Worry-free taxes

We'll calculate, file, and pay your state and federal payroll taxes for you.**

Experts on your side

An expert can review or complete your setup, so you can start paying your team fast.**

Benefits beyond payroll

Find HR resources and offer benefits like workers’ comp, 401(k) plans, and healthcare.**

Start off strong with the right payroll plan

Payroll Core

Payroll Elite

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

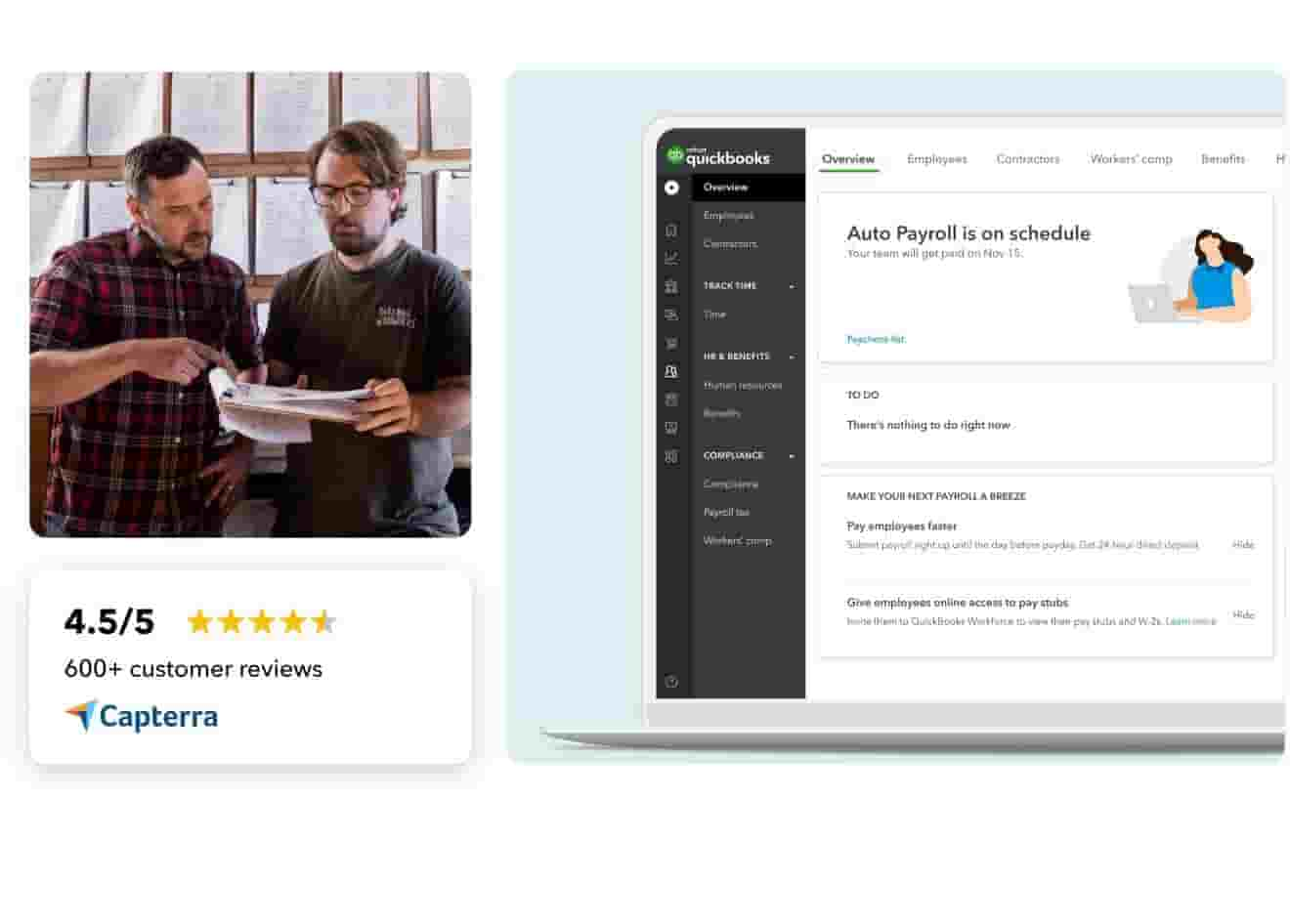

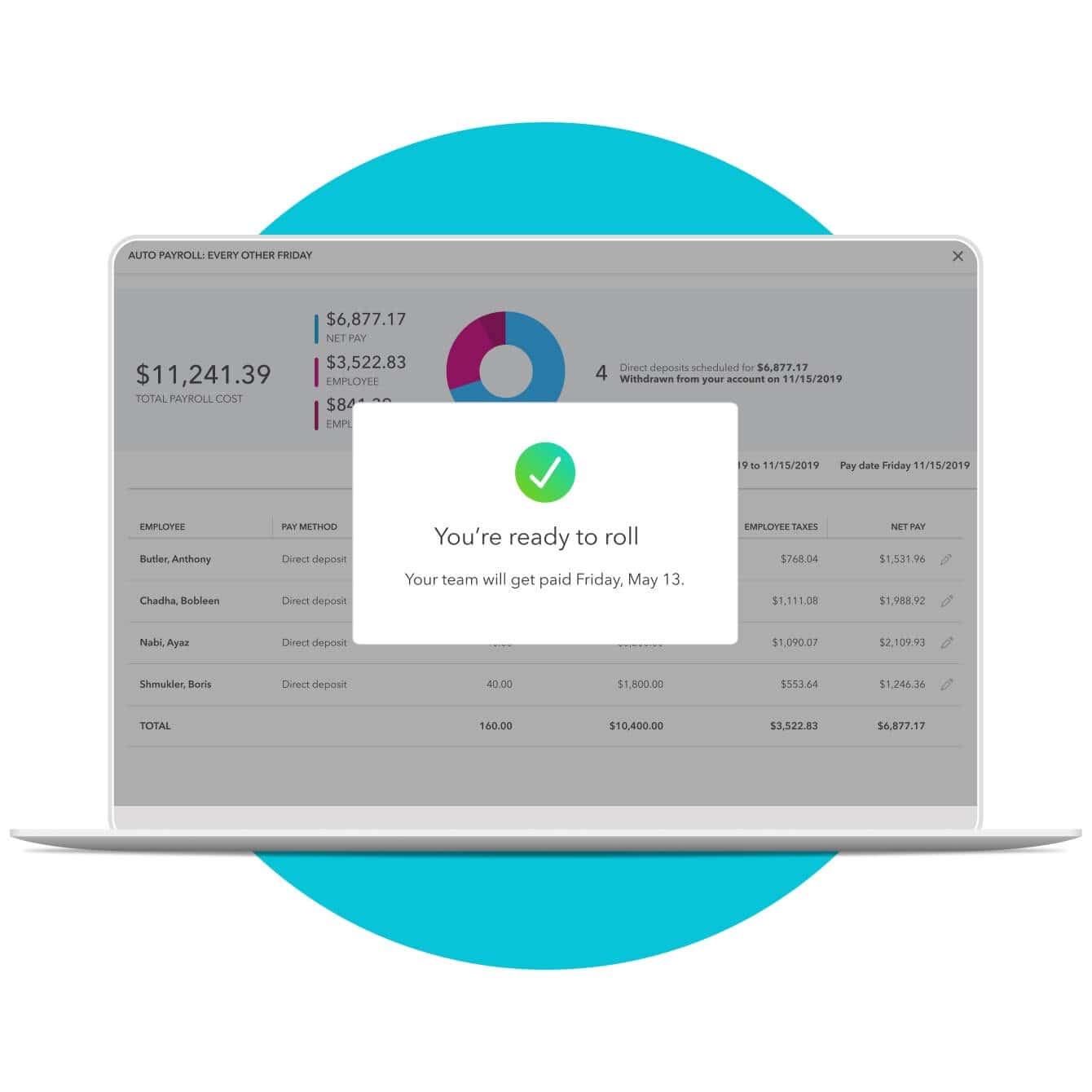

Take payroll off your plate

Get payroll that's accurate, automatic, and easy to use. Pay employees fast with direct deposit and manage hours and projects with time tracking.**

