Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI just saw your post. It looks like the password has to be 12 characters only. I will try that.

It's nice to see you here, @Child of God,

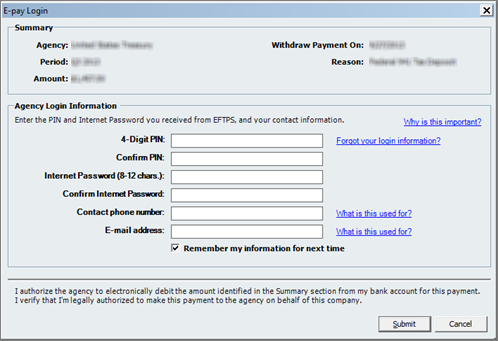

Let's make sure you're able submit your payments in QuickBook using the new password. Please note that if you recently updated the bank account for e-payments, the IRS will provide a new set of PIN for it. This is normally the reason why some users are still getting issues when sending their payments to the agency.

Then you need to update it in QuickBooks using the steps in this article: Change bank account you use to make e-payment for tax liabilities

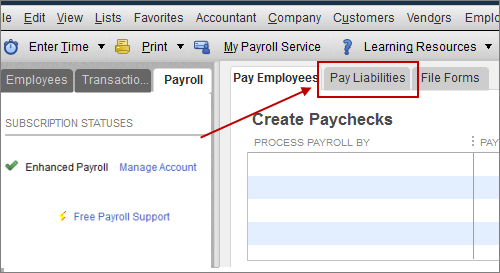

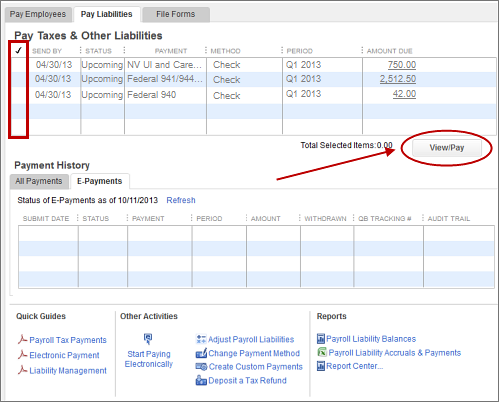

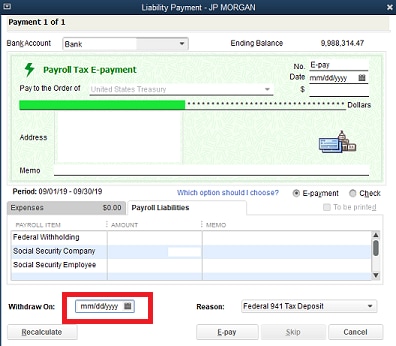

After getting the correct PIN and updated the Internet Password, you also need to update this information inside QuickBooks. Use the steps below:

The next time you make e-payment, re-enter your 4-Digit PIN and EFTPS Internet password, and select the Remember My Information for next Time option.

Check out the following links to guide you with the process:

If the same issue happens again, I recommend reaching out to our Support Team. They can initiate a viewing session with you and help diagnose the company file to verify what causes the problem. If needed, they can also report this to our engineers for further investigation.

Refer to this article for our contact options and support availability: Contact QuickBooks Desktop support

Let me know how it goes. I'll be right here if you have any questions or need any help with your tax filings. Have a lovely week ahead!

I changed my password and EFTPS was still rejecting my payments. I voided them and tried again the next day and they went through. I never understood why they have such strong password requirements. Like is somebody going to pay my employment taxes for me? LOL!!!

I've called into Quickbooks support and they couldn't resolve the issue. They blamed EFTPS, which is working great, and I even changed my perfectly good EFTPS password. Called EFTPS and they agreed that by me logging directly into EFTPS with the same credentials and it works fine, that it is a Quickbooks issue. It is sad the amount of money paid to Quickbooks by us (over $500 per year) and they can't fix the issue. You can try contacting their support at 800-555-4477. I'm looking for a better alternative to Quickbooks that works with great technical support.

Followed the steps. My password was had not expired. I just changed the password now I get an authentication error. Please help payment is due today

Hi Terry.

I want to ensure you'll be able to process your payments with no error.

