According to the American Payroll Association, 80 percent of American companies have hourly employees — and 60 percent of them are still using paper timesheets to track employee hours. That’s 14 million small businesses currently falling prey to paper timesheets.

New! Create Accounts for Your Clients

The easiest way to refer your clients to QuickBooks Time

Your clients NEED QuickBooks Time. And we’re not just saying that.

Five reasons to break the paper chain and switch to automated timesheets

1. Prevent time theft

Paper timesheets leave companies vulnerable to employee time theft and timesheet padding, which costs US employers over $11 billion each year.

2. End “buddy punching”

Over 16 percent of hourly employees admit to “buddy punching” using paper timesheets, costing US employers $373 million each year.

3. Get more accurate time data

Paper timesheets and excel spreadsheets are inaccurate. They’re open to guesstimation and prone to getting misplaced.

4. Decrease payroll processing time

Paper timesheets are inefficient. Collecting timesheets, deciphering employee handwriting, and manually entering time data can add hours to payroll processes.

5. Support labor law compliance

Paper timesheets are a weak defense in employment lawsuits. In a case of “he said, she said” the employee almost always wins.

Get your clients on board, open QuickBooks Time accounts on their behalf (with permission, of course)

QuickBooks Time can save your clients thousands of dollars in gross payroll costs each year, just by curbing time theft, eliminating buddy punching, and keeping overtime costs low.

But it’s beneficial for you too. QuickBooks Time makes running payroll for your clients a total breeze, and you’ll look like a rock star just for recommending it! So show your clients the benefits of automated time tracking. Show them how easy it is for their employees to track accurate-to-the-second time in QuickBooks Time. Then, show them how much they’ll save just by switching!

And the best part? We want to help you simplify your clients’ lives, so we’ve made it super easy for you to start a QuickBooks Time trial or open an account on your client’s behalf (as long as you get their permission, of course). You can set them up, add their employees, then walk them through the basics, on their schedule! We’ll help you do the heavy lifting, so your client can stay focused on their business.

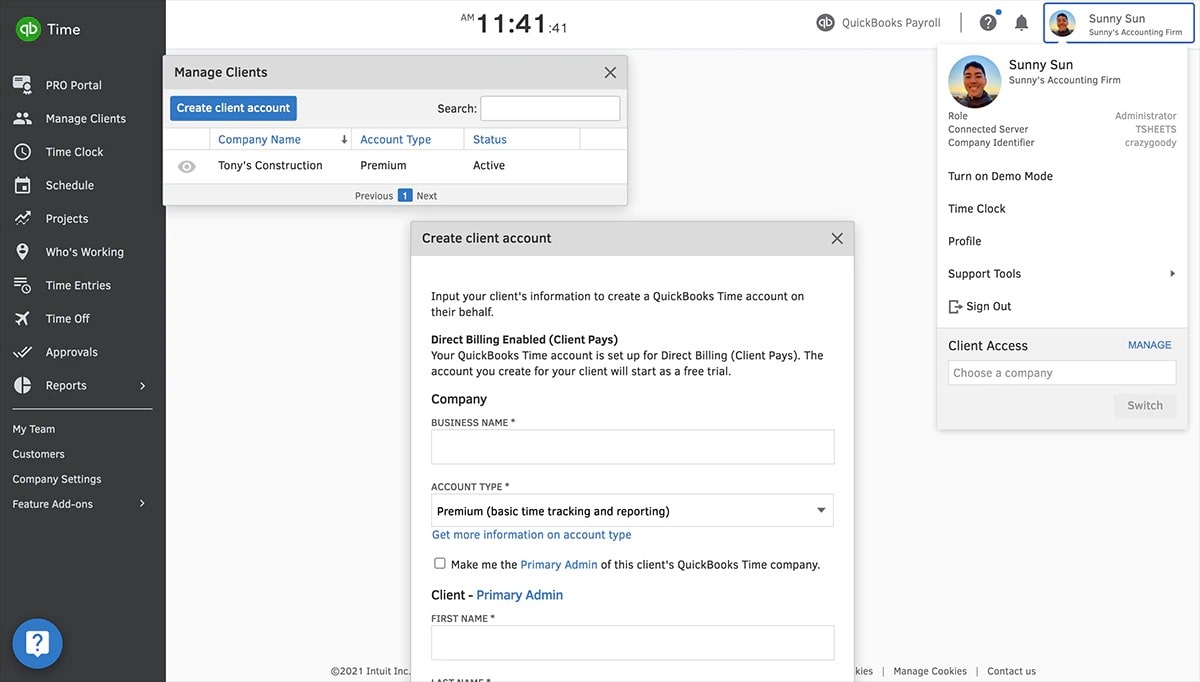

Using QuickBooks Time Accountant View, access, manage, and, set up client accounts directly from your QuickBooks Time dashboard

Here’s how to get started:

1. Log in to your QuickBooks Time PRO account.

2. Click on your name in the upper right-hand corner of your QuickBooks Time dashboard to access the Accountant View menu.

3. Click “Manage” for client access.

4. Click “Add clients” and select “Create client account” (if you’d like your client to open their own account, select “Invite clients”).

5. Fill out the form to set up a new QuickBooks Time account on your client’s behalf and click “Agree & Create Account” when you’re finished.

QuickBooks Time will automatically drop you into the new account. From there, you can add your client’s employees, create job codes, and connect to your preferred accounting or payroll solution. When you’re done, invite your client to access the account as soon as you’re ready!

There’s no credit card required to get started, and the first 30 days of QuickBooks Time are always free, whether you opt for wholesale or direct billing. Best of all, both you and your clients will always have access to QuickBooks Time’ award-winning customer experience team.