Powerful payroll features

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Direct deposit

Keep cash in your account longer and pay your team fast with direct deposit, atno additional cost.**

Pay contractors

QuickBooks keeps contractor W-9 and 1099 forms organized, so you’re ready to go at tax time. Easily track payments and issue paychecks in one place.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

Payroll reports

Create detailed reports to see where your money’s going. Get actionable insights about your franchise to make smarter decisions for your business’s future.

HR services

With HR support from Mineral, Inc., you can access resources or talk with a personal HR advisor about compliance, hiring, onboarding, and more.**

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Direct deposit

Keep cash in your account longer and pay your team fast with direct deposit, atno additional cost.**

Pay contractors

QuickBooks keeps contractor W-9 and 1099 forms organized, so you’re ready to go at tax time. Easily track payments and issue paychecks in one place.

Auto Payroll

Set payroll to run automatically and get notifications so you're always in control.**

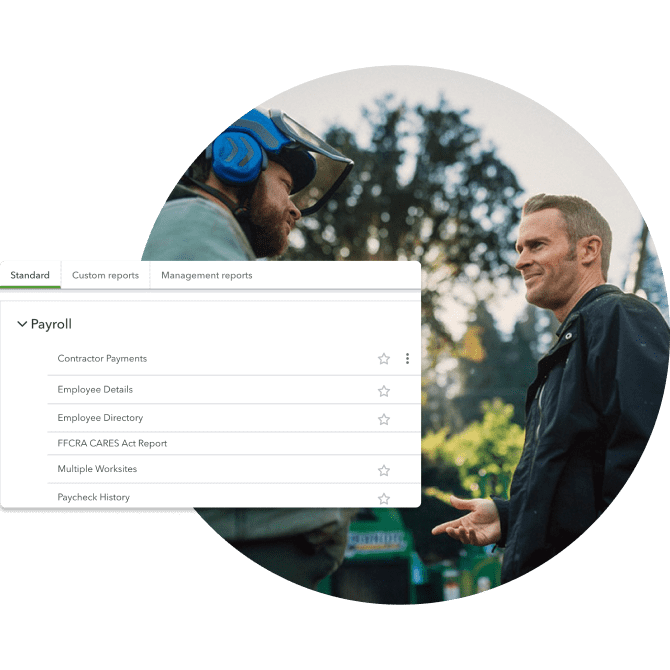

Payroll reports

Create detailed reports to see where your money’s going. Get actionable insights about your franchise to make smarter decisions for your business’s future.

HR services

With HR support from Mineral, Inc., you can access resources or talk with a personal HR advisor about compliance, hiring, onboarding, and more.**

Manage HR and payroll in one place

Pay your team and access helpful resources or talk to an HR advisor. Stay compliant with help from Mineral, Inc.**

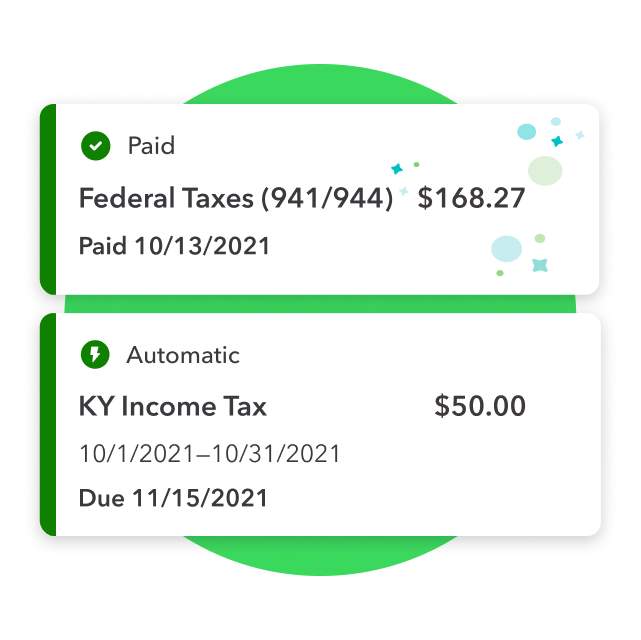

Automated taxes and forms

QuickBooks generates automatic payroll tax calculations on every paycheck and monitors and updates federal and state taxes for you. File payroll taxes yourself, or we’ll file them for you at no extra cost. .

Why use QuickBooks Payroll for franchises?

Whether you’re running one franchise or many, it’s crucial to stay on top of your business financials. Get 15 customizable reports that show real-time data about payroll taxes and contributions, employee work hours, workers’ comp payments, and more.