Explore our payroll service for construction

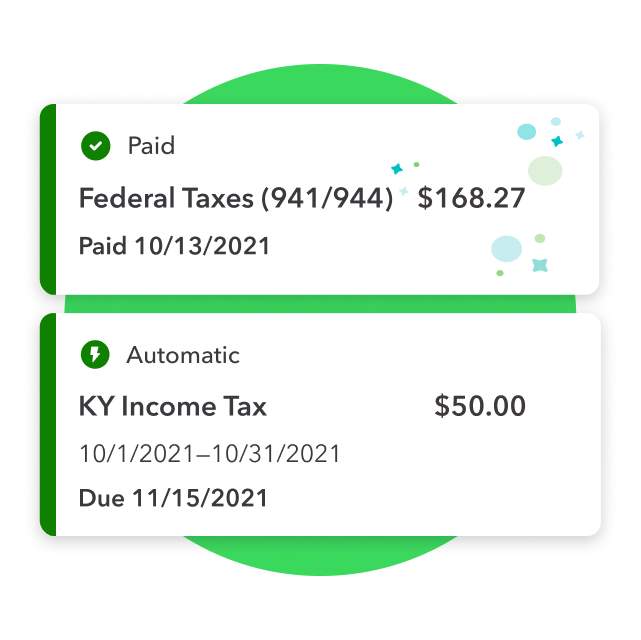

Save time and stay organized with Auto Payroll, time tracking, and automated taxes and forms.** Keep your finances in one place and view reports that help you make informed decisions for your construction business.

Manage labor costs

Do your employees work jobs with different hourly rates? No problem. Create multiple pay rates for the same worker or for each crew member in QuickBooks. With straightforward reporting features, track expenses and get labor costs for each project.

Pay contractors

We’ll track contractor payments and help you fill out your 1099s—just send copies to contractors and get back to business. Tax forms have never been this simple.

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Construction reporting

Run reports to find out how much you’re paying in overtime. View project and labor costs by crew, independent contractors, and more so you always know how your business is doing.

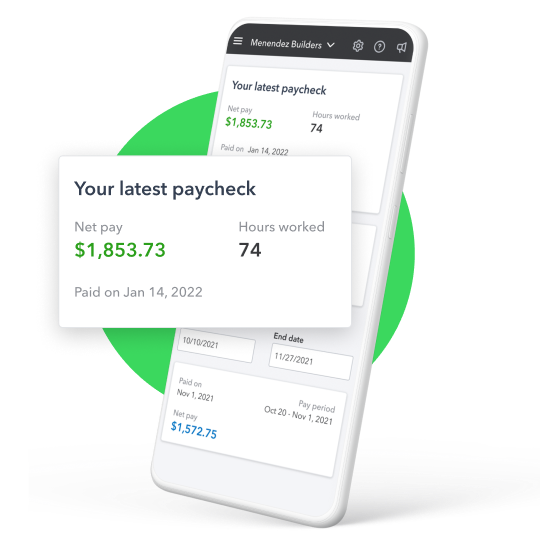

Direct deposit

Make your workers happy and keep money in your pocket longer with same-day or next-day direct deposit.**

Workers’ comp

Help protect your construction company and your team with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Manage labor costs

Do your employees work jobs with different hourly rates? No problem. Create multiple pay rates for the same worker or for each crew member in QuickBooks. With straightforward reporting features, track expenses and get labor costs for each project.

Pay contractors

We’ll track contractor payments and help you fill out your 1099s—just send copies to contractors and get back to business. Tax forms have never been this simple.

Track time and create schedules

Manage multiple timesheets, approve time when you’re ready, and edit, publish, and share schedules with with your team.

Construction reporting

Run reports to find out how much you’re paying in overtime. View project and labor costs by crew, independent contractors, and more so you always know how your business is doing.

Direct deposit

Make your workers happy and keep money in your pocket longer with same-day or next-day direct deposit.**

Workers’ comp

Help protect your construction company and your team with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Time tracking for construction

Construction and field crews have a lot to keep track of on a job site. With QuickBooks Payroll you can enter your employees hours or give them protected time entry access. You'll also save 2 hours on each payroll run and an average of 4% on payroll costs.3

How to manage payroll for construction workers

Once you’ve set up your payroll in QuickBooks, you can get started paying your construction workers and set your payroll to run automatically with direct deposit. With automated tax payments and filing, QuickBooks even monitors and updates your federal, state, and local taxes so you don’t have to.**

- Sign in to QuickBooks to confirm details like your bank account and pay date.

- Select the employees you want to pay and enter their hours worked, or simply review and approve their timesheets.

- Once everything’s in, preview and edit checks as needed.

- When you’re ready, submit and run payroll.

- You’re all set. Print paychecks or pay stubs from QuickBooks, or allow employees and contractors to view them online.

Why use QuickBooks Payroll for your construction company?

When managing a construction company, it’s important to know where your money is going and ensure your financials are accurate. With QuickBooks, federal and state payroll taxes are calculated, filed, and deducted automatically.**