Run payroll in less than 5 minutes2

Tax penalty protection

With tax penalty protection we'll pay up to $25,000 if you receive a penalty.**

Worry-free taxes

We’ll calculate, file, and pay your payroll taxes for you so you’re never caught off guard.**

Same-day direct deposit

Hold onto cash longer, keep your team happy, and run payroll on your schedule.**

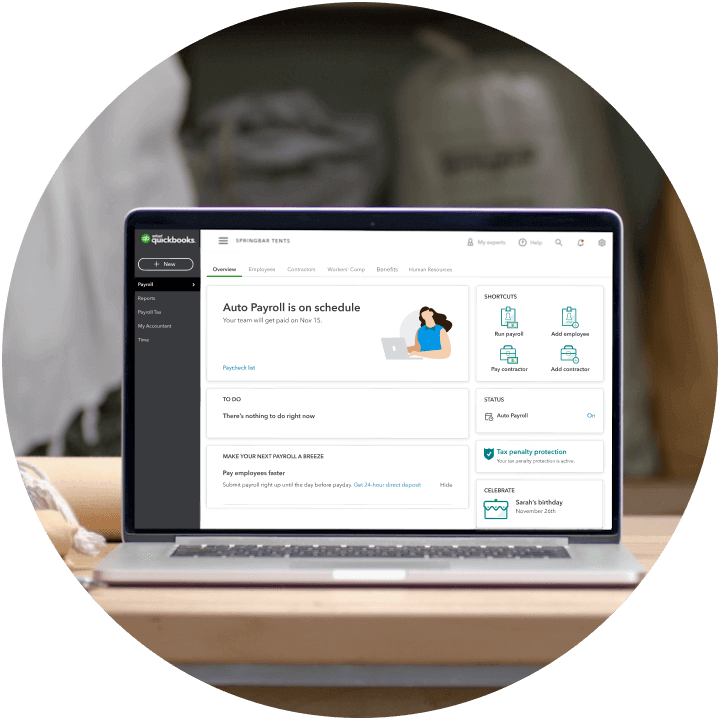

Auto Payroll

Set payroll to run automatically. You can review payroll before paychecks are sent.**

Time & project tracking

Approve your team’s time on any device and track project hours and labor expenses in real-time.**

Expert setup

A payroll expert will complete your setup and review anything you’ve done so far.**

How it works

Take a closer look at what comes with all our payroll plans so can simplify payday, retain top talent, and manage your team.

Choose a plan that’s right for you

Get payroll or bundle with accounting to help you manage your team and your business.

QuickBooks Payroll Elite

Access on-demand experts to simplify payday and stay compliant.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Same-day direct deposit

Pay employees faster, for free. Submit payroll up to the morning of payday.

Expert setup

A payroll expert will complete your setup for you.**

Track time and projects on the go

Track time and manage projects from anywhere.**

24/7 expert product support

Get troubleshooting assistance, tips, and resources from payroll support experts by phone, chat, or video.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty.**

Personal HR advisor

Get professional help on critical HR issues and custom handbooks and policies, powered by Mineral, Inc.**

Take care of your team

Employee portal

Your team can access their pay stubs and W-2s and enter their personal, direct deposit, and tax info online or in app.**

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by NEXT.**

HR support center

Mineral Inc offers customized job descriptions and best practices on everything from hiring to performance.**

Payroll Elite +

Plus

Manage payroll, projects, people, and your books all in one place.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Same-day direct deposit

Pay employees faster, for free. Submit payroll up to the morning of payday.

Expert setup

A payroll expert will complete your setup for you.**

Track time on the go

Track, submit, and approve employee time anywhere.**

24/7 expert product support

Get troubleshooting assistance, tips, and resources from payroll support experts by phone, chat, or video.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty.**

Personal HR advisor

Get professional help on critical HR issues and custom handbooks and policies, powered by Mineral, Inc.**

Take care of your team

Employee portal

Your team can access their pay stubs and W-2s and enter their personal, direct deposit, and tax info online or in app.**

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by NEXT.**

HR support center

Mineral Inc offers customized job descriptions and best practices on everything from hiring to performance.**

Take care of your books

Income and expenses

Securely import transactions and organize your finances automatically.

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

General reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible. Forecast cash flow and more—all in one place.**

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect all sales channels

Connect any available online sales channels and automatically sync with QuickBooks.

Free guided setup

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

Includes 5 users

Invite your accountant to access your books, control user-access levels, and share reports without sharing a log-in.**

Bill management

Organize bills in one place, schedule payments, pay online for free, and choose how vendors get paid.**

Enter time

Enter employee time by client/project and automatically add it to invoices.

Inventory

Track products, cost of goods, see what’s popular, create purchase orders, and manage vendors.

Project profitability

Track all your projects in one place, track labor costs, payroll and expenses.

Payroll Elite + Advanced

Manage payroll, access experts, and grow your business.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Same-day direct deposit

Pay employees faster, for free. Submit payroll up to the morning of payday.

Expert setup

A payroll expert will complete your setup for you.**

Track time on the go

Track, submit, and approve employee time anywhere.**

24/7 expert product support

Get troubleshooting assistance, tips, and resources from payroll support experts by phone, chat, or video.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty.**

Personal HR advisor

Get professional help on critical HR issues and custom handbooks and policies, powered by Mineral, Inc.**

Take care of your team

Employee portal

Your team can access their pay stubs and W-2s and enter their personal, direct deposit, and tax info online or in app.**

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by NEXT.**

HR support center

Mineral Inc offers customized job descriptions and best practices on everything from hiring to performance.**

Take care of your books

Income and expenses

Securely import transactions and organize your finances automatically.

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

Comprehensive reports

Stay on track with inventory reports, enhanced sales reports, and profitability reports.*

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible. Forecast cash flow and more—all in one place.**

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect all sales channels

Connect any available online sales channels and automatically sync with QuickBooks.

Free guided setup

A QuickBooks expert can help you set up your chart of accounts, connect your banks, and show you best practices.

Includes more than 5 users

Invite your accountant to access your books, control user-access levels, and share reports without sharing a log-in.**

Bill management

Organize bills in one place, schedule payments, pay online for free, and choose how vendors get paid.**

Enter time

Enter employee time by client/project and automatically add it to invoices.

Inventory

Track products, cost of goods, see what’s popular, create purchase orders, and manage vendors.

Project profitability

Track all your projects in one place, track labor costs, payroll and expenses.

Business analytics with Excel

Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.

Batch invoices and expenses

Create invoices, enter, edit, and send multiple invoices faster.**

Customized access

Easily control who sees your data, assign work to specific users, and create custom permissions.

24/7 support & training

Connect with an account team to get the right resources, schedule appointments, and resolve technical support issues**

On-demand training

Get free online training and get the most out of QuickBooks.**

Workflow automation

Save time and mitigate risk with automated workflows and set reminders for improved cash flows and more.

Data restoration

Continuously and automatically back up your changes, restore a specific version of your company, and view version history.**