Find more freedom and stability with a family of tools designed for self-employed businesses.

Welcome work-life balance

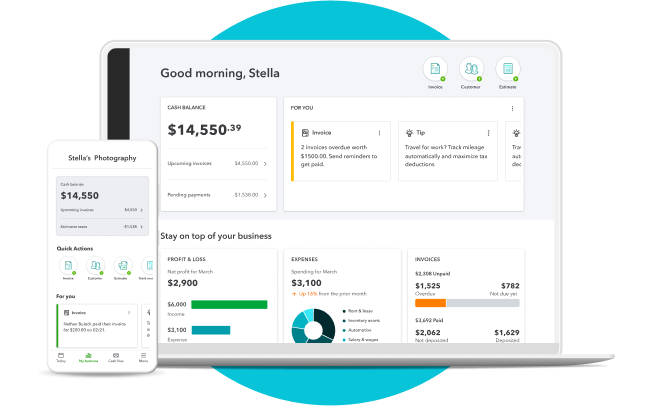

- Connect multiple bank accounts for more seamless money management.

- Get mobile alerts for key events like paid invoices to stay in the know.

- Make quick decisions and find opportunities based on accurate, up-to-date reports.

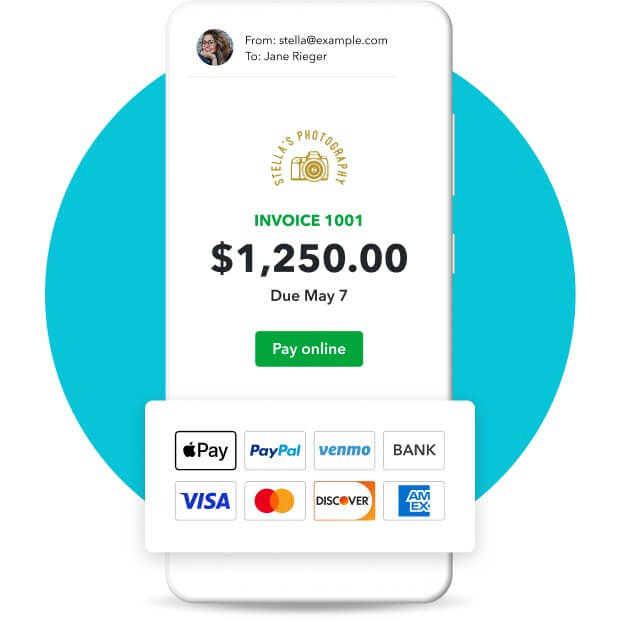

- Send invoices or payment requests. Customers can use card, ACH, Apple Pay®, PayPal, or Venmo.**

- Get same-day deposits on eligible payments at no added cost.**

- Apply for a business bank account with no monthly fees or minimum balance required.**

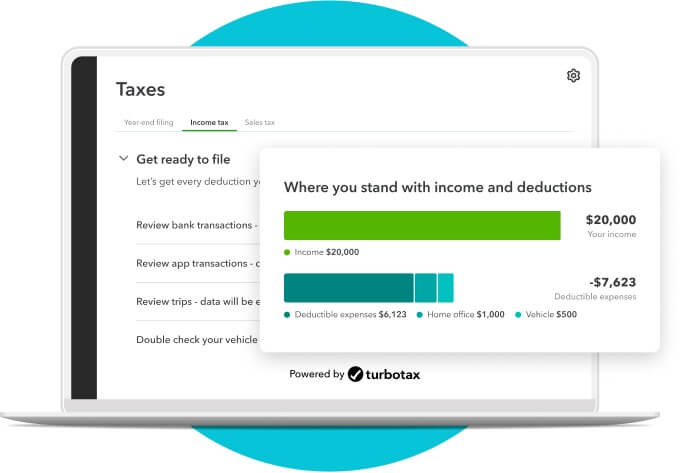

- All your expenses are automatically sorted into tax categories for your review.