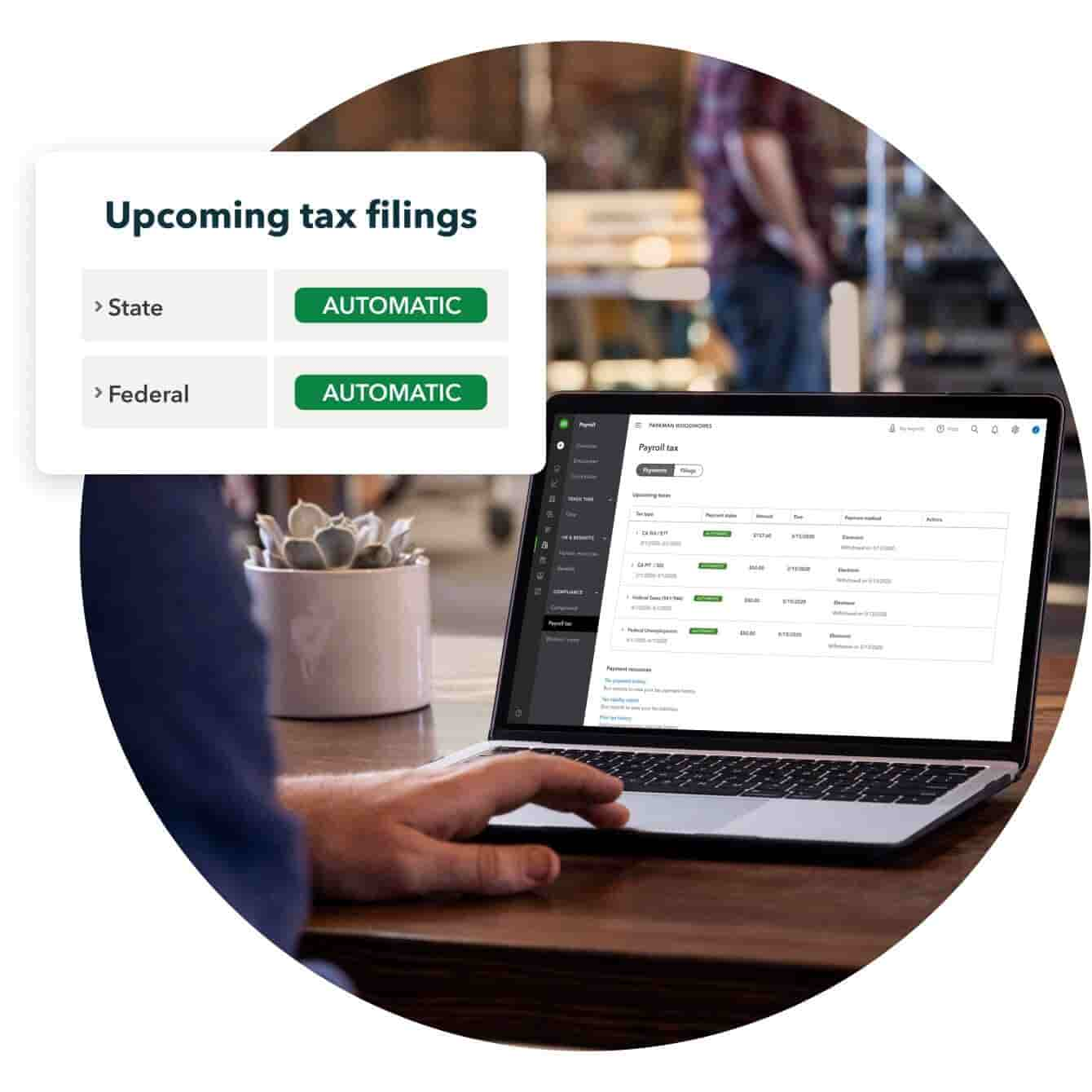

Get payroll taxes done for you

We'll do your payroll taxes so you're never caught off guard. With tax penalty protection, we'll also pay up to $25,000 if you receive a penalty fee.**

Do it all with QuickBooks Online

Your bank and credit card transactions automatically sync so you can manage your books, pay your team, and file payroll taxes in one place.

Customer success stories

Customer success stories