for 3 months*

Trust your school payroll to QuickBooks—the No. 1 payroll provider for small businesses.¹

Benefits of payroll

Between overseeing student and teacher needs and day-to-day administration, running a public or private school can be challenging. Make payday the easy part. With Auto Payroll, you set up payroll once, and we do the rest for you.**

Save time

Run payroll in less than 5 minutes, and get more time back for the work that matters most.2

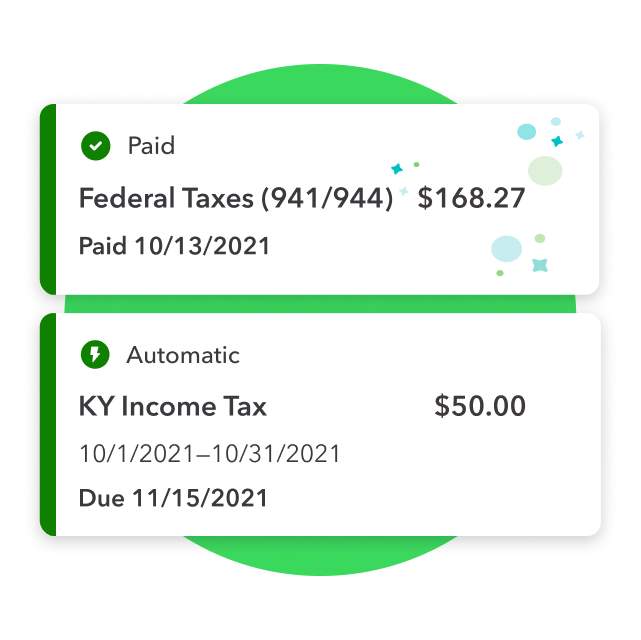

Stay compliant

Have confidence you’re compliant. Your federal, state, and local payroll taxes are calculated, filed, and paid, automatically.**

Support teachers

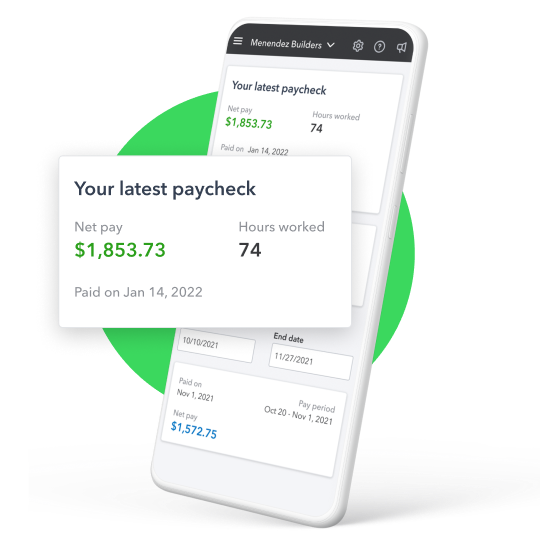

Give teachers access to view pay stubs, W-2s, PTO balances, and withholdings online.**

Powerful payroll features

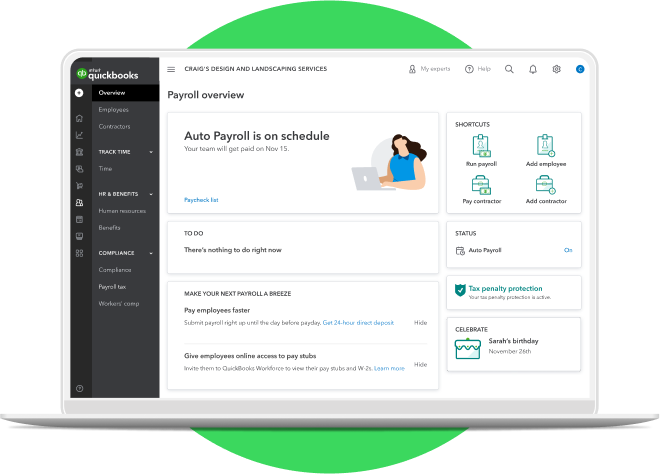

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay fees and penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Auto Payroll

