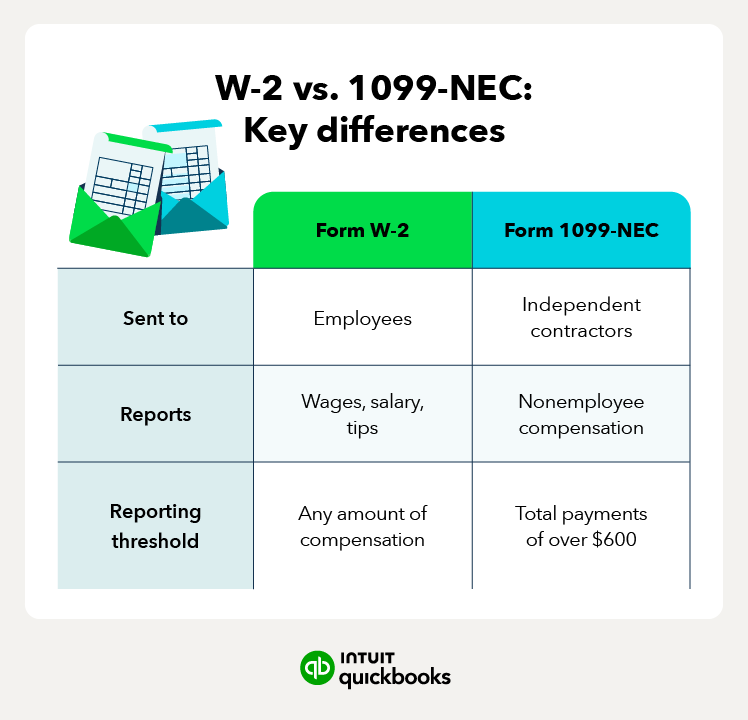

Employees or contractors receiving a 1099 and W-2 form

On the flip side, some employees or contractors will receive both a Form 1099 and a Form W-2. This happens if you have a job where you are a paid employee but also freelance or do contractor work for another company.

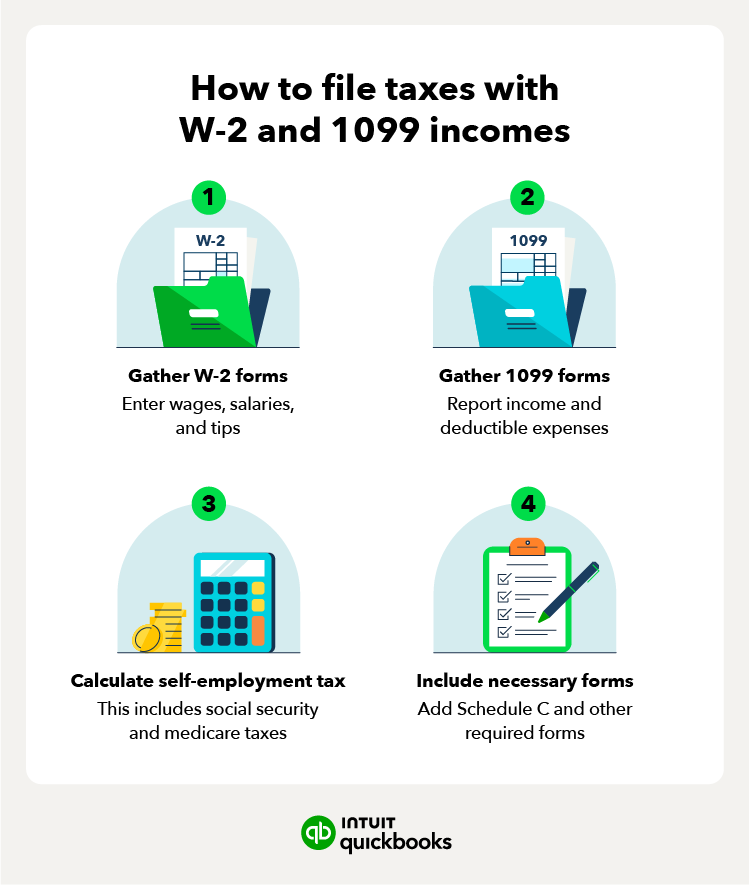

When receiving both a 1099 and a W-2, it's important to consider the different tax implications. For W-2 income, the employer typically withholds taxes. With 1099 income, individuals are responsible for paying their own taxes. There are ways to help make tax time easier if you know you’ll be getting both forms this year:

Using 1099 income to lower your tax bill

A Form W-2 for self-employed individuals does offer advantages when it comes to lowering your tax bill. One advantage of being self-employed is having access to additional tax deductions that can help reduce your taxable income.

Self-employed individuals, including those who also have a W-2 job, can claim tax deductions for 1099 contractors. You can deduct business expenses, such as:

- Home office expenses

- Phone and internet bills

- Health insurance premiums

- Business travel

- Business meals

These deductions can lower your taxable income and ultimately decrease the amount of taxes you owe.

Using your W-2 job to lower your quarterly taxes

If you have a mix of income sources, including a W-2 job and freelance work, you can use your W-2 job to help lower your quarterly taxes. One way to do this is by increasing your tax withholdings from your W-2 income through a new Form W-4.

By increasing your tax withholdings from your W-2 job, you can have additional tax withheld from your wages, which can help cover the tax liability generated from your freelance income.

However, note that using your W-2 job to lower quarterly taxes through increased withholdings may be inaccurate. It's possible to over-withhold or under-withhold, leading to potential tax implications. Consider consulting with a tax advisor to ensure you make the best decision for your individual circumstances.

When issuing both 1099 and W-2 forms to the same individual, consider using tax software to streamline the process and reduce errors.

When issuing both 1099 and W-2 forms to the same individual, consider using tax software to streamline the process and reduce errors.