Accounts receivable definition:

Accounts receivable is the money that customers owe a business for goods or services that have been delivered but not yet paid for.

To keep your business running, you need a steady stream of cash coming in. If you invoice your customers, monitoring accounts receivable is a key part of your cash flow management. The faster you can collect customer payments, the sooner you can reinvest in and grow your business. Here’s what accounts receivable is, where it shows up on the balance sheet, and how to manage it:

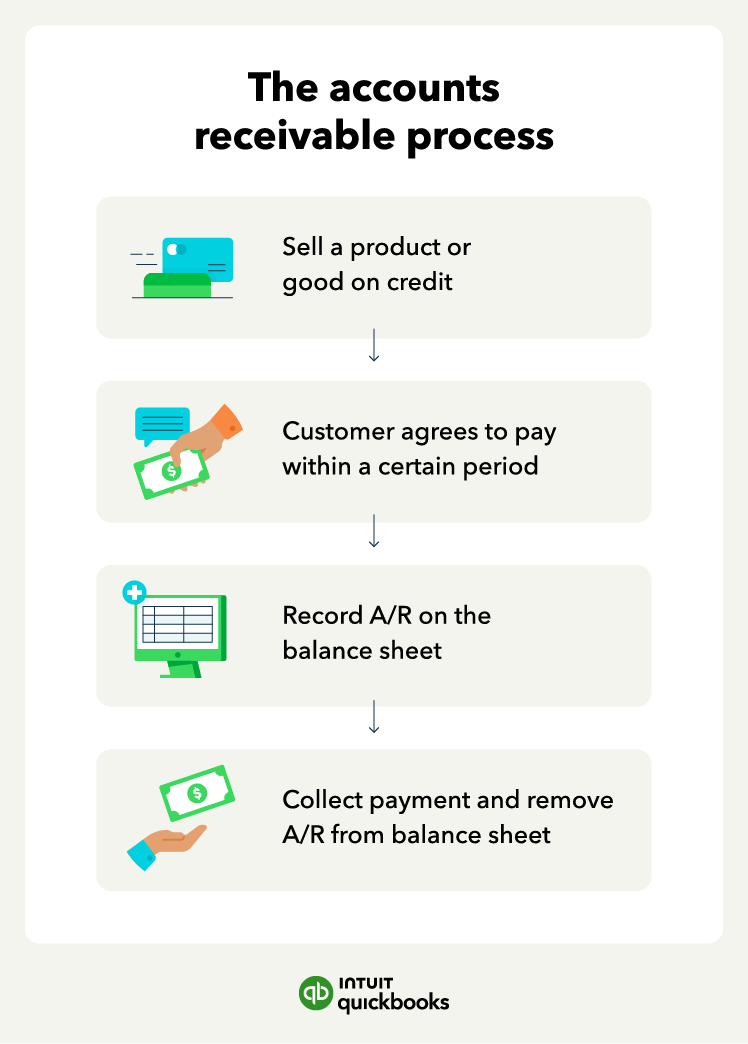

How the accounts receivable (A/R) process works

If you sell a good or product and invoice the customer, you’ll have accounts receivable. Accounts receivable appears as a current asset on the balance sheet. Here are some examples of current assets:

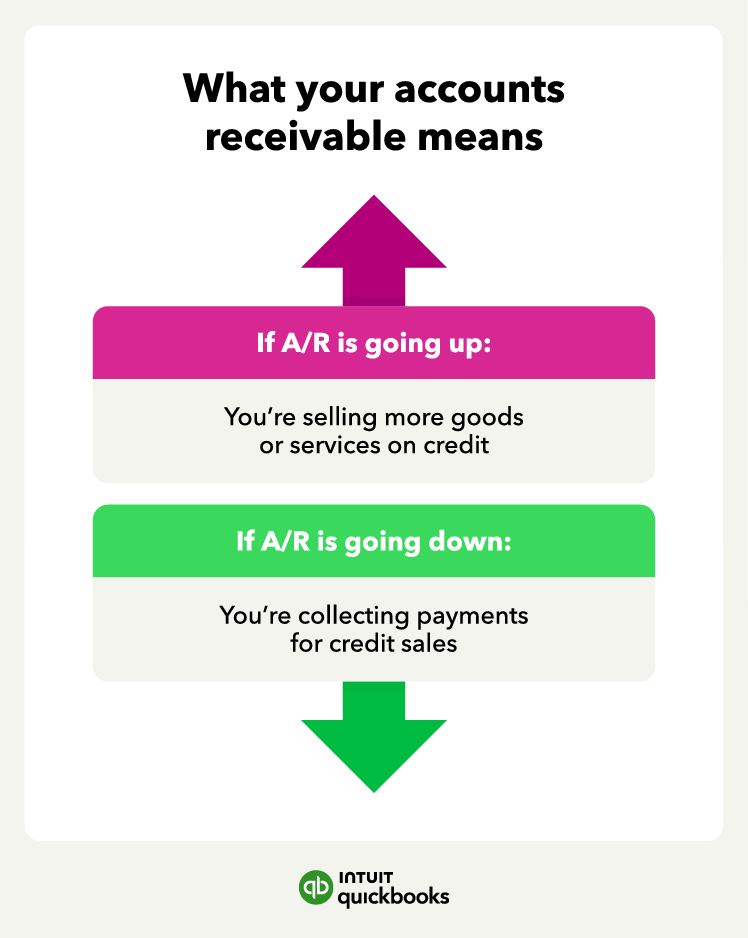

If your accounts receivable balance is going up, that means you're invoicing more. If the balance is going down, that means you're collecting customer payments from previous invoices.

Accounts receivable vs. accounts payable

Accounts payable (A/P) are invoices you owe to other companies. Your accounts payable is accounts receivable for the other company. In many ways, accounts payable is the opposite of accounts receivable. Accounts payable is a current liability on the balance sheet, while accounts receivable is a current asset.

For example, you buy $1,000 in paper from a supplier who sends you an invoice for the goods. You’d have $1,000 in accounts payable on your balance sheet for the invoice. Meanwhile, the supplier would have $1,000 in accounts receivable on their balance sheet.

Accounts receivable formula and ratios

You can measure and track your accounts receivable in several ways, but let’s look at two key ratios:

Accounts receivable turnover ratio

No small business can last long if it can't collect enough cash to operate. The accounts receivable turnover ratio measures how quickly a company collects invoices. The higher the ratio, the better. Here's the formula:

Accounts receivable turnover ratio = Net credit sales / Average accounts receivable

Net credit sales is sales minus returns. Average accounts receivable is the beginning balance + ending balance divided by two.

This ratio tells you how many times you’re collecting your average accounts receivable balance. A higher ratio means that a company is collecting its receivables more quickly, which is a good thing.

A good turnover ratio depends on your industry. Customers at a grocery store or restaurant pay right away with cash or a card. But businesses that sell big-ticket or bulk items might not get paid for months. To see how you're doing, compare your turnover ratio to other businesses in your industry.

A/R aging report

The accounts receivable aging report breaks down your outstanding invoices by how old they are. To create this report, you'll group your accounts receivable balances by the age of each invoice.

A typical aging schedule groups invoices by their number of days outstanding, such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. The goal is to keep receivables from falling too far past due.

The best aging schedule depends on your industry. For example, businesses that collect payments over a period of months may have a larger dollar amount of receivables in the older categories.

With accounting software like QuickBooks, you can access an aging report for accounts receivable in just a few clicks. You’ll want to monitor this report and implement a collections process for emailing and calling clients who fall behind.