As an initial step, please make sure to use the correct credentials during the login. If the error continues, you can proceed with updating your EFTPS password as suggested above to narrow down the result.

If the authentication error continues, I would suggest reaching out to our Support Team. This way, a live representative can check and recover your login securely.

For the support's contact information, you can open this link: Contact QuickBooks Desktop support.

For more tips about handling electronic payments in QuickBooks Desktop, you can also check out these articles:

Please let me know how else I can help you with processing payroll taxes or payments. I'm more than happy to help. Have a good one!

Changing my EFTPS password to 12 characters worked. They did not give me a new PIN #. But everything went through properly this payroll.

Thank you!

Changing my EFTPS password to 12 characters worked. They did not give me a new PIN # and everything went through properly this payroll. Hopefully this helps everyone else having issues.

THE PROBLEM IS THAT THE QUICKBOOKS 2021 UPGRADE MADE IT SO THAT YOUR PASSWORD FOR EFTPS CAN ONLY BE 12 CHARACTERS. IF YOUR EFTPS PASSWORD IS LONGER THAN THAT, YOU'RE SCREWED. I JUST GOT HIT WITH A HUGE PENALTY FROM THE IRS. I FINALLY FOUND ADVICE THAT YOU HAVE TO CHANGE YOUR EFTPS PASSWORD TO 12 CHARACTERS FOR QUICKBOOKS TO CORRECTLY SUBMIT YOUR PASSWORD.

SHAME ON YOU, QUICKBOOKS!!!!!

Yes! What a nightmare. Happened last year when the IRS changed the policy regarding passwords for EFTPS requiring a reset 1 every year. I didn't recall reading or hearing about the impending change, client deposits just kept rejecting. I had clients with the same EFTPS password for 10 years. When it first happened I frantically changed each payroll client password. This year when it happened I went through and changed the passwords. For some reason 1 of the changes must not have happened at the sametime an FTD was processed. FTD's sent after that particular deposit posted without an issue. Because the amount was so similar to another FTD we didn't notice until the client received a notice with penalty and interest tacked on of course. The IRS has been contacted but will not abate the penalty and interest. They said to appeal when they receive a notice from IRS. I think we should file for abatement now!

Unfortunately, the IRS rep denied my request by phone today. She said the client will be sent a notice and have the chance to appeal. What a pain. In the throws of tax season and now this, I found 2 today that I thought the change of EFTPS password went through. I'm planning to request abatement now via written letter and print screens of the attempts and rejects. The penalty and interest = ~$350. Not an enormous amount but I will have to eat the penalty if the IRS refuses to abate. Besides that the issue takes so much time to resolve, time I do not have.

YES!! OMG how difficult could that be! Would save hours of unbillable time and anguish while we are trying to get those 1099's and W2's out the door and then tax season!

@Q3user wrote:Quickbooks has so many useless popup windows, how about putting some purpose behind one and TELLING US CLEARLY WHEN AN IRS PAYMENT HAS BEEN REJECTED!!!!!!!!!!!!!!!!!!!!!!!!

Especially if they get paid weekly.

It sounds awful but I'm actually so relieved to have found this thread. I thought of another point I want to mention - around December/January 2020-2021 whenever I tried to access the "E-Payments" tab in the Pay Liabilities window the program crashes. This happened with just about every client file and is still happening in some files. I think Intuit needs to fess up it's a problem on there end so we can get penalties and interest due to this issue abated. It must be a huge boon for the Federal Government because as we all know when it comes to payroll penalties the IRS takes no prisoners.

It might be time for me to consider other alternatives.

@dso0216 @You must be in Maryland. This is an unrelated issue that was caused by the MD SUI change to the new Beacon site. Completely unrelated to the EFTPS password issue and just as annoying.

Sadly, no. Not Beacon. I stopped using the QB payroll software to send MDSUI payments years ago. They had that all botched up. No this is the FTD unfortunately and one client is getting hit because of a rejected payment from 12/31.

@dso0216 Sorry for the confusion - to clarify, the crashing of QB when you attempt to click on e-pay history is caused entirely by the updates to QB after Maryland SUI changed to the new Beacon site. The new Maryland site changed the way they will accept ACH payments and QB is not able to send them that way. So we all woke up one day to a "one or more liability payments..." message, had to change our payment method to check, and began having the "QB crashes when I try to access e-pay history" issue. That issue is still not fixed - and it has been at least 5 months.

