Michael S. Kun

Epstein Becker & Green

If they’re not unfailingly accurate and consistently kept, the answer is probably no.

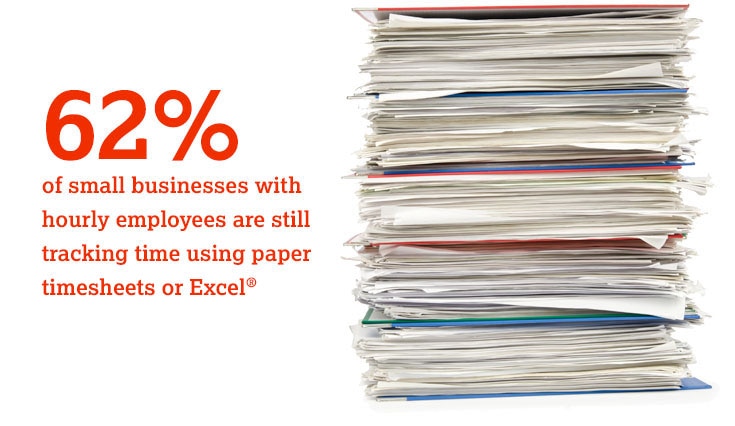

And if you’re keeping track of employee hours worked by asking your team to track their time on a paper time card, then manually entering that time into your payroll system – you’re guilty of committing our fifth deadly sin: Keeping Sloppy or Inaccurate Records.

When it comes to FLSA lawsuits, being able to prove exactly when your employees worked, and how much they were paid, can be a critical defense. Paper time cards are not only inaccurate and prone to human error, but they can be lost, they can illegible, or they can be padded. And because there’s no definitive way to prove that those time cards are correct (or not), they simply won’t hold up in court.

On top of that, by manually entering that time card data into your accounting or payroll system, you run the risk of accidentally hitting the wrong number, reading the time card incorrectly, misinterpreting the total hours worked.

Long story short, manual or handwritten records, no matter how neat and organized, simply aren’t a good defense – and they won’t do a thing to save you from an FLSA lawsuit. If you want to protect yourself, your company, and your employees, you’ve got to add “accurate record keeping” to the top of your list – and start immediately.

How? We reached out to the nation’s top wage and hour experts to get the answers to your most pressing record keeping questions.

“Maintaining accurate records, and taking the required steps to ensure that those records are accurate, may be the most important thing that employers can do to avoid FLSA lawsuits – or, at least, put themselves in the best possible position to defend against them. Aside from misclassification claims, most FLSA claims revolve, in some way, around allegations that employees were not paid for all time worked or were not paid at the right rate for all time worked. To resolve those claims, the courts will need to see an employer’s time and payroll records, among other things.”

“It is critical for an employer to be able to prove that their time and payroll records are accurate, and the reason for that is made clear if an employer can’t show that their time and payroll records are accurate – or if becomes clear that they aren’t accurate. Once that happens, it is exceedingly difficult to establish that employees’ claims are meritless. The burden is on the employer to pay employees for their work and to do so accurately.”

“This issue is particularly problematic when it comes to allegations that employees performed work off-the-clock work before work hours, during breaks, or after their workday ends. If employers do not have policies that require employees to report all time worked, or if managers do not take those policies seriously, then the accuracy of the employer’s time and payroll records comes into question.”

“Due to: (1) the relative ease with which an employee can prove a potential wage and hour violation if the employer does not keep accurate employment records; (2) the potential cost of that violation in unpaid wages, unpaid overtime, punitive damages, and attorney’s fees, and (3) their statutory duty to do so, employers are strongly advised to create and maintain employment records in accordance with the FLSA. Many states have additional or different recordkeeping rules; employers are strongly advised to familiarize themselves with these rules to ensure compliance.”

“Accurate records is the “Golden Grail” for bureaucrats. They’re absolutely necessary to defending classification claims. Without accurate records, it’s nearly impossible for an employer to credibly defend a classification case.”