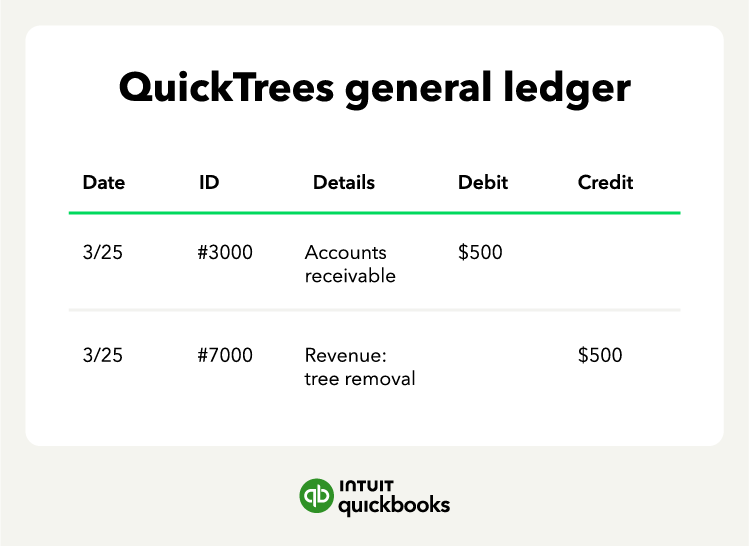

Accounts receivable example and journal entry

Bookkeeping can mean posting dozens of receivable transactions each week. You'll want a solid process in place to make sure you're posting accurate data. Let's say you have a tree service company, and you bill a customer $500 for removing a tree on March 25. Here's the journal entry to record the sale in your general ledger:

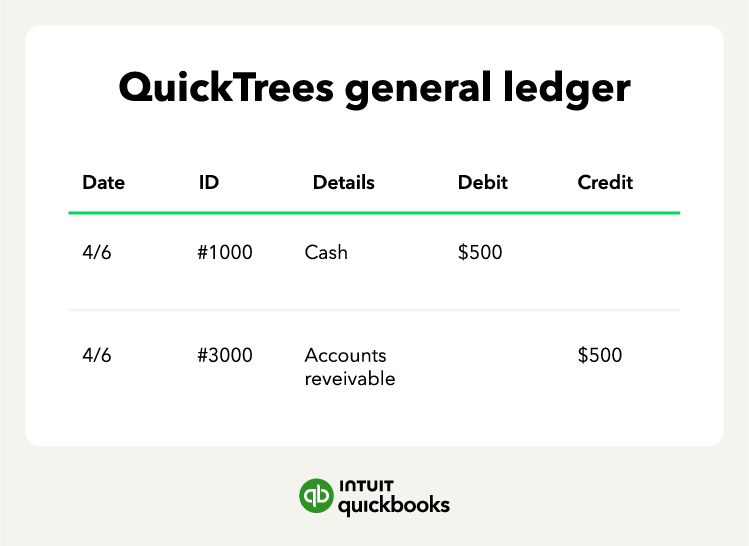

The March 25 transaction records the revenue from the tree removal project and increases the accounts receivable by the amount of the sale. When the customer pays the invoice on April 6, the tree service company posts a journal entry to reflect the transaction as follows:

The April 6 transaction removes the accounts receivable from your balance sheet and records the cash payment. You receive the cash in April but correctly recorded the revenue in March.

When recording accounts receivable, you want to post the revenue in the month you earn it. This will keep your accounting records accurate and consistent with accrual accounting.

Accounting for unpaid accounts receivable

What happens when a customer doesn't pay you? The easiest way to deal with this is to write off the debt as uncollectable. When you know that a customer can't pay their bill, you’ll change the receivable balance to a bad debt expense.

For example, let's say that Jones Manufacturing owes your tree service company $2,000. On April 30, the company declares bankruptcy and won't be able to pay your invoice. You would post this entry on April 30:

- Debit bad debt expense $2,000 (increase)

- Credit accounts receivable $2,000 (increase)

Note that you can also use the allowance for doubtful accounts method, but it’s a bit more complex.

Tips for improving A/R management

If you’re having trouble collecting invoices, here are some strategies to reduce your outstanding invoices:

- Offer a discount: You can offer customers a discount for paying early. For example, you could offer a 2% discount if they pay within 10 days. You might lose a little bit of revenue, but you'll get some cash faster.

- Automate the invoicing process: Using invoicing and accounting automation can help you avoid errors and process invoices more quickly. You can also email invoices and provide an online payment option to encourage customers to pay right away.

- Set a collections policy: It's also important to have a formal, written collections policy. For example, you may consider emailing customers when an invoice is 30 days past due and call them when it's over 60 days late.

Another option for encouraging clients to pay invoices on time is to charge late fees.

Streamline your accounting and save

Every business needs an accounting system to track their money. A good accounting system with tools for managing invoice accounts receivable can help you get paid faster, so you can focus on running your business.

Accounts receivable FAQ

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor's degree in finance from Appalachian State University.