What employers need to know if their employees work in other state

The Complete Guide to State Taxes for Mobile Workers

What employers need to know if their employees work in other states

You must file a state tax return for Iowa if you're a nonresident and your net income from Iowa sources was $1,000 or more — unless your total net income is below $9,000 if you're single, below $13,500 if you're married, or below $5,000 if you're a listed as a dependent on another Iowa tax return. Nonresidents subject to Iowa lump-sum tax or Iowa alternative minimum tax also need to file a state tax return (source). Illinois residents with income from Iowa only pay tax on that income in Illinois.

An overwhelming 93 percent of mobile workers agree: Technology simply can’t replace old-fashioned, face-to-face interactions. With that in mind, it should come as no shock that more than half of U.S. workers still travel for work on a regular basis.According to a recent independent survey conducted by QuickBooks Time, 62 percent of U.S. employees have traveled across state lines for work within the last 12 months.1 And 38 percent of those mobile workers have spent more than 30 days away from home each year, which begs the question:

Are employees required to file multiple state tax returns for working in another state?

If your employees travel to states like California or New York (two of the most frequently visited states for business trips), they may be required to pay additional income tax in those states.2 Many states have laws that require mobile employees to pay state income taxes upon spending time, working, or earning money within that state. But not many employees abide by those laws. According to our survey, less than 1 in 4 mobile workers currently pay additional state income taxes, which means a majority of mobile employees could be breaking the law. Only 23 percent of over 500 respondents said they pay additional state income taxes when they work out of state. The remaining 77 percent of business travelers could potentially be committing tax fraud.3 Fortunately, the law for state taxes imposed upon mobile workers could soon be changing.

The Mobile Workforce State Income Tax Simplification Act

Congress has recently been ruminating on the Mobile Workforce State Income Tax Simplification Act.

If passed, the Act would prevent individual states from taxing nonresidents who work in their state for less than 30 days within a calendar year:

“No part of the wages or other remuneration earned by an employee who performs employment duties in more than one State shall be subject to income tax in any State other than the State of the employee’s residence; and the State within which the employee is present and performing employment duties for more than 30 days during the calendar year in which the wages or other remuneration is earned.”

In other words, state income tax laws would no longer apply to mobile workers until those workers have spent more than 30 days working in that state over the course of 12 months.

How will the Simplification Act affect mobile employees?

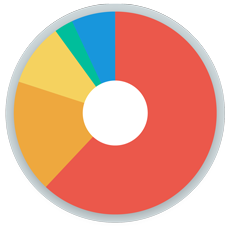

QuickBooks Time’ study found more than one-third of employees who worked out-of-state within the past 12 months spent more than 30 days in the state, or states, they worked in. In fact, 7 percent of those employees were said to have worked in four or more states for more than 30 days each.

In how many states have you worked for more than 30 days each?

- 62% Have not worked in another state for more than 30 days

- 18% Said they worked in one state for more than 30 days

- 10% Said they worked in two states for more than 30 days each

- 3% Said they worked in three states for more than 30 days each

- 7% Said they worked in four states or more for more than 30 days each

Many employees will still be required to abide by state income tax laws in each state they work in, but the remaining 62 percent of mobile employees (who spend less than 30 days working in another state) can travel without paying additional income taxes. It’s good news for the majority of mobile workers, though many wish the news was even better.

According to the survey, approximately 1 in 4 U.S. employees believe states should never tax nonresident workers. Another 1 in 3 thinks the grace period should be longer — up to six months. What’s more, 7 percent of respondents agree that having to pay additional state income taxes actually discourages them from working out of state.

When should a state tax nonresident workers?

- 38% After 30 days

- 9% After 60 days

- 13% After 90 days

- 11% After 6 months

- 23% Never

How can you ensure you and your mobile employees are complying with state income tax requirements?

As always, knowledge is power. It’s important for you and your employees to know exactly how much time they’re spending on the clock, especially while they’re traveling for work.

If the Tax Simplification Act passes, your employees will be responsible for tracking the hours and days they spend working in other states — that is, unless you, the employer, has a time and attendance system“that tracks where the employee performs duties on a daily basis.”

Requiring your employees to track their own time using paper time cards or excel timesheet templates leaves your company and your employees vulnerable to inaccurate data and guesstimation. Those are two words you want to avoid when it comes to paying taxes.

Invest in an automated employee time tracking software that allows your employees to quickly and easily track their hours worked both in the office and out on the road. And with GPS location tracking built in, you can rest easy knowing you and your employees are covered come tax time.