then you will be subjected to severe penalties. The IRS can levy back taxes and penalties. The DOL can also require you to pay wages going back three years if independent contractors have been misclassified.

Although there is some guidance from the IRS about how to correctly classify your workers, we recommend you seek legal advice to best protect yourself.

Here are three major considerations to help you determine whether workers are employees or independent contractors:

Behavioral: Does your company have the right to control what, where, when, and how the worker does his or her job?

Financial: How are you paying that worker? Is it a regular salary or a flat fee? Are expenses reimbursed? Who provides the tools and supplies to get work done?

Type of relationship: Are there written agreements (i.e. contracts) outlining a workers’ compensation or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Is the worker hired for an undefined amount of time or brought on temporarily?

The level of control that a business has over the worker really distinguishes between the two types of workers. If the person’s work is directly controlled by the business in terms of how they perform the job, then the worker is most likely a W-2 employee.

If the person has a greater degree of control and autonomy, then they’re most likely an independent contractor.

Why you should learn the differences

Many businesses are agile with the type of employees they hire. Some only hire full-time employees, while others hire independent contractors. Then there are businesses who employ both.

When hiring, it’s extremely important, as a business owner, to know the difference between hiring full-time employees and independent contractors. It’s important not only from a financial perspective but from a legal perspective.

Make the distinction before you hire to save you from legal trouble later on. Outline the scope of work and how the work is done in a conversation with the prospective employee.

As a business owner, you also have to understand what your needs are. Are you hiring someone to help you perform tasks on a day-to-day basis with a set schedule? Or, are you hiring someone for a set period of time, using their expertise to get a specific job done?

These questions can help you make the distinction between 1099 and W-2 workers.