Switch from Bill Pay powered by Melio

by Intuit•151• Updated about 8 hours ago

Learn more about what you need to do to prepare for the switch from Bill Pay powered by Melio to QuickBooks Bill Pay for QuickBooks Online and QuickBooks Online Accountant. This is also known as Melio Green by users.

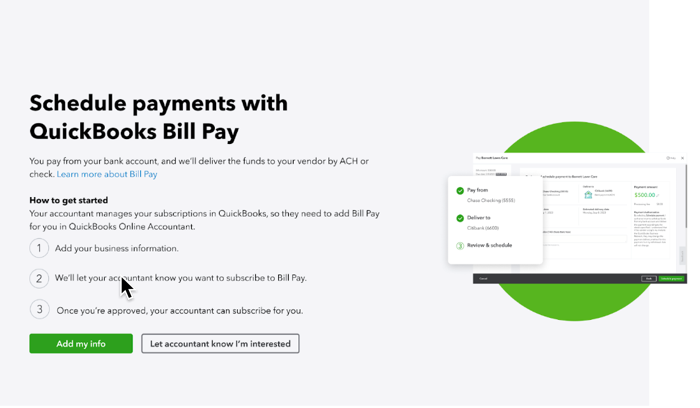

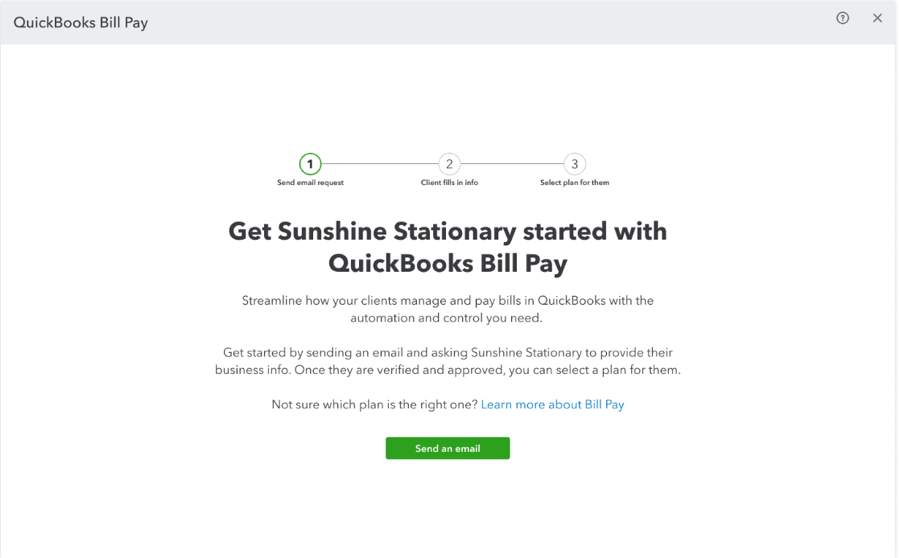

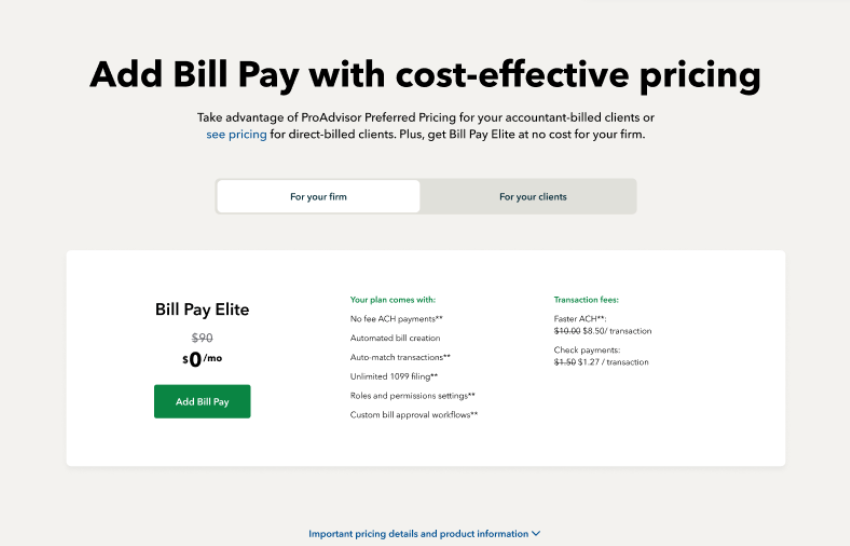

The Bill Pay powered by Melio integration will be discontinued on May 20, 2024, businesses previously using Bill Pay powered by Melio will be able to apply for one of three QuickBooks Bill Pay plans: Basic, Premium or Elite in QuickBooks Online. Accountants who have accountant-billed clients or who want to use Bill Pay for their own firm in QuickBooks Online Accountant, click here to see available plans and pricing.

Just choose a subscription plan that's right for your or your client’s business. You can choose from a QuickBooks Bill Pay Basic plan with no additional subscription fee and up to 5 free* ACH transactions per month or get more features with Bill Pay paid plans.**

Note: The number of additional users who can use QuickBooks Bill Pay is based on your QuickBooks Online plan. Advanced users have up to 25 users, Plus users can have up to 5 users and Essentials have 3. Simple Start only has one user.

Select a section below to address any questions you may have.

Disclaimers:

*Product Information:

QuickBooks Bill Pay: QuickBooks Bill Pay product features and availability subject to change. QuickBooks Bill Pay account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Onlineor QuickBooks Online Accountant required.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments’ money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Bill Pay services powered by Melio with funds held by Evolve Bank & Trust or J.P. Morgan (members of the FDIC and the Federal Reserve). Melio is a registered trademark of Melio LTD Corporation.

**Features:

Standard ACH: Transaction fees apply for ACH payments over the monthly allotted amount included in QuickBooks Bill Pay Basic and Premium plans. Limits may apply on total number and amount of payments.

More like this

- Pay bills online from QuickBooks Desktopby QuickBooks

- Add QuickBooks Bill Pay in QuickBooks Online Accountantby QuickBooks

- Pay bills in QuickBooks Desktopby QuickBooks

- Pay bills with QuickBooks Bill Payby QuickBooks