Manage church payroll with the #1 payroll provider for small businesses.1

Benefits of payroll

Churches have different priorities than traditional businesses but similar financial responsibilities. QuickBooks Payroll has you covered with tools and services that help you pay your employees and file payroll taxes automatically.**

Save time

Run payroll in less than 5 minutes and spend more time on your mission and with your congregation.2

Stay compliant

Get peace of mind knowing your federal, state, and local payroll taxes are calculated, filed, and paid automatically.**

Keep your employees happy

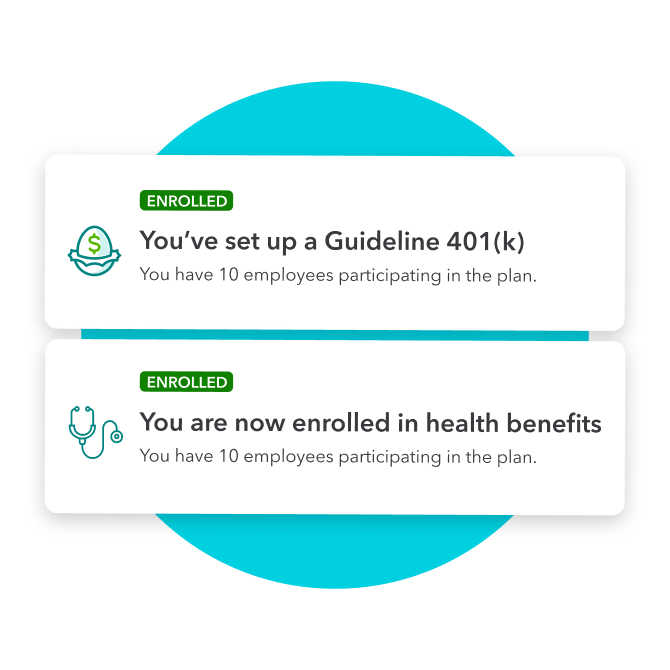

Offer affordable health benefits from Simply Insured and employee services from Mineral, Inc. Manage it all from your Payroll account.**

All the features you need to manage payroll

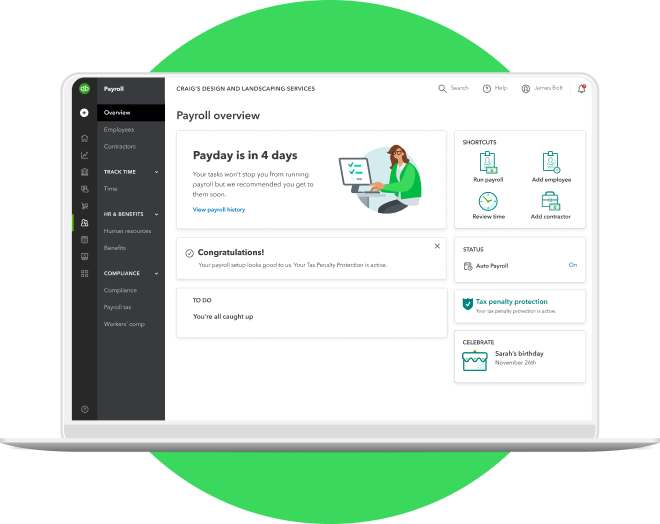

Tax penalty protection

Tax penalty protection means we’ll resolve filing errors and pay penalties up to $25,000. That’s coverage that you can’t find anywhere else.

Auto Payroll

Set up your church payroll to run automatically. Auto Payroll makes it easy to save time and stay in control with clear alerts and notifications.**

Direct deposit

With same-day or next-day direct deposit, you can run payroll as many times as you need each month at no extra cost.**

Customer support

Get step-by-step help, troubleshooting assistance, tips, and resources from our Payroll support experts. We’re here when you need us via phone or online chat.**

Expert setup

With expert setup and review, you can avoid errors and have confidence that your payroll setup is right. Changing payroll providers? We’ll make sure everything transfers over correctly.**

Time tracking

Time tracking flows right into QuickBooks, so you can approve timesheets and run payroll anywhere, on any device. Enter hours yourself or give clergy and employees permission to enter their own time.**

Powerful payroll reports

Turn numbers into knowledge. Generate and download reports to view payroll history, bank transactions, tax payments, and more. Track your financials and make informed decisions to grow your ministry.

Tax penalty protection

Tax penalty protection means we’ll resolve filing errors and pay penalties up to $25,000. That’s coverage that you can’t find anywhere else.

Auto Payroll

Set up your church payroll to run automatically. Auto Payroll makes it easy to save time and stay in control with clear alerts and notifications.**

Direct deposit

With same-day or next-day direct deposit, you can run payroll as many times as you need each month at no extra cost.**

Customer support

Get step-by-step help, troubleshooting assistance, tips, and resources from our Payroll support experts. We’re here when you need us via phone or online chat.**

Expert setup

With expert setup and review, you can avoid errors and have confidence that your payroll setup is right. Changing payroll providers? We’ll make sure everything transfers over correctly.**

Time tracking

Time tracking flows right into QuickBooks, so you can approve timesheets and run payroll anywhere, on any device. Enter hours yourself or give clergy and employees permission to enter their own time.**

Powerful payroll reports

Turn numbers into knowledge. Generate and download reports to view payroll history, bank transactions, tax payments, and more. Track your financials and make informed decisions to grow your ministry.

Payroll services for churches

From basic to advanced features, it’s easy to find a payroll system that works for your church. All plans come with full-service payroll and include automated taxes and forms.**

Payroll Core gives you the tools you need to pay clergy, access employee benefits, and get expert product support.**

Payroll Premium offers powerful tools, including same-day direct deposit, employee time tracking, and help with HR compliance.**

Payroll Elite comes with expert setup, a personal HR advisor, tax penalty protection, and 24/7 support.**

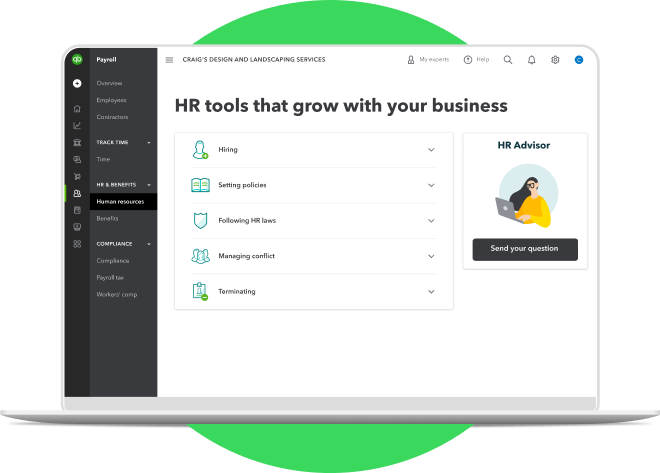

Confidence you’re compliant

Business compliance is an important part of running any church ministry. QuickBooks makes staying compliant simple with HR support, powered by Mineral, Inc. Learn best practices on hiring and termination, and stay on top of state and federal wage and overtime laws and requirements. Then let QuickBooks calculate and file your payroll taxes to stay compliant with the IRS.