Let Auto Payroll do the work. Set up payroll, then turn on notifications to stay in the loop. Spend less time crunching numbers and more time on the work that matters most.**

Direct deposit

Pay employees faster with same-day or next-day direct deposit. Run payroll and direct deposit as many times as you need each month at no extra cost.**

Customer support

Get step-by-step help, troubleshooting assistance, and tips from our payroll support team via phone or online chat.**

Expert setup and review

We make the setup process easy. Payroll experts can review your setup or set up your account for you. Stay a step ahead and avoid common payroll pitfalls that can lead to tax or compliance errors.**

Trusted time tracking

Track projects, approve teachers’ hours, and view everything in QuickBooks. Run payroll from your mobile phone.**

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay fees and penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Auto Payroll

Let Auto Payroll do the work. Set up payroll, then turn on notifications to stay in the loop. Spend less time crunching numbers and more time on the work that matters most.**

Direct deposit

Pay employees faster with same-day or next-day direct deposit. Run payroll and direct deposit as many times as you need each month at no extra cost.**

Customer support

Get step-by-step help, troubleshooting assistance, and tips from our payroll support team via phone or online chat.**

Expert setup and review

We make the setup process easy. Payroll experts can review your setup or set up your account for you. Stay a step ahead and avoid common payroll pitfalls that can lead to tax or compliance errors.**

Trusted time tracking

Track projects, approve teachers’ hours, and view everything in QuickBooks. Run payroll from your mobile phone.**

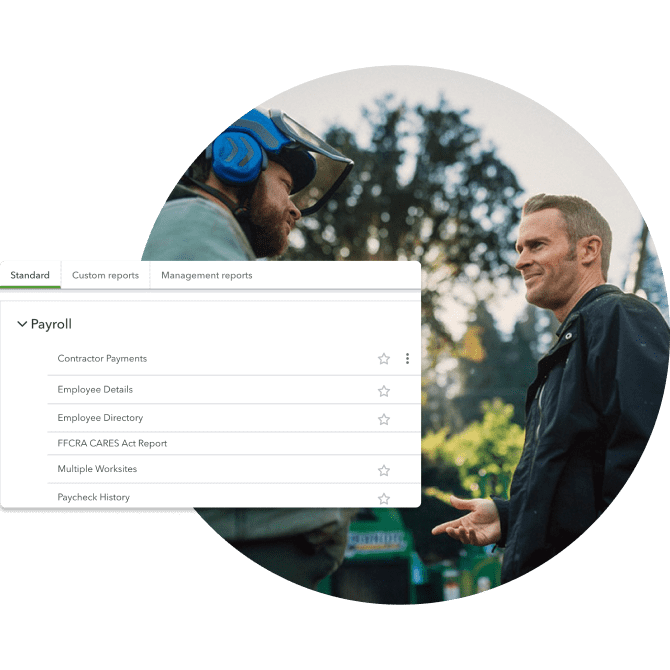

Payroll reports at your fingertips

Get a closer look at your college or school’s finances with over 15 customizable payroll reports. View payroll tax and wage summaries, vacation and sick leave, total payroll costs, and more. Customize reports to meet your needs, and add repeat reports to your favorites to quickly access updated data.

Payroll services for schools

Find the online payroll system that works best for your private or public school. All plans come with full-service payroll and include automated taxes and forms.**

Payroll Core gives you the tools you need to pay teachers, access employee benefits from Allstate Health Solutions, and get expert product support.**

Payroll Premium offers powerful tools, including same-day direct deposit, employee time tracking, and help with HR compliance from Mineral, Inc.**

Payroll Elite comes with customized setup, a personal HR advisor, tax penalty protection, and expert product support.**

Payroll compliance you can count on

QuickBooks generates automatic payroll tax calculations on every paycheck and monitors and updates federal and state taxes so that you don’t have to. File payroll taxes yourself, or we’ll file them for you. It’s payroll that’s committed to compliance.