Get access to powerful tools and employee benefits with the #1 payroll provider.1

Payroll that pays off:

Easily manage payroll and timesheets for your team with QuickBooks-on-site or on the go**.

More time in your day: Auto Payroll, mobile time tracking, and automated tax payments and filing make it easier to save time and stay organized**.

Stay compliant: Help protect your company and your team with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

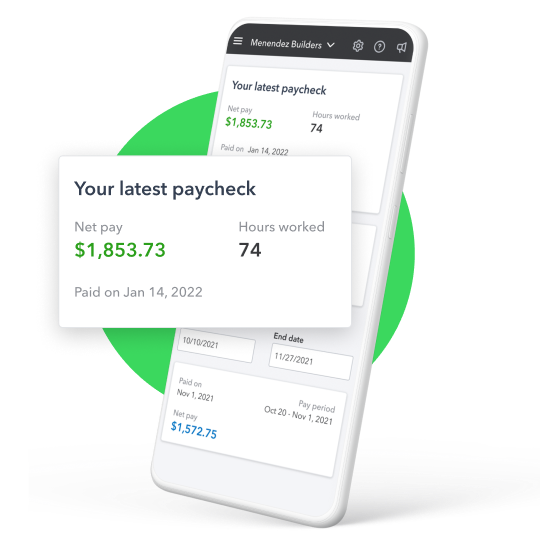

Happy employees: Give your team access to pay stubs, W-2s, PTO balances, and withholding through an online employee portal.**

Powerful payroll features

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty. It doesn’t matter who made the error—we’ll make it right. It’s coverage that you can’t find anywhere else.

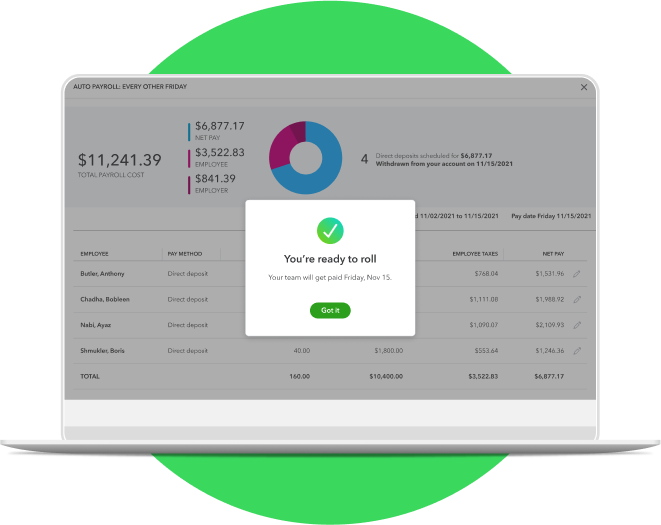

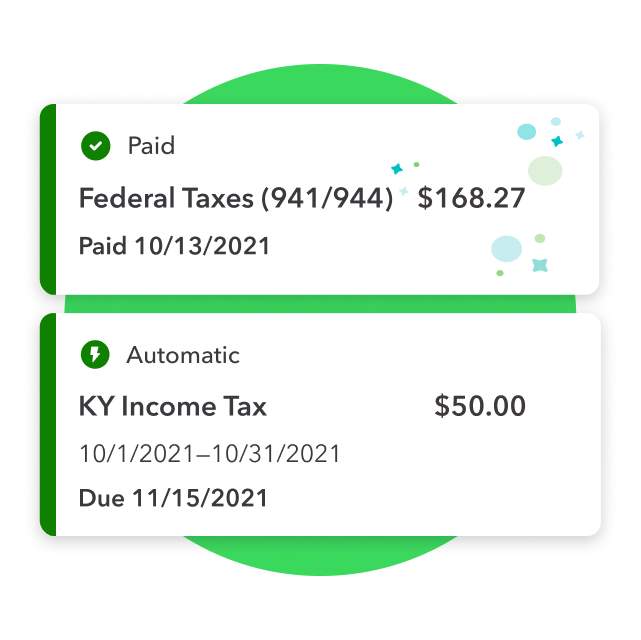

Auto Payroll

There’s more time on your side when you use Auto Payroll. Even better, your federal, state, and local payroll taxes are all calculated, filed, and paid automatically.**

