All the features you need to manage contractor payroll

Setup made simple

Get an expert to review your payroll or have them set it up for you.** Questions? Call or access 24/7 online chat support.**

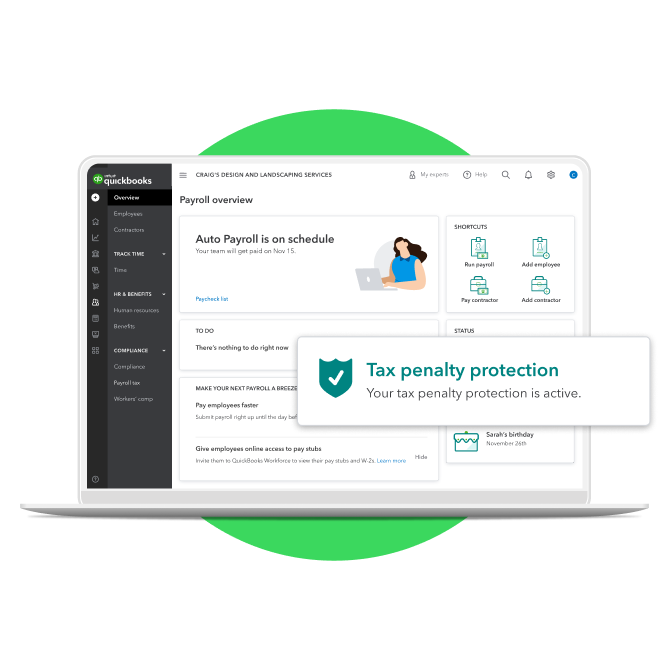

Tax penalty protection

Make tax time worry-free. Our Tax Resolution team pays penalty fees and interest up to $25,000 per year and works with the IRS to resolve errors. That’s payroll that’s got your back.

Trusted time tracking

Approve time when you’re ready and save an average of 2 hours on each payroll run with QuickBooks Payroll.2

HR support

Pay your team and access helpful resources or talk to an HR advisor. Stay compliant with help from Mineral, Inc.**

Same-day direct deposit

Keep money in your pocket longer with same-day direct deposit. Submit payroll by 7 AM PT payday morning to have funds withdrawn the same day.**

Auto Payroll

Set up your insurance payroll to run automatically. Auto Payroll makes it easy to save time and stay in control with clear alerts and notifications.**

Setup made simple

Get an expert to review your payroll or have them set it up for you.** Questions? Call or access 24/7 online chat support.**

Tax penalty protection

Make tax time worry-free. Our Tax Resolution team pays penalty fees and interest up to $25,000 per year and works with the IRS to resolve errors. That’s payroll that’s got your back.

Trusted time tracking

Approve time when you’re ready and save an average of 2 hours on each payroll run with QuickBooks Payroll.2

HR support

Pay your team and access helpful resources or talk to an HR advisor. Stay compliant with help from Mineral, Inc.**

Same-day direct deposit

Keep money in your pocket longer with same-day direct deposit. Submit payroll by 7 AM PT payday morning to have funds withdrawn the same day.**

Auto Payroll

Set up your insurance payroll to run automatically. Auto Payroll makes it easy to save time and stay in control with clear alerts and notifications.**

Manage insurance payroll

Insurance agencies need to hit sales numbers. Between that and paying employees, issuing paychecks on time, and staying on top of payroll taxes, there’s a lot to manage. Run payroll in less than 5 minutes with QuickBooks Payroll.3

Powerful payroll reports

Insurance is all about risk management. Avoid risk by staying informed about your business. Run and export reports to view bank transactions, employee work hours, paid time off, and more. Track your tax deductions and liabilities with quarterly or annual payroll tax reports from your dashboard.

Why use QuickBooks Payroll for insurance companies?

Run your insurance company with confidence, thanks to expert payroll and tax support that makes payday a breeze. Stay compliant with one-on-one HR support that can help you customize job descriptions, create onboarding checklists, and boost your employees’ performance.