The EFTPS password issue could be one of a couple of things. EFTPS instituted a new policy about 15 months ago now, that you must change your password every 13 months if you are using a 3rd party processor (like QB). They do not tell you that anywhere on their site. So you could blithely login on the site, and say - well, there's nothing wrong with my password, and resubmit your payment, only to get the same rejection notice. So the first thing to do is go to the EFTPS site, change your password, then return to QB and pay the liability - entering the new password in QB as you do so. Here's a link (one of many) that discusses this policy.

That said, there have been so many reports of this in the last 2 days, I wonder if they had a system glitch.

Yes unfortunately I now owe about 18k plus the penalties and late fees bcuz I had no clue they were rejected! I don’t remember my PIN or password but I entered it 11 yrs ago and have never had any problems until now. This is financially devastating to my company! And calling support got me nowhere!

I am having the same problem with Quickbooks EFTPS and have incurred penalties due to this. is there an answer to fix this?

Hi there, @KLCPA2.

I want to make sure this issue is taken care of, and I personally want to get this fixed for you.

Were you able to update your EFTPS login credentials? If you haven't yet, I suggest doing it so. This is to ensure you won't get any issues when processing e-payment.

However, if you get the same result after updating your EFTPS credentials, I highly recommend contacting our QuickBooks Support Team. This way, they can further check on this matter and provide some assistance to get this resolved. They can also look for a way to waive the penalties if necessary. Here's how you can reach them:

I'm also adding this article to learn more about processing electronic payments in QuickBooks Desktop: E-Pay tax liability payments.

Please let me know if you need clarification about processing e-payments, or there's anything else I can do for you. I'll be standing by for your response. Have a great day.

Yes. I was. I did get it taken care of. The password needs to be only 12 characters long, no more, no less.

no update was needed. I am able to make payments on EFTPS directly- the problem is with Quickbooks-not the password for EFTPS

I got the same rejected payment message from EFTPS and didn't notice it for about a week and only then because the payment didn't clear checking. I'm glad I found this thread before trying to submit again and generating another EFTPS rejection due to QB issues. I logged onto EFTPS again and created a long-ish password (14 chars) but updated again to 12 characters based on another post. I was able to successfully submit payment. Note that another user posted that EFTPS would not allow an immediate change of password... I did not find this to be the case and was able to effect another update right away, your mileage may vary. Also, I'm still hanging onto desktop QB Pro 2018, so there may be other issues with the latest flavor of desktop that I'm not experiencing yet.

QuickBooks, you have not once, in your many responses since the original post on May 2020, indicated that engineers are working on this issue. And clearly it's an issue that needs updated code or specific EFTPS guidance (like change password every XX months, limit password to XX characters, etc.). You punt the problem to contacting your support team, and based on the follow-up posts here, they have been unable to provide more than band-aids or non-working solutions.

Generally, I've found less than robust support for Desktop QB and an undisguised, continuous push toward the QBO product. I don't know about the rest of you, but I pay over $500/annually just for DIY QB Payroll to pay a single person. QBO with Payroll is absurdly overpriced for a small or micro business. Compared to other players in the software subscription realm (e.g., Microsoft, Adobe), Intuit's subscription prices are sky high for far less robust offerings. I've had issues with QB Desktop that I simply give up on (like, oh, blank PDFs of invoices generated by QB Payments, for one) because I can work around them. But, as others have argued, tax obligations are mission critical and really the sole reason for Intuit's existence.

It's unacceptable for QB to not have engineers ON THIS. Please communicate a clear timeline for resolution.

This is not the impression we want to leave you with, @lfitz151.

We can see how these issues affect your QuickBooks experience. As much as we want to help you and other users, we have a specific department that can further investigate and give you an update. I recommend contacting our Payroll team for assistance.

Here’s how:

We also understand your concern regarding our subscription charges. QuickBooks make sure to provide your business needs by investing in product enhancements.

Here’s a guide to check e-file or e-pay status in QuickBooks. This is to make sure that your payment or form is received by the agency on time.

The Community is always here whenever you need help. Just let us know, and we will get back to you as soon as possible. Take care!

Not helpful. We’re literally helping each other as a community because QB has no fix. SHAME.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here