Our payroll software goes beyond paychecks. We back your hospitality business with personalized HR support and guidance from Mineral, Inc.****

Benefits of payroll

Hospitality management is a people-facing industry, so it’s important to save time where you can and get back to your guests. QuickBooks helps you run payroll in less than 5 minutes.1

Save time

With built-in time tracking, you can oversee employee work hours from your mobile phone and save 3 hours each payroll run.2

Stay compliant

Help protect your hotel employees with workers’ comp from Next. Find the best coverage for your team and pay as you go to free up your cash flow.**

Happy employees

Offer employees affordable health and wellness benefits through our partner, Allstate Health Solutions. With automatic calculations and deductions, you can be confident everyone’s covered.**

All the features you need to manage payroll

Tax penalty protection

Our Tax Resolution team has your back. We’ll resolve any payroll tax or filing errors with the IRS and pay penalties up to $25,000.

Auto Payroll

Put Auto Payroll to work. Set up your payroll to run automatically, and turn on notifications, so you’re always in the loop.**

Same-day direct deposit

Keep money in your bank account longer with same-day direct deposit. Submit payroll up to 7 AM PT payday morning to have funds withdrawn the same day.**

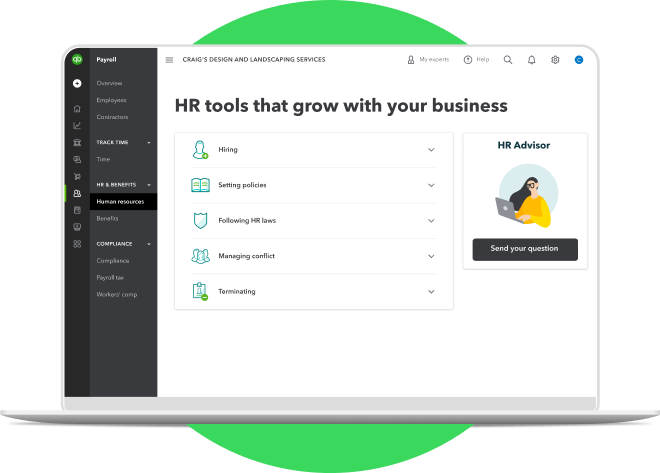

HR services

With HR support from Mineral, Inc., you can stay on top of state and federal wage and overtime laws, hiring, and more. Access HR services right from your Payroll account.

Expert setup and review

You don’t have to go it alone. Let our Payroll experts review your hospitality payroll setup or take care of setting it up for you.**

Customer support

Get answers to your payroll questions with 24/7 online chat. Prefer to talk? Give us a call, and we’ll help you get payday-ready.**

Tax penalty protection

Our Tax Resolution team has your back. We’ll resolve any payroll tax or filing errors with the IRS and pay penalties up to $25,000.

Auto Payroll

Put Auto Payroll to work. Set up your payroll to run automatically, and turn on notifications, so you’re always in the loop.**

Same-day direct deposit

Keep money in your bank account longer with same-day direct deposit. Submit payroll up to 7 AM PT payday morning to have funds withdrawn the same day.**

HR services

With HR support from Mineral, Inc., you can stay on top of state and federal wage and overtime laws, hiring, and more. Access HR services right from your Payroll account.

Expert setup and review

You don’t have to go it alone. Let our Payroll experts review your hospitality payroll setup or take care of setting it up for you.**

Customer support

Get answers to your payroll questions with 24/7 online chat. Prefer to talk? Give us a call, and we’ll help you get payday-ready.**

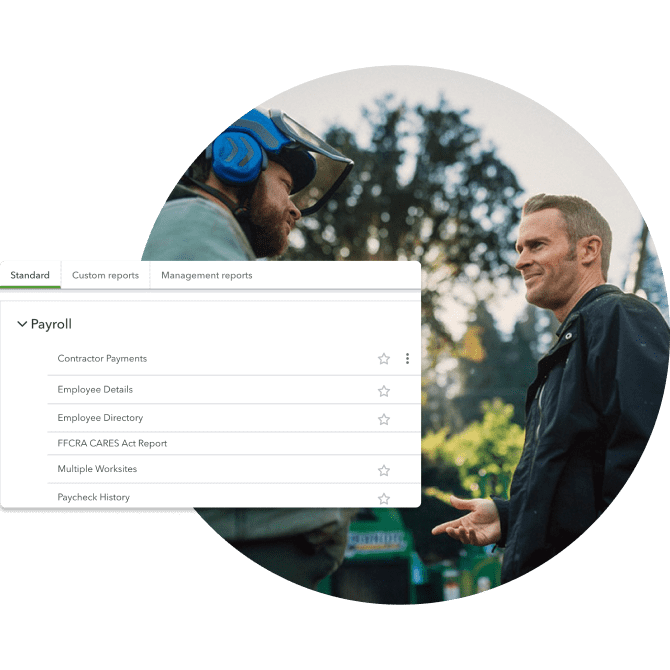

Dive into your data with payroll reports

Generate and download payroll reports to get the information you need to make smarter business decisions.

- Track your finances and see where your money’s going with more than 15 customizable payroll reports.

- View your total payroll costs, tax liabilities, bank transactions, and more.

- Tailor reports to meet your needs, and add repeat reports to your favorites to see on your dashboard.

Payroll services for the hospitality industry

Hospitality businesses vary. So do our online payroll solutions.

Payroll Core gives you the tools you need to pay your team, access employee benefits, and get expert product support.*

Payroll Premium offers powerful tools, including same-day direct deposit, employee time tracking, and help with HR compliance.**

Payroll Elite comes with customized setup, a personal HR advisor, tax penalty protection, and 24/7 support.**

All plans come with full-service payroll and automated taxes and forms.**