What is a chart of accounts and how to set one up [examples included]

By Marshall Hargrave

June 20, 2024

What is a chart of accounts?

The chart of accounts, or COA, is an organized list of the financial account numbers and names in your company’s general ledger. Typically, a chart of accounts will have four categories: assets, liabilities, income, and expenses.

Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances.

However, your accounting requires that you record your transactions in the correct accounts. A chart of accounts helps you do just that. Let’s look at how to create and utilize the chart to keep better track of your business’s accounts:

Chart of accounts structure

To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information.

Within each chart of accounts category, line items distinguish the specific accounts. Each line item represents an account within each category. The main account types for a chart of accounts include asset, liability, income, and expense accounts. Let’s look at the key accounts for a chart of accounts:

Asset accounts

The chart of accounts streamlines various asset accounts by organizing them into line items so that you can track multiple components easily.

Your asset accounts typically include:

- Buildings and land

- Equipment and vehicles

- Inventory

- Bank accounts

- Accounts receivables

Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation.

Liability accounts

Liabilities are things you owe. Major liability accounts include things like:

- Accounts payables

- Payroll taxes

- Bank loans

- Credit card balances

- Deferred tax liabilities

Current liabilities are any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report.

Income accounts

Income is often the category that business owners underutilize the most. Some of the most common types of revenue or income accounts include sales, rental, and dividend income.

Consider creating separate line items in your chart of accounts for different types of income. Instead of lumping all your income into one account, assess your various profitable activities and sort them by income type.

For example, imagine you have a store that sells an array of items, such as food and books. You would create a chart of accounts as follows:

- On your chart of accounts, you create line items for “income from food sold” and “income from books sold.”

- Then, compare the profit levels and cost of goods sold from each category (which allows you to better determine your financial health).

- When compiling data in your income accounts category, consider anything that brings money into the company, including things like interest income.

Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging.

Expense accounts

Expense accounts represent any money you spend. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.

Here are more examples of expense accounts your business may use:

- Advertising expense

- Interest expense

- Depreciation expense

- Salaries or wages

It’s also a good idea to break up expenses into separate accounts. For instance, if you ship a lot of products, you may want to track your costs from different shipping carriers separately. Within each line account, you can create sub-categories for the various expenses associated with each carrier.

How to set up the chart of accounts

Setting up your chart of accounts is relatively simple. First, create your blank chart and assign the columns. The chart of accounts typically breaks down into three columns:

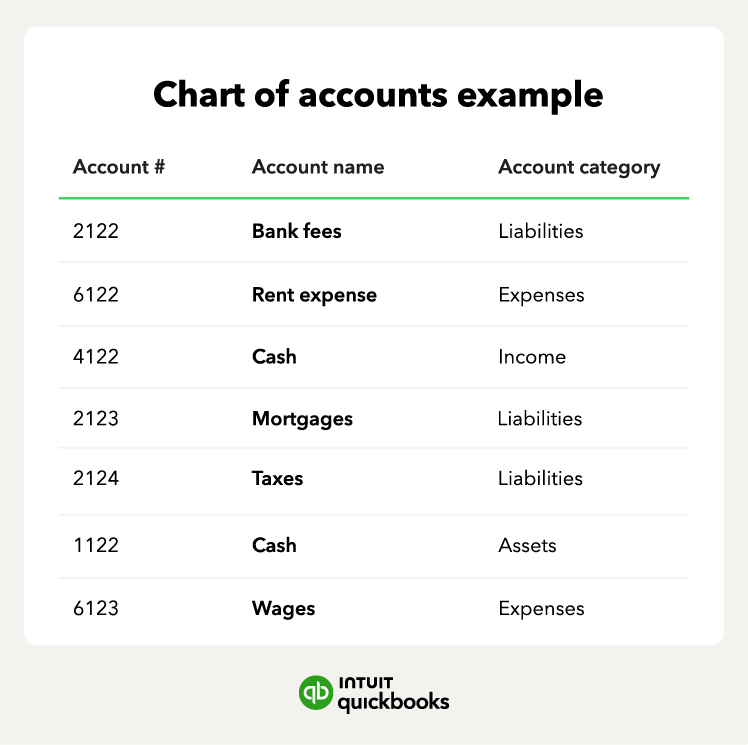

1. Create business account names

The account names are the titles of the business accounts you use. For example, bank fees and rent expenses might be account names you use.

2. Assign account numbers to business accounts

Account numbers are the numbers you assign to each account name. These numbers are typically four digits, and each account has a unique number.

The most common number sequences for each account are:

- Assets: 1,000 to 1,999

- Liabilities: 2,000 to 2,999

- Income: 4,000 to 4,999

- Expenses: 6,000 to 7.999

Note that you can create sub-accounts to streamline your account numbering. For example, imagine you need to create a new account for “PayPal fees.” Instead of creating a new line on your chart of accounts, you can create a sub-account under “bank fees.”

3. Organize account names into one of the four account category types

For optimal organization, each of your account names should have an account type. Choose the main account types like assets vs. liabilities or income vs. expenses. Below is an example of what your chart will look like once you’ve added all of the necessary components:

Once you’ve set up your chart, you can then begin adding specific account names and the account category they’re associated with.

Tips for organizing your chart of accounts

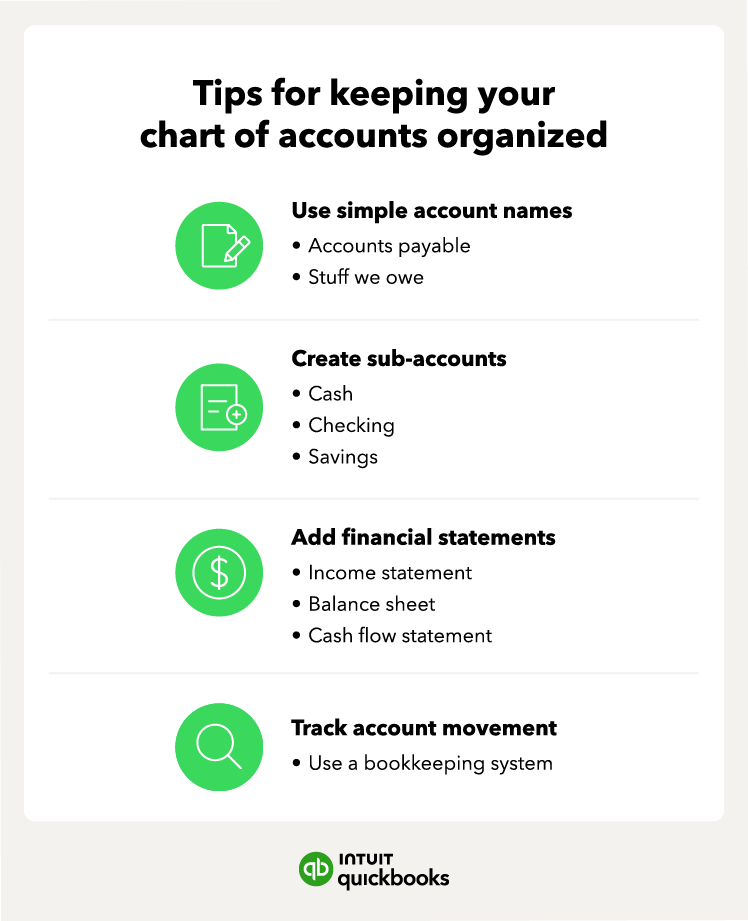

Once you set up your COA, keeping it organized as you continue to add or adjust accounts is important. The following tips will help you set your chart of accounts up for success:

- Use simple account names: When setting up your line items for the first time, keep it simple. Provide titles for your line items that make sense to you and your accountant.

- Create sub-accounts: As time goes by, you may want to create a new line item for each transaction. However, doing so could litter your company’s chart and make it confusing to navigate. Instead, take advantage of your accounting software’s sub-accounts.

- Add financial statements: You can add an account statement column to your COA to record which statement you’ll be using for each account—cash flow, balance sheet, or income statement. For example, balance sheets are typically for asset and liability accounts, while income statements are for expense accounts.

- Track account movement: Your chart of accounts is a living document for your business and because of that, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in but wait until the end of the year or quarter to remove any old ones.

Streamline your accounting and save time

As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future. A chart of accounts should keep your business accounting error-free and straightforward. This will allow you to quickly determine your financial health so that you can make intelligent decisions moving forward.

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done.

Chart of accounts FAQ

Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association. Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor's degree in finance from Appalachian State University.