Keeping and maintaining accurate time and payroll records is the most important thing you can do to avoid or defend against FLSA lawsuits.

“The FLSA requires covered employers to keep certain records for covered and non-exempt workers. The required records include the employee’s identifying information and information showing the employee’s hours worked and wages earned. The FLSA further requires that these records be accurate.

The following records must be kept for at least three years:

The following records must be kept for at least two years:

“Any records concerning any financial transactions between a contractor and employees. More specifically, any contracts, agreements or understandings concerning anything involving scope of services or work. Employers should also track employee time (tracking contractor isn’t usually necessary).”

“Records must be open for inspection by the DOL’s investigators, who may require the employer to make computations and transcripts. An employer’s failure to maintain accurate employment records can be to its detriment in an investigation or a lawsuit.”

“The Supreme Court of the United States has held that employees will not be penalized for the employer’s insufficient records because doing otherwise would encourage the employer’s failure to meet its statutory duty. All an employee has to do to prove that he or she has performed the work for which they were improperly compensated is to “produce sufficient evidence to show the amount and extent of that work as a matter of just and reasonable inference.” The burden then shifts to the employer to show “the precise amount of work performed or with evidence to negative the reasonableness of the inference to be drawn from the employee’s evidence.” If they cannot, the court can award damages to the employee. Employees are permitted to prove their hours worked based on their own testimony and the testimony of their co-workers. Therefore, it is important that employers maintain accurate records and employers should avoid altering time records or, at the very least, minimize the altering of records and have the employee acknowledge the altered record.”

“Fabricated payroll documents. Payroll documents that were obviously created by hand, and worse yet, they were undated, so there was no way to know what time periods the records applied to. There are some who would argue that handwritten records are the worst, but I disagree. As long as the records appear legitimate and accurate, I don’t care if they’re written, typed or in code.”

“From a legal perspective, all I look for is that a company has a consistent way to track hours. How a business tracks hours is up to them. However, the easier it is, the more likely employees will do it. Employees need to track their hours so they know what they’re entitled to, and employers need to keep an accurate record of those tracked hours to know what their employees are owed. Tracking time should be a part of the policy, and expectations need to be clear: This is how we track time, this is you’re required to track, etc.”

“There’s a number of ways. One way is to randomly select payroll records and have them independently audited by an outside auditor. Another way is to use bonded, licensed or certified payroll companies.”

Consistently using an automated time tracking system is an easy way to keep accurate records – protecting both you and your employees.

Michael S. Kun is a Member of Epstein Becker Green in the Employment, Labor & Workforce Management practice, in the firm’s Los Angeles office. He is also the national Chairperson of the firm’s Wage and Hour practice group. Kun speaks before professional and business groups on a variety of employment-related topics, and his is the co-editor of the wage and hour defense blog (wagehourblog.com). Additionally, Kun is one of the creators of the Wage & Hour Guide for Employers app, which provides employers with easy access to federal and state wage and hour laws.

Maria O. Hart is a member of the Litigation, Trials and Appeals practice group at Parsons Behle and Latimer. Hart’s practice focuses generally on commercial litigation and business law. She has experience representing businesses and individuals in both Idaho and Montana. Her practice involves litigation in both federal and state court pursuing or defending against a variety of issues related to health care law, employment law, and general commercial matters.

Jonathan M. Young focuses his practice on labor and employment matters, including wage and hour claims, class action benefit claims, class action contract and tort cases, state Attorney General investigations, commercial litigation, Department of Labor investigations and banking settlements.

Charles A. Krugel is a management side labor and employment attorney as well as a human resources counselor. He has more than 20 years of experience in his field and has been running his own practice for the past 15. He serves small to medium sized companies in a variety of industries. Besides providing traditional labor and employment law services, Charles has negotiated hundreds of labor and employment agreements and contracts.