- Maximize deductions, stay compliant, and know what to expect when it's time to file your taxes.**

- Prepare your tax year return with access to expert help, powered by TurboTax.**

Find a plan that’s right for you

Whether you’re just starting out or ready to get organized, there’s a plan that’s right for you.

- Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.See more

- Customize and send up to two invoices a month—or unlimited invoices if you qualify for and enable QuickBooks Payments. Accept mobile signatures, see estimate status, and convert into invoices.**

- Customize and send up to two estimates a month. Accept mobile signatures, see estimate status, and convert into invoices.**

- Connect 1 bank account directly to QuickBooks to automatically sync transactions for accurate, real-time data.

- QuickBooks learns how you categorize income and expenses and then automatically matches and records transactions from then on.

- Automatically track miles and categorize up to 5 trips each month.**See more

- Snap photos of 2 receipts each month and categorize them on the go.*See more

- Access the top 3 reports for your business: profit and loss, balance sheet, and account quick report.

- Track income and expenses and run a monthly profit and loss report to get a clear view of your business performance.See more

- Manage 1 contractor: Assign payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

- Collect sales tax by adding the amount to your invoices.

- Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.See more

- Send instantly payable invoices, schedule recurring invoices, track their status, send payment reminders, and match payments to invoices—automatically.See more

- Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**See more

- Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go.See more

- Get instant access to eligible payments no matter what time of day you get paid.**See more

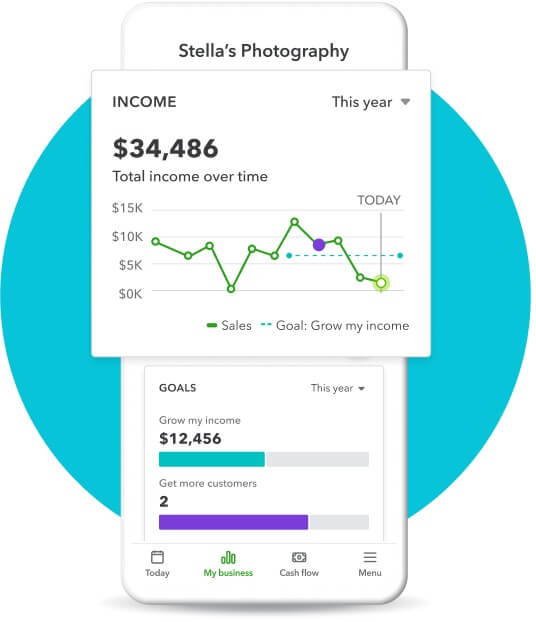

- See your business money come in and out over time, so you can make smart business decisions and pivot as you grow.See more

- QuickBooks learns how you categorize income and expenses and then automatically matches and records transactions from then on.

- Securely import transactions and organize your finances automatically.See more

- Automatically track miles, categorize trips, and get sharable reports.**See more

- Snap photos of your receipts and categorize them on the go.**See more

- Get an overview of your business with profit & loss and sales reports.See more

- Securely import transactions and organize your finances automatically.See more

- Share your books with your accountant or export important documents.**See more

- Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**See more

- with QuickBooks Live TaxSave time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.See more

- Give customers flexible ways to pay—via PayPal,** Venmo, Apple Pay®, credit, debit, or ACH payments.See more

- Send instantly payable invoices, schedule recurring invoices, track their status, send payment reminders, and match payments to invoices—automatically.See more

- Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**See more

- Get competitive payment processing rates with no setup costs or hidden fees—just pay as you go.See more

- Get instant access to eligible payments no matter what time of day you get paid.**See more

- See your business money come in and out over time, so you can make smart business decisions and pivot as you grow.See more

- Let customers insert, tap, or use digital wallets to make in-person payments seamless.**See more

- Sync with customers, see their contact info, send invoices, and accept and track payments with ease.See more

- Automate recurring payments and give your customers the option to set up automatic payments.See more

- Apply for a flexible line of credit to get cash when you need it.See more

- Explore funding options with competitive rates—no hidden fees and no surprises.See more

