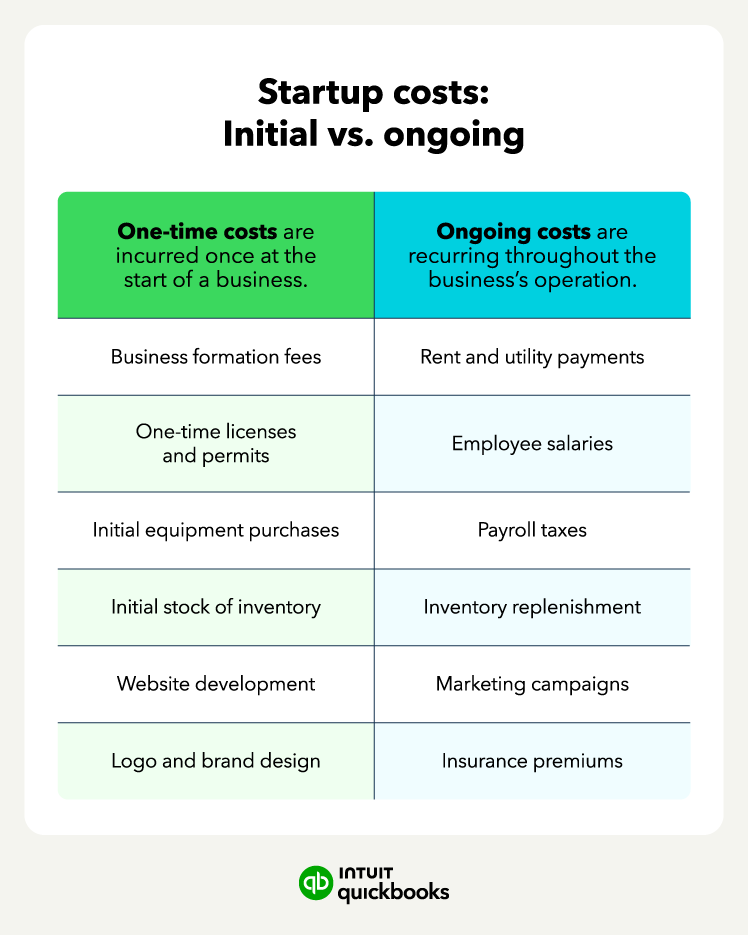

Few things are as exciting as starting a new business from scratch. But you must first determine which startup costs are required to get your business off the ground. Without proper due diligence and calculation, your company might be going out of business before it can succeed.

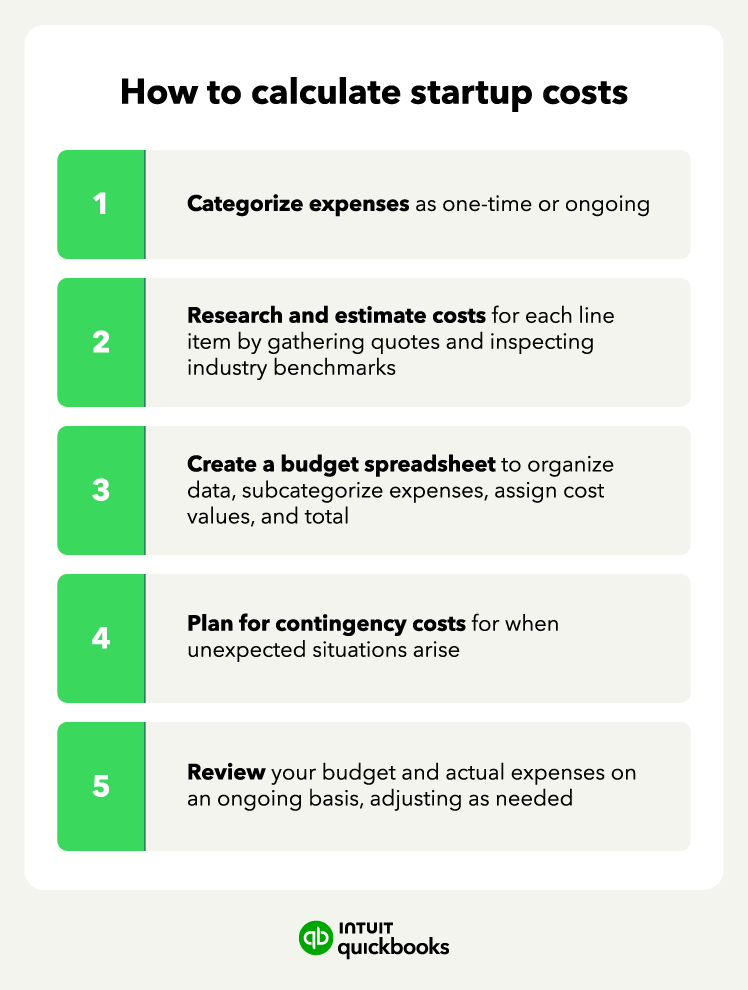

Tracking expenses, understanding your business startup cost budget, and leveraging potential tax deductions can all help optimize your financial position, allowing your business to thrive.

Read on to learn the basics of accounting for startup costs, what to consider when calculating them, and what you might be able to deduct from your taxes.

Jump to: