How much your business makes is very important. Just as important is how much your business keeps from the money it makes. When it comes to measuring profitability, business owners should start with gross margin—the amount of money they make after accounting for the direct costs of producing goods and services. Let’s look deeper into what gross margin is, how to calculate it, and strategies to increase it:

Gross margin: Definition, formula, and how to improve it

What is gross margin? Gross margin measures the profitability of a company's core operations. It’s calculated by subtracting COGS from net sales and dividing the result by net sales.

How to calculate gross margin

Finding your gross margin is necessary for assessing your business's profitability. Gross margin is also known as the gross margin percentage or gross margin ratio. To calculate gross margin, you need to know two things: Your net sales and cost of goods sold (COGS).

The gross margin formula is:

Gross margin = (Net sales - COGS) / Net sales

For example, say your net sales is $1 million while your COGS is $800,000. Your gross margin is 20%, which is ($1 million - $800,000) / $1 million.

Your net sales figure is your total revenue minus returns, discounts, and allowances. Your COGS includes expenses directly related to the production costs of your goods. Note indirect costs, such as marketing and admin salaries, are not part of COGS. To calculate gross margin, sort your costs into direct or indirect:

- Direct costs are directly related to producing a product or delivering a service. The most common direct costs are material and labor expenses.

- Indirect costs, on the other hand, do not come from a specific product or service. Indirect costs include rent, utilities, insurance, and legal expenses.

As a general rule of thumb, fixed costs tend to be indirect, and variable costs are usually direct. However, there are some exceptions by cost or industry, so you should still review each charge before including it in the COGS.

Use net sales and not total revenue when calculating gross margin—total revenue does not include returns, discounts, and allowances.