- Organize and track your business bills online.See more

- Automatically track miles, categorize trips, and get sharable reports.**See more

- Snap photos of your receipts and categorize them on the go.**See more

- Run and export reports including profit & loss, expenses, and balance sheets.*See more

- Securely import transactions and organize your finances automatically.See more

- Share your books with your accountant or export important documents.**See more

- Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**See more

- Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**See more

- with QuickBooks Live TaxSave time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.See more

- Connect 1 online sales channel and automatically sync with QuickBooks.See more

- Try expert help FREE for 30 days**Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days. No auto-renew.See more

Stay steady as you grow

With QuickBooks Online plans, you have access to expert guidance, and can even integrate a Mailchimp account for simplified marketing.

Reach new customers

Mailchimp comes with pre-built templates, so you can look more professional and unlock creative ways to reach potential customers.**

File taxes with expert help

Seamlessly export expenses, then prepare your tax year return with access to expert help, powered by TurboTax. Your maximum deductions, guaranteed.*

QuickBooks Solopreneur

Get special features designed for the self-employed.

- Untangle your finances for a better view of your spending with automatic categorization of business and personal expenses.

- See where your business stands with simple reports and dashboards.

- Set growth goals and get tips for reaching them.

Build your knowledge

Mind the Business podcast series

Get inspired this season as hosts Jannese Torres and Austin Hankwitz connect with solo business owners on the twists and turns of running their own businesses.

Choose the best payment method

The best small business payment method depends on many factors. As you think about the best method, consider the size of your transactions, who’s handling the money, and your accounting system.

Business vs. personal checking

Keeping your personal and business finances separate is a smart idea to maintain accurate records, understand your business’ financial health, and make informed decisions.

Cash flow guide for business owners

As a small business owner, cash flow is king. Dive into how to define cash flow, how to analyze it, and how to read cash flow statements to help you better manage your business cash flow.

Free invoice templates

A well-designed and custom invoice says a lot about your business. No matter your industry, build your brand and get money faster with the help of our free invoice templates.

Free business budget templates

Creating a business budget is an excellent first step for any new business owner. By taking a closer look at your assets, expenses, and financial goals, you can craft a better plan for the future.

Working capital calculator

To run a successful business, you need to manage your cash flow. The key to controlling your stock levels is fine tuning your purchasing volume with the sales trend and forecast data available to you.

LLCs vs. sole proprietorships

If you’re the sole owner of a business, there are two different types of business entities that you’ll choose from: a sole proprietorship and a single-member limited liability company (LLC).

How to file small business taxes

If you’re new to filing taxes, you might feel a little intimidated by the process. This guide answers the most common questions and tips on how to file small business taxes in 2023.

Steps to starting a business

QuickBooks asked 965 seasoned small business owners if they had any advice for people who are about to start their first business. They recommended 3 things you should definitely do before you start.

Frequently asked questions

Upgrades aren’t available to or from QuickBooks Solopreneur just yet, but they will be soon.

QuickBooks Solopreneur is designed for one-person businesses who may use 1099 contractors. It includes easy-to-use organization, tax, and growth-focused tools to help drive financial stability. Managing your finances has never been easier with the new transaction management system that automatically categorizes transactions into predefined categories for review.

The tax filing capabilities available in QuickBooks Solopreneur are designed for ‘Schedule C’ (form 1040) filers, most commonly applicable to sole proprietors or single-member LLCs.

QuickBooks Simple Start is designed for new, single-person registered businesses that want to get insights into their day-to-day business finances and performance. Simple Start accounting helps entrepreneurs set up and maintain their books independently. Comprehensive reporting helps businesses navigate tax filing requirements, while affordable pricing offers great value.

You’ll need to have a QuickBooks Online account and get approved for online payments to use QuickBooks Checking. QuickBooks Checking account opening is subject to identity verification and approval by Green Dot Bank. QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

To open a business checking account with QuickBooks, sign up for QuickBooks Online and apply for payments and banking. You can get approved for a checking account in as little as a few minutes—no employer identification number or credit check required.

