Explore the features

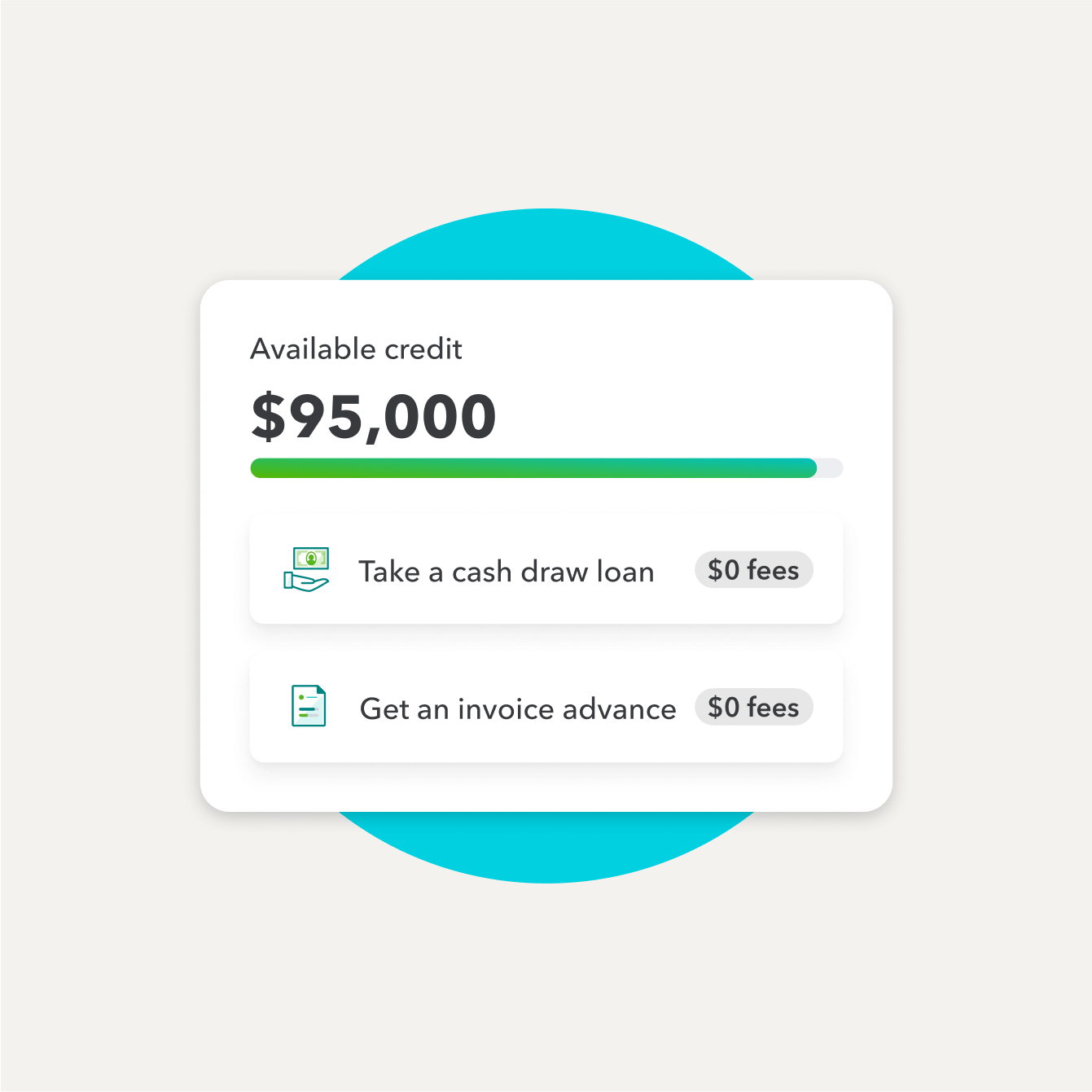

No fees, no hassle

You won’t pay origination fees, late fees, or prepayment penalties.²

Get started in minutes

Apply right in QuickBooks, have a decision in a few short minutes, and see your cash fast.³

Borrow up to $100,000

Get a credit limit from $1,000–$100,000, and only pay interest on the amount you use.

Money on hand when you need it

A QuickBooks Line of Credit can help you cover unexpected expenses or keep your business moving while you wait for a customer payment.

Time is on your side

Apply right in QuickBooks and get a decision in minutes. If approved, funds are typically deposited in just 1-2 business days.³ Set up autopay to make repayment a breeze.