What does a construction job cost structure look like?

A construction job cost structure offers a systematic framework for organizing and monitoring the costs related to a specific project. A well-designed job cost structure ensures that all costs are accurately allocated and accounted for, providing valuable insights into project profitability and performance.

A typical construction job cost structure includes:

- Job codes: Unique identifiers assigned to each project or job

- Phases: Different stages or milestones of the project

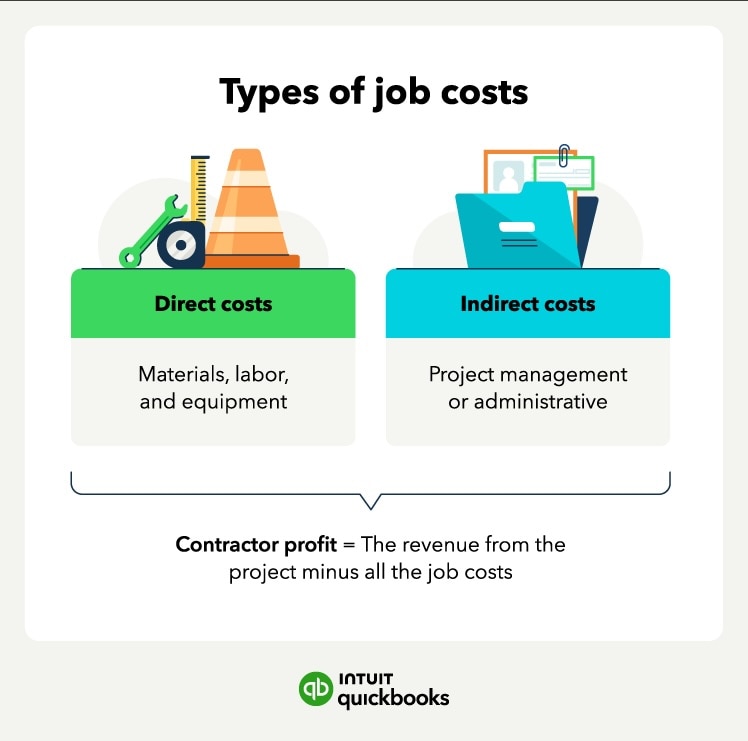

- Cost types: Categories of costs, including direct materials, direct labor, and overhead

- Cost codes: Specific codes assigned to each cost element within a cost type

- Classes: Groups of similar cost elements

Here’s how to build a construction job cost structure:

- Clearly outline the project's scope, including the deliverables, milestones, and expected completion date.

- Determine the key cost elements involved in the project, such as materials, labor, equipment, subcontractors, and overhead expenses.

- Develop a systematic way to categorize and track different types of costs.

- Assign specific codes to each job or project to differentiate costs and track them separately.

- Break down the project into distinct phases or stages to track expenses at different points in the project lifecycle.

- Make a comprehensive list of all cost types and assign corresponding codes.

Finally, group similar cost elements into classes to simplify reporting and analysis. For example, materials can be classified as lumber, concrete, and electrical supplies. It can help create a clear track record of the cost of goods sold (COGS).