Move your QuickBooks Desktop accounting info to QuickBooks Online Payroll

by Intuit•15• Updated 2 months ago

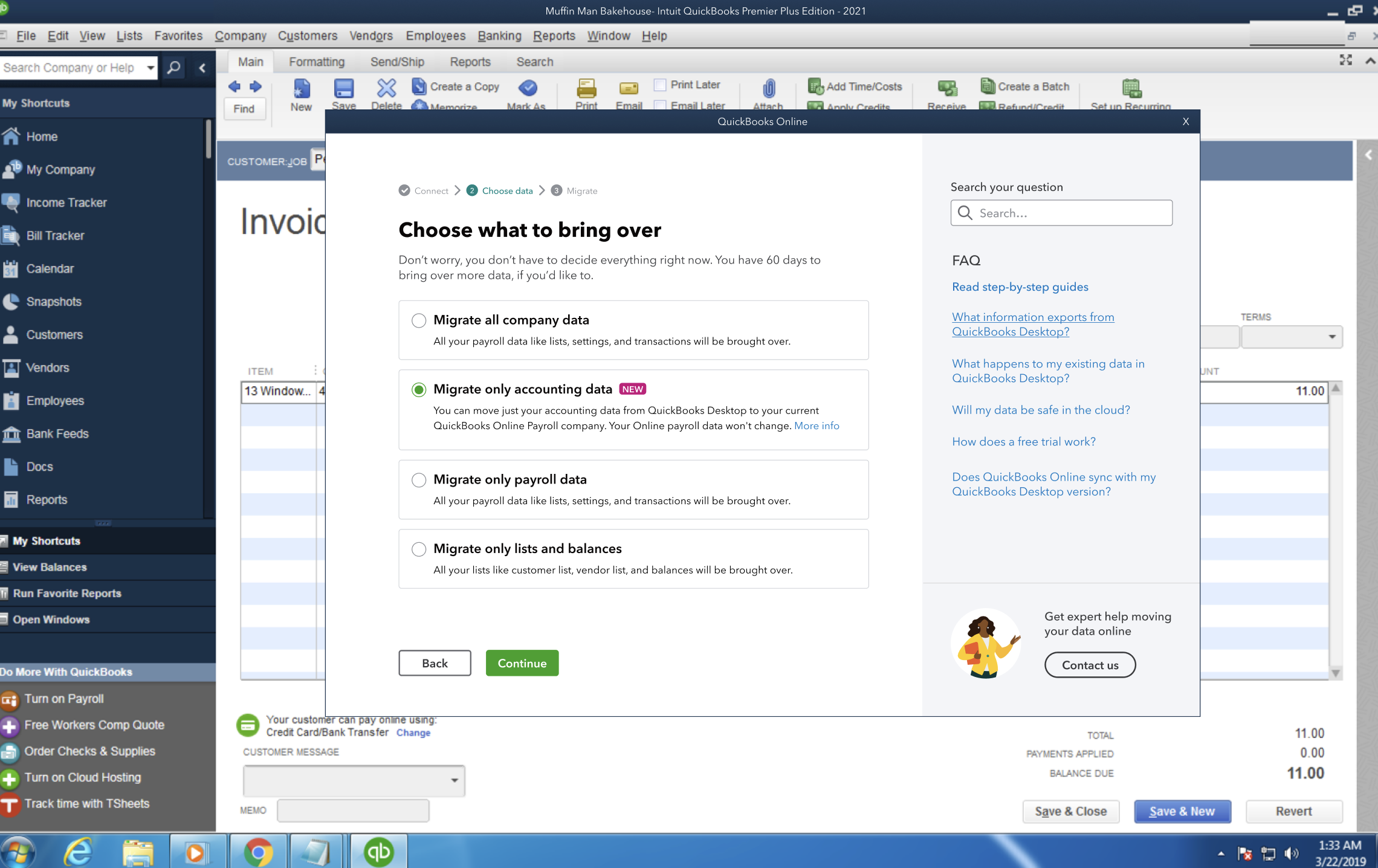

Learn how to import your accounting info from QuickBooks Desktop to QuickBooks Online Payroll.