Time tracking

Create schedules by shift or job and avoid surprises with real-time employee email alerts for schedule changes. Approve and run payroll right from your mobile phone.**

Learn more about time tracking

Workers’ comp

Help protect your manufacturing business and employees with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Same-day direct deposit

Run payroll and use same-day direct deposit as many times as you need each month at no extra cost. Just submit payroll by 7 AM PT on payday.**

Expert review and setup

Get payroll setup done for you by an experienced payroll professional. We’re here to help via phone or online chat so that you can get up and running fast.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty. It doesn’t matter who made the error—we’ll make it right. It’s coverage that you can’t find anywhere else.

Auto Payroll

There’s more time on your side when you use Auto Payroll. Even better, your federal, state, and local payroll taxes are all calculated, filed, and paid automatically.**

Time tracking

Create schedules by shift or job and avoid surprises with real-time employee email alerts for schedule changes. Approve and run payroll right from your mobile phone.**

Learn more about time tracking

Workers’ comp

Help protect your manufacturing business and employees with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Same-day direct deposit

Run payroll and use same-day direct deposit as many times as you need each month at no extra cost. Just submit payroll by 7 AM PT on payday.**

Expert review and setup

Get payroll setup done for you by an experienced payroll professional. We’re here to help via phone or online chat so that you can get up and running fast.**

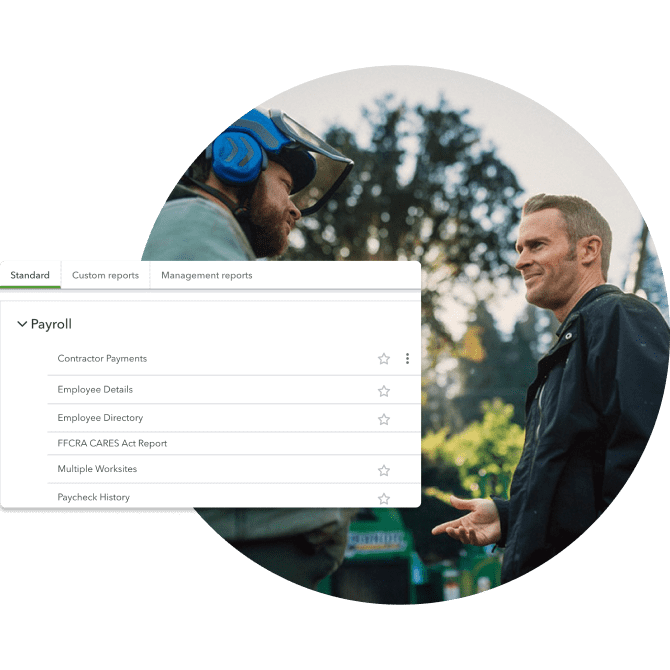

Work smarter with payroll reports:

Straightforward reporting features allow you to easily track your finances and make informed decisions for your manufacturing business.

View your total payroll cost, tax liabilities, bank transactions, and more from your dashboard.

Choose from more than 15 customizable payroll reports to analyze what you’ve paid and where your money’s going.

Add repeat reports to your favorites to get detailed data at your fingertips.

Payroll services for manufacturing:

Find the online payroll system that works best for your manufacturing company. All plans come with full-service payroll, including automated taxes and forms.**

Payroll Core adds powerful tools, including same-day direct deposit, mobile time tracking, and help with HR compliance.**

Payroll Premium offers powerful tools including same-day direct deposit, employee time tracking, and help with HR compliance, powered by Mineral, Inc.**

Payroll Elite is there every step of the way with customized setup, a personal HR advisor, tax penalty protection, and expert product support.**

Get help with HR compliance:

Access online resources or talk directly with a personal HR advisor powered by Mineral, Inc. Stay compliant with hiring and terminations. Get help in creating job descriptions, onboarding documents, employee handbooks, and more.**