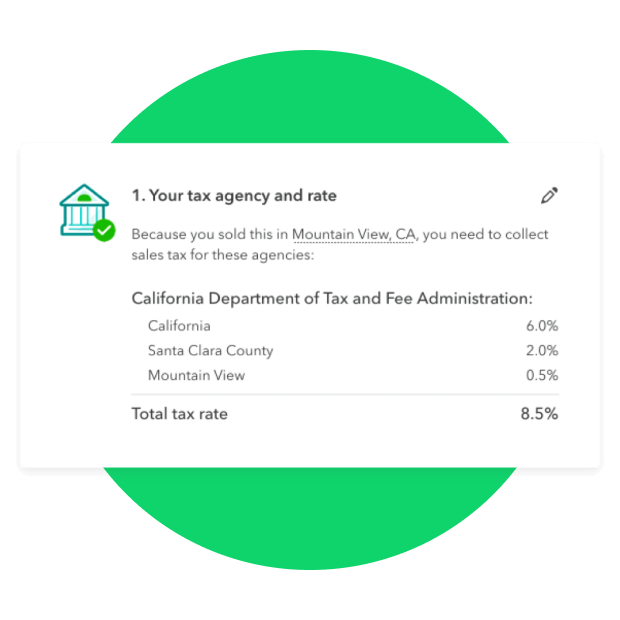

Sales tax simplified

We keep track of thousands of tax laws so you don’t have to.

- We automatically calculate the sales tax rate based on date, location, type of product or service, and customer

- QuickBooks makes sure the correct rate is applied to your transactions based on the product category and location of sale you indicate

- Know how much you owe with a Sales Tax Liability report, which keeps you up to date on your taxable and non-taxable sales

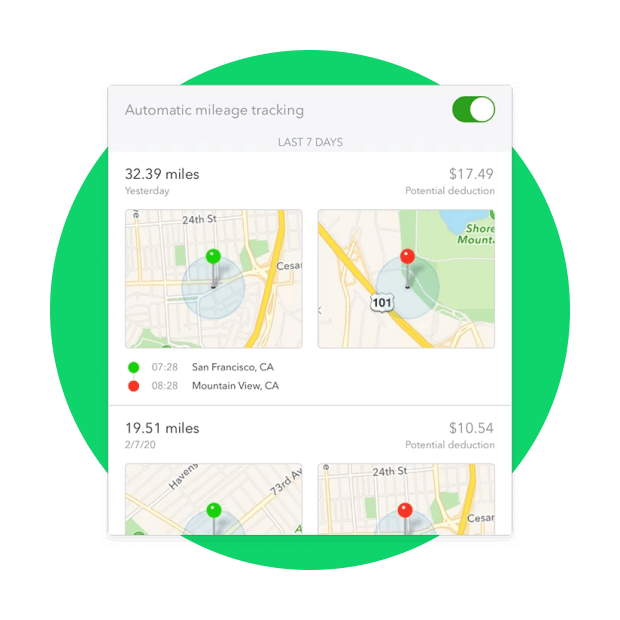

Drive up mileage deductions

Whether you drive part-time, full-time, or occasionally make deliveries, QuickBooks can help you track your mileage deductions.

- Just drive, and we’ll use your phone’s location to automatically detect where you’re driving

- Easily categorize trips as business or personal to accurately rack up potential tax deductions

- See the breakdown of miles and potential deductions in an easily shareable report

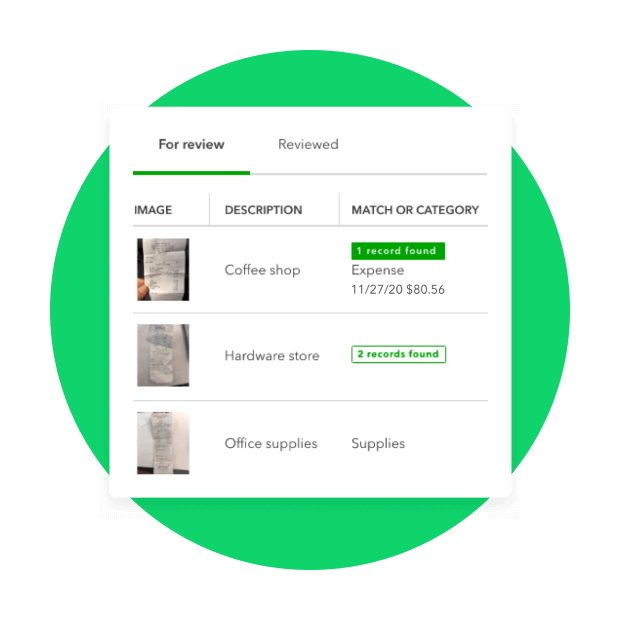

Receipt details, handled

Feel confident knowing that your receipts are organized and ready for tax time.

- Snap photos of your receipts with the QuickBooks mobile app and we’ll automatically match them to stored transactions

- Attach receipts to invoices and accurately record billable expenses in your books

- With receipts in one place, you can easily search and send them to your accountant during tax time

Manage your 1099 contractors

Send, track, and file 1099 forms for your independent contractors, and be prepared when it’s time to file with the IRS.

- QuickBooks Online Advanced lets you track every payment you make to contractors and then creates ready-to-send 1099 forms at tax time

- If you pay a contractor or vendor for equipment or supplies, QuickBooks can track those as separate expenses so you file your 1099 forms accurately

- We’ll walk you through how to map your contractor payments to the correct boxes on the 1099 tax form