Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat the difference between setting up ACH Debit vs. Quickbooks Payments-Bank? Thanks

Solved! Go to Solution.

Hi there, @jay87. I'm here to clear up the confusion.

The ACH Debit and QuickBooks Payments-Bank payment methods are the same. If you're using QuickBooks Payments, you have the advantage to enter the bank details in the customer's profile. This is why you have the option to select the QuickBooks Payments-Bank option. Otherwise, choose ACH Debit if you're using a third-party merchant account.

I'm also adding these helpful articles that consist of questions and answers about QuickBooks Payments deposits:

Feel free to comment down below if you have any follow-up questions about QuickBooks Payments. The Community is always here to help. Have a wonderful day.

It's great to see you here in the Community, Jay!

I'll be happy to provide information about the payment method you mentioned.

Bank (or bank transfer) and ACH are the same thing. Speaking of which, please know that this has a faster process compared to credit card payment because you will receive your funds the next day. For more details, please refer to this article: Find out when QuickBooks Payments deposits customer payments.

On the other hand, we also offer a QuickBooks Cash account for Merchants in partnership with Green Dot Bank. It is a bank account where you can deposit customer payments and earn interest.

Let me know if you have other queries about QuickBooks Payments. Take care, and wishing more success in your business!

So if they are the same thing why are there two different options for it? There has to be some difference between the two like fees or something. It doesn't appear you set up ACH Debit like you do Quickbooks Payments-Bank because they one has fields to set-up and the other does not.

Hello jay87.

Let me further assist you with the QuickBooks Payments.

If what you meant by Quickbooks Payments-Bank is the bank transfer, this is a payment method where the system process electronic money transfer between banks. It pulls money from your customer's bank account and deposits it into your bank account. It is another term for ACH Debit.

With QuickBooks Payments, the transaction fees are based on how the payments were processed. Please visit this microsite for more details: https://quickbooks.intuit.com/payments/.

When creating an invoice in QuickBooks Online, under the Online payments section, you can turn on either Cards or Bank transfer. The Cards allows your clients to pay the invoices using credit cards while the Bank transfer is for ACH Debit or also called the bank transfer.

You'll want to check this link: QuickBooks Payments FAQ. This contains different articles to understand how to use this service.

Keep on posting here if you have other clarifications. Take care!

Thanks, that's getting closer to an explanation but still doesn't explain the differences between the two options. If they are exactly the same then why are there two options to make a selection? It's likely because they are in-fact different and the developers made them different to function differently.

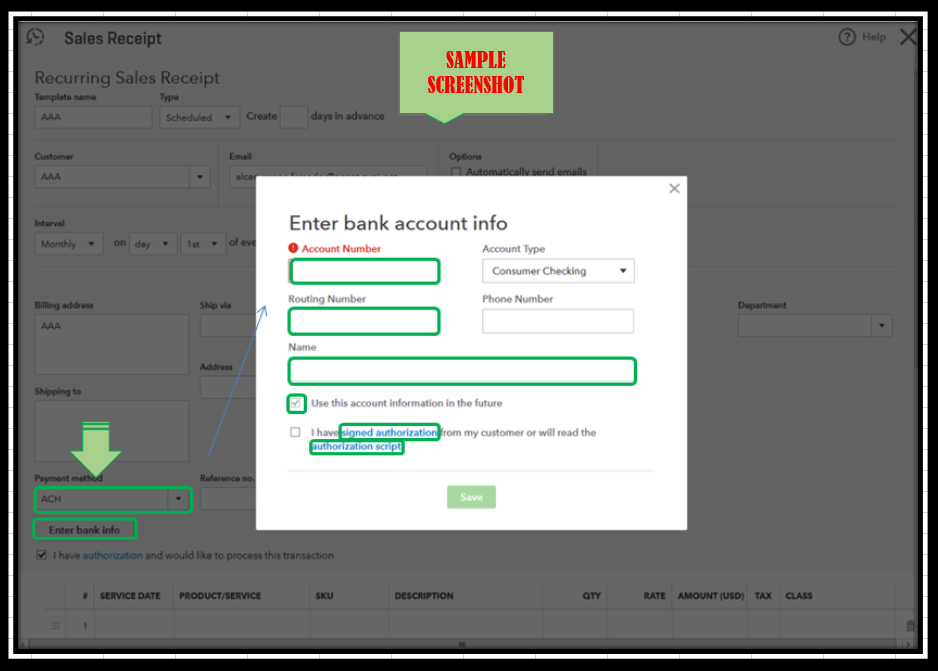

I've attached two screenshots to show you what I am referring to. Hopefully, this will help in getting a better understanding to why these choices are different and not actually the same thing. ACH debit does not give you any options to enter bank info so I don't even see how this works where as the Quickbooks Payments-Bank option does permit you to enter bank info. What's the point of the ACH debit option if you can't enter in any of the bank info anyway?

Thanks

Thanks for adding screenshots, jay87.

This helps us get a clearer view of your issue, so we can share more info about the two payment options.

In QuickBooks Payments, you can only enter bank details in the customer's profile. At this time, QuickBooks Online doesn't have the option to save your customer's billing info when paying via ACH or other third-party merchant accounts.