For QuickBooks Checking members, 3.00% APY is earned on balances held across all envelopes (a savings tool inside your QuickBooks Checking account). To start earning APY, manually move money from your main account to a new or existing envelope. You will earn 3.00% APY on the average daily available balance distributed across your created envelopes. To spend money from an envelope, transfer money back into your main account and process transactions as normal.

QuickBooks Live Tax helps small businesses that file taxes as S-corp, partnership (GP, LP, LLP), LLC, or sole proprietor to get their taxes done with unlimited expert help and guaranteed accuracy, powered by TurboTax, all without leaving QuickBooks.

Sign in to QuickBooks Online, then go to "Taxes" in the left navigation panel. Select the "Year-end tax filing" tab to get started with QuickBooks Live Tax. You're ready to prepare and file your state or federal tax return with expert guidance, without ever leaving QuickBooks.

Quickbooks-certified bookkeepers are available to give you guidance and answer questions on topics like:

- Categorization

- Automation

- Reconciliation

- Reporting

- Workflow management

You can request a callback anytime when you need a little extra help. Bookkeepers are available Monday – Friday 6 AM – 6 PM PT.

You will need a Mailchimp account to use the integration in QuickBooks. You can connect an existing account or sign up if you don't have one already. Mailchimp has both free and paid options. There’s no Mailchimp integration available with QuickBooks Solopreneur just yet. Explore Mailchimp pricing

When you connect your QuickBooks Online account with Mailchimp, you can sync your marketing and financial data to the Mailchimp audience you choose. Your QuickBooks Online customer information, including email address, name, physical address, purchase history syncs to Mailchimp as contacts in the audience. These new contacts get tagged as imported from QuickBooks Online which makes it easier to identify them for your targeted marketing efforts. Then, you can use everything you know about these contacts to create segments and send targeted, personalized campaigns.

Simple solutions for your business of one

All the right tools to help your solo business succeed moving forward.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank, Member FDIC.

QuickBooks Term Loan (“Term Loan”) is issued by WebBank.

*Offer terms

QuickBooks Live Expert Assisted Free 30-day Trial Offer Terms: Access an expert when you add the thirty (30) day trial of QuickBooks Live Expert Assisted services (“Live Expert Assisted”) to your purchase of QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QBO”) subscription. You must be a new QBO customer to be eligible. To continue using Expert Assisted after your 30-day trial, you’ll be asked to present a valid credit card for authorization, and you’ll be charged on a monthly basis at the then-current fee until you cancel. Sales tax may be applied where applicable. To cancel your Expert Assisted subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period.

Expert Assisted is a monthly subscription service that requires a QBO subscription and provides expert help to answer your questions related to the books that you maintain full ownership and control. An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

Discount offer: Discount applied to the monthly price for QuickBooks Solopreneur is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must sign up for the monthly plan using the "Buy Now" option.

Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can't be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers only. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation policy: There's no contract or commitment. You're free to switch plans or cancel any time.

**Product information

**QuickBooks Free: Free is currently available at no charge and may be offered for a limited time. Features and availability, are subject to change or discontinuation at any time, with or without notice. If the Free plan is discontinued, we will notify you in advance and provide you with comparable options to transition to another QuickBooks plan that meets your business needs. Certain add-on products may be eligible for use with the Free plan. To utilize any add-on products, you must agree to additional terms and conditions, and limitations and fees for and any selected add-ons will apply. Terms, conditions, pricing, special features, service and support options are subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required.

QuickBooks Card Reader: Data access subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance. Product registration and QuickBooks Payments account required. Terms, conditions, and features subject to change.

QuickBooks Checking account: Banking services provided by and QuickBooks Visa® Debit Card are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association.Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank,

Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Account funds are FDIC-insured up to the allowable limits upon verification of Cardholder’s identity. Green Dot is a registered trademark of Green Dot Corporation. ©2023 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, next-day deposit are not provided by Green Dot Bank.

