Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAfter I have submitted a payroll direct deposit to Intuit, I found a correction that needs to be made. It is still before the 2 banking days before the paycheck date (1/15/19) and the transction is showing as pending when I view my Intuit Payroll Service Account Information. Is there a way to delete this transaction and resubmit it?

Solved! Go to Solution.

Hello there, mnmcgeecpa.

I'm glad you've reached out to us. Let me help and provide you the information about voiding Direct Deposit paychecks in QuickBooks Desktop.

The direct deposit scheduled to offload is exactly 5 PM Pacific Time two days prior to the paycheck date. If you need to make any changes to direct deposit paycheck, you must void the payment you already sent before the offload schedule.

To void a direct deposit paycheck, here's how:

For additional reference, you can check this article on how to cancel or stop a Direct Deposit paycheck.

If you need further assistance with the steps, you can contact our QuickBooks Desktop Payroll Support Team. They have the tools to pull up your account and do a remote session.

Here's how you can contact our phone support:

That should do it! By following these steps, you can now void the incorrect direct deposit paycheck and create a new one. Don't hesitate to leave a comment below if you have other questions about Direct Deposit. Have a good day.

Hello there, mnmcgeecpa.

I'm glad you've reached out to us. Let me help and provide you the information about voiding Direct Deposit paychecks in QuickBooks Desktop.

The direct deposit scheduled to offload is exactly 5 PM Pacific Time two days prior to the paycheck date. If you need to make any changes to direct deposit paycheck, you must void the payment you already sent before the offload schedule.

To void a direct deposit paycheck, here's how:

For additional reference, you can check this article on how to cancel or stop a Direct Deposit paycheck.

If you need further assistance with the steps, you can contact our QuickBooks Desktop Payroll Support Team. They have the tools to pull up your account and do a remote session.

Here's how you can contact our phone support:

That should do it! By following these steps, you can now void the incorrect direct deposit paycheck and create a new one. Don't hesitate to leave a comment below if you have other questions about Direct Deposit. Have a good day.

If my account is in suspension until March 30 and I ran a payroll with a deposit date of March 25 is this already offloaded and can I void these checks so they don't deposit in the employee's accounts?

Hello there, sanders-melody. I'm here to help you clarify things.

Yes, running payroll before the suspended date will still be offloaded. When voiding a direct deposit paycheck, there are specific timelines that we need to follow.

For example, our check date on Wednesday, direct deposit checks will be processed Monday at 5:00 PM PT. With that being said, we can void them until Monday before 5 PM PT.

Here's an article that will help you through: Void a paycheck.

I'm always around to help in case you need one. I hope you're all set and good. Take care!

Hi, I need to speak with upper management about this case as I have been told several conflicting things through phone and email. How can I contact someone to discuss this?

Hi there, sanders-melody.

To contact someone to discuss your concern and help you further, I suggest contacting our QuickBooks Desktop Support.

Here's how:

Please check this article on how to check the status of the payroll you have sent, and verify that the employee was included in the payroll: Employee did not receive direct deposit created in QuickBooks Desktop Payroll.

You can also refer to this article to see steps on how to remove direct deposit permanently from an employee's profile: Set up, edit, and remove direct deposit for employees in QuickBooks Desktop. This also provides information on how to disable direct deposit temporarily on a paycheck only.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

My assistant sent our direct deposit with the wrong paycheck date. Instead of June 29th, the payroll was sent with July 24. It offloaded for ACH but was not deposited into the employees' accounts because it is not yet July 24th. I had to issue them paper checks for the June 29th payroll, but the July 24th direct deposit is still sitting in Quickbooks waiting to pay. How do I cancel it? When I try to void it, it says I can't because it was processed by Intuit Payroll.

Let me route you to the team who has access to check this, Tracy.

Based on the deadlines, you can void a direct deposit before 5 PM PST, 2 days prior to the check date.

I would recommend contacting our Support for this scenario. They will be able to help you to check to see why your direct deposit was offloaded early which disabled the option to void it. They are available from 6:00 AM-6:00 PM PST Monday-Friday and 6:00 AM-3:00 PM PST on Saturdays.

Please don't hesitate to go back to this thread if you have more questions about direct deposit.

I also need help with payroll direct deposit check sent tonight. Hasn't been uploaded to bank. how do I edit a check?

Good day, EllenKowal.

You must void the check before 5:00 p.m. Pacific Time, and 2 banking days before the paycheck date. Then, we can recreate it to correct what's needs to be corrected. You can follow the steps shared by JanyRoseB.

I've included this link for more details: Cancel a Direct Deposit pay check.

Post again here if you have more questions. I'll be here!

I made a mistake on payroll checks to be direct deposited in two weeks. After entering the checks, I received a direct deposit receipt email from the Payroll Service. I then voided the checks and sent the message to the Payroll Service. However, I have not received a confirmation that the direct deposit was cancelled. Is there a way to confirm that the direct deposit was in fact cancelled. I would like to know for certain if that is the case before reissuing corrected checks for the direct deposit.

Hello there, @FarmerAl.