You can now move your QuickBooks Desktop accounting info to your existing QuickBooks Online Payroll subscription. This lets you manage your business online with a single company file. No need to start over or maintain 2 different company files.

Notes:

If you’re on wholesale billing:

- Contact your accountant to purchase QuickBooks Online for you. This way you can continue to manage your wholesale billing after the migration.

If you’re not on wholesale billing:

- Set up QuickBooks Online through your account management settings to access all its standard features.

You can also migrate without making any changes. Upon migration, QuickBooks Online sets up a 30-day trial of QuickBooks Online Advanced. This trial includes access to advanced features, including wholesale billing.

You can change plans if you find that the advanced features aren't necessary. After the trial ends, you can’t change the plan to QuickBooks Online Ledger. You can change to a standard QuickBooks Online plan any time.

Delete unmatched data

You can delete unmatched checks from QuickBooks Desktop using the exception report. Once all unmatched checks are deleted, the accounts and balances in QuickBooks Online will match those in QuickBooks Desktop.

Notes:

- A paycheck is considered matched if all three criteria—date, amount, and payee name—are an exact match. If none or any one variable doesn’t match, the paychecks are considered unmatched.

- The exception report provides suggestions for matching checks that need to be reviewed and deleted manually in QuickBooks Online from the transaction search screen.

- These suggestions are based on the most probable match (date and amount match or date and payee name match).

- If there’s no probable match, then the matching check section will be empty for that paycheck.

- Check the matched and unmatched data in the exception report.

- Open the downloaded exception report.

- Switch between the Matched paychecks sheet and the Paychecks not matched sheet to review the data.

- If a payroll check is balanced against a check via manual entry:

- Select the Search 🔍 icon.

- Enter the transaction details such as the customer name, date, or amount to locate the specific transaction you want to delete.

- Select the transaction.

- Double-check the customer name, date, and amount to make sure you’ll delete the correct transaction.

- Delete the transaction.

- Select More.

- Select either Delete or Void.

- To confirm, select Void transaction or Delete transaction.

- If you balance a payroll check against a journal entry, then find the respective journal entry and delete it.

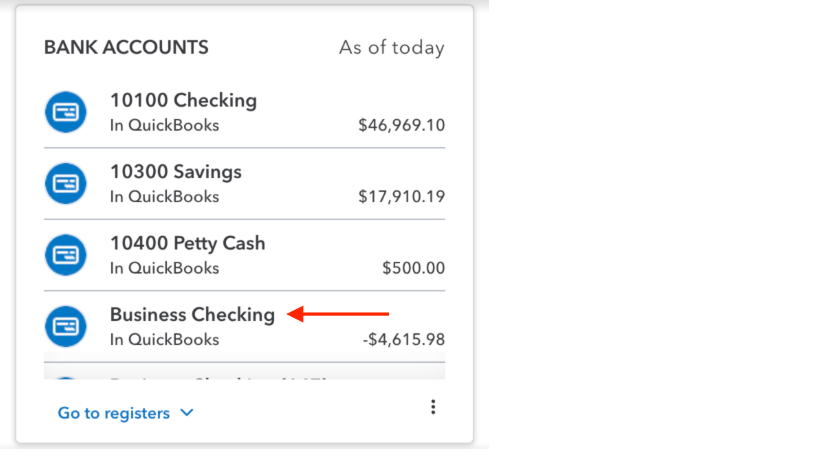

Learn about the business checking account

- After data migration, you'll see the bank accounts you moved from QuickBooks Desktop. You’ll also see the business checking bank account in your list.

- QuickBooks Online Payroll automatically created this bank account to track all payroll transactions, tax transactions, and contractor payments.

- When you delete both matched and unmatched data, QuickBooks updates the balance in your business checking account. This balances your books.

- Your business can continue operating with your business checking account.

More like this