QuickBooks Live Tax, powered by TurboTax, is an integrated service with QuickBooks Online. Additional terms, conditions and limitations apply; fees may apply. Some tax situations may not be supported. For more information about the services provided by QuickBooks Live Tax, refer to the QuickBooks Terms of Service and TurboTax Terms of Service.

QuickBooks Payments and QuickBooks Checking accounts: Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled. QuickBooks Payments’ Merchant Agreement and QuickBooks Checking account’s Deposit Account Agreement apply.

Google Pay: Google Pay is a trademark of Google LLC.

PayPal and Venmo: Not currently available on invoicing through QuickBooks Online Advanced subscription.

Venmo is available only in the US.

QuickBooks Online System Requirements: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). Network fees may apply.

**Features

Annual percentage yield: The annual percentage yield ("APY") is accurate as of December 9, 2024, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

Automatic Matching: QuickBooks Online will only match bank deposits with transactions processed through QuickBooks Payments. Not all transactions are eligible and accuracy of matches is not guaranteed.

Payment links: Payment links require a QuickBooks Online Payments account and are subject to the same pricing terms including card-swiped fees, card-keyed fees, bank transfer/ACH fees and check transactions fees. See Important Info, Pricing, Acceptable Use Policy and Merchant Agreement.

Automatic sales tax: Underlying sales tax rates are estimated based on the location information associated with each individual transaction. Additional factors that may impact sales tax rates include product type, date, and customer type. Customers need to validate tax information prior to filing their tax returns with the IRS.

Instant deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, including delayed eligibility for new users and availability for only some transactions and financial institutions. The service carries a 1.75% fee in addition to standard rates for ACH, swiped, invoiced, and keyed card transactions. This 1.75% fee does not apply to payments deposited into a QuickBooks Checking account. Deposits are sent to the financial institution or debit card that you have selected to receive instant deposits in up to 30 minutes. Transactions between 2:15 PM PT and 3:15 PM PT are excluded and processed the next day. Deposit times may vary due to third party delays.

Same-day deposit: Same Day Deposit allows you to have near-real time deposits sent to you on a predetermined daily schedule (up to 3x a day, Monday through Sunday, including holidays). Same Day Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Transactions between 2:15-3:00 pm PST are excluded and transactions after 9:00 pm PST will be available for deposit the following morning. Deposit times may vary for third party delays.

Fast funding: Loans are typically deposited within 1-2 business days. Actual funding time can vary depending on third party processing time.

Repayment: The advance is interest-free for the first 30 days with no prepayment penalties or fees. If the invoice amount isn’t repaid within 30 days after the funds are disbursed, the outstanding balance begins to accrue interest on day 31. The total invoice amount can be repaid in 12 monthly installments at a fixed interest rate. The first monthly installment will be due 60 days after the advance is disbursed. The amount may be paid in full (including any fees) within the first 30 days to avoid additional interest.

No additional processing fees when clients pay invoices through QuickBooks Payments within the first 30 days: This feature isn’t available for customer invoice payments made through GoPayment, Pay links, or QuickBooks Online Receive Payment experience.

No minimum balances or monthly fees: There are no minimum balance requirements to open or maintain this account or obtain the listed APY. Other fees and limits apply. See Deposit Account Agreement for details.

No monthly fees: Other fees and limits apply to the business bank account. See QuickBooks Money Deposit Account Agreement for details.

Fee-free ATM withdrawals: Fee-free ATM access applies to in-network AllPoint ATMs only (up to 4 withdrawals per statement cycle). For out-of-network ATMs and bank tellers, a $3 fee will apply, plus any additional fees charged by the ATM owner or bank. See app for fee-free ATM locations.

Cash flow planner: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary.

Bill Pay: QuickBooks Bill Pay is an additional product capability to QuickBooks Payments that may require a separate subscription.

#Claims

1. Over 40x U.S. average APY: Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-800-285-4854

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For details about our money transmission licenses, or for Texas customers with complaints about our service, please click here.

By accessing and using this page you agree to the Website Terms of Service.