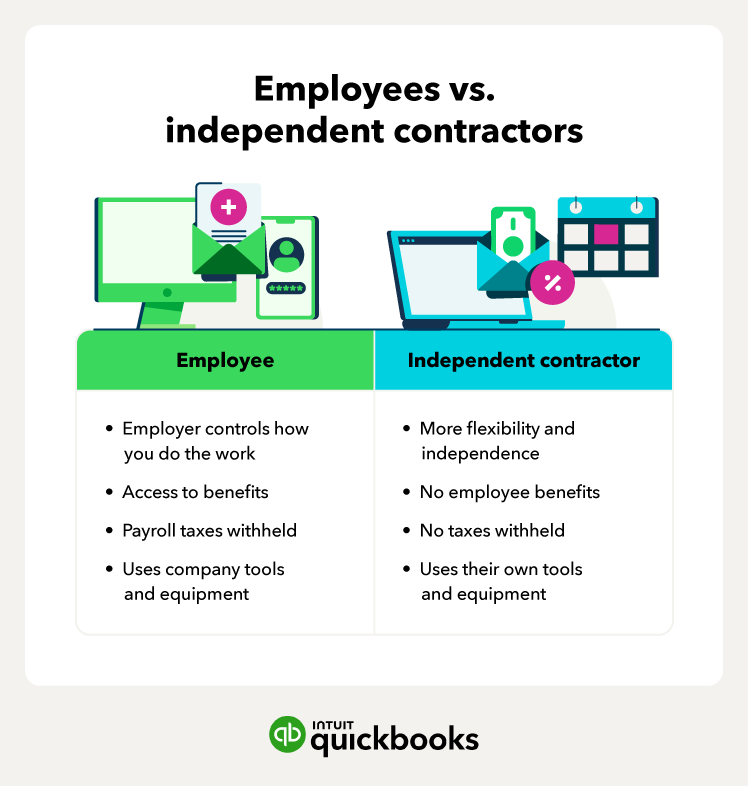

You’re typically an employee if any of these are true:

- Behavior: The company has the right to control how, when, or where you work.

- Financial: The company provides tools and equipment.

- Training: The company provides training and development, such as on-the-job training or workshops.

- Taxes: The company withholds payroll tax.

- Benefits: The company provides various benefits and perks like insurance, paid time off, or retirement.

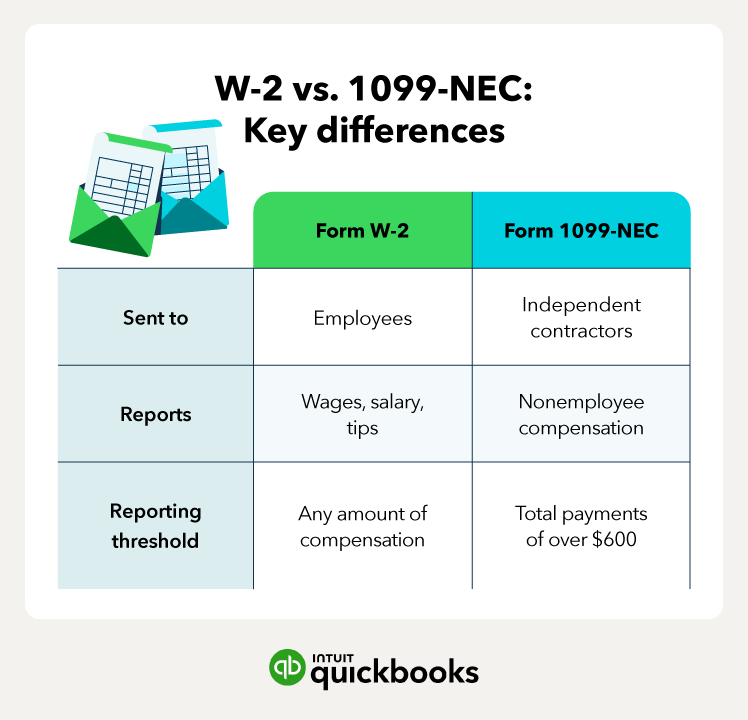

The tax consequences of each form are generally the biggest distinction. For W-2 employees, taxes are automatically withheld from their paychecks throughout the year, reducing the tax liability when it's time to file.

Employers issuing both Forms 1099 and W-2 in the same year

Small businesses often need to issue both Forms 1099 and W-2 in the same year because they hire independent contractors and employees. So, if you pay employees and contractors in the same year, you’ll likely need to issue both.

Most individuals receive a W-2 and 1099 form from different employers. Businesses typically do not issue both a Form 1099 and W-2 to the same person. However, there are a few situations where you might need to issue both forms to the same worker.

Here are some situations when you might need to issue a 1099 and W-2 to the same person:

- Worker becomes an employee (or vice versa): Say you have an independent contractor that you utilize for part of the year but decide to hire them as an employee. If you paid them over $600 for their independent contractor work, you’ll send them a 1099 plus a W-2 for the wages earned as an employee. Or, if a worker transitions from an employee to an independent contractor for your company during the year, you may need to send them both a 1099 and W-2.

- Side projects: You may have a worker who performs both employee and independent contractor duties. For example, you have an employee work on a project unrelated to their regular work. Compensation for that nonemployee work shows up on a 1099.

In both of these scenarios, employers should accurately report both the W-2 income and the 1099 income. This will help avoid any discrepancies or potential audits.

If you find yourself in this situation, a bookkeeping professional may be able to provide guidance on properly reporting both the W-2 and 1099 income.

Employees or contractors receiving a 1099 and W-2 form

On the flip side, some employees or contractors will receive both a Form 1099 and a Form W-2. This happens if you have a job where you are a paid employee but also freelance or do contractor work for another company.

When receiving both a 1099 and a W-2, it's important to consider the different tax implications. For W-2 income, the employer typically withholds taxes. With 1099 income, individuals are responsible for paying their own taxes. There are ways to help make tax time easier if you know you’ll be getting both forms this year:

Using 1099 income to lower your tax bill

Form W-2 for self-employed individuals does offer advantages when it comes to lowering your tax bill. One advantage of being self-employed is having access to additional tax deductions that can help reduce your taxable income.

Self-employed individuals, including those with a W-2 job, can claim tax deductions for 1099 contractors. You can deduct business expenses, such as home office expenses, phone and internet bills, health insurance premiums, business travel, and business meals. These deductions can lower your taxable income and ultimately decrease the amount of taxes you owe.

Using your W-2 job to lower your quarterly taxes

If you have a mix of income sources, including a W-2 job and freelance work, you can use your W-2 job to help lower your quarterly taxes. One way to do this is by increasing your tax withholdings from your W-2 income through a new Form W-4.

By increasing your tax withholdings from your W-2 job, you can have additional tax withheld from your wages, which can help cover the tax liability generated from your freelance income.

However, note that using your W-2 job to lower your quarterly taxes through increased withholdings may be inaccurate. It's possible to over-withhold or under-withhold, leading to potential tax implications. You may want to consult with a tax advisor to ensure you make the best decision for your individual circumstances.