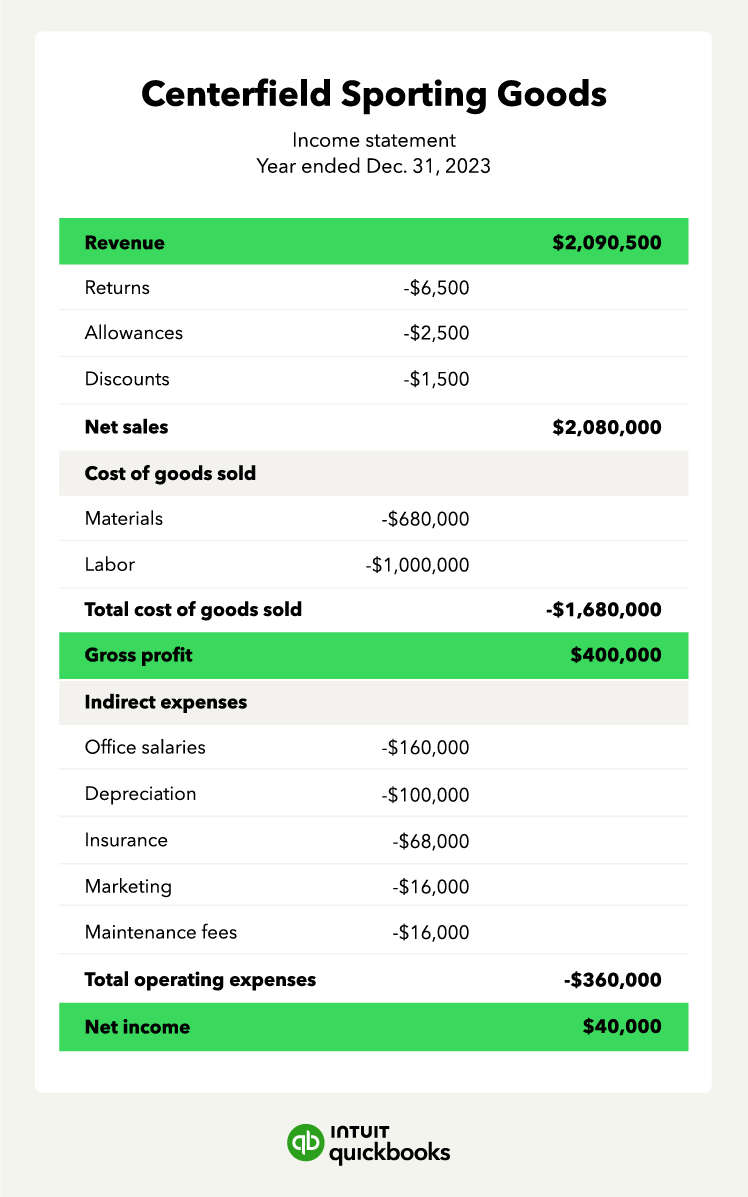

Gross margin calculation example

Here is a gross margin calculation example for Centerfield Sporting Goods. From the income statement, we see that the company’s net sales figure is $2,080,000, and its COGS is $1,680,000.

Plugging these numbers into the gross margin formula, the calculation is:

- Gross margin = (Net sales - COGS) / Net sales

- ($2,080,000 - $1,680,000) / $2,080,000 = 19%

For every dollar of sales revenue, this company generates $0.19 of gross margin. However, that gross margin does not equal net income or net profit.

Unlike gross profit, net income accounts for indirect expenses. You can use gross margins to decide if direct costs detract from the bottom line more than indirect costs.

You can generate financial statements similar to the above using bookkeeping software like QuickBooks Online.

Why is gross margin important?

Your gross margin provides insight into the business’s efficiency and production return on investment (ROI). Analyzing your gross margin can improve business operations in many ways, including:

- Financial health indicator: A healthy gross margin suggests that your business is financially stable and can sustain its operations.

- Pricing strategy: You can use gross margin to set pricing at a competitive level without cutting into profits.

- Cost management: Identifying areas where you can cut costs without compromising quality can improve your profitability.

- Industry comparisons: Gross margin shows how profitable you are compared to competitors.

Gross margin analysis can inform your strategic decisions, such as entering new markets, launching new products, or adjusting your sales tactics. It ensures your business decisions are data-driven and focused on profitability.

Gross margin is a key metric in any business. When paired with net margins and gross profits, it provides comprehensive financial information.

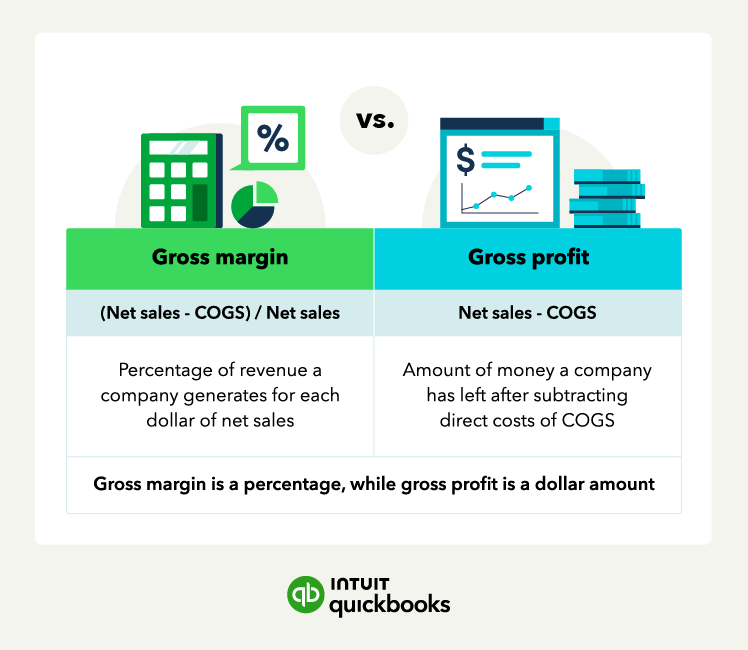

Gross margin vs. gross profit: The main differences

Gross margin is generally a percentage, while gross profit is a dollar amount. Gross profit measures the difference between your net sales and COGS). A higher gross profit indicates your business is more efficient at converting sales into actual profit.

The gross profit formula is:

Gross profit = Net sales - COGS

Understanding what influences your gross profit is key to maintaining and boosting your gross margin. Here are the main factors to consider:

- Pricing: Low prices can shrink your profits, while high prices might drive customers away. Striking the right balance helps maximize margins while keeping customers happy.