If you'd like to set up ACH as a payment method, you have a way to save the bank details for future use. This will prevent your customer from entering it every time they pay you. I'll show you how.

For more details, please see this article: Process an ACH Bank Transfer from a Customer.

Additionally, I've added these articles that'll help you stay informed about how QuickBooks Payments works:

I'm only a few clicks away if you need assistance managing your customer transactions in QuickBooks, jay87. It's always my pleasure to help you out again.

So what method is "Quickbooks Payments-Bank" then if it is not ACH but allows you to enter the bank information of the customer?

Hi there, @jay87. I'm here to clear up the confusion.

The ACH Debit and QuickBooks Payments-Bank payment methods are the same. If you're using QuickBooks Payments, you have the advantage to enter the bank details in the customer's profile. This is why you have the option to select the QuickBooks Payments-Bank option. Otherwise, choose ACH Debit if you're using a third-party merchant account.

I'm also adding these helpful articles that consist of questions and answers about QuickBooks Payments deposits:

Feel free to comment down below if you have any follow-up questions about QuickBooks Payments. The Community is always here to help. Have a wonderful day.

Thank you, that makes sense now.

"ACH Debit" is the non-proprietary way of entering payment information and cannot be entered directly into the customer profile. "QuickBooks Payment-Bank" is the software's proprietary way of entering payment information and can be entered into the customer profile. Easier to enter, easier for QuickBooks to collect merchant fees.

I understand now. Thank you

I can't find the authorization script for the client's to sign. Where did it get moved to?

@jay87 Have you found there is a difference in fees between the two?

I wish I could say but Quickbooks does not list their ACH fees. I could only find this statement online: Processing fees: ACH transfers, while convenient, aren’t always free for either party. Oftentimes an ACH payment comes with a percentage-based fee or flat rate for each transaction.

For Quickbooks Payments, it appears to be 1% of the total.

I can share some information about our rates per transaction for QuickBooks Payments, @jay87.

Yes, you're right! Our rate per transaction for ACH bank payments is 1% (max $10 per transaction). For more information about payment fees for invoicing, using a card reader, and keyed transactions, refer to this link: Payments pricing.

In case you'd need to void and refund a transaction, here's how to void or fully refund a transaction and partially refund or credit a transaction: Void or refund transactions in QuickBooks Payments. To know the fee that you may incur, see this guide: Understand fees for refunds or void transactions. It'll be based on your pricing plan and transaction type.

For more information about when QuickBooks deposits customer payments into your bank account, refer to this article: Find Out When QuickBooks Payments Deposits Your Money.

Let me know if you still have follow-up questions about QuickBooks payments or any other concerns. I'm always here to help. Have a wonderful day!

I would like to know how to issue a refund to a customer who paid via Bank Transfer in Quickbooks Payments? Please help, this customer is requesting a refund right away in the same manner as he paid.

Hello, amyworking12.

Regarding of the payment method, we were unable to make a refund via bank transfer in QuickBooks Payment. The option to process the refund to a customer in QuickBooks is via credit card, checks, and cash payments. However, you can make an internal arrangement with your customer about how he/she wanted to receive the refund.

To send an actual refund to the customer’s account to reverse the transaction. Here's how:

Check out the Void or fully refund a transaction section in this article for more information: Void or refund transactions in QuickBooks Payments.

In case you need tips and related articles in the future, visit our QuickBooks Community help website for reference: QBO Self-help.

Please let me know if you have further questions about processing refund. I'll be around. Have a great day.

Is there a way to not incur fees so I do not have to charge my customers the fees. My customer just paid her invoice and there is a $47.13 fee that now I will incur.

Hi there, @TAHJS.

I understand how you want your customer to get charged with the invoice amount alone. However, the following fees are needed and imposed by financial institutions for maintenance and minor transactional services.

Moreover, you can also contact our Customer Care Team to assist you with your request: Contact Payments or Point of Sale Support.

Additionally, here is a resource you can visit when checking out QuickBooks Payments' latest processing fee rates and pricing: What are the fees for QuickBooks Payments?

Let me know if you have more questions or other inquiries about QuickBooks. I’m just a few clicks away. Have a good one!

AileneA - this refund process doesn't seem to work. I'm following the instructions provided, but it is only giving me the "Reverse a transaction" option under credit card transactions - it does not give me the option to reverse or search for a "QuickBooks Payments - Bank" ACH transaction to refund. I also searched under the "Reverse an eCheck" just to see if that's how it was being referred to, but the transaction is no where to be found.

Can anyone please provide actual instructions on how to refund a payment that was made via "QuickBooks Payments - Bank" transfer and not a credit card?

Thanks for joining and updating us, @kateBBA. Let me provide information to get your refund settled.

Since the refund instructions provided didn’t work, it would be best to contact our Payments Support team to help reverse your transaction made via ACH. Our representatives can assist you in navigating the reimbursement process with ease.

You can use this Contact option to get in touch with our experts. It includes details about our operation hours so you’ll receive responses quickly.

I’m also adding these references to get more information about updating business and account info, processing payments, and how the program matches transactions for you:

I want to ensure that all your questions about payments and managing them are covered. If any chance you need further assistance, please feel welcome to reply to this thread or create a new post. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here