All things bills, all in one place

Organize, track, and pay your business bills online with confidence.

Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.2

★★★★★

I work at a doctors office and use QuickBooks to manage all of the bills that are paid for the practice. It is easy to learn and user friendly.

It can easily keep an eye on all the payments and bills as it provides me all the information of [a] customer's transaction.

★★★★★

Any business can utilize this program naturally. It's a great way to get organized with costs, payments, bills, and invoices.

★★★★★

QuickBooks Online helps you manage your payroll, expenses, bills and other accounts quickly and productively thanks to its excellent interface.

Paying vendor bills is so much simpler while using this product.

★★★★★

We use a lot of progressive billing and it keeps up with my balances.

I was able to forecast profits and manage bills/invoices through QuickBooks instead of hiring multiple people.

Helps manage my bills, track miles, and many other great features. This is a very user-friendly program that is easy to use and understand. I would definitely recommend this program to family, friends, and co-workers.

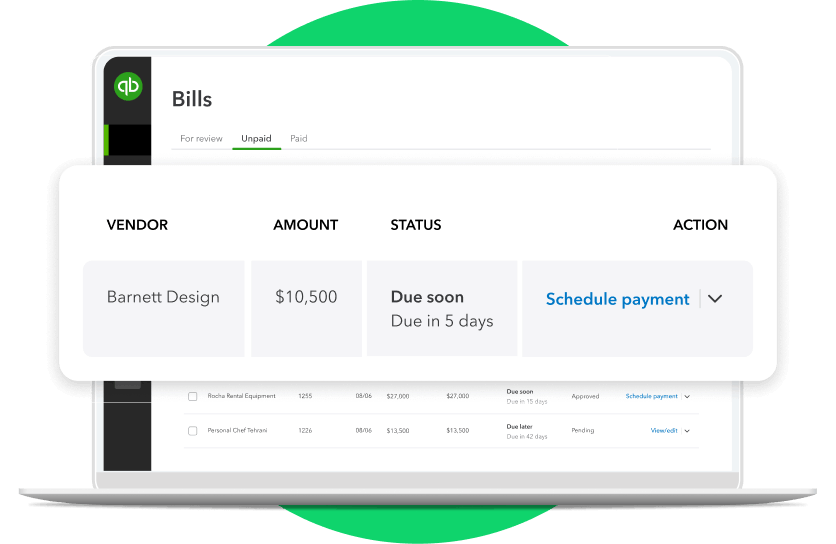

Bills don’t belong in a spreadsheet

Keep up with due dates for everyone you owe. The bills dashboard shows you what you owe, when, and to who, in a glance.

Once you connect your bank or business accounts (like Apple Pay® or PayPal), we’ll import your bill payments and match them to your vendors’ invoices.**

Enter the amount you want to pay and QuickBooks automatically tracks anything you still owe and when it’s due.

One place to streamline bill pay

From tracking and paying bills to gathering business insights, now do it all in QuickBooks to work smarter and free up more time.

Subscribe in your QuickBooks account

Plans for every kind of business

Subscribe to QuickBooks Online and try Live Expert Assisted FREE for 30 days.

- QuickBooks learns how you categorize income and expenses and then automatically matches and records transactions from then on.

- $0.50/standard ACH transaction over monthly allotments. Allotments may vary.**

- Automatically invoice clients who have regularly-scheduled orders.

- AI-powered insights proactively surface trends, anomalies, and what’s causing them, personalized to your business.

- Close your books in a fraction of the time with advanced AI that includes anomaly detection that automatically finds and resolves discrepancies with you in control.

- Create and manage users and pre-defined roles, assigning them specific access levels to various areas of QuickBooks.

- Build and save reports that are tailored to your business needs.

- Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.See more

- Stay consistent, compliant, and credible with automated revenue recognition.See more

- Use your historical financial data to analyze trends and create projections of future outcomes, so you can make better-informed business decisions.

QUICKBOOKS LIVE EXPERT ASSISTED

Live experts. Total confidence.

Feel confident in your business—and your books. Get setup help and guidance with Live Expert Assisted FREE for 30 days.*

Feel confident from day one

You’re never too small, and it’s never too soon to know you’re on track for success.

Frequently asked questions

Yes. We keep all of your bill payments organized in one place. Simply click on the ‘Sent Payments’ tab and you will see the date the payment was processed, the payment method, the payment amount, and other details of the payment.

In QuickBooks there are two ways to manage bills from your vendors or suppliers. You can use Pay Bills for bills that should be paid later, like utility bills. You can use Write Checks for expenses that you want to pay immediately, or have already been paid. For example, if you bought office supplies at the local store and immediately paid for them, you can record the transaction under Write Checks instead of Pay Bills.

More ways to learn about managing business bills

Find more of what you need with these tools, resources, and solutions.

A business owner’s guide to the accounts payable process

If you use accrual accounting, you’ll want to understand how to track accounts payable in your balance sheet.

How to create a small business budget that works for you

Take a closer look at your assets, expenses, and financial goals to craft a plan for the future of your booming business.

Talk to sales

Give us a call if you need help picking a QuickBooks product.

Call 1-877-866-5232 Mon-Fri, 5 AM to 6 PM PT

Visit our support hub

Find help articles, video tutorials, and connect with other businesses in our online community.

Find a plan that works for your business

Guarantees

Payroll Accuracy Guaranteed: Available with QuickBooks Online Payroll Core, Premium, and Elite. We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15 days of the tax notice, we will cover the payroll tax penalty, up to $25,000. Intuit cannot help resolve notices for customers in Collections with the IRS because IRS Collections will only work with businesses directly. Additional conditions and restrictions apply. Learn more about tax penalty protection.

*Offer terms

QuickBooks Products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the "QuickBooks Products"). The offer includes either a free trial for 30 days ("Free Trial for 30 Days") or a discount for 3 months of service ("Discount") (collectively, the "QuickBooks Offer"). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer.

QuickBooks Live Expert Assisted Free 30-day Trial Offer Terms: Access an expert when you add the thirty (30) day trial of QuickBooks Live Expert Assisted services (“Live Expert Assisted”) to your purchase of QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QBO”) subscription. You must be a new QBO customer to be eligible. To continue using Expert Assisted after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee until you cancel. Sales tax may be applied where applicable. To cancel your Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period.

Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

QuickBooks Online Live Expert Assisted Discount Offer Terms: Discount applied to the first 3 months of Expert Assisted, starting from the date of enrollment, followed by the then-current monthly Expert Assisted list price with your QuickBooks Online Simple Start, Essentials, Plus or Advanced (“QBO”) subscription. Your account will automatically be charged on a monthly basis until you cancel. Sales tax may be applied where applicable. To be eligible for this offer you must be an active QBO customer, new to Expert Assisted and sign up for the Expert Assisted monthly plan by calling sales at 1-800-816-4611. Offer available for a limited time only. To cancel your Live Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Online Payroll terms: Each employee (active or on paid leave) is an additional $6.50/month for Core, $10/month for Premium, and $12/month for Elite. Contractor payments via direct deposit are $6.50/month for Core, $10/month for Premium, and $12/month for Elite. The service includes 1 state filing. If your business requires tax calculation and/or filing in more than one state, each additional state is $12/month for Core and Premium. There is no charge for state tax calculation or filing for Elite. The discounts do not apply to additional employees and state tax filing fees.

Free trial for 30 days: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. To continue using the QuickBooks Products after your 30-day trial, you'll be asked to present a valid credit card for authorization. Thereafter, you'll be charged on a monthly basis at the then-current fee for the service(s) you've selected until you cancel. To be eligible for this offer you must sign up for the free trial plan using the "Try it free" option.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must sign up for the monthly plan using the "Buy Now" option.

Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can't be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers only. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation terms: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select "Cancel." Your QuickBooks Products cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

**Products

QuickBooks Bill Pay: QuickBooks Bill Pay product features and availability subject to change. QuickBooks Bill Pay account subject to eligibility criteria, credit, and application approval. Not available in U.S. territories or outside the U.S. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments’ money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Bill Pay: QuickBooks Bill Pay is an additional product enablement to an existing QuickBooks Payments account that may require a separate subscription.

QuickBooks Online and QuickBooks Self-Employed system requirements: QuickBooks Online requires a persistent internet connection (a high-speed connection is recommended) and computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements) and an Internet connection. Network fees may apply.

QuickBooks Online and QuickBooks Self-Employed mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Online usage limits: QuickBooks Online Advanced includes unlimited Chart of Account entry. Essentials and Plus allow up to 250 accounts. QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. Tracked Classes and Locations are not available in Essentials.

**QuickBooks features

Beta features have very limited availability and are subject to change. Features may be more broadly available soon.

Annual percentage yield: The annual percentage yield ("APY") is accurate as of December 31, 2023, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

QuickBooks Live Expert Assisted: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live bookkeeper. The Live bookkeeper will provide help based on the information you provide.

QuickBooks Live Expert Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Expert Cleanup and QuickBooks Live Expert Full-Service Bookkeeping.

Receipt capture: Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Accounting firms must connect using QuickBooks Online Accountant.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Subscription to QuickBooks Online is required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Bill Pay: Subject to eligibility criteria, credit, and application approval prior to first payment. Subscription to QuickBooks Online required. Bill Pay Basic is included with QuickBooks Online when purchased directly from QuickBooks.com or QuickBooks Sales. Not available in U.S. territories or outside the U.S.

QuickBooks Term Loan (“Term Loan”) is issued by WebBank.

Auto-match transactions: Automatic Matching: QuickBooks Online will only match bank withdrawals with transactions processed through QuickBooks Bill Pay. Not all transactions are eligible.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Accelerated Invoicing: QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 20% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

Account team benefits for Priority Circle: Only available with a paid subscription. Trial customers have access to QuickBooks Online Advanced product experts.

Priority Circle: Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

Automatic data backup and recovery: QuickBooks Online uses technical and administrative security measures such as, but not limited to, firewalls, encryption techniques, and authentication procedures, among others, to work to maintain the security of your online session and information.

Cash flow: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary. Available in QuickBooks Online only.

**QuickBooks Payroll Features

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Includes state filings for eligible states participating in IRS Combined Federal/State Filing program; please check with your state agency on any additional state filing requirements. Additional fees may apply to print and mail a copy to your vendors and contractors and to other upgrades or add-on services.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Garnishments and deductions: Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

QuickBooks Workforce: Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

Terms, conditions, pricing, special features, and service and support options subject to change without notice

#Claims

1. Over 40x U.S. average APY: Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

2. The #1 accounting software for small businesses: #1 accounting software for small to midsize business based on PCMag, as of December 2021.

Call Sales: 1-877-866-5232

© 2025 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.