Making sure you're able to void or stop direct deposit paycheck depends on its paycheck date. Once it is successfully voided, you can see a Voided pay status in the items to send screen. Let me share additional information on how you can manage your direct deposit payroll check.

Here are the things you'd want to consider when stopping or voiding a direct deposit paycheck:

Also, you can access your account maintenance page to view the status of your payroll transmission. Here's how:

You can read through these articles for more insights about the process:

Get back to us here if you have other questions or concerns about managing your employees' payroll. I'm always here to help.

Can you edit vs voiding a direct deposit payroll check before it's been sent for processing?

Hey DorisJayne,

Thank you for coming to the QuickBooks Communty! Yes, you can edit a direct deposit payroll check before processing it. Here's how:

That should do it! If you have any questions pertaining to cancelling or voiding a paycheck, this article is very instrumental for future use.

Let me know if you to run into any issues! I will be here to assist further. I hope you have a good day!

I sent a direct deposit for process yesterday pay day is tomorrow. Wrong amt was sent what are my options

Allow me to help you with this payroll concern, @EZ4.

You can void the paychecks if it's not yet processed. Please note that we cannot stop a Direct Deposit once it has been offloaded for ACH. You need to check Payroll Check Direct Deposit status first to make sure the cancellation is successful.

I'm not sure what version of payroll you have, so I will provide both options for QuickBooks Online Payroll and QuickBooks Desktop below.

To check the payroll status for QuickBooks Desktop:

To verify the Direct Deposit Payroll Check status when using QuickBooks Online Payroll:

See this links to void DD if it is not yet offloaded or processed:

If it has already been processed, you can make an internal agreement with the employee to return the funds if you sent an overpayment. Otherwise, you can deduct the amount on their next pay run if they refuse to return it.

However, if you underpaid them, you can process an unscheduled paycheck for the remaining balance. Please note that doing so will not post on their original pay date as QuickBooks will follow the normal Direct Deposit lead time.

See this link for the steps to process an unscheduled paycheck in QBO: Create Unscheduled Payroll Check for QuickBooks Online

For QuickBooks Desktop, go to the Employees > Pay Employees then Unscheduled Payroll.

If you have other payroll or QuickBooks concerns, please let me know in the comment below. I'll be more than happy to help. Have a nice day!

So I made a mistake. I submitted payroll yesterday. Then found out we needed to reimburse an employee for some expenses. It was before the cut off time. I went into the edit/void menu and clicked on employee. I should have voided and then re-entered it for him but I just edited with the new amount. I re-submitted the payroll and got the confirmation that one check had been modified. When i checked the bank account to see what cleared our company account it was for the lower amount (ie not the amount with the addition). But when I look At QB for the employee it shows the modified amount even though thats not what hit our bank. What do i do? I'm fine if I need to cut a manual check for that amount I just dont know what accounts to hit. Right now its showing more hit our bank account in QB than really did.

Let me help you with editing cleared direct deposit paycheck, twinkler06.

The option to edit cleared paychecks is unavailable in QuickBooks Desktop. However, we can make the adjustment and the correction on your employee's current direct deposit to catch up on the previous direct deposit paycheck. Here's how to create an adjustment:

For additional reference, you can check this article on how to cancel or stop a Direct Deposit paycheck. See these links to void DD if it is not yet offloaded or processed:

If you need further assistance with the steps, you can contact our QuickBooks Desktop Payroll Support Team. They have the tools to pull up your account and help you with this one. They are available from 6:00 AM-6:00 PM PST Monday-Friday and 6:00 AM-3:00 PM PST on Saturdays. Here's how:

You can also refer to this article to see steps on how to remove direct deposit permanently from an employee's profile: Set up, edit, and remove direct deposit for employees in QuickBooks Desktop. This also provides information on how to disable direct deposit temporarily on a paycheck only. In case you need help with other payroll tasks, click this link to go to our general payroll topics with articles.

Please get back to me if you still have questions or concerns. I'm more than happy to answer them for you. Take care and stay safe.

I submitted my payroll for direct deposit and didn't notice that the check date is 8/19 and it should be 8/12 How do I correct it? I went back and edited the checks but it still shows the funding date as 8/19. It should be 8/12

Welcome, @krisel.

Congrats on making your first post here in the Community. Allow me to point you in the right direction.

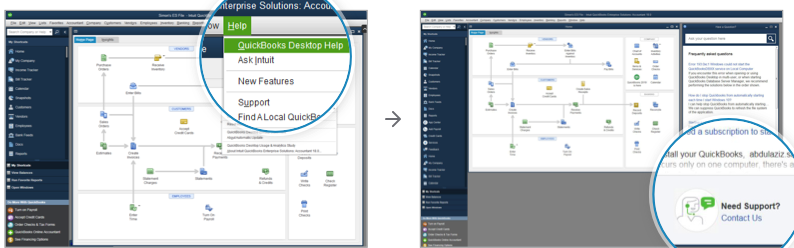

The best route would be to contact our Customer Support Team to confirm a few details on their side. Here's how:

From there, you'll be able to receive an estimated time of when they'll be in touch with you.

Let us know how the call goes. I'm only a post away if you need me. Have a wonderful day!

Thanks for Sharing Such a informative info.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here