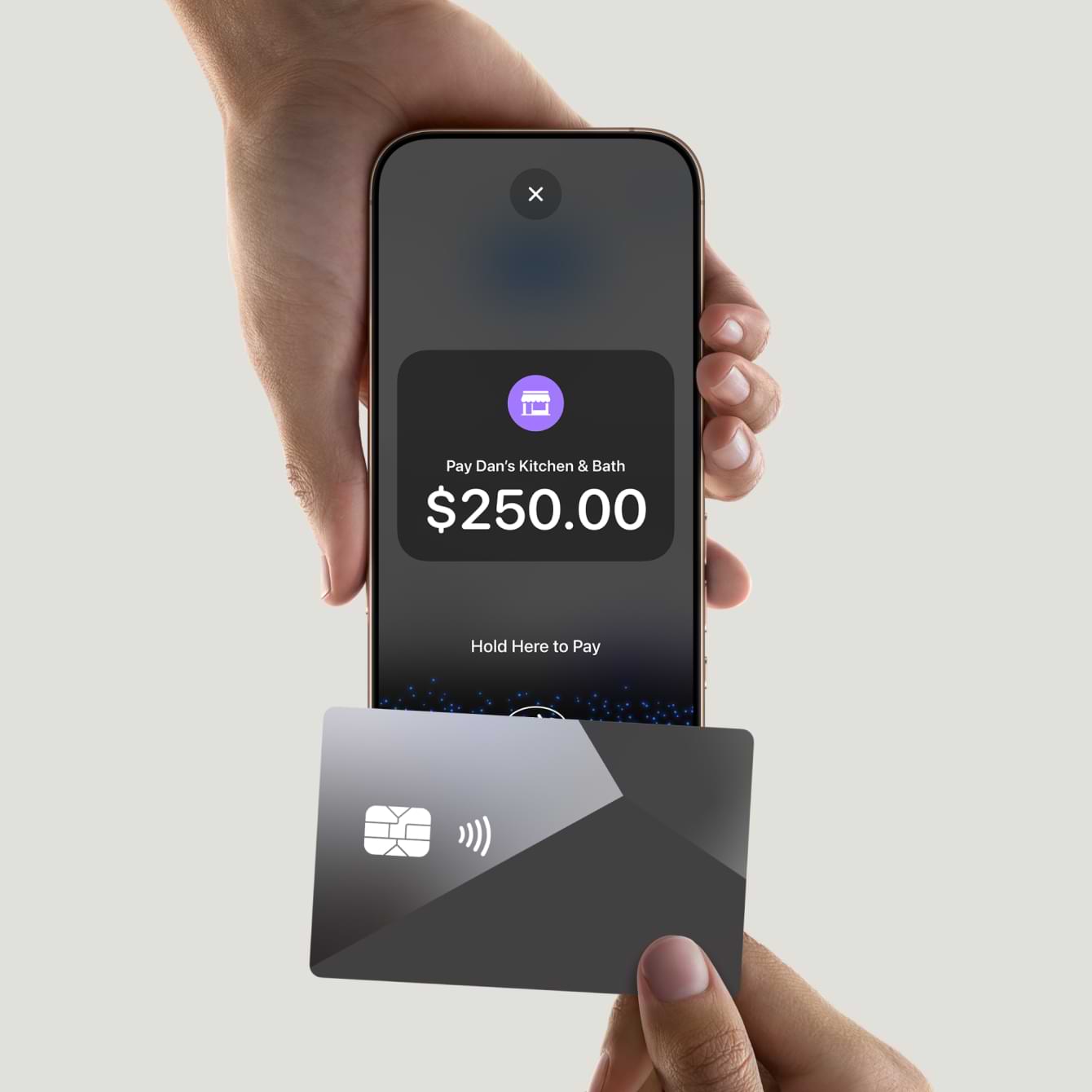

Tap to Pay on iPhone

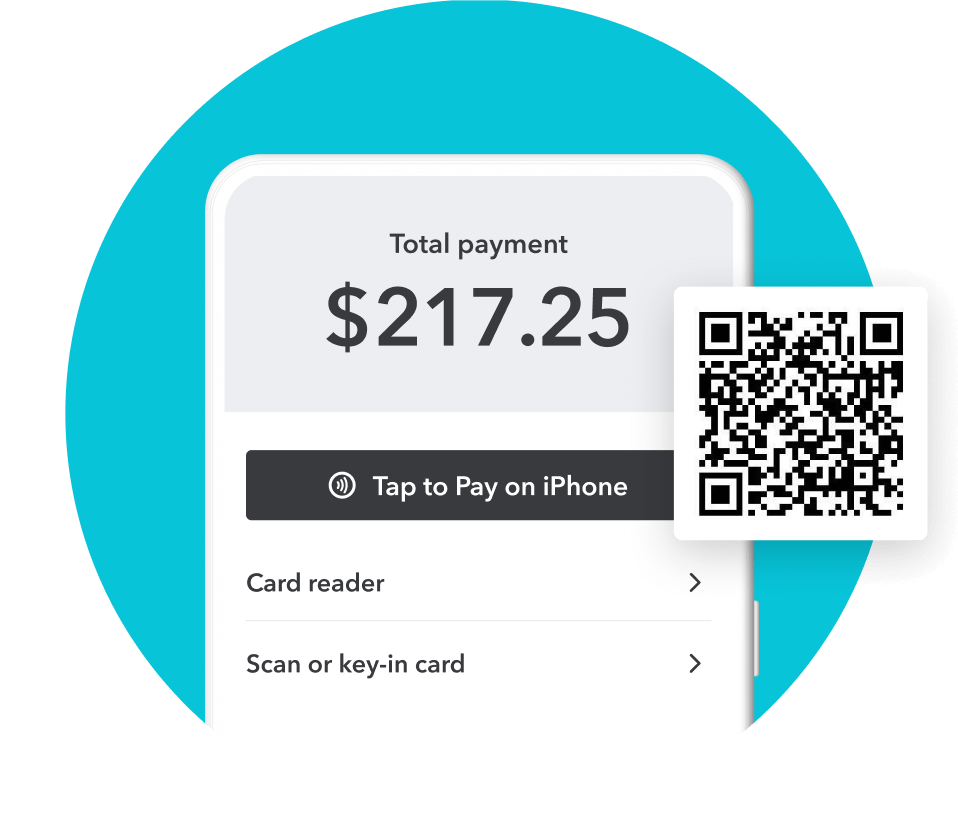

With Tap to Pay on iPhone and the QuickBooks mobile or GoPayment apps, you can accept all types of in-person, contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets—no card reader needed. It’s easy, secure, and private.

Available with iPhone XS to later, using the latest version of iOS.

Getting started is easy

To use Tap to Pay on iPhone, simply download the QuickBooks mobile app, sign up, and start accepting in-person, contactless payments anytime, anywhere—right on your iPhone.

Designed to be secure

Apple doesn’t store card numbers on your iPhone or on Apple servers, helping to protect your business and customer data.

No recording

Tap to Pay on iPhone is designed to prevent all photo, video, screenshot, and screen-recording features from capturing a customer’s card number.

Stop chasing payments

Get paid instantly on outstanding invoices, or create new ones on the fly to accept in-person payments right then and there.

QuickBooks

Square

Stripe

In-person payments

2.5%

2.6% + 15¢

2.7% + 5¢*

Keyed-in cards

3.5%

3.5% + 15¢

3.4% + 30¢*

Rates are accurate as of 07/31/2025. All listed rates are per transaction. Not all payment plans shown; only most comparable plan by feature are highlighted. An additional 1% fee is charged on transactions made using an internationally issued card (non-U.S.) or an international PayPal account.

*Stripe charges an additional 1.5% for international cards and additional 1% if currency conversion required.

Easy for customers, powerful for business

Up-to-date books

Every sale made with the app or card reader is automatically synced with QuickBooks so your books are up-to-date with your latest sales.

Empower your team

With the GoPayment app, your employees can take payments without accessing your sensitive business data.

View sales by employee

Use the QuickBooks mobile app, included with your subscription, to view team member sales all in one place.

Instant eligible deposits

For a 1.75% fee, get eligible payments deposited instantly so you can quickly access the money your business needs.**

Start accepting payments,

wherever there’s business

Download the QuickBooks Mobile app today. Must sign up for QuickBooks Online and Payments in order to use the in-person payments features.

Frequently asked questions

Build your knowledge

Harness powerful tools to find real solutions.

Start accepting in-person payments

Download the QuickBooks mobile app to start taking payments from anywhere.