- Sales volume: Higher sales volumes can improve your gross profit by spreading fixed costs over more units. However, increasing sales shouldn't come at the expense of significantly lowering prices or compromising quality.

- Product mix: The range of products or services you offer affects your gross profit margin. High-margin products can boost overall profitability, while low-margin items might drag it down.

- Production efficiency: Efficient production processes reduce waste and lower costs. Investing in technology, training employees, and streamlining operations can improve efficiency.

Note that seasonal fluctuations in demand can impact your gross profit. During peak selling season, increased sales volume can boost margins, while off-seasons require strategic planning to maintain profitability.

How to use gross margin for analysis

Every business owner should analyze key financial ratios to improve business results. Understanding your gross margin allows you to benchmark against competitors. This comparison can highlight areas where you excel or need improvement, helping you stay competitive in the market.

For example, online resources like the NYU Stern School of Business can provide the average gross margin for your industry. Once you've found the average gross margin in your field, you should attempt to meet or exceed the average.

However, note that there are limitations to analyzing the gross margin:

- Doesn’t depict overall profitability: Gross margin excludes the indirect costs of producing a good, like rent and marketing fees.

- Not good for comparing across industries: Different industries have their own cost structures and profit margins. As a result, gross margin analysis won’t help you compare businesses in different industries.

- Won’t account for outside factors: Outside factors like increased production costs to secure a supplier won't apply.

A higher gross margin indicates a company is more efficient at managing production costs and retaining a larger portion of its revenue to cover other expenses.

Ways to improve your gross margin

Gross margin is the percentage of revenue you keep after subtracting COGS. So, to improve gross margin, focus on increasing your revenue or lowering your COGS. There are six key ways to increase your gross margin:

1. Increase your revenue per transaction

Businesses can increase net sales by raising selling prices. But remember that price increases can be difficult in highly competitive industries.

2. Increase your repeat business

Developing repeat business can improve your recurring revenue and other customer metrics. If you sell a quality product and provide a high level of service, customers may come back every month or year. You can increase sales and spend less on marketing to find new clients.

3. Improve your marketing results

Improving your marketing plan and outcomes can increase revenue. Give your customers a reason to stay with you by using tactics like:

- Promotions: Use data analytics to promote products and services that your customers want.

- Rewards: When a customer makes a certain number of purchases or reaches a specific dollar amount of activity, offer a reward or incentive.

- Surveys: Ask questions using surveys in each of your marketing channels and emphasize that the survey won't take much time to complete.

Use your analytics and survey results to make product improvements and add new product offerings.

4. Shorten your sales cycle

The sales cycle encompasses all activities for closing a sale. One way to speed up the process is to leverage technology. For example, customers often need more information before making a buying decision. People may buy sooner if you improve your website. Live chat, automated responses, and built-in frequently asked questions can speed up the customer journey.

5. Reduce your material costs

Another strategy to increase gross margin is to reduce costs on materials. You can reduce material costs by:

- Negotiating a lower price with current suppliers

- Asking new suppliers to compete on price

- Analyzing your production system and avoiding wasted material

- Changing your production system

Different approaches can reduce the amount of scrap you produce. As well, employee training can help workers minimize waste and work more efficiently.

6. Improve your labor productivity

Like material costs, labor costs can impact your COGS. You can better manage employee costs by investing in training and optimizing schedules. Also, reduce turnover to cut costs because hiring a new employee costs more than retaining a trained one.

Note that once you boost your gross profit, you’ll need to overcome the key challenges of maintaining a high profit margin.

Navigate midsize and complex business challenges and opportunities

Your gross margin does more than paint a picture of company finances. It can highlight the best path to improving profitability. Be proactive and make improvements sooner rather than later. By learning and using key financial metrics and KPIs like gross margin, you can improve your business results.

Use accounting software like QuickBooks to quickly analyze your company’s metrics. It can generate your business’s gross margin and suggest improvements that lower costs and increase revenue. If your business is more complex, an all-in-one enterprise resource planning system like Intuit Enterprise Suite can help you manage your finances with precision and ease. Keep growing with a more powerful suite, and boost productivity with business and financial management all in one solution. Make faster decisions with real-time data and visibility across your portfolio.